Overview

This strategy is a comprehensive trading system that combines multiple Exponential Moving Averages (EMA) crossovers, Average True Range (ATR), and Pivot Points support/resistance levels. It captures market trend reversals by analyzing short-term EMA crosses against medium and long-term EMAs, combined with ATR volatility ranges and key price levels.

Strategy Principles

The strategy is based on three dimensions of technical analysis: 1. Trend Identification: Uses triple EMAs (4, 9, and 18 periods), confirming trend direction through synchronized crosses of short-term EMA(4) against medium-term EMA(9) and long-term EMA(18). 2. Volatility Range: Incorporates 14-period ATR to quantify market volatility and set dynamic trading thresholds. 3. Price Support/Resistance: Implements daily Pivot Points system (PPSignal), establishing 7 key price levels (PP, R1-R3, S1-S3) as reference points.

Trading rules are clearly defined: - Long Entry: EMA4 crosses above both EMA9 and EMA18, with closing price breaking above EMA9 + ATR - Short Entry: EMA4 crosses below both EMA9 and EMA18, with closing price breaking below EMA9 - ATR - Stop Loss: Dynamically tracks EMA4 level

Strategy Advantages

- Multi-dimensional Analysis: Combines trend, volatility, and price structure analysis for improved signal reliability

- Dynamic Adaptation: Adapts to different market conditions through ATR and dynamic support/resistance levels

- Comprehensive Risk Control: Implements dynamic stop-loss mechanism for profit protection and risk management

- Robust Signal Confirmation: Requires multiple technical indicator convergence, reducing false breakout risks

Strategy Risks

- Choppy Market Risk: May generate frequent false signals during consolidation phases

- Lag Risk: Inherent delay in moving averages may miss optimal entry points

- Gap Risk: Overnight gaps may render stop-loss levels ineffective

- Parameter Sensitivity: Different period combinations may produce significantly varying results

Strategy Optimization Directions

- Volume Integration: Add volume confirmation for crossover signals

- Dynamic Parameter Optimization: Adapt EMA periods based on market volatility

- Enhanced Stop-Loss: Consider implementing floating stops based on ATR

- Market Environment Filter: Add trend strength indicators to trade only during strong trends

- Time Filter: Establish optimal trading sessions based on different timeframe characteristics

Summary

This strategy constructs a comprehensive trading system through the synergy of multiple technical indicators. Its core strengths lie in its multi-dimensional signal confirmation mechanism and robust risk control framework, though traders need to optimize parameters and improve the system based on specific market conditions. Through the suggested optimization directions, the strategy’s stability and reliability can be further enhanced.

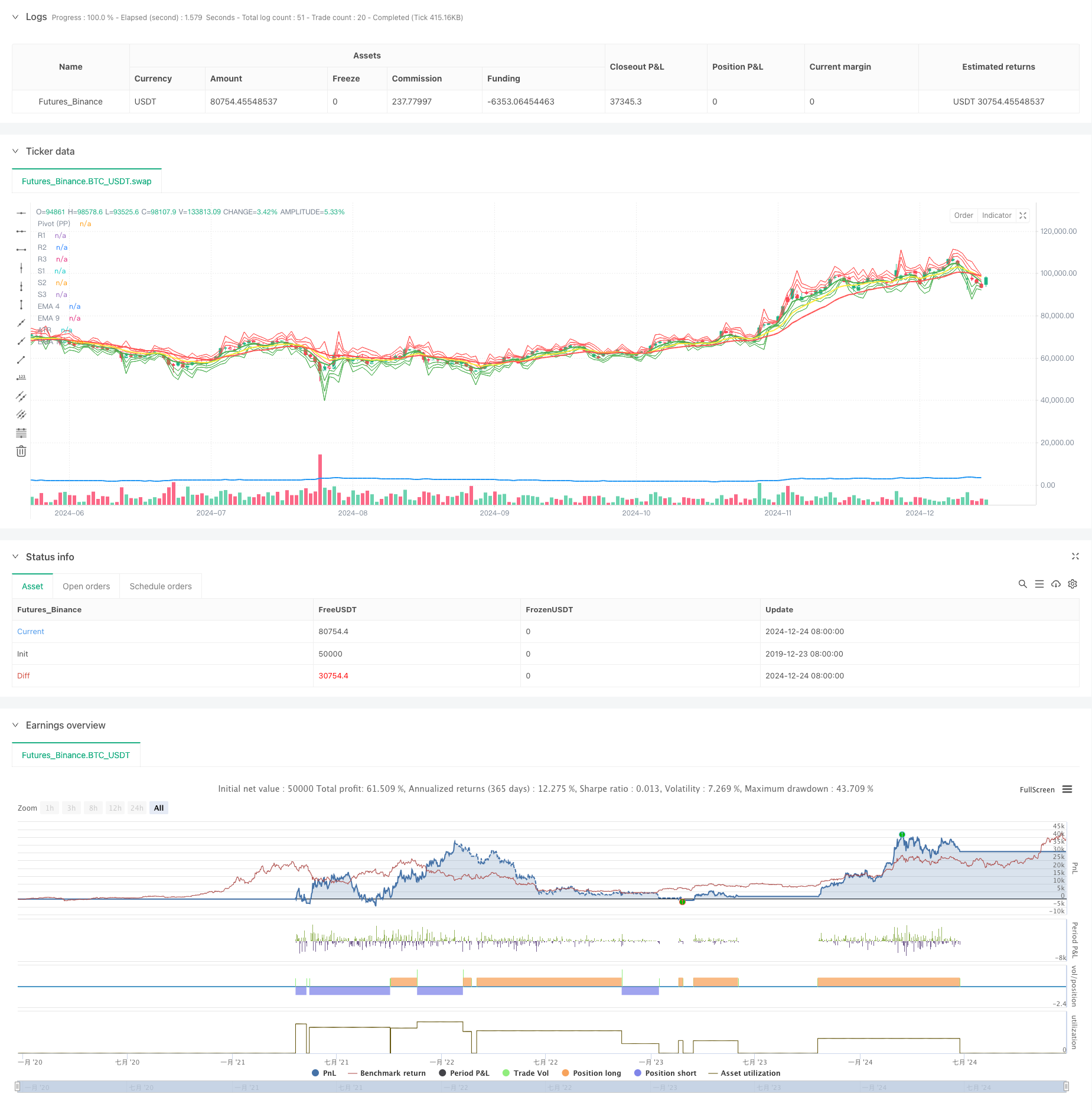

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover + ATR + PPSignal", overlay=true)

//--------------------------------------------------------------------

// 1. Cálculo de EMAs y ATR

//--------------------------------------------------------------------

ema4 = ta.ema(close, 4)

ema9 = ta.ema(close, 9)

ema18 = ta.ema(close, 18)

atrLength = 14

atr = ta.atr(atrLength)

//--------------------------------------------------------------------

// 2. Cálculo de Pivot Points diarios (PPSignal)

// Tomamos datos del día anterior (timeframe D) para calcularlos

//--------------------------------------------------------------------

dayHigh = request.security(syminfo.tickerid, "D", high[1])

dayLow = request.security(syminfo.tickerid, "D", low[1])

dayClose = request.security(syminfo.tickerid, "D", close[1])

// Fórmula Pivot Points estándar

pp = (dayHigh + dayLow + dayClose) / 3.0

r1 = 2.0 * pp - dayLow

s1 = 2.0 * pp - dayHigh

r2 = pp + (r1 - s1)

s2 = pp - (r1 - s1)

r3 = dayHigh + 2.0 * (pp - dayLow)

s3 = dayLow - 2.0 * (dayHigh - pp)

//--------------------------------------------------------------------

// 3. Definir colores para las EMAs

//--------------------------------------------------------------------

col4 = color.green // EMA 4

col9 = color.yellow // EMA 9

col18 = color.red // EMA 18

//--------------------------------------------------------------------

// 4. Dibujar indicadores en el gráfico

//--------------------------------------------------------------------

// EMAs

plot(ema4, title="EMA 4", color=col4, linewidth=2)

plot(ema9, title="EMA 9", color=col9, linewidth=2)

plot(ema18, title="EMA 18", color=col18, linewidth=2)

// ATR

plot(atr, title="ATR", color=color.blue, linewidth=2)

// Pivot Points (PPSignal)

plot(pp, title="Pivot (PP)", color=color.new(color.white, 0), style=plot.style_line, linewidth=1)

plot(r1, title="R1", color=color.new(color.red, 0), style=plot.style_line, linewidth=1)

plot(r2, title="R2", color=color.new(color.red, 0), style=plot.style_line, linewidth=1)

plot(r3, title="R3", color=color.new(color.red, 0), style=plot.style_line, linewidth=1)

plot(s1, title="S1", color=color.new(color.green, 0), style=plot.style_line, linewidth=1)

plot(s2, title="S2", color=color.new(color.green, 0), style=plot.style_line, linewidth=1)

plot(s3, title="S3", color=color.new(color.green, 0), style=plot.style_line, linewidth=1)

//--------------------------------------------------------------------

// 5. Condiciones de cruce (EMA4 vs EMA9 y EMA18) y estrategia

//--------------------------------------------------------------------

crossedAbove = ta.crossover(ema4, ema9) and ta.crossover(ema4, ema18)

crossedBelow = ta.crossunder(ema4, ema9) and ta.crossunder(ema4, ema18)

// Señales de Buy y Sell basadas en cruces + condición con ATR

if crossedAbove and close > ema9 + atr

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", "Buy", stop=ema4)

if crossedBelow and close < ema9 - atr

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=ema4)