Momentum Moving Average Crossover Trading Strategy

Author: ChaoZhang, Date: 2024-02-19 14:53:50Tags:

Overview

This strategy generates trading signals based on the MACD indicator. The MACD indicator consists of three lines: the MACD line, SIGNAL line and histogram (HISTO) line. When the MACD line crosses above the SIGNAL line and turns positive, it generates a buy signal. When the MACD line crosses below the SIGNAL line and turns negative, it generates a sell signal.

Strategy Logic

- Calculate the MACD line, SIGNAL line and HISTO line.

- Identify crossover points between the MACD line and SIGNAL line to determine buy and sell signals.

- Use a 34-period EMA as support/resistance zone, go long only above EMA and go short only below EMA.

- Set stop loss and take profit to lock in profits.

Specifically, when the close price crosses above the 34-period EMA and the MACD line crosses above the SIGNAL line into positive territory, it indicates strong upside momentum, so we buy. When the close price crosses below the 34-period EMA and the MACD line crosses below the SIGNAL line into negative territory, it indicates strong downside momentum, so we sell.

Advantages

- MACD indicator accurately identifies turns in price action with clear signals.

- Combining with EMA filter avoids false buy/sell signals.

- Stop loss and take profit controls per trade loss.

Risks and Solutions

- MACD signals lag price action and may miss best entry/exit points. Can optimize parameters to shorten moving average periods.

- Single indicator prone to generating false signals. Can add other indicators like KDJ for filtration.

- No limit on number of trades, may lead to overtrading. Can set daily/weekly trade limits.

Enhancement Opportunities

- Optimize MACD parameters to find best parameter combination.

- Add other indicator judgments to avoid false signals, e.g. MACD+KDJ, MACD+BOLL combinations.

- Implement trade frequency limits to prevent overtrading.

- Optimize stop loss/take profit strategy to improve risk/reward ratio.

Conclusion

This strategy identifies trading opportunities using the MACD indicator and filters signals using a 34-period EMA. It allows timely entries when new price trends start while controlling risk via stop loss/take profit. The strategy can be further refined via parameter optimization, adding other indicators etc. to improve profitability.

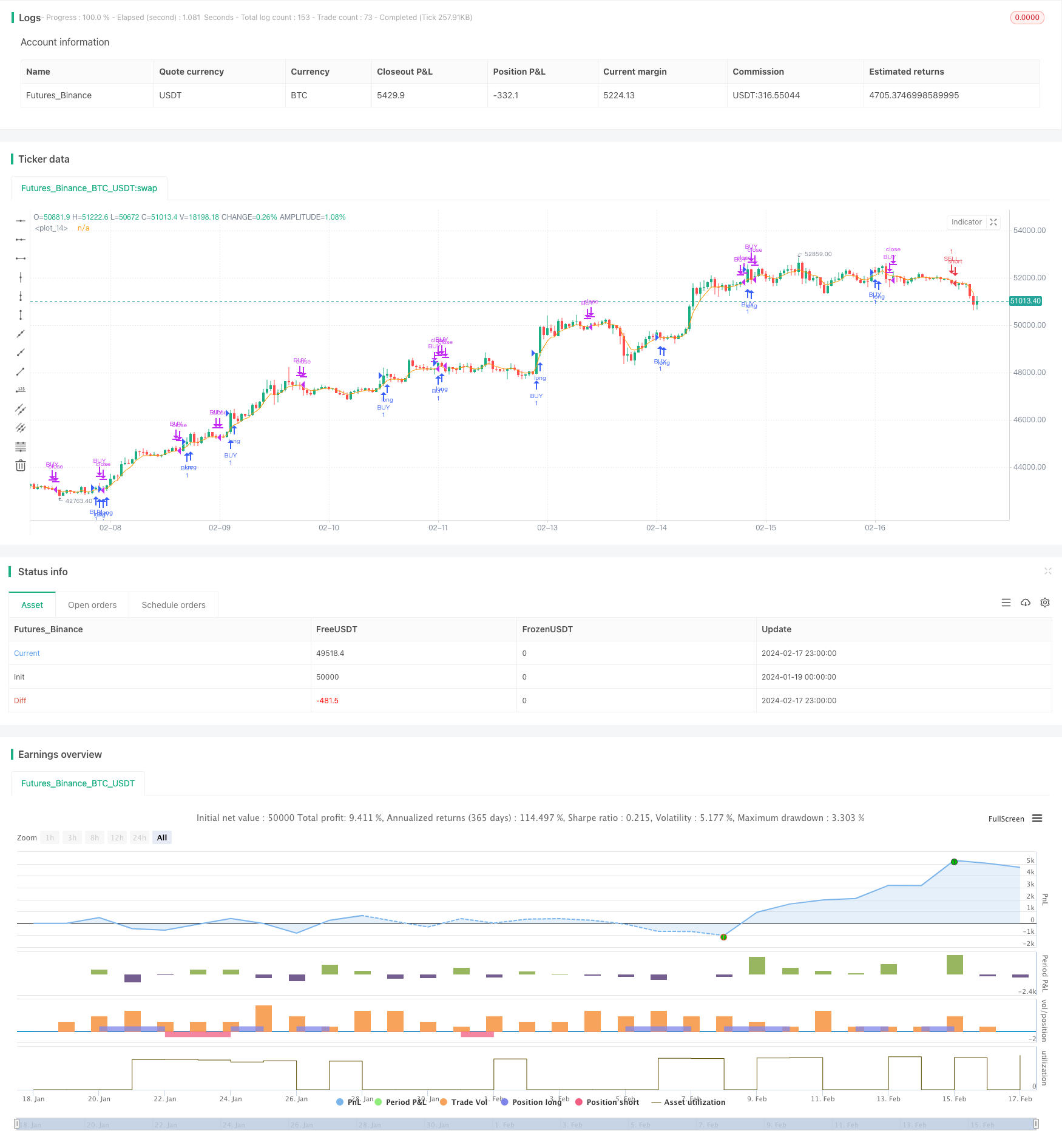

/*backtest

start: 2024-01-19 00:00:00

end: 2024-02-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © melihtuna

//@version=2

strategy("Jim's MACD", overlay=true)

Tendies = input(true, title="Check here for tendies")

// === MACD Setup ===

[macdLine, signalLine, histLine] = macd(close, 12, 26, 9)

//EMA

ma = ema(close, 5)

plot(ema(close,5))

//Entry

if (close > ma and cross(macdLine,signalLine) and histLine> 0.4 and signalLine > 0 or histLine > 0 and signalLine > 0 )

strategy.entry("BUY", strategy.long)

if(close < ma and cross(macdLine,signalLine) and histLine < -0.4 and signalLine < 0 or close < ma and histLine < 0 and signalLine < 0 )

strategy.entry("SELL", strategy.short)

//Exit

strategy.close("BUY", when = histLine < 0 )

strategy.close("SELL", when = histLine > 0 )

- Ichimoku Cloud Oscillator Trading Strategy

- Double Bottom Reversal Mean Reversion DCA Grid Strategy

- Assassin's Grid B – A Dynamic Grid Trading Strategy

- Multi Timeframe Moving Average Crossover Strategy

- Adaptive Zero Lag Exponential Moving Average Quantitative Trading Strategy

- Momentum Brick Strategy

- Volatility Breakout Reversal Trading Strategy

- Candle Patterns Trading Strategy

- ADX-Filtered SuperTrend Pivot Trading Strategy

- Momentum Moving Average Reversal Strategy

- Momentum Trend Synergy Strategy

- Rational Trading Robot Powered by RSI Strategy

- DYNAMIC MOMENTUM OSCILLATOR TRAILING STOP STRATEGY

- Bugra Trading Strategy Based on Dual Kinetic Moving Average

- Fractal and Pattern Based Quantitative Trading Strategy

- Reversal Fluctuation CAT Strategy

- Price Channel VWAP Trading Strategy

- The Interwoven Moving Average Crossover Strategy

- Moving Average Breakout and Bollinger Band Breakout Strategy

- Absolute Momentum Indicator Strategy