Overview

This is a momentum breakout trading strategy based on the Donchian Channel, combining price breakout and volume confirmation as key conditions. The strategy captures upward market trends by observing price breakouts beyond a predefined range while requiring volume support. It incorporates a lag parameter to enhance channel stability and offers flexible exit conditions.

Strategy Principles

The core logic includes the following key components: 1. Uses a lagged Donchian Channel as the primary technical indicator, constructed using the highest and lowest prices over 27 periods. 2. Entry conditions require both: - Closing price breaks above the upper Donchian Channel band - Current volume exceeds 1.4 times the 27-period average volume 3. Flexible exit conditions: - Can exit when price falls below upper, middle, or lower band - Middle band is used as default exit signal 4. Implements a 10-period lag parameter to enhance channel stability and reduce false breakouts.

Strategy Advantages

- Multiple confirmation mechanism: Combines price breakout and volume confirmation, significantly reducing false signals.

- High adaptability: Parameterized design allows adaptation to different market conditions.

- Comprehensive risk control: Offers multiple exit condition choices for different risk preferences.

- Clear execution: Entry and exit conditions are well-defined without ambiguity.

- Easy implementation: Simple and straightforward logic suitable for live trading.

Strategy Risks

- Market volatility risk: May generate frequent false breakout signals in ranging markets.

- Slippage risk: High trading volume during breakouts may lead to significant slippage.

- Trend reversal risk: Sudden market reversals may not allow timely exits.

- Parameter sensitivity: Strategy performance is sensitive to parameter settings, requiring careful optimization.

Optimization Directions

- Add trend filters: Can incorporate additional trend indicators like moving average systems.

- Enhance volume indicators: Consider using more sophisticated volume analysis methods like OBV or money flow indicators.

- Improve stop-loss mechanism: Add trailing stop or fixed stop-loss functionality.

- Implement time filters: Add intraday time filters to avoid trading during volatile opening and closing periods.

- Introduce volatility adaptation: Automatically adjust parameters based on market volatility to improve strategy adaptability.

Summary

This is a well-designed trend-following strategy with clear logic. By combining price breakout and volume confirmation, the strategy maintains reliability while preserving flexibility. The parameterized design provides good adaptability, though investors need to optimize parameters based on specific market conditions. Overall, this represents a strategic framework worthy of further optimization and practical implementation.

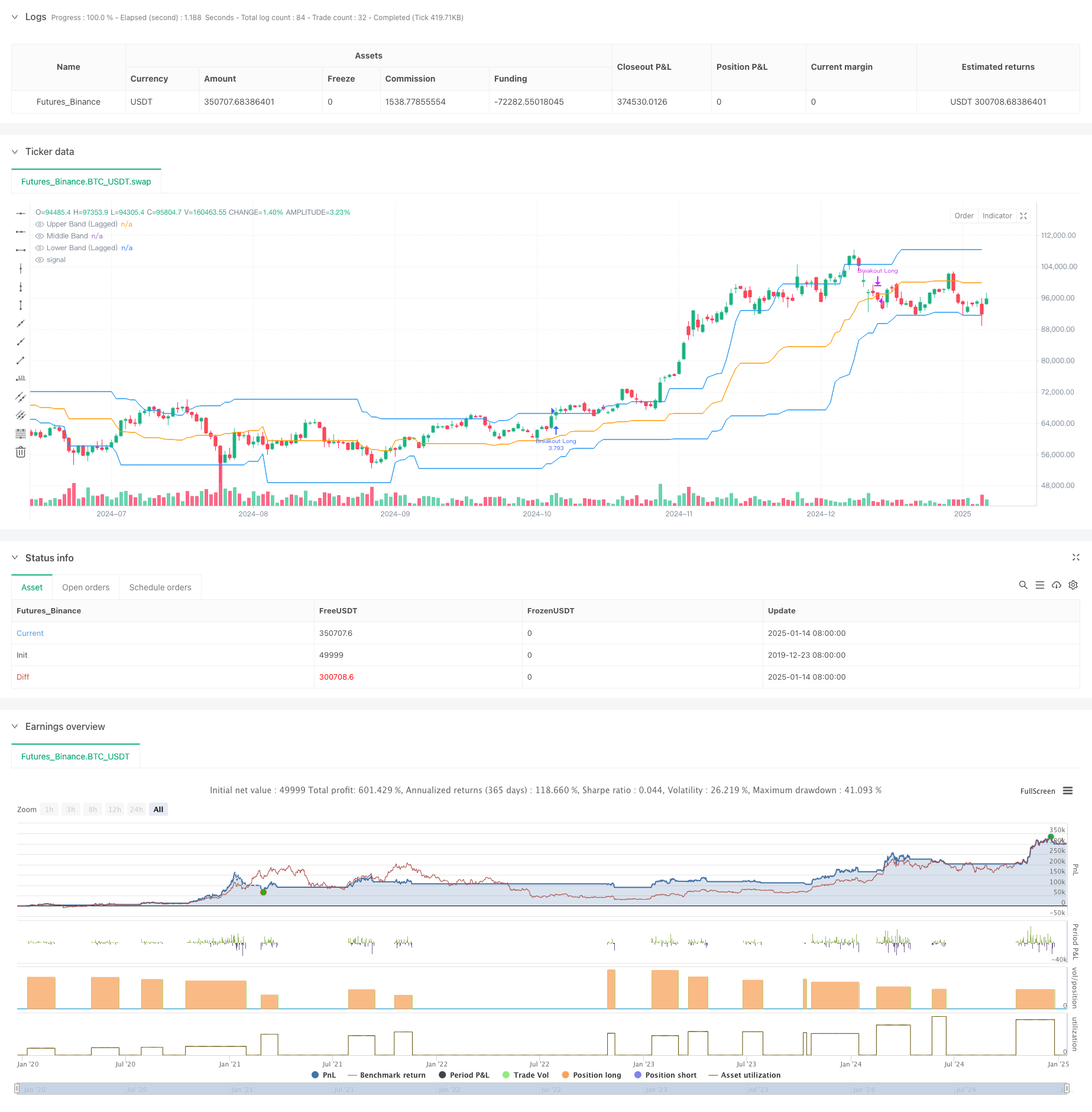

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-15 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=6

strategy("Breakout Strategy", overlay=true, calc_on_every_tick=false, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1, pyramiding=1, fill_orders_on_standard_ohlc=true)

// Input Parameters

start_date = input(timestamp("2018-01-01 00:00"), "Start Date")

end_date = input(timestamp("2060-01-01 00:00"), "End Date")

in_time_range = true

length = input.int(27, title="Donchian Channel Length", minval=1, tooltip="Number of bars used to calculate the Donchian channel.")

lag = input.int(10, title="Donchian Channel Offset", minval=1, tooltip = "Offset to delay the Donchian channel, enhancing stability.")

volume_mult = input.float(1.4, title="Volume Multiplier", minval=0.1, step=0.1, tooltip="Multiplier for the average volume to filter breakout conditions.")

closing_condition = input.string("Mid", title="Trade Closing Band", options= ["Upper","Lower","Mid"], tooltip = "Donchian Channel Band to use for exiting trades: Upper, Lower, or Middle.") //

// Donchian Channel (Lagged for Stability)

upper_band = ta.highest(high[lag], length)

lower_band = ta.lowest(low[lag], length)

middle_band = (upper_band + lower_band) / 2

plot(upper_band, color=color.blue, title="Upper Band (Lagged)")

plot(middle_band, color=color.orange, title="Middle Band")

plot(lower_band, color=color.blue, title="Lower Band (Lagged)")

// Volume Filter

avg_volume = ta.sma(volume, length)

volume_condition = volume > avg_volume * volume_mult

// Long Breakout Condition

long_condition = close > upper_band and volume_condition

bool reverse_exit_condition = false

// Exit Condition (Close below the middle line)

if closing_condition == "Lower"

reverse_exit_condition := close < lower_band

else if closing_condition == "Upper"

reverse_exit_condition := close < upper_band

else

reverse_exit_condition := close < middle_band

// Long Strategy: Entry and Exit

if in_time_range and long_condition

strategy.entry("Breakout Long", strategy.long)

// Exit on Reverse Signal

if in_time_range and reverse_exit_condition

strategy.close("Breakout Long", comment="Reverse Exit")