Overview

The core of this strategy is based on the indicator developed in the article “Trading the Trend” published by Andrew Abraham in TASC magazine September 1998 issue. The indicator utilizes average true range and price channel to determine market trend direction, combined with MACD indicator for trade signal filtering, aiming to capture medium-long term trends.

Strategy Logic

The strategy first calculates 21-day weighted moving average of average true range (ATR) as a baseline volatility range. Then it calculates highest and lowest prices over the past 21 days. By comparing current close price with upper and lower limits of the baseline range, it judges whether price breaks out of the channel to determine trend direction.

Specifically, the upper channel limit is defined as the highest price over past 21 days minus 3 times baseline ATR, and the lower channel limit is the lowest price over past 21 days plus 3 times baseline ATR. When close price is higher than the upper limit, it signals a bullish trend. When close price is lower than the lower limit, it signals a bearish trend.

While determining trend direction, this strategy also introduces MACD indicator for filtering. It only generates buy signals when MACD histogram is positive to avoid missing buy opportunities.

Advantages

This strategy combines trend determination and indicator filtering, which can effectively identify mid-long term market trend direction without being misguided by short-term fluctuations. The main advantages are:

- Using price channel to determine trends and accurately identify long term direction

- The dynamic baseline volatility range adapts to market changes

- MACD filtering provides additional decision support to avoid missing buy points

- Configurable parameters offer flexibility in adjusting strategy style

Risks

The strategy also has some risks, mainly in the following aspects:

- Risk of price channel being broken

- Risk of MACD signaling errors

- Inadequate parameter setup may cause strategy instability

These risks can be reduced by optimizing parameters, strict position sizing, and timely stop loss.

Optimization Directions

The strategy can be optimized in the following main aspects:

- Test different parameter combinations to find optimum

Test different combinations of Length or Multiplier to find the parameter combination that yields the highest return based on backtest.

- Add filtering with other indicators

Test incorporating RSI, KDJ and other indicators to filter signals and improve profitability.

- Dynamically adjust parameters

Adapt parameters dynamically based on market conditions, such as appropriately widening channel range when trend is strong, or tightening range when market is more range-bound.

Summary

In summary, this is an overall robust trend following strategy. By combining price channel trend determination and MACD filtering, it can effectively identify mid-long term trends and generate steady returns. With parameter optimization, risk management, and appropriate adjustments, this strategy can become an integral part of a trading system.

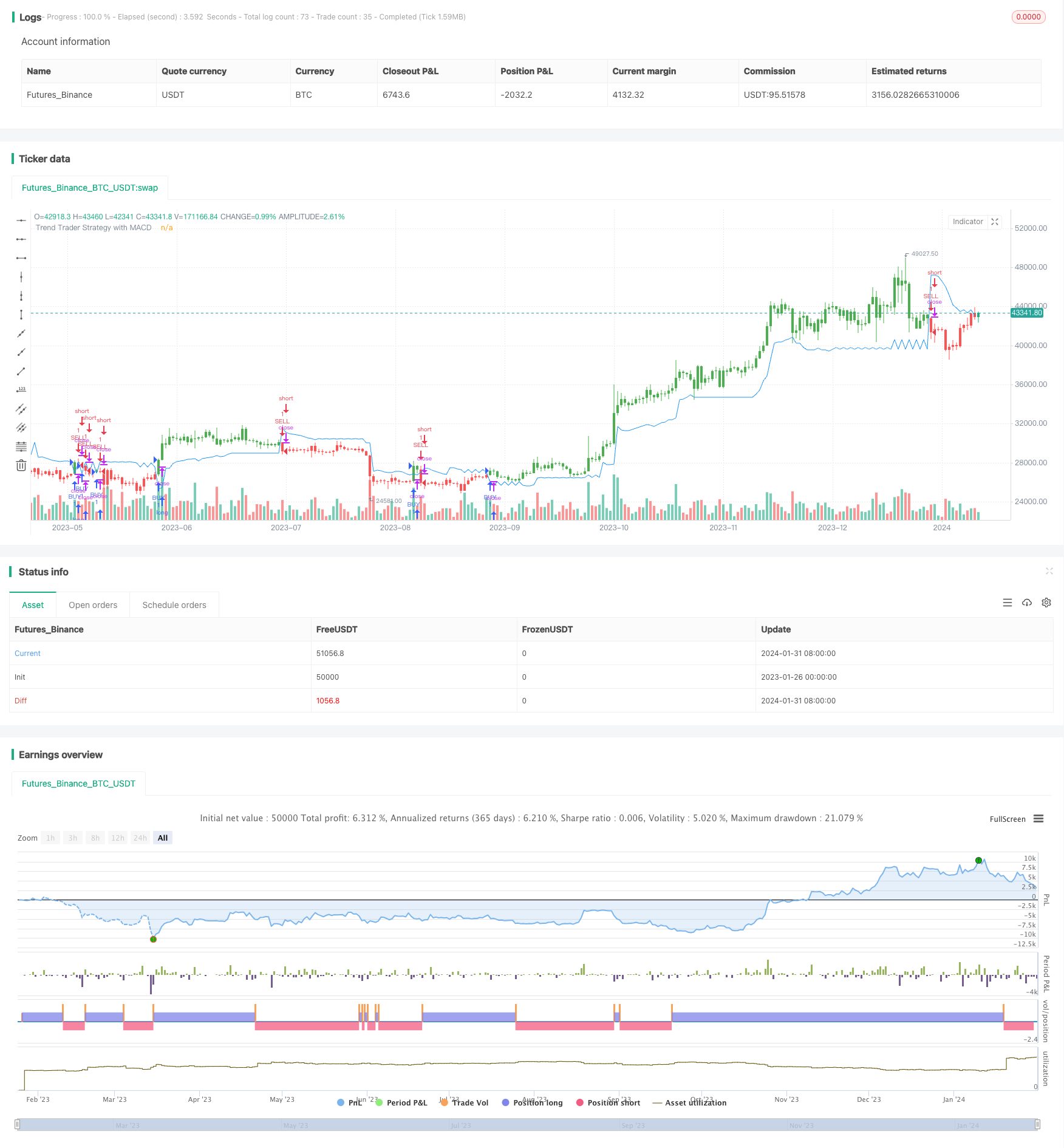

/*backtest

start: 2023-01-26 00:00:00

end: 2024-02-01 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © melihtuna

//@version=1

strategy("Trend Trader Strategy with MACD", overlay=true)

// === Trend Trader Strategy ===

Length = input(21),

Multiplier = input(3, minval=1)

MacdControl = input(true, title="Control 'MACD Histogram is positive?' when Buy condition")

avgTR = wma(atr(1), Length)

highestC = highest(Length)

lowestC = lowest(Length)

hiLimit = highestC[1]-(avgTR[1] * Multiplier)

loLimit = lowestC[1]+(avgTR[1] * Multiplier)

ret = iff(close > hiLimit and close > loLimit, hiLimit,

iff(close < loLimit and close < hiLimit, loLimit, nz(ret[1], 0)))

pos = iff(close > ret, 1,

iff(close < ret, -1, nz(pos[1], 0)))

barcolor(pos == -1 ? red: pos == 1 ? green : blue )

plot(ret, color= blue , title="Trend Trader Strategy with MACD")

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2020, title = "From Year", minval = 2017)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true

// === MACD ===

[macdLine, signalLine, histLine] = macd(close, 12, 26, 9)

macdCond= MacdControl ? histLine[0] > 0 ? true : false : true

strategy.entry("BUY", strategy.long, when = window() and pos == 1 and macdCond)

strategy.entry("SELL", strategy.short, when = window() and pos == -1)