RMI Trend Sync Strategy

Author: ChaoZhang, Date: 2024-01-16 14:10:25Tags:

Overview

The RMI Trend Sync strategy effectively combines the strengths of the Relative Momentum Index (RMI) and the Super Trend indicator to realize the integration of momentum analysis and trend judgment. By concurrently monitoring price change trends and market momentum levels, the strategy determines market trends from a more comprehensive perspective.

Strategy Principles

Relative Momentum Index (RMI)

RMI is an enhanced version of the Relative Strength Index (RSI). It incorporates more features of price changes such as directionality and magnitude to more precisely gauge market momentum.

RMI Calculation Method

The RMI calculation method is: first calculate the average gain and average loss over a certain period. Unlike RSI, RMI uses the change between the current closing price and the previous closing price, rather than simple positive and negative growth. Then divide the average gain by the average loss and normalize the value to fit within a 0-100 scale.

Momentum Judgment

This strategy uses the mean value of RMI and MFI to compare with preset positive momentum and negative momentum thresholds to determine the current market momentum level for entry and exit decisions.

Super Trend Indicator

The Super Trend indicator is calculated based on a higher timeframe, which can provide judgments on major trends. It dynamically adjusts parameters based on the true volatility ATR to effectively identify trend reversals.

This strategy also incorporates the Volume Weighted Moving Average (VWMA) to further enhance its capability to detect important trend shifts.

Trading Direction Selection

This strategy allows choosing long, short or two-way trading. This flexibility enables traders to adapt to their market views and risk appetite.

Advantage Analysis

Combining Momentum and Trend Analysis

Compared with strategies relying solely on momentum or trend indicators, this strategy realizes more accurate market trend identification through integrating the strengths of RMI and Super Trend.

Multi-Timeframe Analysis

The application of RMI and Super Trend in different timeframes leads to a more appropriate grasp of both short-term and long-term trends.

Real-time Stop Loss

The real-time stop loss mechanism based on the Super Trend can effectively limit per trade loss.

Flexible Trading Direction

The choice among long, short or two-way trading allows this strategy to adapt to different market environments.

Risk Analysis

Difficult Parameter Optimization

The optimization for parameters like RMI and Super Trend is quite complex. Inappropriate settings may undermine strategy performance.

Stop Loss too Tight

Being overly sensitive to small fluctuations may result in excessive stop loss triggers.

Solution: Appropriately loosen the stop loss range or adopt other volatility-based stop loss methods.

Optimization Directions

Cross Asset Adaptiveness

Expanding applicable assets and identifying parameter optimization directions for different assets, to enable broader replication across more markets.

Dynamic Stop Loss

Incorporate dynamic stop loss mechanisms to better track current swing waves and reduce excessive stop loss caused by minor retracements.

Additional Filter Conditions

Add judgments from more indicators as filter conditions to avoid entering positions without clear signals.

Conclusion

Through the ingenious combination of RMI and Super Trend, this strategy realizes accurate market condition judgments. It also excels in risk control. With in-depth optimization, it is believed that its performance across more assets and timeframes will become increasingly remarkable.

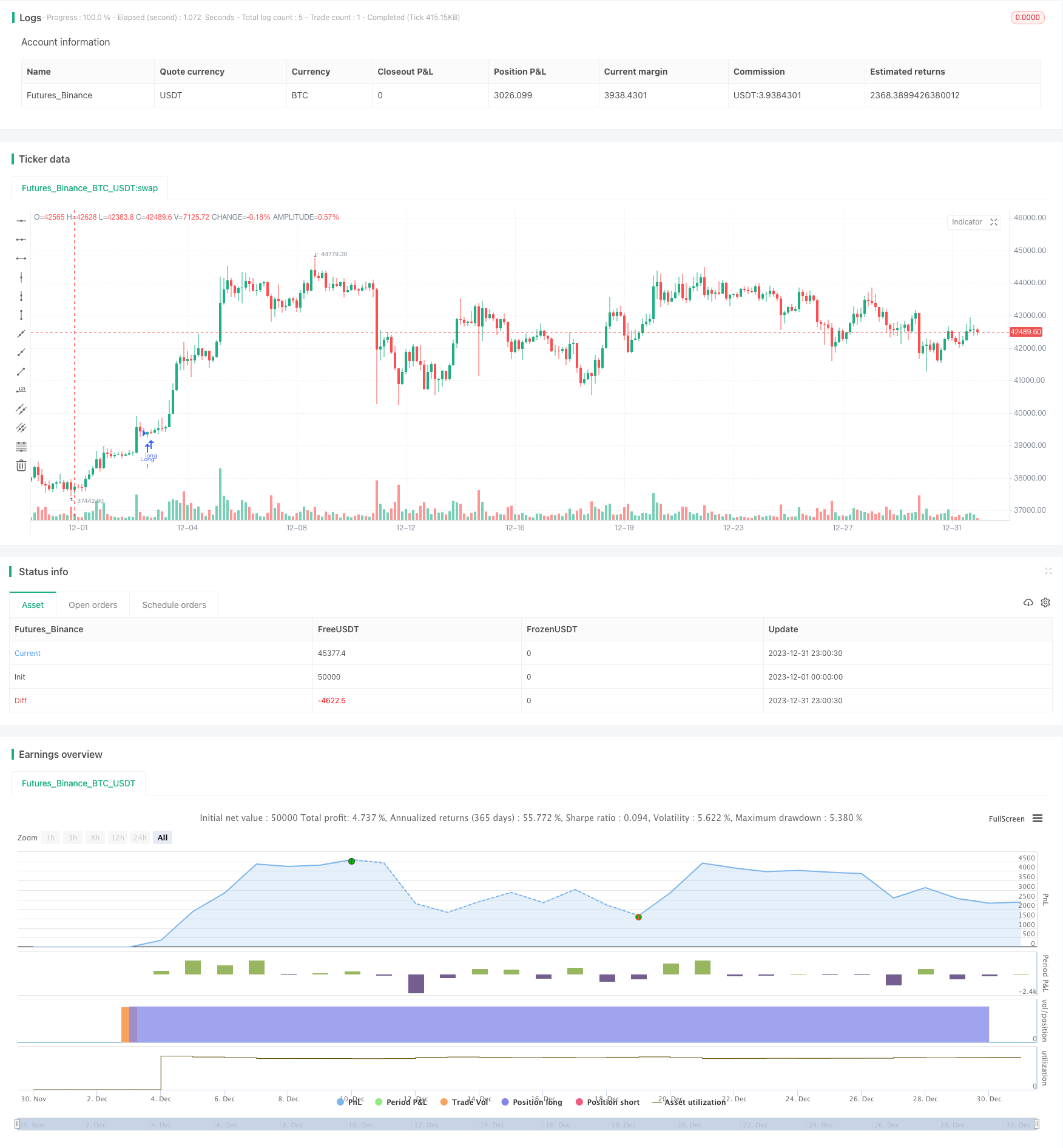

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// @ presentTrading

//@version=5

strategy("RMI Trend Sync - Strategy [presentTrading]", shorttitle = "RMI Sync [presentTrading]", overlay=true )

// ---> Inputs --------------

// Add Button for Trading Direction

tradeDirection = input.string("Both", "Select Trading Direction", options=["Long", "Short", "Both"])

// Relative Momentum Index (RMI) Settings

Length = input.int(21, "RMI Length", group = "RMI Settings")

pmom = input.int(70, "Positive Momentum Threshold", group = "RMI Settings")

nmom = input.int(30, "Negative Momentum Threshold", group = "RMI Settings")

bandLength = input.int(30, "Band Length", group = "Momentum Settings")

rwmaLength = input.int(20, "RWMA Length", group = "Momentum Settings")

// Super Trend Settings

len = input.int(10, "Super Trend Length", minval=1, group="Super Trend Settings")

higherTf1 = input.timeframe('480', "Higher Time Frame", group="Super Trend Settings")

factor = input.float(3.5, "Super Trend Factor", step=.1, group="Super Trend Settings")

maSrc = input.string("WMA", "MA Source", options=["SMA", "EMA", "WMA", "RMA", "VWMA"], group="Super Trend Settings")

atr = request.security(syminfo.tickerid, higherTf1, ta.atr(len))

TfClose1 = request.security(syminfo.tickerid, higherTf1, close)

// Visual Settings

filleshow = input.bool(true, "Display Range MA", group = "Visual Settings")

bull = input.color(#00bcd4, "Bullish Color", group = "Visual Settings")

bear = input.color(#ff5252, "Bearish Color", group = "Visual Settings")

// Calculation of Bar Range

barRange = high - low

// RMI and MFI Calculations

upChange = ta.rma(math.max(ta.change(close), 0), Length)

downChange = ta.rma(-math.min(ta.change(close), 0), Length)

rsi = downChange == 0 ? 100 : upChange == 0 ? 0 : 100 - (100 / (1 + upChange / downChange))

mf = ta.mfi(hlc3, Length)

rsiMfi = math.avg(rsi, mf)

// Momentum Conditions

positiveMomentum = rsiMfi[1] < pmom and rsiMfi > pmom and rsiMfi > nmom and ta.change(ta.ema(close,5)) > 0

negativeMomentum = rsiMfi < nmom and ta.change(ta.ema(close,5)) < 0

// Momentum Status

bool positive = positiveMomentum ? true : negativeMomentum ? false : na

bool negative = negativeMomentum ? true : positiveMomentum ? false : na

// Band Calculation

calculateBand(len) =>

math.min(ta.atr(len) * 0.3, close * (0.3/100)) * 4

band = calculateBand(bandLength)

// Range Weighted Moving Average (RWMA) Calculation

calculateRwma(range_, period) =>

weight = range_ / math.sum(range_, period)

sumWeightedClose = math.sum(close * weight, period)

totalWeight = math.sum(weight, period)

sumWeightedClose / totalWeight

rwma = calculateRwma(barRange, rwmaLength)

colour = positive ? bull : negative ? bear : na

rwmaAdjusted = positive ? rwma - band : negative ? rwma + band : na

max = rwma + band

min = rwma - band

longCondition = positive and not positive[1]

shortCondition = negative and not negative[1]

longExitCondition = shortCondition

shortExitCondition = longCondition

// Dynamic Trailing Stop Loss

vwma1 = switch maSrc

"SMA" => ta.sma(TfClose1*volume, len) / ta.sma(volume, len)

"EMA" => ta.ema(TfClose1*volume, len) / ta.ema(volume, len)

"WMA" => ta.wma(TfClose1*volume, len) / ta.wma(volume, len)

upperBand = vwma1 + factor * atr

lowerBand = vwma1 - factor * atr

prevLowerBand = nz(lowerBand[1])

prevUpperBand = nz(upperBand[1])

float superTrend = na

int direction = na

superTrend := direction == -1 ? lowerBand : upperBand

longTrailingStop = superTrend - atr * factor

shortTrailingStop = superTrend + atr * factor

// Strategy Order Execution

if (tradeDirection == "Long" or tradeDirection == "Both")

strategy.entry("Long", strategy.long, when = longCondition)

strategy.exit("Exit Long", "Long", when=longExitCondition, stop = longTrailingStop)

if (tradeDirection == "Short" or tradeDirection == "Both")

strategy.entry("Short", strategy.short, when =shortCondition)

strategy.exit("Exit Short", "Short", when=shortExitCondition, stop = shortTrailingStop)

- Super Trend Dual Moving Average Strategy

- WaveTrend and DER Based Swing Trading Strategy

- Hull Fisher Adaptive Intelligent Multi-factor Strategy

- Dynamic Position Sizing Strategy Based on Equity Curve

- Dual Trend Tracking Strategy

- Adaptive Intelligent Grid Trading Strategy

- Trend Tracking Reversal Strategy

- Price Channel Breakout Strategy

- SAR Alternating Timeframe Trading Strategy

- EMA/MA Crossover Options Trading Strategy

- Multi Timeframe MACD Moving Average Trading Strategy

- ADX Dynamic Trend Strategy

- Trend Following Strategy Based on Hull Moving Average and True Range

- Dual Confirmation Quant Trading Strategy

- Confirmed Divergence Strategy

- Bollinger Wave Strategy

- Myo_LS_D Quantitative Strategy

- Multiplicative Moving Average Dual-direction Trading Strategy

- Donchian Channels Long Term Trend Following Strategy

- IBS and Weekly High Based SP500 Futures Trading Strategy