IBS and Weekly High Based SP500 Futures Trading Strategy

Author: ChaoZhang, Date: 2024-01-15 14:42:00Tags:

Overview

This is a simple SP500 futures trading strategy based on the intraday volatility index IBS and weekly highs. It only sends trading signals on Monday opening, using the conditions of IBS below 0.5 and price lower than last Friday’s close to determine entry timing. It will exit in 5 trading days later.

Strategy Principle

The strategy mainly judges based on two indicators:

-

IBS - Intraday Breadth Strength, used to determine whether the volatility of the day is low enough. The calculation method is: (close - low) / (high - low). When the IBS is below 0.5, the volatility is considered to be low, which is suitable for entering.

-

Weekly High - Use last Friday’s close as the reference high point. If this Monday’s close is lower than last Friday’s close, it may form a reversal and generate trading opportunities.

The entry conditions are: Monday + IBS <0.5 + Close < Last Friday’s Close.

The exit conditions are: close in 5 trading days or opening high point reversal the next day.

Strategy Advantages

The main advantages of this strategy are:

- The strategy logic is simple and clear, easy to understand and implement.

- Signals can only be issued on Monday opening, avoiding excessive trading.

- Use the IBS indicator to determine intraday volatility, which is good for locking the turning point of trends.

- The weekly structure reference is simple and effective to judge whether a reversal is formed.

- The risk control is in place with limited drawdown.

Strategy Risks

There are also some risks in this strategy:

- IBS and weekly structure judgments rely solely on technical indicators, which may cause misjudgments.

- The fixed 5-day exit time can lead to additional gains or losses. Dynamic exit conditions should be set.

- Trading only on Mondays has strong cycle, with too few signal frequency, easily missing signals at other times.

- The drawdown control may be inadequate, with excessive maximum drawdown.

Strategy Optimization

The strategy can be optimized in the following aspects:

-

Increase more technical indicators confirmation to improve signal accuracy. Such as enhanced short-term trends, support/resistance, volume and other judgment logics.

-

Set dynamic exit conditions based on real-time fluctuations to set stop loss or take profit price. Avoid additional gain/loss caused by fixed exit time.

-

Expand the trading time frame of the strategy instead of limiting to Mondays. Reasonably set entry conditions for other trading days to improve signal coverage.

-

Introduce risk management modules to control drawdowns using stop loss strategies. Methods like floating stop loss, trailing stop loss can be used to optimize.

Conclusion

In general, this strategy is a simple short-term trading strategy based on intraday IBS indicators and weekly structure judgments. The strategy idea is clear, easy to implement with controllable risks. But there are also certain probabilities of signal misjudgments and potential excessive drawback problems. Future optimization spaces lie in adding more technical indicators, setting dynamic stop loss mechanisms and so on. By continuously testing and optimizing, gradually improve the win rate and profitability of the strategy.

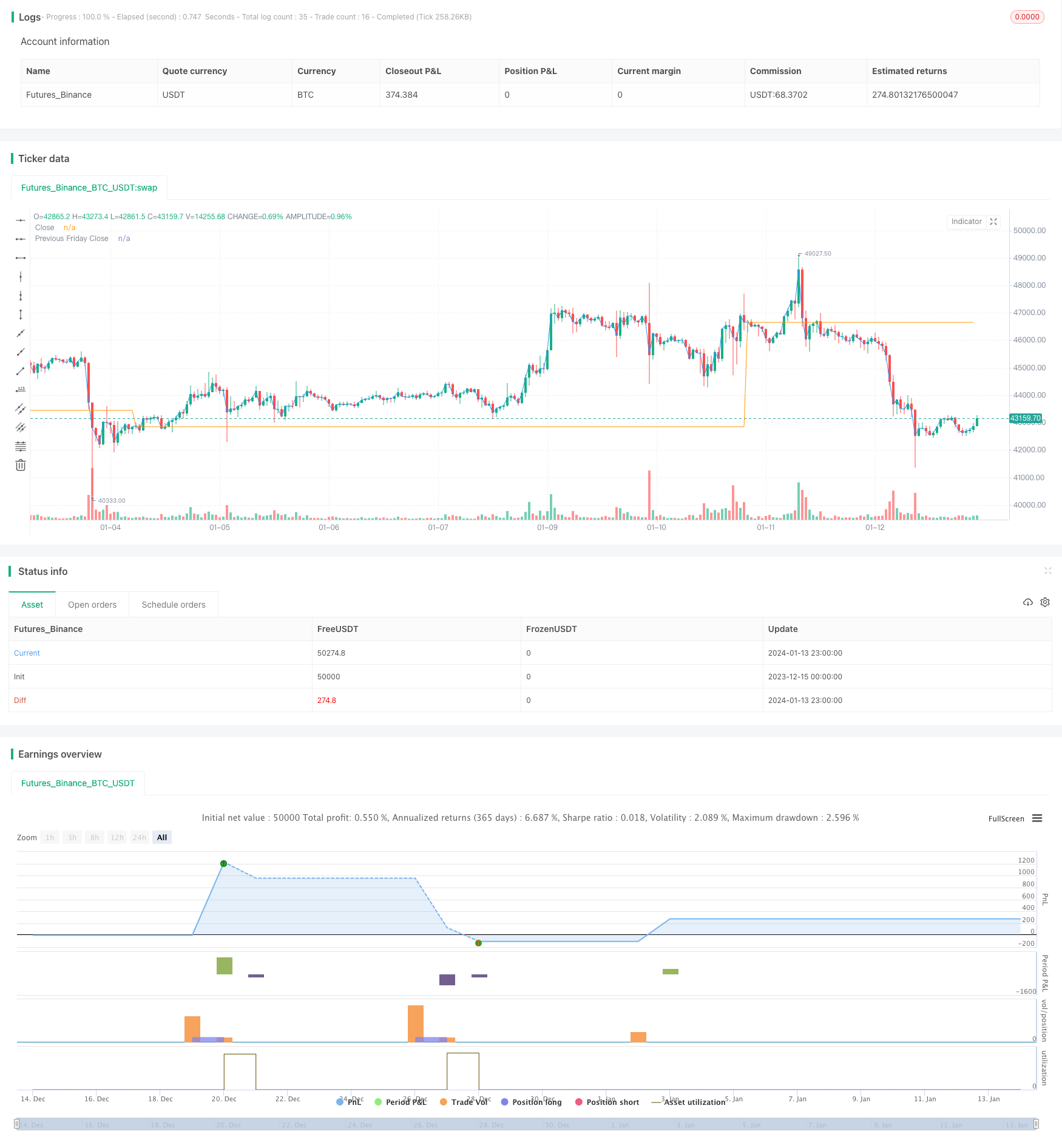

/*backtest

start: 2023-12-15 00:00:00

end: 2024-01-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © hobbiecode

// Today is Monday.

// The close must be lower than the close on Friday.

// The IBS must be below 0.5.

// If 1-3 are true, then enter at the close.

// Sell 5 trading days later (at the close).

//@version=5

strategy("Hobbiecode - SP500 IBS + Higher", overlay=true)

// Check if it's Monday

isMonday = dayofweek(time) == dayofweek.monday

// Calculate the IBS (Intraday Breadth Strength) indicator

ibs = (close - low) / (high - low)

// Calculate the close on the previous Friday

prevFridayClose = request.security(syminfo.tickerid, "W", close[1])

// Entry conditions

enterCondition = isMonday and close < prevFridayClose and ibs < 0.5 and strategy.position_size < 1

// Exit conditions

exitCondition = (close > high[1] or ta.barssince(enterCondition) == 4) and strategy.position_size > 0

// Entry signal

if enterCondition

strategy.entry("Buy", strategy.long)

// Exit signal

if exitCondition

strategy.close("Buy")

// Plotting the close, previous Friday's close, and entry/exit points on the chart

plot(close, title="Close", color=color.blue)

plot(prevFridayClose, title="Previous Friday Close", color=color.orange)

plotshape(enterCondition, title="Enter", location=location.belowbar, color=color.green, style=shape.labelup, text="Enter")

plotshape(exitCondition, title="Exit", location=location.abovebar, color=color.red, style=shape.labeldown, text="Exit")

- RMI Trend Sync Strategy

- Multi Timeframe MACD Moving Average Trading Strategy

- ADX Dynamic Trend Strategy

- Trend Following Strategy Based on Hull Moving Average and True Range

- Dual Confirmation Quant Trading Strategy

- Confirmed Divergence Strategy

- Bollinger Wave Strategy

- Myo_LS_D Quantitative Strategy

- Multiplicative Moving Average Dual-direction Trading Strategy

- Donchian Channels Long Term Trend Following Strategy

- FraMA and MA Crossover Trading Strategy Based on FRAMA Indicator

- Trend Following Strategy Based on SSL Baseline

- Bollinger Bands Trend Following Strategy

- Momentum Trend Following Trading Strategy

- Open Close Cross Moving Average Trend Following Strategy

- Adaptive Trend Following Strategy

- Multi Timeframe RSI Strategy

- Bollinger Bands and K-line Combined Strategy

- Aroon Oscillator Based Stock Trading Strategy

- EintSimple Pullback Strategy