RSI Indicator Based Short-term Trading Strategy

Author: ChaoZhang, Date: 2024-01-17 11:49:15Tags:

Overview

This strategy designs a short-term trading strategy based on the Relative Strength Index (RSI) indicator, mainly for trading in the 15-minute timeframe. The strategy generates buy and sell signals by calculating the RSI indicator to judge whether the market is overbought or oversold. It generates a buy signal when the RSI indicator crosses above the lower point of 30, and generates a sell signal when the RSI indicator crosses below the upper point of 70. This strategy is suitable for short-term range trading to capture profits from intermediate fluctuations.

Strategy Logic

The RSI indicator is a technical analysis tool that calculates the ratio of price uptrends and downtrends over a certain time period to determine whether the market is overbought or oversold. The RSI indicator value ranges from 0 to 100. A value below 30 indicates the asset is oversold, and a value above 70 indicates the asset is overbought.

This strategy sets the RSI indicator parameters to 14 periods, the overbought line to 70, and the oversold line to 30. When the RSI crosses above 30 from below, a buy signal is generated, which means the market turns from oversold to bullish. When the RSI crosses below 70 from above, a sell signal is generated, which means the market turns from bullish to bearish. After receiving the signal, the strategy takes a directional long or short position with 1x leverage of the total account funds to make profits from short-term trading.

Advantage Analysis

The biggest advantage of this strategy is that the rules are simple and clear, easy to understand and implement. The Relative Strength Index is a very classic quantitative indicator, widely used to judge the overbought and oversold conditions of the market. The strategy itself does not need to predict future market trends and price targets, just follow the RSI indicator signals, which reduces the difficulty of strategy optimization.

Another advantage is that the strategy has strong adaptability. This strategy can be applied to any variety and timeframe, especially suitable for catching range oscillation in medium and short term. In addition, the strategy only needs to optimize three parameters: RSI period, overbought line and oversold line. The parameter space is small, which makes it easy to test and optimize to find the best parameter combination.

Risk Analysis

The biggest risk of this strategy is that the holding time is uncertain. When the market experiences prolonged overbought or oversold conditions, it will lead to excessively long holding periods of the strategy positions and greater losses. At this point, timely stop loss is needed to control risks.

Another risk is that the trading frequency may be too high. When the market fluctuates up and down around the RSI overbought and oversold lines, it will frequently trigger buy and sell signals, increasing transaction fees and slippage costs. This requires appropriate adjustments to parameters to widen the overbought and oversold interval distance to reduce unnecessary trading.

Optimization Directions

This strategy can be optimized in the following aspects:

-

Optimize RSI parameters to find the best combination of period parameters and overbought/oversold line positions.

-

Add stop loss/take profit strategies with reasonable stop loss price and take profit price.

-

Add filtering conditions to avoid unnecessary trading, e.g. minimum fluctuation range, trading volume filters.

-

Optimize capital utilization by setting dynamic position sizing.

-

Combine with other indicators to improve strategy stability.

Conclusion

This strategy designs a simple and practical short-term trading strategy based on the RSI indicator. The strategy signal rules are clear and easy to implement with high capital utilization. It is suitable for catching market overbought/oversold conditions for contrarian trading in medium and short term. Through continuous testing and optimization, this strategy can become a very stable and reliable quantitative trading system.

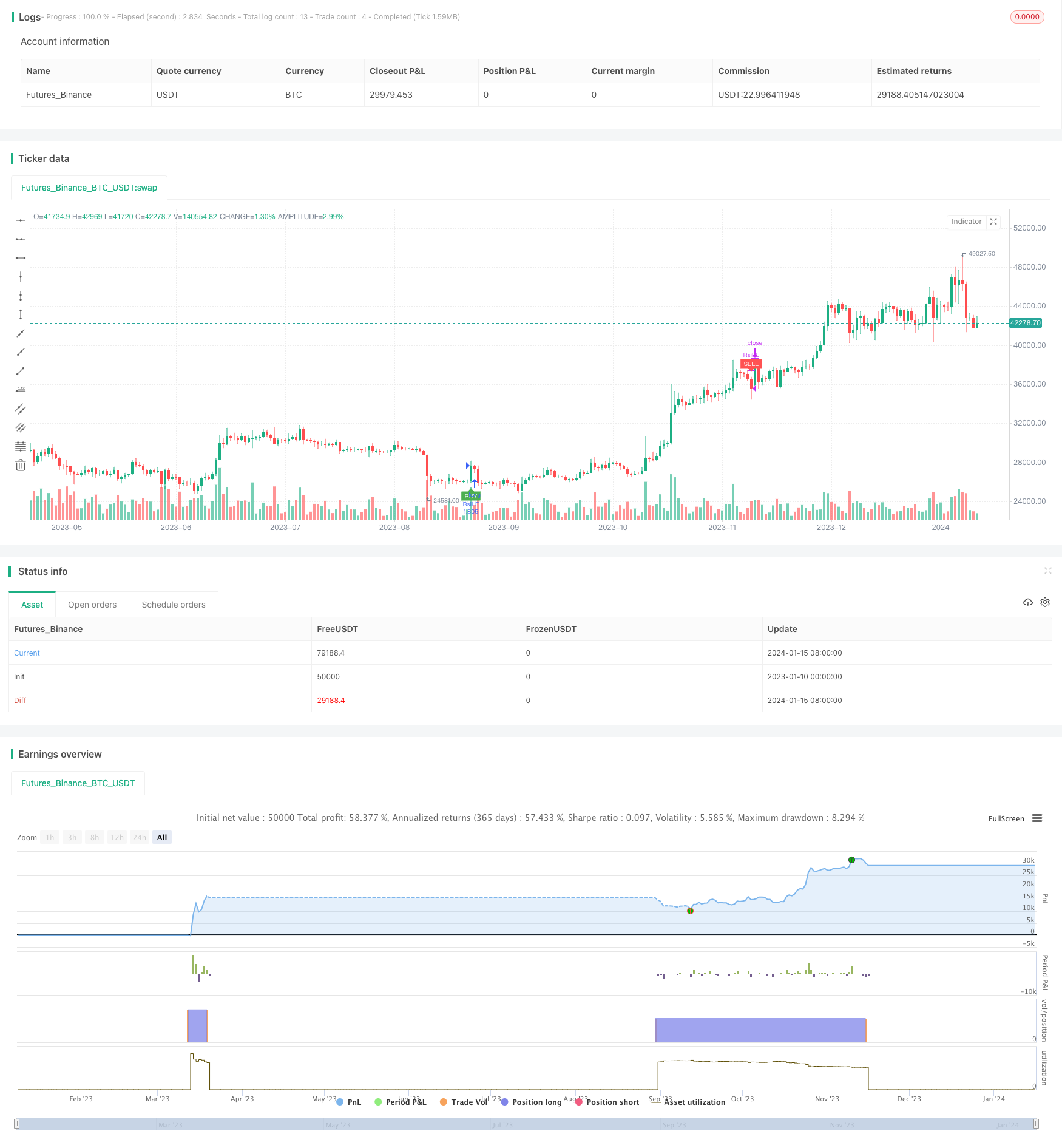

/*backtest

start: 2023-01-10 00:00:00

end: 2024-01-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("RSI Strategy", overlay=true)

length = input( 14 )

overSold = input( 30 )

overBought = input( 70 )

sl_inp = input(10.0, title='Stop Loss %')/100

tp_inp = input(1.0, title='Take Profit %')/100

haOpen = 0.0

haOpen := haOpen[1]

st_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

price = close

vrsi = rsi(price, length)

co = crossover(vrsi, overSold)

cu = crossunder(vrsi, overBought)

strategy.initial_capital =50000

orderSize = ((strategy.initial_capital * 1) / close)

if (not na(vrsi))

if (co)

strategy.order("RsiLE", strategy.long, orderSize, take_level, st_level, comment="RsiLE")

if (cu)

strategy.close("RsiLE")//strategy.entry("RsiSE", strategy.short, qty=orderSize, comment="RsiSE")

plotshape(not na(vrsi) and co and haOpen == 0.0, style=shape.labelup, location=location.belowbar, color=color.green, size=size.tiny, title="buy label", text="BUY", textcolor=color.white)

plotshape(not na(vrsi) and co and haOpen == 1.0, style=shape.labelup, location=location.belowbar, color=color.orange, size=size.tiny, title="buy label", text="INC", textcolor=color.white)

plotshape(not na(vrsi) and cu and haOpen == 1.0, style=shape.labeldown, location=location.abovebar, color=color.red, size=size.tiny, title="sell label", text="SELL", textcolor=color.white)

if (not na(vrsi))

if (co)

haOpen := 1.0

if (cu)

haOpen := 0.0

//strategy.exit("Stop Loss/TP","RsiLE", stop=stop_level, limit=take_level)

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

- Dual SMA Momentum Strategy

- Momentum Mean Deviation Breakthrough Strategy

- Bollinger Bands Based Intelligent Tracking Trading Strategy

- Multifactor-Driven Trend Trading Strategy

- Momentum Breakout Strategy

- RSI Indicator Based Moving Stop Loss Buy Sell Strategy

- Extreme Short-term Scalping Strategy

- Optimized EMA Crossover Strategy

- MA Turning Point Long and Short Strategy

- RSI Target and Stop Loss Tracking Strategy

- Moving Average and Super Trend Tracking Stop Loss Strategy

- Linear Regression Channel Strategy

- Combination Trading Strategy Based on Dual EMA and Bandpass Filter

- Trend Tracking Trailing Stop Strategy

- Key Reversal Backtest Strategy

- Triangular Moving Average Crossover Trading Strategy

- Quantitative Trading Strategy Based on Moving Average

- Trend Following Strategy Based on Price Action and Volume

- Ichimoku Kinko Hyo Breakout Strategy

- ADX Momentum Trend Strategy