Trend Tracking Reversal Strategy

Author: ChaoZhang, Date: 2024-01-16 14:44:35Tags:

Overview

The Trend Tracking Reversal strategy is a short-term trend trading strategy based on 15-minute NQ futures. It identifies trading opportunities through trend filtering and reversal pattern recognition. This simple yet effective strategy suits active short-term traders.

Strategy Logic

The strategy mainly operates on the following principles:

-

Use an 8-period EMA as the main trend filter, with long signals above EMA and short signals below EMA.

-

Identify specific candlestick reversal patterns as entry signals, including long green candles followed by short red candles for long signals, and long red candles followed by short green candles for short signals. These patterns suggest a potential trend reversal.

-

Entry points are set near the high/low of the reversal candle, with stop loss levels at the high/low of the reversal candle itself, allowing efficient risk/reward ratios.

-

Validate reversal signals using candlestick relationship rules e.g. the open price of the red candle is above the last green candle’s body, body fully engulfs etc to filter noise.

-

Only operate the strategy during specific trading hours, avoiding volatile periods around major contract rollovers etc, to prevent unnecessary losses from abnormal price action.

Advantage Analysis

The main advantages of this strategy include:

-

Simple and effective signal logic that is easy to grasp and execute.

-

Trend and reversal based, avoiding whipsaws from raging bull and bear markets.

-

Good risk control with reasonable stop loss placement for capital preservation.

-

Low data needs fit various platforms and tools.

-

High trading frequency suits active short-term trading style.

Risks & Solutions

There are some risks to note:

-

Insufficient reversal opportunities and limited signals. Relax reversal criteria to allow more signals.

-

Occasional false breakouts. Add more filters for combinational logic.

-

Volatility in overnight and non-main sessions. Restrict strategy operation to US trading hours.

-

Limited optimization flexibility. Consider machine learning for better parameter tuning.

Enhancement Opportunities

There is room for optimization:

-

Test longer EMA periods to improve trend definition.

-

Add equity index filters as supplemental trend filters.

-

Use machine learning techniques to auto-tune entry and stop loss levels.

-

Introduce volatility adjusted position sizing and dynamic stops.

-

Explore cross-asset arbitrage to diversify single-asset systemic risks.

Conclusion

The Trend Tracking Reversal Strategy offers a very practical short-term strategy framework that is simple to implement with limited parameters and good personal risk control. It suits active short-term traders on day trading forums. With further R&D, it can potentially be applicable for medium-long term algorithmic trading, demonstrating strong versatility and development potential.

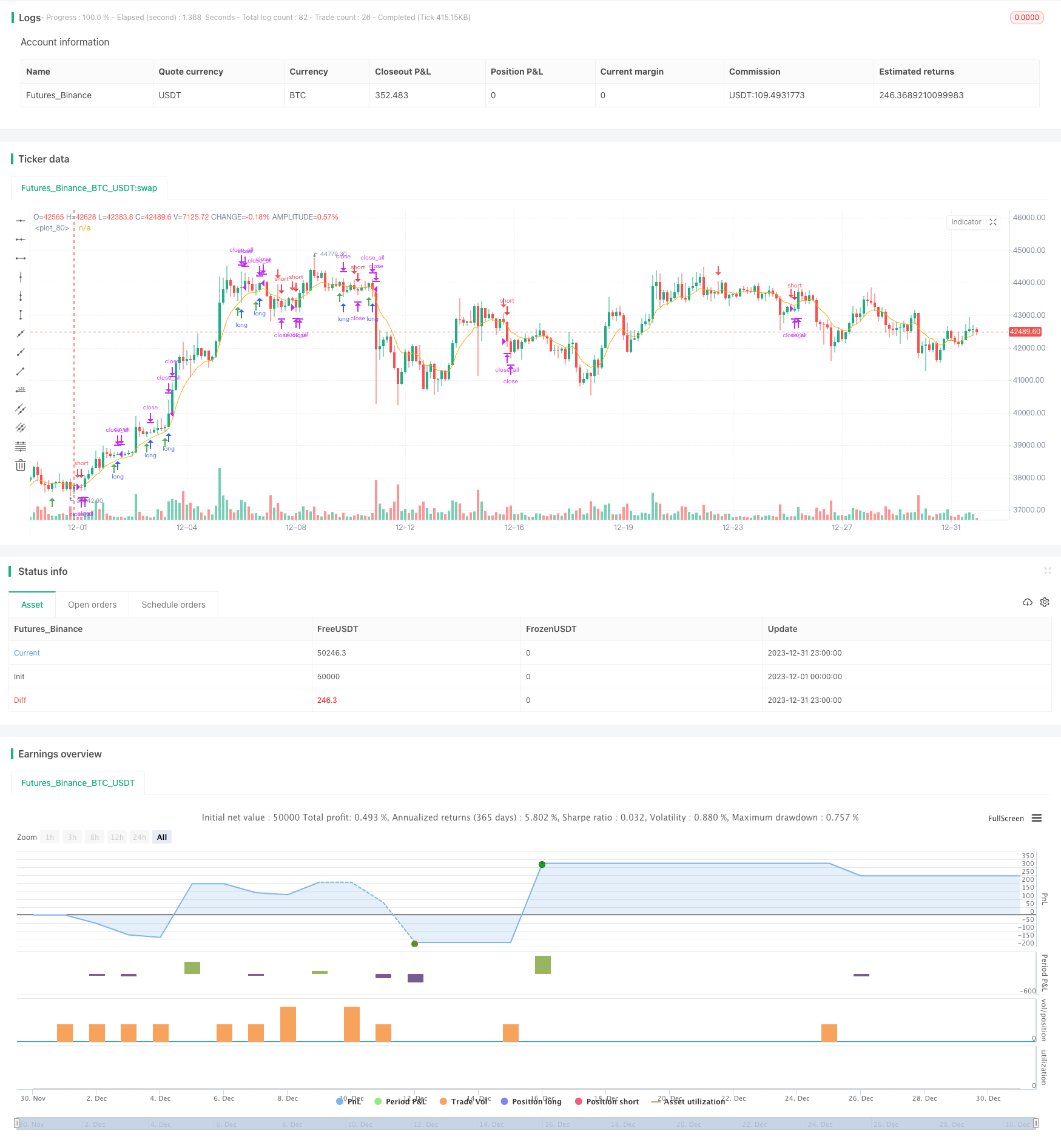

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © bdrex95

//@version=5

// Rob Reversal Strategy - Official

// Using Rob Reversal Indicator: Original

// Description

// This indicator is based on the strategy created by Trader Rob on the NQ 15m chart.

//

// Timeframe for trading is 8:30am-1:15pm Central.

//

// Above the EMA line, look for a long position. You will have a short candle, then a long candle that opens below the short candle. It will have a lower high and a lower low. Once the long candle closes, your entry will be 1 tick above the wick (green line) and stop loss will be at the bottom of the bottom wick (red line).

//

// Below the EMA line, look for a short position. You will have a long candle, then a short candle that opens above the long candle. It will have a higher high and a higher low. Once the short candle closes, your entry will be 1 tick below the wick (green line) and stop loss will be at the top of the top wick (red line).

//

strategy("Trader Rob Reversal Strategy NQ 15min", shorttitle="Official Rob Rev Strat", overlay=true)

//--- Session Input ---

sess = input(defval = "0930-1415", title="Trading Session")

t = time(timeframe.period, sess)

sessionOpen = na(t) ? false : true

flat_time = input(defval = "1515-1558", title="Close All Open Trades")

ft = time(timeframe.period, flat_time)

flatOpen = na(ft) ? false : true

// Calculate start/end date and time condition

startDate = input(timestamp('2018-12-24T00:00:00'),group = "ALL STRATEGY SETTINGS BELOW")

finishDate = input(timestamp('2029-02-26T00:00:00'),group = "ALL STRATEGY SETTINGS BELOW")

time_cond = true

emaColor = input.color(color.orange, title="EMA Color")

emaLength = input.int(8, title="EMA Length")

emaInd = ta.ema(close, emaLength)

rr = input(1.0,"Enter RR",group = "TP/SL CONDITION INPUTS HERE")

sellShapeInput = input.string("Arrow", title="Sell Entry Shape", options=["Arrow", "Triangle"])

buyShapeInput = input.string("Arrow", title="Buy Entry Shape", options=["Arrow", "Triangle"])

sellShapeOption = switch sellShapeInput

"Arrow" => shape.arrowdown

"Triangle" => shape.triangledown

buyShapeOption = switch buyShapeInput

"Arrow" => shape.arrowup

"Triangle" => shape.triangleup

O = open

C = close

H = high

L = low

sellEntry = (C[1] > O[1]) and (C < O) and (H[1] < H) and (C < H[1]) and (C > L[1]) and (L > L[1]) and (C < emaInd) and sessionOpen and time_cond

buyEntry = (C[1] < O[1]) and (C > O) and (H[1] > H) and (L[1] > L) and (C < H[1]) and (C > L[1]) and (C > emaInd) and sessionOpen and time_cond

sellEntry_index = ta.valuewhen(sellEntry,bar_index,0)

sellEntry_hi = ta.valuewhen(sellEntry,high,0)

sellEntry_low = ta.valuewhen(sellEntry,low,0)

buyEntry_index = ta.valuewhen(buyEntry,bar_index,0)

buyEntry_hi = ta.valuewhen(buyEntry,high,0)

buyEntry_lo = ta.valuewhen(buyEntry,low,0)

plotshape(buyEntry, color = color.green, location = location.belowbar, style = buyShapeOption, size = size.small)

plotshape(sellEntry, color = color.red, location = location.abovebar, style = sellShapeOption, size = size.small)

plot(emaInd, color=emaColor)

// Risk Management

entry_price_long = (buyEntry_hi + syminfo.mintick)

entry_price_short = (sellEntry_low - syminfo.mintick)

long_sl_price = (buyEntry_lo-syminfo.mintick)

short_sl_price = (sellEntry_hi + syminfo.mintick)

long_tp_price = ((entry_price_long - long_sl_price)*rr) + entry_price_long

short_tp_price = entry_price_short - ((short_sl_price - entry_price_short)*rr)

long_sl_ticks = (entry_price_long - long_sl_price) / syminfo.mintick

short_sl_ticks = (short_sl_price - entry_price_short) / syminfo.mintick

long_tp_ticks = (long_tp_price - entry_price_long) / syminfo.mintick

short_tp_ticks = (entry_price_short - short_tp_price) / syminfo.mintick

// Positions

if (buyEntry)

strategy.entry("Long", strategy.long,stop = H + syminfo.mintick)

if strategy.position_size > 0

strategy.exit("Long Ex","Long", loss = long_sl_ticks, profit = long_tp_ticks, comment_loss = "SL Long", comment_profit = "TP Long")

if (sellEntry)

strategy.entry("Short", strategy.short,stop = L - syminfo.mintick)

if strategy.position_size < 0

strategy.exit("Short Ex","Short",loss = short_sl_ticks, profit = short_tp_ticks, comment_loss = "SL Short", comment_profit = "TP Short")

// Cancel order if close beyond ema

if (C < emaInd)

strategy.cancel("Long")

if (C > emaInd)

strategy.cancel("Short")

// Go flat at close (for futures funded account)

if strategy.position_size > 0 and flatOpen

strategy.close_all(comment = "EOD Flat")

if strategy.position_size < 0 and flatOpen

strategy.close_all(comment = "EOD Flat")

//END

- Moving Average and Stochastic RSI Combination Trading Strategy

- Dynamic Trend Tracking Reversal Strategy

- Daily DCA Strategy with Touching EMAs

- Trend Strength Confirm Bars Strategy

- Super Trend Dual Moving Average Strategy

- WaveTrend and DER Based Swing Trading Strategy

- Hull Fisher Adaptive Intelligent Multi-factor Strategy

- Dynamic Position Sizing Strategy Based on Equity Curve

- Dual Trend Tracking Strategy

- Adaptive Intelligent Grid Trading Strategy

- Price Channel Breakout Strategy

- SAR Alternating Timeframe Trading Strategy

- EMA/MA Crossover Options Trading Strategy

- RMI Trend Sync Strategy

- Multi Timeframe MACD Moving Average Trading Strategy

- ADX Dynamic Trend Strategy

- Trend Following Strategy Based on Hull Moving Average and True Range

- Dual Confirmation Quant Trading Strategy

- Confirmed Divergence Strategy

- Bollinger Wave Strategy