Price Channel Breakout Strategy

Author: ChaoZhang, Date: 2024-01-16 14:22:57Tags:

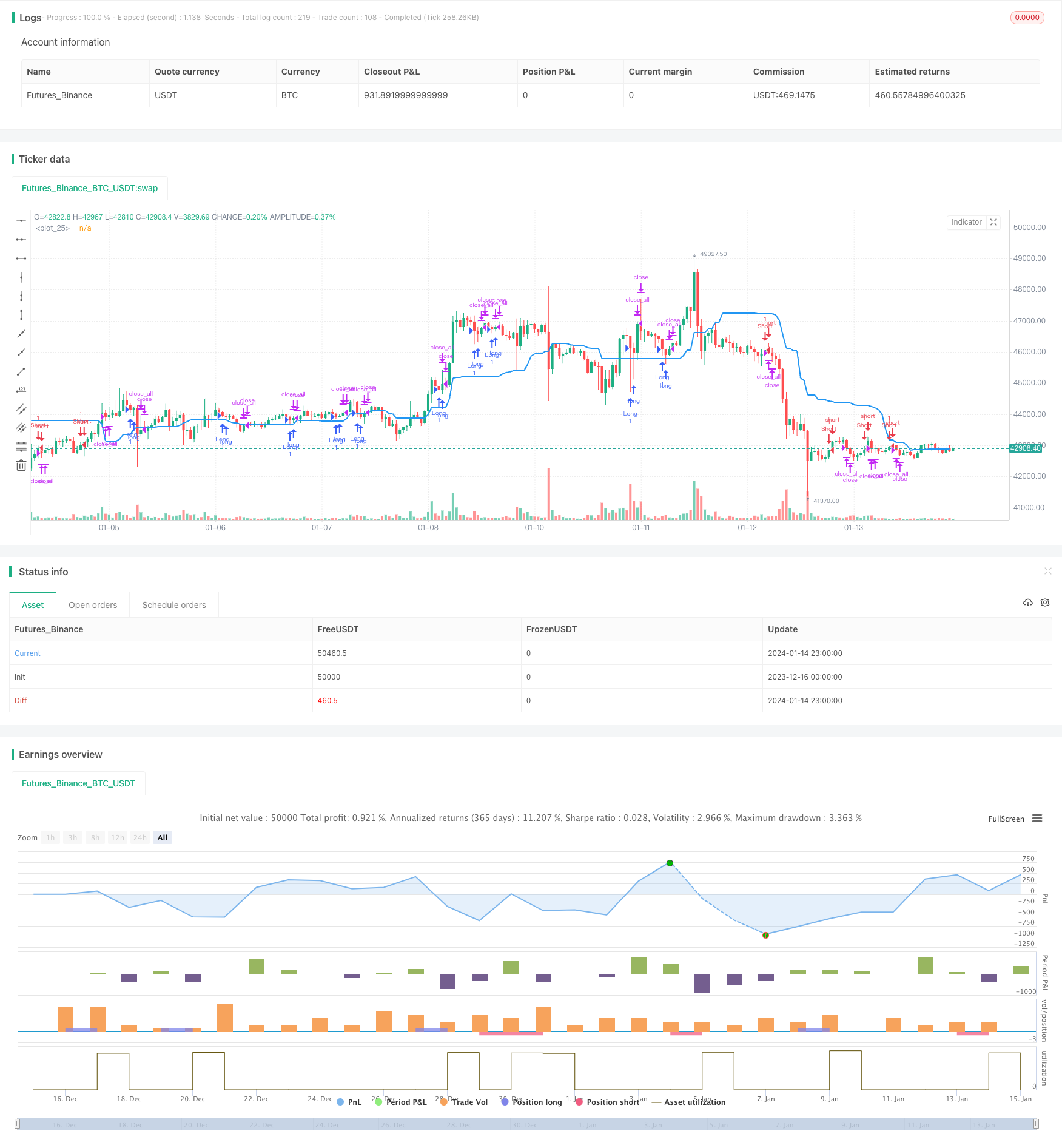

This strategy is named “Price Channel Breakout Strategy”. Its main idea is to use price channel to determine market trend and direction and establish positions when price breaks out of the channel. It will first draw the price channel range, then judge if there are two consecutive red or green K-lines. If the last K-line breaks through half of the channel width and closes outside the channel, it will generate buy or sell signals.

Strategy Logic

The strategy calculates the highest high and lowest low over a certain period in the past using highest() and lowest() functions to determine the upper and lower rails of the price channel. The midpoint of the channel is defined as the average of the upper and lower rails. It then calculates the K-line body size and smoothes it using SMA to determine if the last K-line body is larger than half of the average body. It also judges if the last two K-lines are in the same direction (two consecutive red or green). When these conditions are met, it generates buy/sell signals and closes positions when price falls back into the channel direction.

Advantage Analysis

This is a breakout strategy that uses price channel to judge the overall trend. It has the following advantages:

-

Using price channel to determine the overall trend direction can effectively filter market noise.

-

Consecutive two K-lines breaking through the channel in the same direction indicates stronger momentum and higher success rate of breakout.

-

Judging K-line body larger than half of average body can avoid being misled by false breakout.

-

The strategy logic is simple and easy to implement.

-

Customizable parameters such as channel period, trading products, trading hours etc. make it highly adaptable.

Risk Analysis

The strategy also has some potential risks:

-

There is still probability of failed breakout, which may lead to losses.

-

Price channel may fail when market fluctuates violently.

-

Lack of stop loss mechanism fails to effectively control losses.

-

Simple trading rules have overfitting risks.

-

Unable to adapt to more complex market environments.

The corresponding solutions are:

-

Optimize parameters to improve success rate of breakout.

-

Add volatility index to avoid choppy market.

-

Add mobile stop loss.

-

Conduct complexity test to check overfitting.

-

Increase machine learning models to improve adaptability.

Optimization Directions

The main optimization directions are:

-

Add stop loss mechanism to better control risks. Set price retracement stop loss or mobile stop loss based on ATR.

-

Optimize parameters like channel period, breakout threshold etc. Find optimal parameters through genetic algorithm, grid search etc.

-

Add filtering conditions to improve certainty of breakout. For example, combine trading volume to confirm breakout.

-

Add machine learning models like LSTM to improve prediction capability and adaptability by utilizing more data.

-

Conduct portfolio optimization, combine different types of breakout strategies to achieve orthogonality and reduce similarities.

Conclusion

In conclusion, this is a quantitative strategy based on price channel to determine trend and discover breakout signals. It has the advantage of judging trend and confirming breakout, but also has certain risks of false breakout. We can improve the strategy by parameter optimization, stop loss, adding filters etc. to reduce risks. Meanwhile, introducing machine learning models can further enhance the predictive capability. Overall, this is a promising quantitative strategy approach worth researching and improving.

/*backtest

start: 2023-12-16 00:00:00

end: 2024-01-15 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's Price Channel Strategy v1.0", shorttitle = "Price Channel str 1.0", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

pch = input(30, defval = 30, minval = 2, maxval = 200, title = "Price Channel")

showcl = input(true, defval = true, title = "Show center-line")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

src = close

//Price channel

lasthigh = highest(src, pch)

lastlow = lowest(src, pch)

center = (lasthigh + lastlow) / 2

col = showcl ? blue : na

plot(center, color = col, linewidth = 2)

//Bars

bar = close > open ? 1 : close < open ? -1 : 0

rbars = sma(bar, 2) == -1

gbars = sma(bar, 2) == 1

//Signals

body = abs(close - open)

abody = sma(body, 10)

up = rbars and close > center and body > abody / 2

dn = gbars and close < center and body > abody / 2

exit = ((strategy.position_size > 0 and close > open) or (strategy.position_size < 0 and close < open)) and body > abody / 2

//Trading

if up

if strategy.position_size < 0

strategy.close_all()

strategy.entry("Long", strategy.long, needlong == false ? 0 : na)

if dn

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : na)

if exit

strategy.close_all()

- Dynamic Trend Tracking Reversal Strategy

- Daily DCA Strategy with Touching EMAs

- Trend Strength Confirm Bars Strategy

- Super Trend Dual Moving Average Strategy

- WaveTrend and DER Based Swing Trading Strategy

- Hull Fisher Adaptive Intelligent Multi-factor Strategy

- Dynamic Position Sizing Strategy Based on Equity Curve

- Dual Trend Tracking Strategy

- Adaptive Intelligent Grid Trading Strategy

- Trend Tracking Reversal Strategy

- SAR Alternating Timeframe Trading Strategy

- EMA/MA Crossover Options Trading Strategy

- RMI Trend Sync Strategy

- Multi Timeframe MACD Moving Average Trading Strategy

- ADX Dynamic Trend Strategy

- Trend Following Strategy Based on Hull Moving Average and True Range

- Dual Confirmation Quant Trading Strategy

- Confirmed Divergence Strategy

- Bollinger Wave Strategy

- Myo_LS_D Quantitative Strategy