Myo_LS_D Quantitative Strategy

Author: ChaoZhang, Date: 2024-01-15 14:56:03Tags:

Overview

The Myo_LS_D quantitative strategy is a dual-track tracking stop-profit strategy based on long and short positions. The strategy combines multiple indicators such as moving averages, price breakthroughs, and risk-return ratios to build trading signals. It achieves a high win rate and profit rate on the premise of accurate trend judgment.

Principle

The strategy consists mainly of a trend judgment module, long position module, short position module, tracking stop profit module, etc.

-

The trend judgment module uses the Donchain channel to determine the overall trend direction. The prerequisite for going long is an upward trend, while going short requires a downward trend.

-

The long position module takes into account factors such as new highs, lows, long moving average positions, etc. The short position module considers new highs, lows, short moving average positions and other factors. This ensures the opening of positions when breaking through critical price points upwards or downwards.

-

The tracking stop profit module uses two SMA moving averages of different cycles to track price changes in real time. When the price breaks through the moving average line, the position is closed for profit. This kind of real-time tracking can maximize profits from the trend.

-

Stop loss setting considers enlarged stop loss to keep the stop loss point far away from the support level to avoid being knocked out.

Advantage Analysis

The biggest advantage of this strategy is the separate long and short position building and tracking stop profit strategy. Specifically, it is mainly embodied in:

-

Separate long and short positions can maximize profit opportunities by capturing one-sided trend trading opportunities.

-

Tracking stop profit can obtain higher profit margin through real-time adjustment. Compared with traditional stop profit methods, income can be significantly improved.

-

Enlarged stops can reduce the probability of being knocked out and reduce the risk of losses.

Risk and Solutions

The main risks of this strategy are concentrated in the following points:

-

Incorrect trend judgment may result in contrarian positions and losses. Optimization can be achieved by appropriately adjusting Donchain parameters or adding other indicators for judgment.

-

Tracking stop profit is too aggressive and may prematurely stop profit without being able to sustain gains. Optimization can be achieved by appropriately increasing the spacing between stop profit moving averages.

-

The stop loss range is too small, which may increase the probability of being knocked out. Appropriately expanding the stop loss magnitude can mitigate risks.

Optimization Directions

The main optimization directions for this strategy are:

-

Optimize the trend judgment module to improve judgment accuracy. Consider combining more indicators such as MACD.

-

Adjust the tracking stop profit method to further expand profit space. For example, moving stop profit lines in proportion.

-

Expanding the stop loss range or considering shrinkage stops can further reduce the probability of being knocked out.

-

Different varieties have different parameters. Optimal parameter combinations can be obtained through training to further improve strategy returns.

Summary

In general, the Myo_LS_D strategy is a relatively mature and stable dual-track tracking stop-profit quantitative strategy. It has obvious advantages and controllable risks. It is one of the quantitative solutions worth holding for the long term. Future optimizations can enable continuous performance improvement to make it an even more superior quantitative strategy.

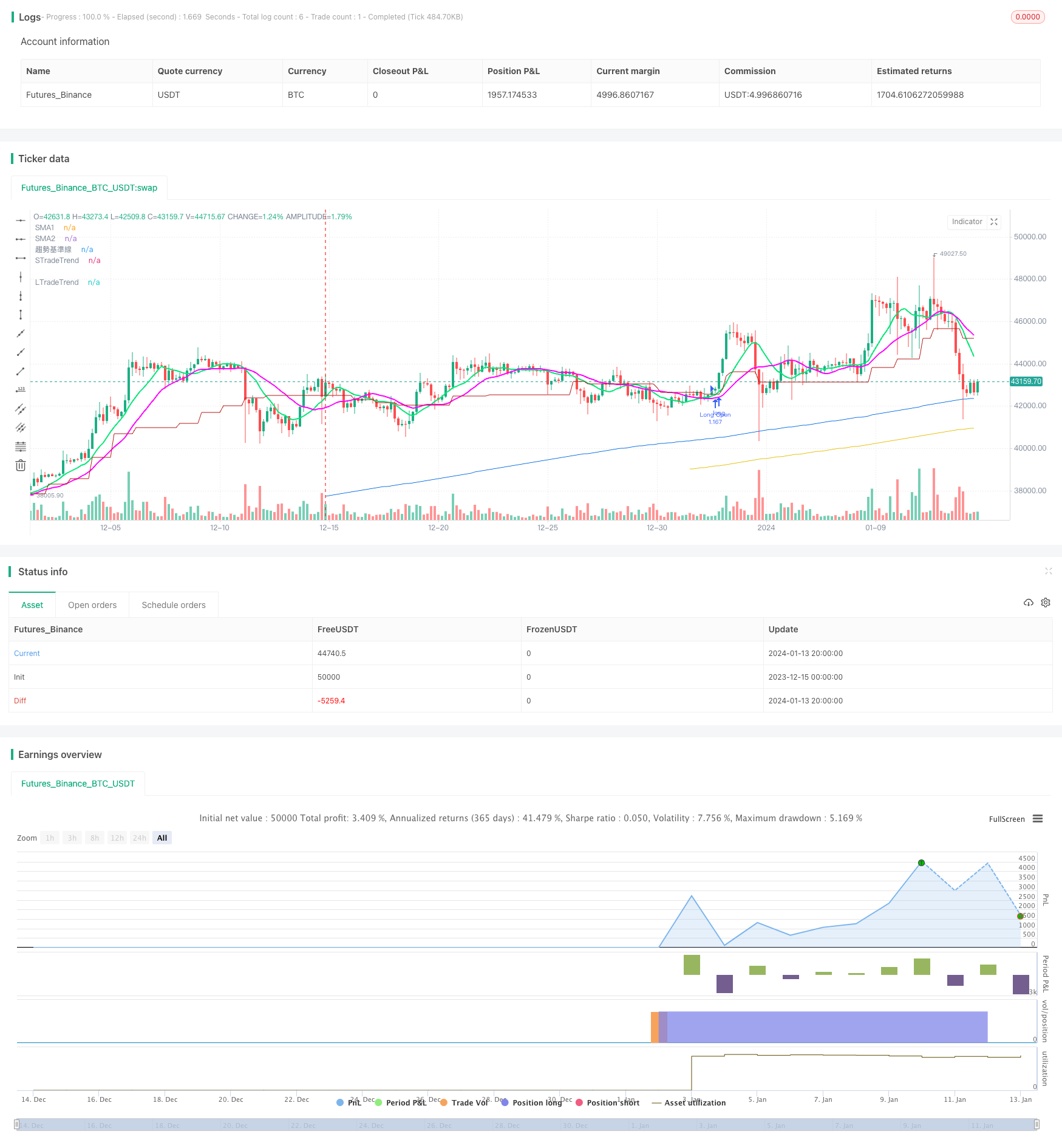

/*backtest

start: 2023-12-15 00:00:00

end: 2024-01-14 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © agresiynin

//@version=5

// ©Myo_Pionex

strategy(

title = "Myo_simple strategy_LS_D",

shorttitle = "Myo_LS_D",

overlay = true )

// var

lowest_price = ta.lowest(low, 200)

highest_price = ta.highest(high, 200)

min_800 = ta.lowest(low, 800)

max_800 = ta.highest(high, 800)

tp_target_L = min_800 + (max_800 - min_800) * math.rphi

tp_target_S = max_800 - (max_800 - min_800) * math.rphi

sl_length_L = input.int(100, "做多的止損長度", minval = 50, maxval = 300, step = 50)

sl_length_S = input.int(100, "做空的止損長度", minval = 50, maxval = 300, step = 50)

sl_L = lowest_price * (1 - 0.005)

sl_S = highest_price * (1 + 0.005)

rrr_L = tp_target_L - sl_L / sl_L

rrr_S = ta.lowest(low, 800) + ta.highest(high, 800) - ta.lowest(low, 800) * math.rphi / ta.highest(high, 200) + 0.005 * ta.highest(high, 200) - ta.lowest(low, 200) - 0.005 * ta.lowest(low, 200)

smalen1 = input.int(10, "做多追蹤止盈SMA長度1", options = [5, 10, 20, 40, 60, 80])

smalen2 = input.int(20, "做多追蹤止盈SMA長度2", options = [5, 10, 20, 40, 60, 80])

smalen1_S = input.int(5, "做空追蹤止盈SMA長度1", options = [5, 10, 20, 40, 60, 80])

smalen2_S = input.int(10, "做空追蹤止盈SMA長度2", options = [5, 10, 20, 40, 60, 80])

TrendLength_L = input.int(400, "做多趨勢線", options = [100, 200, 300, 400, 500])

TrendLength_S = input.int(300, "做空趨勢線", options = [100, 200, 300, 400, 500])

SMA1 = ta.sma(close, smalen1)

SMA2 = ta.sma(close, smalen2)

SMA1_S = ta.sma(close, smalen1_S)

SMA2_S = ta.sma(close, smalen2_S)

shortlength = input.int(20, "短期均價K線數量")

midlength = input.int(60, "中期均價K線數量")

longlength = input.int(120, "長期均價K線數量")

ShortAvg = math.sum(close, shortlength)/shortlength

MidAvg = math.sum(close, midlength)/midlength

LongAvg = math.sum(close, longlength)/longlength

// Trend

basePeriods = input.int(8, minval=1, title="趨勢基準線")

basePeriods_Short = input.int(26, "做空基準線")

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

baseLine = donchian(basePeriods)

baseLine_Short = donchian(basePeriods_Short)

trend = request.security(syminfo.tickerid, "D", baseLine)

isUptrend = false

isDowntrend = false

baseLine_D = request.security(syminfo.tickerid, "D", baseLine)

plot(baseLine_D, color=#B71C1C, title="趨勢基準線")

if close[0] > baseLine_D

isUptrend := true

if close[0] < baseLine_Short

isDowntrend := true

// Long

// Condition

// entry

con_a = low > lowest_price ? 1 : 0

con_b = high > highest_price ? 1 : 0

con_c = close[0] > ta.sma(close, TrendLength_L) ? 1 : 0

con_d = isUptrend ? 1 : 0

con_e = rrr_L > 3 ? 1 : 0

con_a1 = close[0] > ShortAvg[shortlength] ? 1 : 0

con_b1 = close[0] > MidAvg[midlength] ? 1 : 0

// close

con_f = ta.crossunder(close, SMA1) and ta.crossunder(close, SMA2) ? 1 : 0

con_g = close < ta.lowest(low, sl_length_L)[1] * (1 - 0.005) ? 1 : 0

// exit

con_h = tp_target_L

// Main calculation

LongOpen = false

AddPosition_L = false

if con_a + con_b + con_c + con_e + con_a1 + con_b1 >= 4 and con_d >= 1

LongOpen := true

// Short

// Condition

// entry

con_1 = high < highest_price ? 1 : 0

con_2 = low < lowest_price ? 1 : 0

con_3 = close[0] < ta.sma(close, TrendLength_S) ? 1 : 0

con_4 = isDowntrend ? 1 : 0

con_5 = rrr_S > 3 ? 1 : 0

con_11 = close[0] < ShortAvg[shortlength] ? 1 : 0

con_12 = close[0] < MidAvg[midlength] ? 1 : 0

// close

con_6 = ta.crossover(close, SMA1_S) and ta.crossover(close, SMA2_S) ? 1 : 0

con_7 = close > ta.highest(high, sl_length_S)[1] * (1 + 0.005) ? 1 : 0

// exit

con_8 = tp_target_S

// Main calculation

ShortOpen = false

AddPosition_S = false

if con_1 + con_2 + con_3 + con_4 + con_5 + con_11 + con_12 >= 5

ShortOpen := true

//

// execute

//

strategy.initial_capital = 50000

if strategy.position_size == 0

if LongOpen

strategy.entry("Long Open" , strategy.long , comment= "Long Open " + str.tostring(close[0]), qty=strategy.initial_capital/close[0])

if strategy.position_size > 0

if (con_f > 0 or con_g > 0 or ShortOpen) and close <= baseLine_D

strategy.close_all(comment="Close Long " + str.tostring(close[0]))

if strategy.position_size == 0

if ShortOpen

strategy.entry("Short Open" , strategy.short , comment= "Short Open " + str.tostring(close[0]), qty=strategy.initial_capital/close[0])

if strategy.position_size < 0

if (con_6 > 0 or con_7 > 0 or LongOpen) and close >= baseLine_D

strategy.close_all(comment="Close Short " + str.tostring(close[0]))

plot(ta.sma(close, TrendLength_L), color=#e5c212, title="LTradeTrend")

plot(ta.sma(close, TrendLength_S), color=#1275e5, title="STradeTrend")

plot(SMA1, "SMA1", color = color.lime, linewidth = 2)

plot(SMA2, "SMA2", color = color.rgb(255, 0, 255), linewidth = 2)

- Price Channel Breakout Strategy

- SAR Alternating Timeframe Trading Strategy

- EMA/MA Crossover Options Trading Strategy

- RMI Trend Sync Strategy

- Multi Timeframe MACD Moving Average Trading Strategy

- ADX Dynamic Trend Strategy

- Trend Following Strategy Based on Hull Moving Average and True Range

- Dual Confirmation Quant Trading Strategy

- Confirmed Divergence Strategy

- Bollinger Wave Strategy

- Multiplicative Moving Average Dual-direction Trading Strategy

- Donchian Channels Long Term Trend Following Strategy

- IBS and Weekly High Based SP500 Futures Trading Strategy

- FraMA and MA Crossover Trading Strategy Based on FRAMA Indicator

- Trend Following Strategy Based on SSL Baseline

- Bollinger Bands Trend Following Strategy

- Momentum Trend Following Trading Strategy

- Open Close Cross Moving Average Trend Following Strategy

- Adaptive Trend Following Strategy

- Multi Timeframe RSI Strategy