Momentum Moving Average Reversal Strategy

Author: ChaoZhang, Date: 2024-02-19 14:59:10Tags:

Overview

The core idea of this strategy is to combine the RSI indicator and moving average to find opportunities for stock price reversals and achieve buying low and selling high. When the RSI indicator shows that the stock is oversold and the short-term moving average crosses below the price, it serves as a buy signal. After setting the stop loss and take profit, wait for the price to reverse upward.

Strategy Principle

This strategy mainly uses the RSI indicator to judge oversold and overbought conditions, and the golden cross and dead cross of the moving average to determine price trends. Specifically, the RSI indicator can effectively judge whether a stock is oversold or overbought. When the RSI is below 30, it is in the oversold range. And when the short-term moving average (set to 9-day in this strategy) crosses below the price, it means the price is falling.

So when the RSI indicator is below 40, nearing the oversold state, and the 9-day moving average crosses below the price, it can be judged as a possible timing for the stock price to reverse, going long to buy. Then set the stop loss and take profit to exit, waiting for the stock price to reverse upward before selling to take profits.

Advantage Analysis

This strategy combines the RSI indicator and moving average, which can effectively determine the timing of buying. Compared with a single judgment of oversold, the added condition judgment of the moving average avoids fluctuation in the oversold area. The setting of stop loss and take profit is flexible and can vary from person to person.

Risk Analysis

This strategy relies on parameter settings such as RSI judgment threshold, moving average time window, etc. Different parameters may lead to different results. And under certain market conditions, stop loss is still possible.

In addition, transaction fees will also have a certain impact on profits. It is worth considering incorporating trading volume or fund management modules later for optimization.

Optimization Direction

Consider dynamically adjusting moving average parameters, selecting different parameters for different cycle; or introducing other indicators to judge, such as KDJ, MACD, etc., to form a comprehensive judgment based on multiple conditions.

It is also possible to establish a trading volume or capital management module to control the proportion of funds occupied by a single trade and reduce the impact of a single loss.

Summary

In general, this strategy uses RSI indicators and moving averages to determine buy timing and can effectively determine price reversals. Buying in oversold and locking in profits with stop loss and take profit can yield good results. For future optimizations, it is worth considering incorporating more Indicators or adding additional trading/fund management modules to make the strategy more robust.

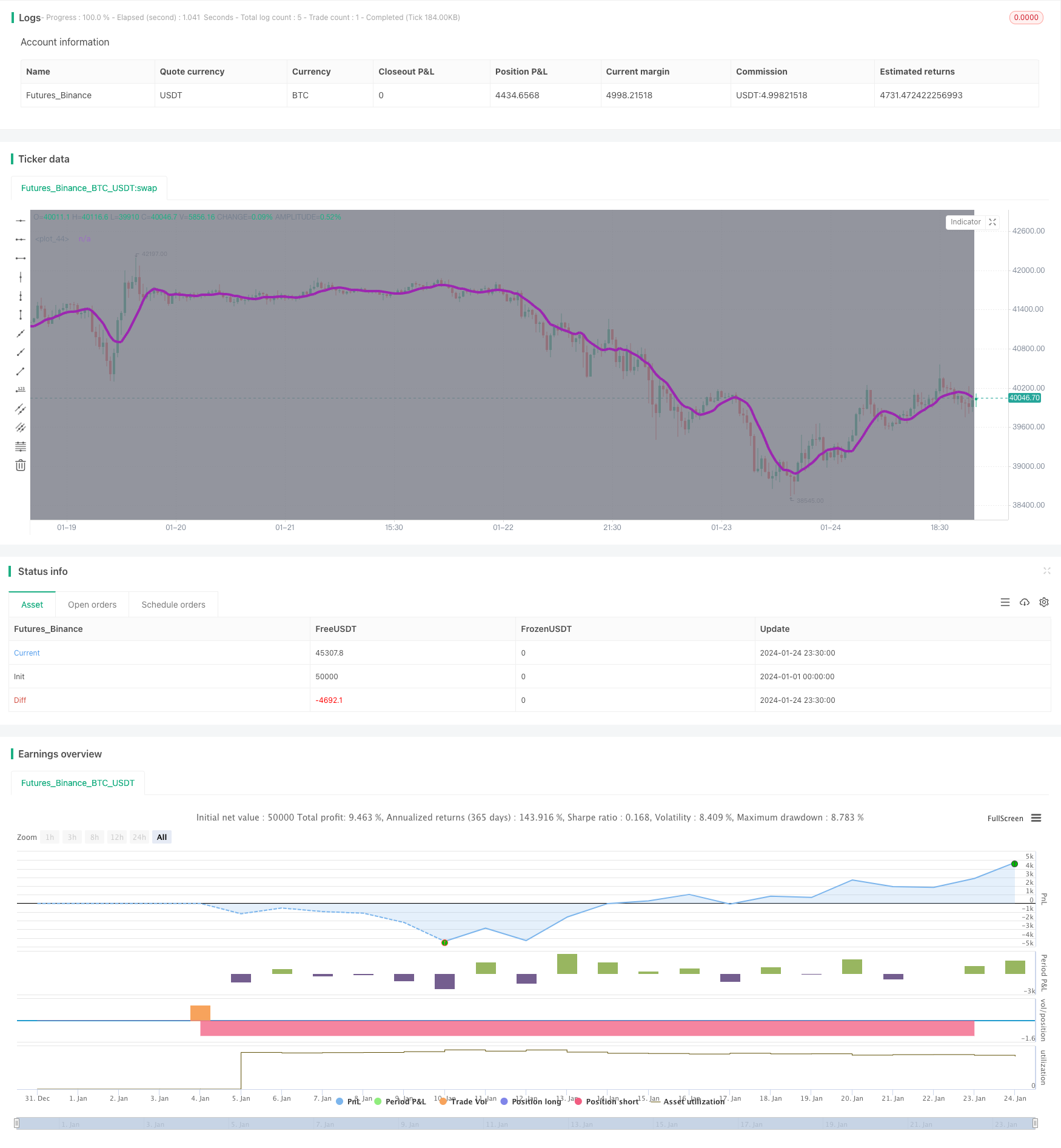

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 23:59:59

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

//@version=4

strategy(shorttitle='MARSI',title='Moving Average', overlay=true, initial_capital=1000, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

//Backtest dates

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2020, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

//MA inputs and calculations

inshort=input(9, title='MA short period')

MAshort= sma(close, inshort)

// RSI inputs and calculations

lengthRSI = input(14, title = 'RSI period', minval=1)

RSI = rsi(close, lengthRSI)

//Entry

strategy.entry(id="long", long = true, when = MAshort<close and RSI<40 and window())

//Exit

longLossPerc = input(title="Long Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=1.5) * 0.01

longTakePerc = input(title="Long Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=3) * 0.01

longSL = strategy.position_avg_price * (1 - longLossPerc)

longTP = strategy.position_avg_price * (1 + longTakePerc)

if (strategy.position_size > 0 and window())

strategy.exit(id="TP/SL", stop=longSL, limit=longTP)

bgcolor(color = showDate and window() ? color.gray : na, transp = 90)

plot(MAshort, color=color.purple, linewidth=4)

- Trend Following Strategy Based on Smoothed Deviation

- Ichimoku Cloud Oscillator Trading Strategy

- Double Bottom Reversal Mean Reversion DCA Grid Strategy

- Assassin's Grid B – A Dynamic Grid Trading Strategy

- Multi Timeframe Moving Average Crossover Strategy

- Adaptive Zero Lag Exponential Moving Average Quantitative Trading Strategy

- Momentum Brick Strategy

- Volatility Breakout Reversal Trading Strategy

- Candle Patterns Trading Strategy

- ADX-Filtered SuperTrend Pivot Trading Strategy

- Momentum Moving Average Crossover Trading Strategy

- Momentum Trend Synergy Strategy

- Rational Trading Robot Powered by RSI Strategy

- DYNAMIC MOMENTUM OSCILLATOR TRAILING STOP STRATEGY

- Bugra Trading Strategy Based on Dual Kinetic Moving Average

- Fractal and Pattern Based Quantitative Trading Strategy

- Reversal Fluctuation CAT Strategy

- Price Channel VWAP Trading Strategy

- The Interwoven Moving Average Crossover Strategy

- Moving Average Breakout and Bollinger Band Breakout Strategy