Overview

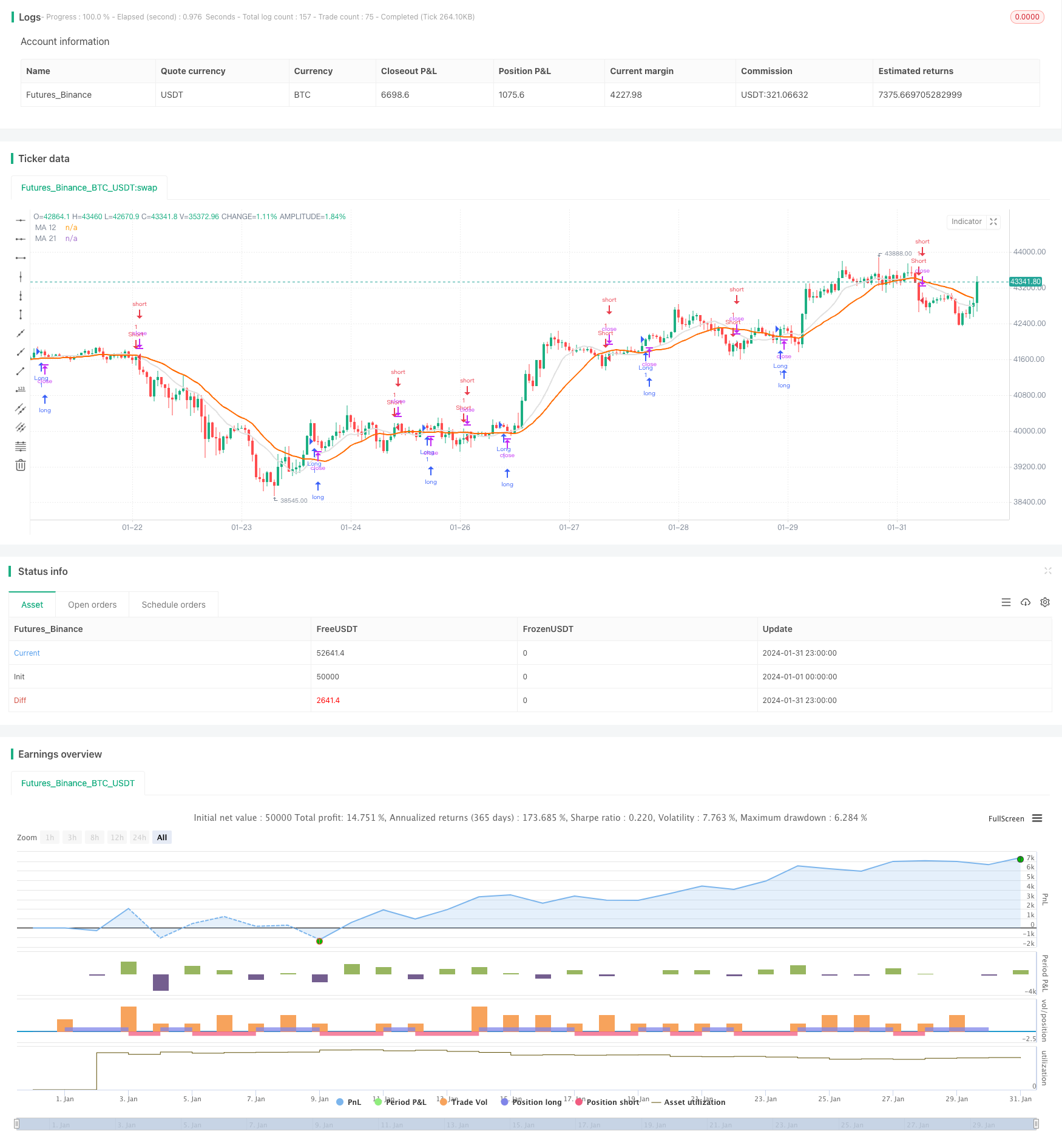

The moving average crossover breakout strategy is a short-term strategy that utilizes moving average crossover signals to enter and exit trades. This strategy constructs trading signals using the 12-period and 21-period simple moving averages. When the 12-period line crosses above the 21-period line, a buy signal is generated. When the 12-period line crosses below the 21-period line, a sell signal is generated. This strategy is suitable for short-term trading in high volatility markets.

Strategy Logic

The moving average crossover breakout strategy employs two moving averages, the 12-period and 21-period lines. These two moving averages can effectively depict short-term market trends. When the shorter term moving average crosses above the longer term line, it indicates the market is entering an uptrend. When the shorter term line crosses below the longer term line, it signals the start of a downtrend. The strategy goes long when a golden cross happens and goes short when a death cross happens, profiting by capturing turns in short-term trends.

Specifically, the strategy first calculates and plots the 12-period and 21-period simple moving averages. It then uses ta.crossover and ta.crossunder to determine if a crossover happens. When the 12-period line crosses above the 21-period line, it signals the market trend has changed from down to up. The strategy will then open a long position. When the 12-period line crosses below the 21-period line, the market has changed from an uptrend to a downtrend. The strategy will open a short position.

Through this method, the strategy can quickly capture reversal points in short-term trends, entering the market before prices reverse, and trading along the trend. When the trend reverses again, the strategy exits its position after another moving average crossover.

Advantage Analysis

The moving average crossover breakout strategy has the following advantages:

Simple to implement. The strategy relies solely on moving average crossovers for trading signals, which is very straightforward.

Systematic with low subjective influence. Strategy signals are completely based on specified parameter moving average crosses, not emotions.

Quick response to capture short-term trends. The use of faster moving averages can swiftly capture trend reversals and capitalize on short-term moves.

No need for stock picking or in-depth research. The strategy can be applied for short-term trading on all kinds of stocks and products without spending lots of time picking stocks.

Risk Analysis

Although the moving average crossover breakout strategy has many advantages, there are still some risks to consider:

Susceptible to false breakouts. Moving average crossovers don’t necessarily represent real trend reversals. False breakouts can cause unnecessary losses.

No position sizing rules. The strategy does not have rules around position sizing which can lead to overtrading in trending markets.

No stop loss in place. Not having stops can lead to huge losses in extreme market conditions.

Limited optimization space. Moving average periods are not the only optimal parameter setting. Parameter tuning space is constrained.

Some ways to address the above risks are:

Add volume indicators to filter out false breakouts.

Implement position sizing and capital management rules to prevent overtrading.

Add moving or volatility stops.

Test different parameter combinations to find optimal parameters.

Enhancement Areas

To reduce false signals, consider adding other indicators like MACD and RSI to provide additional signal confirmation before entering trades.

To control single trade loss, set up moving or volatility stops. When prices move a certain amount against the position, the stops will trigger trade exits.

To make strategy parameters more robust, optimize key inputs like moving average periods and position sizing to find the best performing combinations.

In addition, the strategy can also incorporate adaptive trading mechanisms. Use trend following techniques and longer holding periods when the market trends strongly. Revert to shorter holding times and timely stop losses when markets oscillate and volatility rises.

Conclusion

Overall this is an excellent strategy for short-term trend reversals. It uses just two moving averages to construct simple and fast trading signals that respond swiftly to price changes and capture shorter-term moves. However, there are risks around mistrades and overtrading in persistent trending markets. By adding filters, stops, robust parameters, and adaptive mechanisms, the strategy can be significantly enhanced to become a very practical tool for short-term breakout trading.

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rodrigofveras

//@version=5

strategy("BOT Bitget 12/21", overlay=true)

// Variáveis para armazenar as médias móveis

ma12 = ta.sma(close, 12)

ma21 = ta.sma(close, 21)

// Adicionar média móvel de 12 períodos ao gráfico

plot(ma12, color=color.rgb(224, 224, 224), linewidth=2, title="MA 12")

// Adicionar média móvel de 21 períodos ao gráfico

plot(ma21, color=color.rgb(255, 106, 0), linewidth=2, title="MA 21")

// Variáveis para armazenar o estado da estratégia

isLong = false

isShort = false

// Verifica se a média móvel de 12 períodos está cruzando acima da média móvel de 21 períodos

if ta.crossover(ma12, ma21)

// Entra em uma posição longa

isLong := true

isShort := false

strategy.entry("Long", strategy.long)

// Verifica se a média móvel de 12 períodos está cruzando abaixo da média móvel de 21 períodos

if ta.crossunder(ma12, ma21)

// Entra em uma posição curta

isLong := false

isShort := true

strategy.entry("Short", strategy.short)