ADX Dynamic Trend Strategy

Author: ChaoZhang, Date: 2024-01-15 15:32:45Tags:

Overview

The ADX Dynamic Trend Strategy is a quantitative trading strategy that utilizes the ADX indicator to determine the strength and direction of market trends. It generates buy and sell signals by calculating the Average Directional Index (ADX) to judge if a trend exists in the market and by calculating the Positive Directional Indicator (DI+) and Negative Directional Indicator (DI-) to determine the direction of the trend.

Trading Logic

The strategy first uses the ADX indicator to determine if a trend exists in the market. When ADX is above a user-defined key level (default 23), it signals that the market trend is relatively strong. When the current ADX value is higher than the ADX value n days ago (n is the user-defined lookback period, default 3 days), it signals that ADX is rising and a trend is forming in the market.

The strategy then utilizes DI+ and DI- to determine the direction of the market trend. When DI+ is higher than DI-, it signals an uptrend in the market. When DI+ is lower than DI-, it signals a downtrend in the market.

Finally, the strategy combines the ADX and DI analysis to generate specific buy and sell signals:

- When ADX rises and is above key level and DI+ is higher than DI-, a buy signal is generated

- When ADX rises and is above key level and DI+ is lower than DI-, a sell signal is generated

- When ADX turns to decrease, a flatten position signal is generated

The strategy also provides features like moving average filtering and customizable backtesting time range.

Advantage Analysis

The ADX Dynamic Trend Strategy has the following advantages:

- Automatically detect the existence of market trends, avoiding ineffective trading

- Automatically determine the direction of market trends for trend following

- Clear logic of buying on trend existence and flattening on trend disappearance

- Configurable moving average filtering avoids false breakouts

- Customizable backtesting time range for historical testing

- Adjustable indicator parameters for optimization across different products

Risk Analysis

The strategy also has some risks:

- ADX indicator has lagging effect, possibly missing early trend opportunities

- Trend direction reliance on DI may produce false signals as DI is sensitive

- Moving average filter may miss short-term opportunities

- Improper backtesting time frame may cause overfitting

- Improper indicator parameters may affect strategy performance

To mitigate risks, the following can be considered:

- Shorten ADX parameters to reduce lagging

- Remove or adjust DI filter to prevent false signals

- Shorten moving average period

- Expand backtesting time frame for full sample testing

- Optimize parameters to find best settings

Enhancement Opportunities

The strategy can be enhanced from the following aspects:

- Portfolio testing across multiple stocks to diversify single-stock risk

- Add stop loss logic to control per trade loss

- Combine with other indicators for signal verification to improve accuracy

- Introduce machine learning algorithms for buy/sell signal generation

- Add auto parameter tuning module for dynamic adjustment

Conclusion

The ADX Dynamic Trend Strategy utilizes ADX to determine trend existence and DI for trend direction. It generates trading signals when a trend exists and flattens positions when the trend disappears. The logic is clear. By automatically detecting and tracking trends, ineffective trading can be avoided to some extent in non-trending markets. With proper enhancement, this strategy can become a powerful tool for medium-to-long term quantitative trading.

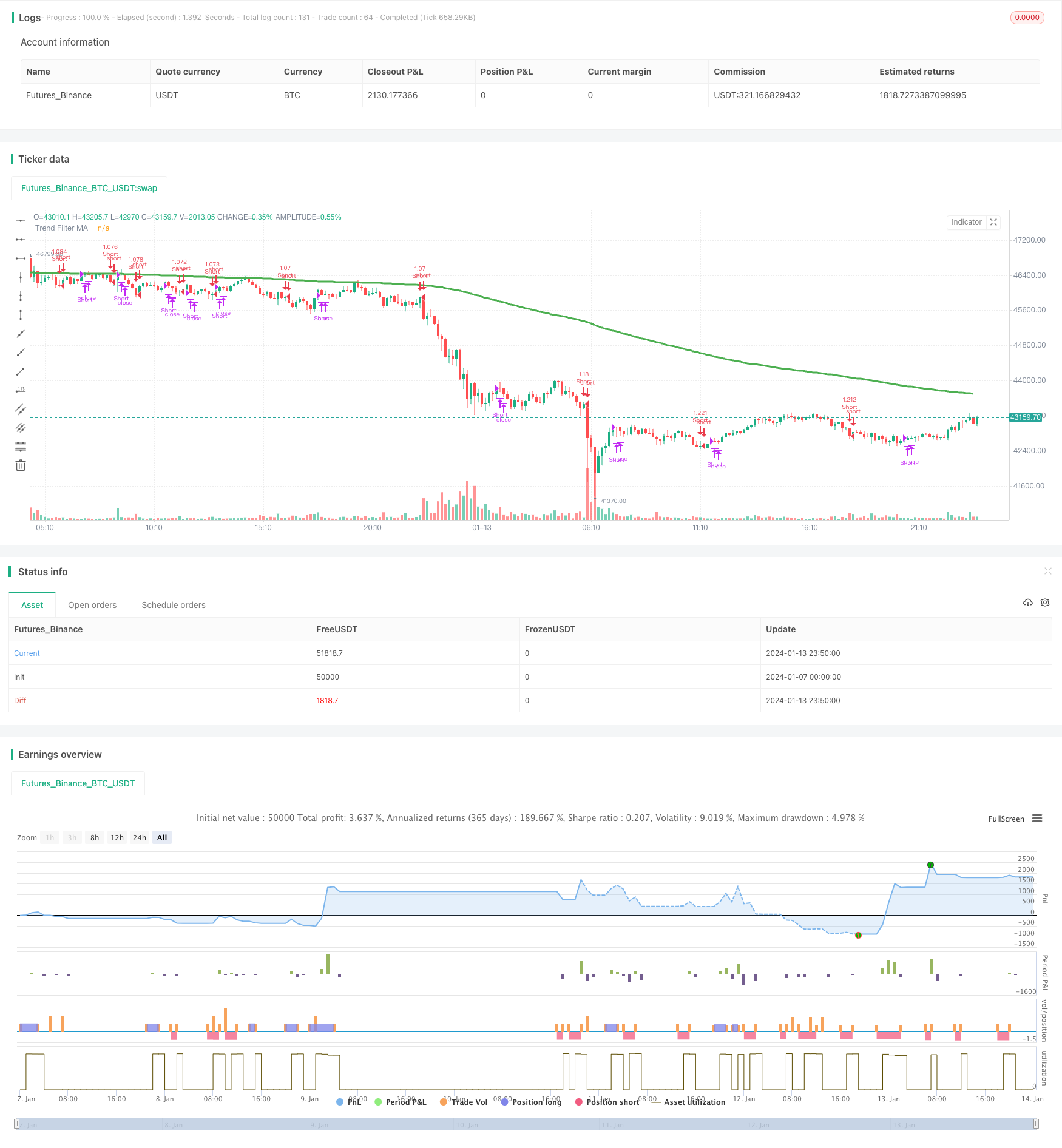

/*backtest

start: 2024-01-07 00:00:00

end: 2024-01-14 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © millerrh with inspiration from @9e52f12edd034d28bdd5544e7ff92e

//The intent behind this study is to look at ADX when it has an increasing slope and is above a user-defined key level (23 default).

//This is to identify when it is trending.

//It then looks at the DMI levels. If D+ is above D- and the ADX is sloping upwards and above the key level, it triggers a buy condition. Opposite for short.

//Can use a user-defined moving average to filter long/short if desried.

// NOTE: THIS IS MEANT TO BE USED IN CONJUNCTION WITH MY "ATX TRIGGER" INDICATOR FOR VISUALIZATION. MAKE SURE SETTINGS ARE THE SAME FOR BOTH.

strategy("ADX | DMI Trend", overlay=true, initial_capital=10000, currency='USD',

default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.04)

// === BACKTEST RANGE ===

From_Year = input(defval = 2019, title = "From Year")

From_Month = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

From_Day = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

To_Year = input(defval = 9999, title = "To Year")

To_Month = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

To_Day = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

Start = timestamp(From_Year, From_Month, From_Day, 00, 00) // backtest start window

Finish = timestamp(To_Year, To_Month, To_Day, 23, 59) // backtest finish window

// == INPUTS ==

// ADX Info

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Period")

keyLevel = input(23, title="Keylevel for ADX")

adxLookback = input(3, title="Lookback Period for Slope")

// == FILTERING ==

// Inputs

useMaFilter = input(title = "Use MA for Filtering?", type = input.bool, defval = true)

maType = input(defval="EMA", options=["EMA", "SMA"], title = "MA Type For Filtering")

maLength = input(defval = 200, title = "MA Period for Filtering", minval = 1)

// Declare function to be able to swap out EMA/SMA

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length) //Ternary Operator (if maType equals EMA, then do ema calc, else do sma calc)

maFilter = ma(maType, close, maLength)

plot(maFilter, title = "Trend Filter MA", color = color.green, linewidth = 3, style = plot.style_line, transp = 50)

// Check to see if the useMaFilter check box is checked, this then inputs this conditional "maFilterCheck" variable into the strategy entry

maFilterCheck = if useMaFilter == true

maFilter

else

close

// == USE BUILT-IN DMI FUNCTION TO DETERMINE ADX AND BULL/BEAR STRENGTH

[diplus, diminus, adx] = dmi(dilen, adxlen)

buySignal = (adx[0]-adx[adxLookback] > 0) and adx > keyLevel and diplus > diminus and close >= maFilterCheck

// buySignalValue = valuewhen(buySignal, close, 0)

shortSignal = (adx[0]-adx[adxLookback] > 0) and adx > keyLevel and diplus < diminus and close <= maFilterCheck

// shortSignalValue = valuewhen(shortSignal, close, 0)

sellCoverSignal = adx[0]-adx[adxLookback] < 0

// == ENTRY & EXIT CRITERIA

// Triggers to be TRUE for it to fire of the BUY Signal : (opposite for the SELL signal).

// (1): Price is over the 200 EMA line. (EMA level configurable by the user)

// (2): "D+" is OVER the "D-" line

// (3): RSI 7 is under 30 (for SELL, RSI 7 is over 70)

// 1* = The ultimate is to have a combination line of 3 EMA values, EMA 14, EMA 50 and EMA 200 - And if price is over this "combo" line, then it's a strong signal

// == STRATEGY ENTRIES/EXITS ==

strategy.entry("Long", strategy.long, when = buySignal)

strategy.close("Long", when = sellCoverSignal)

strategy.entry("Short", strategy.short, when = shortSignal)

strategy.close("Short", when = sellCoverSignal)

// == ALERTS ==

// alertcondition(buySignal, title='ADX Trigger Buy', message='ADX Trigger Buy')

// alertcondition(sellSignal, title='ADX Trigger Sell', message='ADX Trigger Sell')

- Hull Fisher Adaptive Intelligent Multi-factor Strategy

- Dynamic Position Sizing Strategy Based on Equity Curve

- Dual Trend Tracking Strategy

- Adaptive Intelligent Grid Trading Strategy

- Trend Tracking Reversal Strategy

- Price Channel Breakout Strategy

- SAR Alternating Timeframe Trading Strategy

- EMA/MA Crossover Options Trading Strategy

- RMI Trend Sync Strategy

- Multi Timeframe MACD Moving Average Trading Strategy

- Trend Following Strategy Based on Hull Moving Average and True Range

- Dual Confirmation Quant Trading Strategy

- Confirmed Divergence Strategy

- Bollinger Wave Strategy

- Myo_LS_D Quantitative Strategy

- Multiplicative Moving Average Dual-direction Trading Strategy

- Donchian Channels Long Term Trend Following Strategy

- IBS and Weekly High Based SP500 Futures Trading Strategy

- FraMA and MA Crossover Trading Strategy Based on FRAMA Indicator

- Trend Following Strategy Based on SSL Baseline