Extreme Short-term Scalping Strategy

Author: ChaoZhang, Date: 2024-01-17 12:06:39Tags:

Overview

The extreme short-term scalping strategy attempts to establish short positions when prices approach or break support lines and sets very small stop loss and take profit levels for high frequency trading. The strategy exploits short-term price breakthroughs to capture market fluctuations for profits.

Strategy Logic

The strategy first calculates the linear regression line of prices. If the actual closing price is lower than the forecast closing price, long positions are established. If the actual closing price is higher than the forecast closing price, short positions are established. Stop loss and take profit are set to very small number of pips. The strategy allows choosing only long, only short or all direction trading.

Key parameters include:

- Source price: closing price

- Length of linear regression line: 14

- Offset: 1

- Trading direction: all/only buy/only sell

- Stop loss and take profit in pips: very small fixed pips or minimum tick pips

The main idea of the strategy is to capture short-term price breakthroughs of moving averages. When prices approach or break through support or resistance lines, timely establish positions. And set very small stop loss and take profit to realise profit then close positions immediately, repeating the process.

Advantage Analysis

The strategy has the following advantages:

- High trading frequency, suitable for high frequency trading, can capture more short-term price fluctuations

- Very small stop loss and take profit helps control single loss

- Can flexibly choose trading direction to adapt to different market environments

- Easy to implement with simple logic

Risk Analysis

There are also some risks:

- Price gaps may lead to expanded losses

- High transaction costs

- Signal errors may happen and need timely attention and optimisation

- Requires continuous market monitoring

Corresponding risk management measures include:

- Disable overnight trading

- Optimise stop loss and take profit to reduce transaction cost impacts

- Test and optimise parameters to reduce wrong signals

- Pay close attention to the market

Optimisation Directions

Further optimisation directions include:

- Add other indicators to filter signals and reduce wrong trades

- Dynamically adjust stop loss and take profit

- Optimise parameters to reduce overfitting

- Consider transaction cost impacts for reasonable stop loss and take profit configuration

- Test stability across products and timeframes

Summary

The extreme short-term scalping strategy is a typical high frequency trading strategy. By establishing positions around key price levels and setting very small stop loss and take profit, it captures short-term price fluctuations. Although it can achieve high returns, there are also certain risks. With continuous testing and optimisation, the strategy can be further enhanced for stability and profitability.

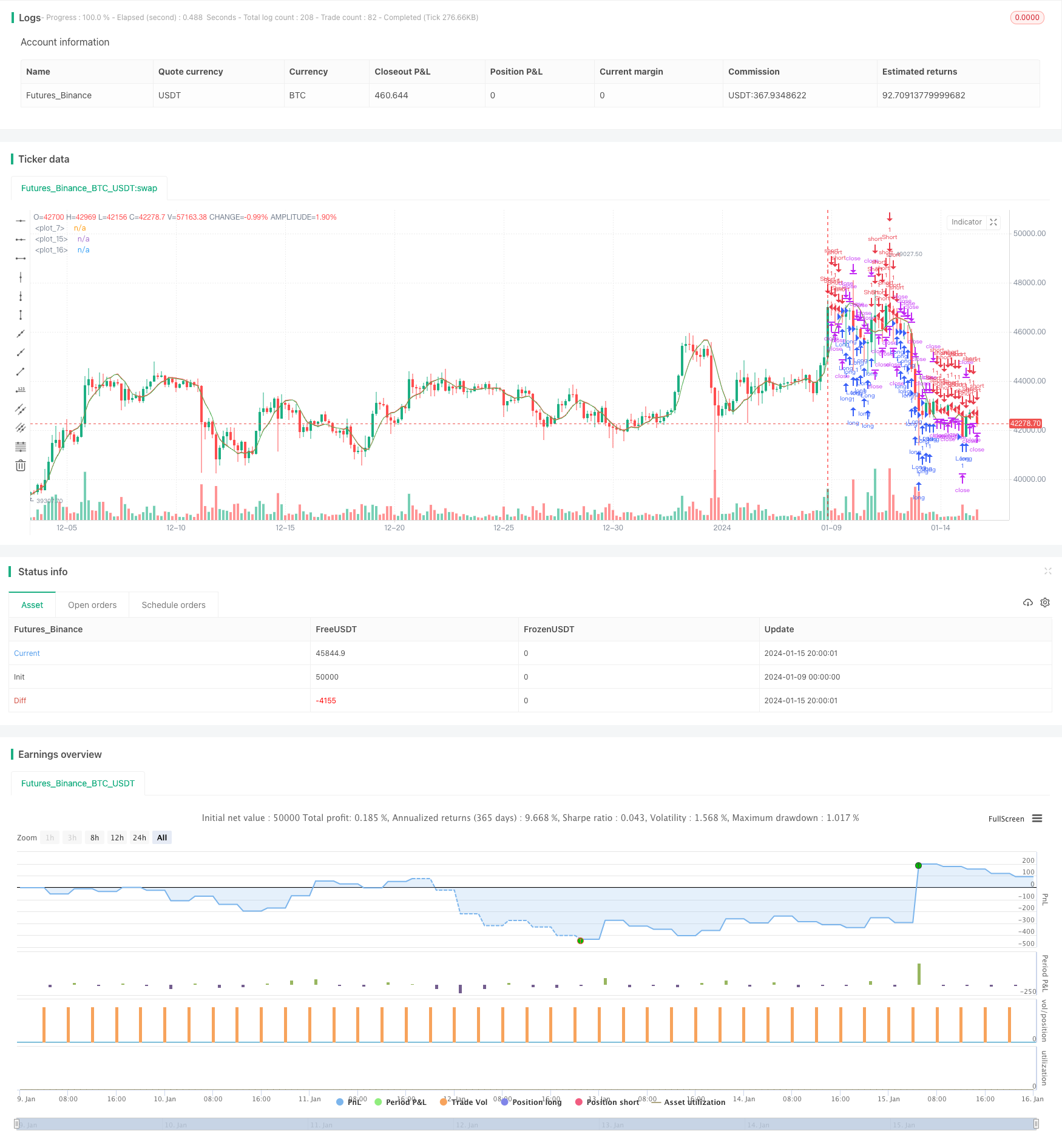

/*backtest

start: 2024-01-09 00:00:00

end: 2024-01-16 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Extreme Scalping", overlay=true )

src = input(close,title="Source")

len = input(defval=14, minval=1, title="Length")

offset = input(1)

out = linreg(src, len, offset)

plot(out)

gap_tick=input(100)

fixedTP=input(300)

fixedSL=input(100)

useFixedSLTP=input(true)

direction=input(defval="ALL",title="Direction of order",options=["ALL","BUY ONLY","SELL ONLY"])

gap=gap_tick*syminfo.mintick

plot(out+gap,color=color.red)

plot(out-gap,color=color.green)

tp=useFixedSLTP?fixedTP:gap_tick

sl=useFixedSLTP?fixedSL:gap_tick

longCondition = close<(out-gap) and (direction=="ALL" or direction=="BUY ONLY")

shortCondition = close>(out+gap) and (direction=="ALL" or direction=="SELL ONLY")

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("exit long","Long",profit = tp,loss = sl)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("exit short","Short",profit =tp,loss=sl)

// === Backtesting Dates === thanks to Trost

// testPeriodSwitch = input(true, "Custom Backtesting Dates")

// testStartYear = input(2019, "Backtest Start Year")

// testStartMonth = input(10, "Backtest Start Month")

// testStartDay = input(3, "Backtest Start Day")

// testStartHour = input(0, "Backtest Start Hour")

// testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,testStartHour,0)

// testStopYear = input(2019, "Backtest Stop Year")

// testStopMonth = input(12, "Backtest Stop Month")

// testStopDay = input(31, "Backtest Stop Day")

// testStopHour = input(23, "Backtest Stop Hour")

// testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,testStopHour,0)

// testPeriod() =>

// time >= testPeriodStart and time <= testPeriodStop ? true : false

// isPeriod = testPeriodSwitch == true ? testPeriod() : true

// // === /END

// if not isPeriod

// strategy.cancel_all()

// strategy.close_all()

- Adaptive Trading Strategy Based on ADX Indicator

- Dynamic Channel Breakout Strategy

- Multi-filter Bollinger Band Trading Strategy

- True Range Based Weighted Moving Average Cross Period Strategy

- Dual SMA Momentum Strategy

- Momentum Mean Deviation Breakthrough Strategy

- Bollinger Bands Based Intelligent Tracking Trading Strategy

- Multifactor-Driven Trend Trading Strategy

- Momentum Breakout Strategy

- RSI Indicator Based Moving Stop Loss Buy Sell Strategy

- Optimized EMA Crossover Strategy

- MA Turning Point Long and Short Strategy

- RSI Target and Stop Loss Tracking Strategy

- RSI Indicator Based Short-term Trading Strategy

- Moving Average and Super Trend Tracking Stop Loss Strategy

- Linear Regression Channel Strategy

- Combination Trading Strategy Based on Dual EMA and Bandpass Filter

- Trend Tracking Trailing Stop Strategy

- Key Reversal Backtest Strategy

- Triangular Moving Average Crossover Trading Strategy