Key Reversal Backtest Strategy

Author: ChaoZhang, Date: 2024-01-17 10:56:52Tags:

Overview

The key reversal backtest strategy detects potential short opportunities in the market by checking if stock prices hit new highs and then close lower. It is a short-term trading strategy. This strategy combines visual pattern recognition to assist in identifying price reversal signals, and then backtests to verify the feasibility of the strategy.

Strategy Principle

The core logic of this strategy is based on the “key reversal indicator” theory, by judging whether there are obvious signs of decline after the price hits a new high, to identify potential short opportunities. The specific implementation principles are as follows:

-

Define the parameter nLength, which represents the lookback period, to determine whether the price is hitting a new high or not;

-

Define the variable xHH to store the highest price in the past nLength cycles;

-

Define the variable C1 to determine if today’s highest price exceeds xHH, i.e. hitting a new high, while the closing price is lower than the previous day’s closing price, which meets the conditions that may be a key reversal pattern;

-

Draw triangle to indicate the potential key reversal K-line today;

-

When identifying the key reversal pattern, make short-term short trades and set stop profit and stop loss logic.

Through the above process, potential key reversal patterns can be effectively identified, price reversal signals can be judged, and short-term short trades can be made.

Advantage Analysis

The strategy has the following advantages:

-

Identifying reversal signals based on actual price patterns is more reliable;

-

Visual graphical indicators make trading signals more intuitive;

-

Implementing stop profit and stop loss logic is conducive to risk control;

-

Backtesting to verify the feasibility of the strategy is more convincing.

Overall, the strategy combines multiple factors to determine trading signals and backtesting to verify the accuracy of price reversals is relatively high, with good practical value.

Risk Analysis

Although the strategy has obvious advantages, there are still some risks to note:

-

Key reversal patterns do not necessarily lead to trend reversals, there is a certain risk of false signals;

-

The sample size of a single stock may be small and may not fully represent the overall market;

-

Improper stop loss point settings can lead to greater capital losses.

To avoid the above risks, the following points can be considered:

-

Verify trading signals with more factors, such as abnormal trading volume;

-

Increase backtest sample size, combination backtest of different varieties;

-

Optimize and test different stop loss points to find the optimal parameters.

Optimization Directions

There are still some directions that can be optimized in this strategy:

-

Increase machine learning algorithms to train models to determine the probability of key reversal patterns to improve accuracy;

-

Optimize stop loss algorithms, such as trailing stop loss, average stop loss, etc., to reduce single stop loss;

-

Incorporate more factors such as sentiment analysis to determine the probability of market reversal and set dynamic trading signals;

-

Enrich strategy types, such as combining momentum indicators, volatility indicators, etc. to determine reversal signals;

-

Use backtesting and optimization functions of more complex trading systems to improve strategy flexibility.

Through the above aspects of optimization, the accuracy and practical level of this trading strategy can be further improved.

Summary

The key reversal backtest strategy identifies short-term reversal signals by judging price patterns, and verifies them through backtesting. It can effectively capture reversal opportunities. This strategy has intuitive graphical indicators and complete stop profit and stop loss logic, with good practical value. Of course, certain false signal risks still need to be noted. By continuously optimizing the judgment model and stop loss algorithm, the effect of the strategy can be better. Overall, this strategy provides new ideas for judging market reversals and is a very promising quantitative trading method.

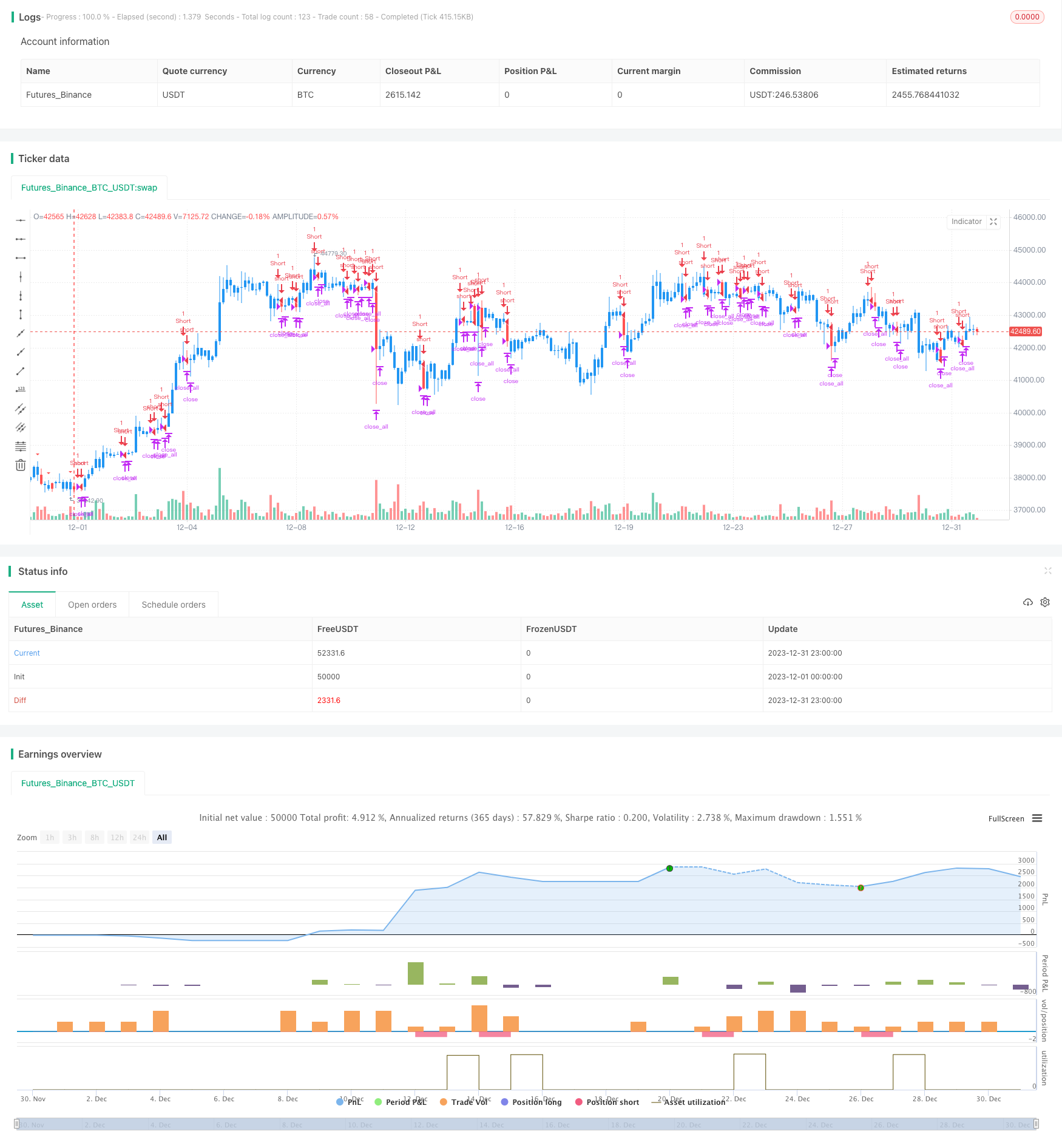

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 20/01/2020

//

// A key reversal is a one-day trading pattern that may signal the reversal of a trend.

// Other frequently-used names for key reversal include "one-day reversal" and "reversal day."

// How Does a Key Reversal Work?

// Depending on which way the stock is trending, a key reversal day occurs when:

// In an uptrend -- prices hit a new high and then close near the previous day's lows.

// In a downtrend -- prices hit a new low, but close near the previous day's highs

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Key Reversal Down Backtest", shorttitle="KRD Backtest", overlay = true)

input_takeprofit = input(20, title="Take Profit pip", step=0.01)

input_stoploss = input(10, title="Stop Loss pip", step=0.01)

nLength = input(1, minval=1, title="Enter the number of bars over which to look for a new high in prices.")

xHH = highest(high[1], nLength)

C1 = iff(high > xHH and close < close[1], true, false)

plotshape(C1, style=shape.triangledown, size = size.small, color=color.red)

posprice = 0.0

pos = 0

barcolor(nz(pos[1], 0) == -1 ? color.red: nz(pos[1], 0) == 1 ? color.green : color.blue )

posprice := iff(C1== true, close, nz(posprice[1], 0))

pos := iff(posprice > 0, -1, 0)

if (pos == 0)

strategy.close_all()

if (pos == -1)

strategy.entry("Short", strategy.short)

posprice := iff(low <= posprice - input_takeprofit and posprice > 0, 0 , nz(posprice, 0))

posprice := iff(high >= posprice + input_stoploss and posprice > 0, 0 , nz(posprice, 0))

- RSI Indicator Based Moving Stop Loss Buy Sell Strategy

- Extreme Short-term Scalping Strategy

- Optimized EMA Crossover Strategy

- MA Turning Point Long and Short Strategy

- RSI Target and Stop Loss Tracking Strategy

- RSI Indicator Based Short-term Trading Strategy

- Moving Average and Super Trend Tracking Stop Loss Strategy

- Linear Regression Channel Strategy

- Combination Trading Strategy Based on Dual EMA and Bandpass Filter

- Trend Tracking Trailing Stop Strategy

- Triangular Moving Average Crossover Trading Strategy

- Quantitative Trading Strategy Based on Moving Average

- Trend Following Strategy Based on Price Action and Volume

- Ichimoku Kinko Hyo Breakout Strategy

- ADX Momentum Trend Strategy

- Combination Strategy of 123 Reversal and Pivot Point

- Moving Average and Stochastic RSI Combination Trading Strategy

- Dynamic Trend Tracking Reversal Strategy

- Daily DCA Strategy with Touching EMAs

- Trend Strength Confirm Bars Strategy