Estrategia cuántica de la OCM para la doble reversión

El autor:¿ Qué pasa?, Fecha: 2024-01-04 14:35:23Las etiquetas:

Resumen general

Esta estrategia es una doble estrategia de reversión, que combina el indicador 123 de reversión y el indicador cuántico CMOWMA para lograr una doble confirmación de las señales de reversión de precios con efectos visuales de línea K roja y verde.

Principio de la estrategia

La estrategia consta de dos partes:

-

123 Indicador de reversión

- Utilice el precio de cierre frente al precio de cierre anterior para determinar el precio hacia arriba o hacia abajo

- Utilice el indicador estocástico para confirmar las señales de inversión.

- Generar señales largas o cortas cuando se cumplen las condiciones

-

Indicador cuántico CMOWMA

- Utilizar el indicador de OCM para medir el impulso de los precios

- Aplicar el promedio móvil ponderado de la AMM al indicador de OCM

- Ver largo (corto) cuando el OCM está por encima (por debajo) de su AMM

Introduzca posiciones cuando ambas partes den señales en la misma dirección.

Ventajas de la estrategia

- El mecanismo de doble confirmación puede filtrar las roturas falsas y reducir las posiciones innecesarias

- La coloración de la línea K roja y verde genera efectos visuales para juzgar fácilmente las condiciones del mercado

- La combinación de indicadores de reversión e impulso proporciona una estabilidad general

- Los parámetros sencillos lo hacen adecuado para varios productos y fácil de implementar

Riesgos de la estrategia

- Los precios pueden revertirse nuevamente después de la inversión inicial, con riesgo de cambios drásticos

- Los cambios frecuentes de posición generan comisiones de negociación excesivas

- La configuración incorrecta de los parámetros puede causar demasiadas o muy pocas señales

- Los parámetros de la OCM deben ajustarse en función de las características del producto

Los riesgos pueden reducirse relajando las condiciones de inversión, aumentando el período de retención, optimizando las combinaciones de parámetros, etc.

Direcciones de optimización

- Efectos de ensayo de diferentes parámetros estocásticos

- Reemplazar/añadir confirmaciones con otros indicadores como el MACD, el KDJ, etc.

- Optimizaciones de ensayo de diferentes longitudes de la OCM y de la AMM

- Trate de añadir stop loss / tomar ganancias en ciertos niveles

- Configurar filtros para controlar la frecuencia de las nuevas posiciones

Resumen de las actividades

La estrategia es robusta en general con parámetros simples, fácil de implementar, combinando la inversión de precios e indicadores de impulso para formar un mecanismo de filtrado de señal dual eficaz para eliminar señales falsas.

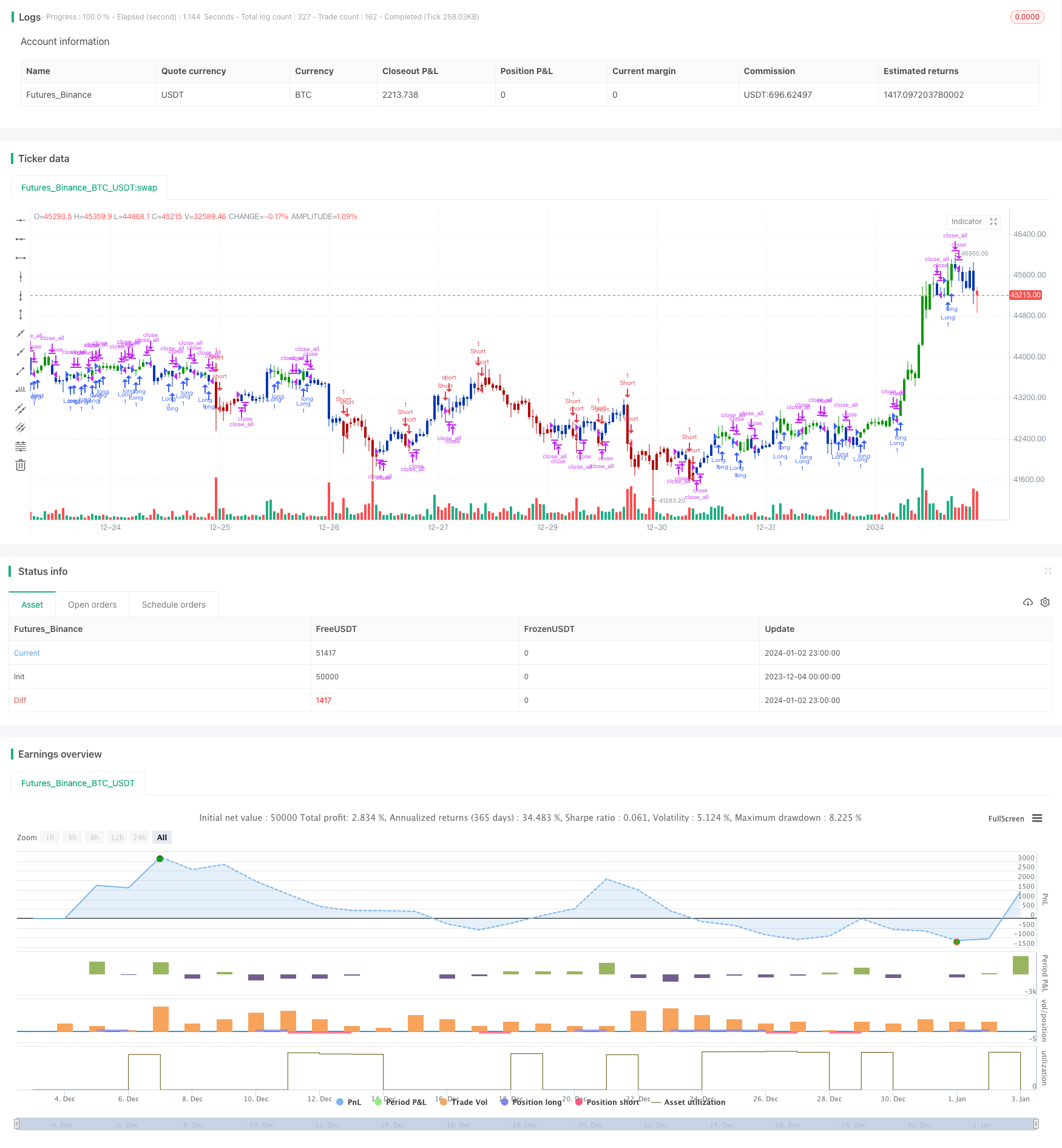

/*backtest

start: 2023-12-04 00:00:00

end: 2024-01-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 19/08/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This indicator plots Chandre Momentum Oscillator and its WMA on the

// same chart. This indicator plots the absolute value of CMO.

// The CMO is closely related to, yet unique from, other momentum oriented

// indicators such as Relative Strength Index, Stochastic, Rate-of-Change,

// etc. It is most closely related to Welles Wilder?s RSI, yet it differs

// in several ways:

// - It uses data for both up days and down days in the numerator, thereby

// directly measuring momentum;

// - The calculations are applied on unsmoothed data. Therefore, short-term

// extreme movements in price are not hidden. Once calculated, smoothing

// can be applied to the CMO, if desired;

// - The scale is bounded between +100 and -100, thereby allowing you to clearly

// see changes in net momentum using the 0 level. The bounded scale also allows

// you to conveniently compare values across different securities.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

CMOWMA(Length, LengthWMA) =>

pos = 0

xMom = abs(close - close[1])

xSMA_mom = sma(xMom, Length)

xMomLength = close - close[Length]

nRes = 100 * (xMomLength / (xSMA_mom * Length))

xWMACMO = wma(nRes, LengthWMA)

pos := iff(nRes > xWMACMO, 1,

iff(nRes <= xWMACMO, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & CMO & WMA", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthCMO = input(14, minval=1)

LengthWMA = input(13, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posCMOWMA = CMOWMA(LengthCMO, LengthWMA)

pos = iff(posReversal123 == 1 and posCMOWMA == 1 , 1,

iff(posReversal123 == -1 and posCMOWMA == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Estrategia de seguimiento de la tendencia inversa de la media móvil doble cruzada

- Estrategia de optimización de seguimiento de tendencia de las luces cuánticas

- Estrategia basada en el volumen y la energía

- Estrategia de impulso de la HMA

- Estrategia de seguimiento de tendencias basada en ATR e índice de volatilidad

- Estrategia de seguimiento de tendencias de impulso

- Tendencia cuantitativa siguiendo la estrategia

- Estrategia de media móvil del filtro de casco

- Estrategia de poder del oso

- Estrategia de cruce de dos medias móviles

- Estrategia de cruce entre el RSI y el SMA

- Estrategia de ruptura de la banda de Bollinger

- Estrategia de seguimiento del impulso del precio

- Estrategia de negociación en red basada en el sistema de medias móviles

- Estrategia de inversión de impulso

- Estrategia de seguimiento de tendencias de media móvil cruzada

- Ratio de oro de Fibonacci y estrategia de RSI de fuerza relativa

- Estrategia de negociación integrada de inversión y centro de gravedad basada en estrategias múltiples

- Estrategia de cruce de media móvil exponencial doble y triple

- Estrategia de negociación de fluctuación de las bandas de Bollinger