Overview

This strategy is a trend-following trading system based on the Ichimoku Cloud indicator. It identifies market trends through crossovers of cloud components and generates trading signals when price breaks through key technical levels. The strategy employs a non-repainting approach, with all signals confirmed at bar close, effectively reducing the risk of false signals. It is applicable across multiple timeframes and particularly suitable for volatile market conditions.

Strategy Principles

The core logic is based on three key conditions: 1. Price breaks above the Base Line, indicating strengthening short-term trend 2. Price breaks above Lead Line A, confirming medium-term trend direction 3. Price remains above the Conversion Line, validating trend continuity When these three conditions are simultaneously met, the system generates a buy signal at bar close. Opposite conditions trigger exit signals. The strategy also utilizes cloud filling for enhanced trend visualization, with green clouds indicating bullish markets and red clouds indicating bearish markets.

Strategy Advantages

- High Signal Reliability: Multiple confirmation conditions reduce false breakout risks

- Non-Repainting Design: All signals confirmed at bar close, preventing backtest beautification

- Multi-Timeframe Applicability: Works on various timeframes from 5-minute to weekly

- Strong Trend Following Capability: Accurately captures major trends through cloud component coordination

- Excellent Visualization: Uses triangle markers for signal points, clear cloud filling for trend changes

- High Flexibility: Key parameters adjustable for different market conditions

Strategy Risks

- Choppy Market Risk: May generate frequent false signals during consolidation phases

- Lag Risk: Signal delay due to moving average calculations

- Money Management Risk: Lack of stop-loss mechanism may lead to significant drawdowns

- Parameter Optimization Risk: Over-optimization may result in overfitting

- Market Environment Dependency: Strategy performs best in strong trends, suboptimal in weak trend periods

Strategy Optimization Directions

- Add Volatility Filtering: Introduce ATR indicator to filter signals during low volatility periods

- Improve Stop-Loss Mechanism: Implement trailing stops to protect profits

- Enhance Signal Confirmation: Integrate RSI, MACD indicators to strengthen signal reliability

- Incorporate Volume Analysis: Confirm price breakout validity through volume

- Market Environment Recognition: Develop trend strength indicators for optimal trading timing

Summary

The strategy establishes a reliable trend-following trading system through innovative application of the Ichimoku Cloud indicator. Its non-repainting design and multiple confirmation mechanisms significantly improve signal quality. While performance may be suboptimal in choppy markets, the suggested optimization directions can further enhance strategy stability and applicability. The strategy is particularly suitable for tracking medium to long-term trends, making it an excellent choice for traders seeking trend-following opportunities.

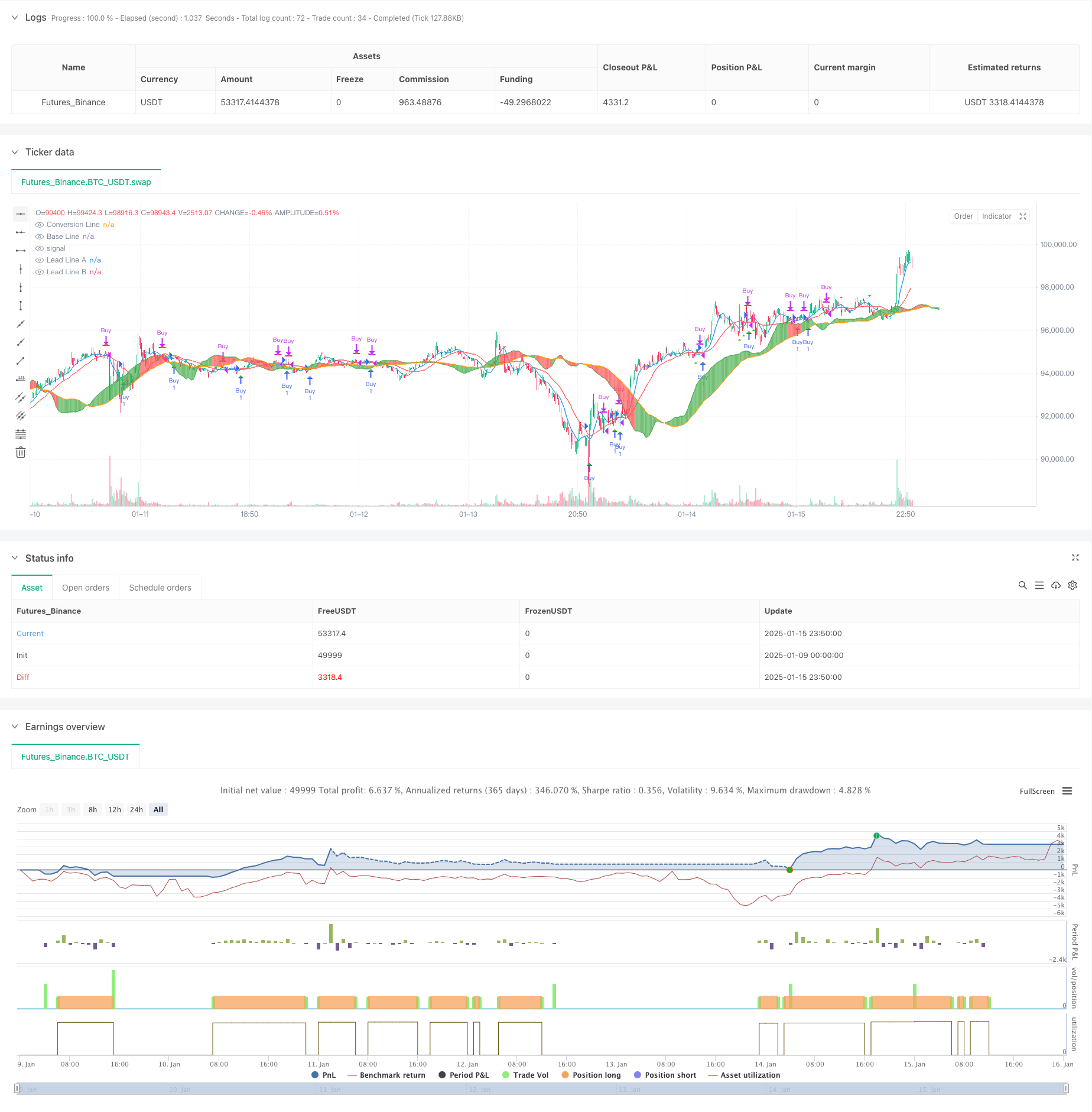

/*backtest

start: 2025-01-09 00:00:00

end: 2025-01-16 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Ichimoku Cloud Buy Strategy (Non-Repainting)", overlay=true)

// === Ichimoku Cloud Settings ===

lengthConversionLine = input(9, title="Conversion Line Length")

lengthBaseLine = input(26, title="Baseline Length")

lengthLeadLine = input(52, title="Lead Line Length")

// === Calculate Ichimoku Cloud Components ===

conversionLine = ta.sma((high + low) / 2, lengthConversionLine)

baseLine = ta.sma((high + low) / 2, lengthBaseLine)

leadLineA = (conversionLine + baseLine) / 2

leadLineB = ta.sma((high + low) / 2, lengthLeadLine)

// === Forward Projected Lead Lines (Fixes Ichimoku Calculation) ===

leadLineA_Future = leadLineA[lengthBaseLine] // Shift forward

leadLineB_Future = leadLineB[lengthBaseLine]

// === Define Buy and Sell Conditions (Confirmed at Bar Close) ===

buyCondition = ta.crossover(close, baseLine) and ta.crossover(close, leadLineA) and close > conversionLine and bar_index > bar_index[1]

sellCondition = ta.crossunder(close, baseLine) and ta.crossunder(close, leadLineA) and close < conversionLine and bar_index > bar_index[1]

// === Plot Buy and Sell Signals (Confirmed at Bar Close) ===

plotshape(buyCondition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(sellCondition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// === Implement Strategy Logic (Trades at Bar Close) ===

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.close("Buy")

// === Plot Ichimoku Cloud Components with Future Projection ===

pConversionLine = plot(conversionLine, color=color.blue, title="Conversion Line")

pBaseLine = plot(baseLine, color=color.red, title="Base Line")

pLeadLineA = plot(leadLineA_Future, color=color.green, title="Lead Line A", offset=lengthBaseLine)

pLeadLineB = plot(leadLineB_Future, color=color.orange, title="Lead Line B", offset=lengthBaseLine)

// === Fill Ichimoku Cloud for Better Visualization ===

fill(pLeadLineA, pLeadLineB, color=leadLineA > leadLineB ? color.green : color.red, transp=80)

// === Alert Conditions (Only Triggered on Confirmed Signals) ===

alertcondition(buyCondition, title="Ichimoku Cloud Buy Signal", message="Ichimoku Cloud Buy Signal Triggered")

alertcondition(sellCondition, title="Ichimoku Cloud Sell Signal", message="Ichimoku Cloud Sell Signal Triggered")