Descripción general

La estrategia es un sistema de seguimiento de tendencias dinámicas basado en el indicador ATR, combinado con análisis de múltiples períodos y funciones de gestión de cartera. La estrategia capta los cambios de tendencia en diferentes períodos de tiempo mediante el seguimiento de la posición relativa de los precios y los canales ATR, mientras que la estrategia gestiona las posiciones dinámicas en función de la cantidad de transacciones establecidas por el usuario. La estrategia está diseñada teniendo en cuenta la estabilidad del seguimiento de tendencias y la flexibilidad de los tiempos de negociación.

Principio de estrategia

La lógica central de la estrategia se basa en los siguientes elementos clave:

- Creación de un canal de deterioro dinámico usando el indicador ATR, cuyo ancho está determinado por el ciclo ATR y los parámetros de sensibilidad

- Determinación de las señales de compra y venta a través de la intersección de los canales EMA y ATR

- Soporta varios períodos de tiempo, desde 5 minutos hasta 2 horas

- Combinado con un mecanismo de seguimiento de la cartera, el volumen de compra y venta se ajusta según la dinámica actual de la posesión

- Se puede optar por utilizar la línea K lisa (Heikin Ashi) para reducir la señal falsa

Ventajas estratégicas

- Adaptabilidad - Adaptación de la anchura del canal de forma dinámica a través de ATR para adaptarse a diferentes entornos del mercado

- Control de riesgo - mecanismo de parada de pérdidas incorporado, que proporciona un punto de parada dinámico a través de la vía ATR

- Flexibilidad operativa - soporte para análisis de múltiples ciclos, con la opción de elegir el período de tiempo adecuado para las diferentes características de la variedad

- Gestión de posiciones - gestión dinámica de posiciones mediante el seguimiento de la cartera

- Estabilidad de la señal - Se puede elegir una línea K suave para reducir el ruido y mejorar la calidad de la señal

Riesgo estratégico

- Dependencia de la tendencia - puede generar transacciones frecuentes en mercados convulsionados

- Lagresión - El uso de la línea media y el ATR trae cierto retraso de la señal

- Sensibilidad de parámetros - la elección de los parámetros de ATR y sensibilidad tiene un impacto mayor en el rendimiento de la estrategia

- Gestión de fondos - la necesidad de establecer un número razonable de transacciones por transacción para evitar la posesión excesiva

- Adaptabilidad del mercado: el rendimiento puede variar en diferentes entornos del mercado

Dirección de optimización de la estrategia

- Filtración de señales

- Indicadores de confirmación de la intensidad de la tendencia

- Introducción al análisis de tráfico

- Considerar la inclusión de un filtro de fluctuación

- Administración de posiciones

- Ajuste dinámico del tamaño de las posiciones basado en la volatilidad

- Realización de la construcción y reducción de almacenes por lotes

- Junto con el control de retirada máxima

- Optimización de pérdidas

- Pérdidas en combinación con la configuración de la resistencia de soporte

- Realización de la pérdida móvil

- Optimización del método de cálculo de la distancia de parada

Resumir

La estrategia es un sistema de negociación completo que combina análisis técnico y gestión de cartera. Ofrece una capacidad de seguimiento de tendencias estable a través de la vía dinámica ATR y análisis de múltiples períodos, al tiempo que considera las necesidades de gestión de posiciones en el comercio real. El enfoque de optimización de la estrategia debe centrarse en la mejora de la calidad de la señal y el control del riesgo, y la practicidad de la estrategia puede mejorarse aún más a través de la optimización de parámetros y la extensión de funciones.

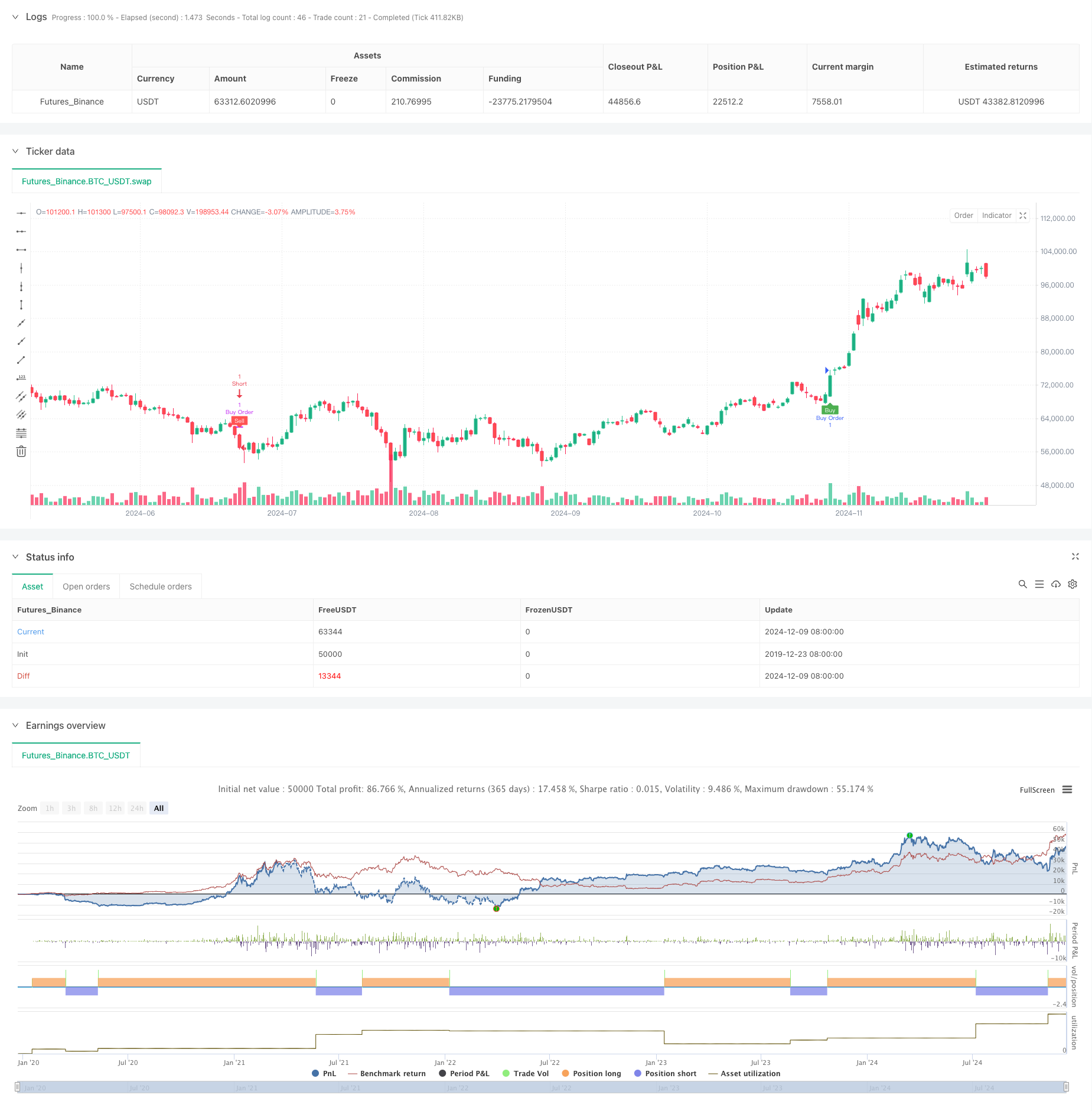

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='ADET GİRMELİ Trend İz Süren Stop Strategy', overlay=true, overlay=true,default_qty_type = strategy.fixed, default_qty_value = 1)

// Inputs

a = input(9, title='Key Value. "This changes the sensitivity"')

c = input(3, title='ATR Period')

h = input(false, title='Signals from Heikin Ashi Candles')

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema = ta.ema(src, 1)

above = ta.crossover(ema, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, ema)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

// Alım ve Satım Sinyalleri

buySignal = src > xATRTrailingStop and above

sellSignal = src < xATRTrailingStop and below

// Kullanıcı girişi

sell_quantity = input.int(1, title="Sell Quantity", minval=1)

buy_quantity = input.int(1, title="Buy Quantity", minval=1)

// Portföy miktarı (örnek simülasyon verisi)

var portfolio_quantity = 0

// Sinyal üretimi (örnek sinyal, gerçek stratejinizle değiştirin)

indicator_signal = (src > xATRTrailingStop and above) ? "buy" :

(src < xATRTrailingStop and below) ? "sell" : "hold"

// Şartlara göre al/sat

if indicator_signal == "buy" and portfolio_quantity < buy_quantity

strategy.entry("Buy Order", strategy.long, qty=buy_quantity)

portfolio_quantity := portfolio_quantity + buy_quantity

if indicator_signal == "sell" and portfolio_quantity >= sell_quantity

strategy.close("Buy Order", qty=sell_quantity)

portfolio_quantity := portfolio_quantity - sell_quantity

// Plot buy and sell signals

plotshape(buy, title='Buy', text='Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(sell, title='Sell', text='Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

// Bar coloring

barcolor(barbuy ? color.rgb(6, 250, 14) : na)

barcolor(barsell ? color.red : na)

// Alerts

alertcondition(buy, 'UT Long', 'UT Long')

alertcondition(sell, 'UT Short', 'UT Short')

// Strategy Entry and Exit

if buy

strategy.entry('Long', strategy.long)

if sell

strategy.entry('Short', strategy.short)

// Optional Exit Conditions

if sell

strategy.close('Long')

if buy

strategy.close('Short')

// ///TARAMA///

// gurupSec = input.string(defval='1', options=['1', '2', '3', '4', '5','6','7'], group='Taraması yapılacak 40\'arlı gruplardan birini seçin', title='Grup seç')

// per = input.timeframe(defval='', title='PERİYOT',group = "Tarama yapmak istediğiniz periyotu seçin")

// loc = input.int(defval=20, title='Konum Ayarı', minval = -100,maxval = 200 , step = 5, group='Tablonun konumunu belirleyin')

// func() =>

// //ÖRNEK BİR FONKSİYON AŞAĞIDA YAZILMIŞTIR. SİZ DE İSTEDİĞİNİZ KOŞULLAR İÇİN TARAMA YAZABİLİRSİNİZ.

// //rsi = ta.rsi(close,14)

// //cond = rsi <= 30

// //[close,cond]

// ////value = ta.cci(close,length23)

// cond = buySignal or sellSignal

// [close,cond]

// c1 = input.symbol(title='1', defval='BIST:BRYAT',group = "1. Grup Hisseleri")

// c2 = input.symbol(title='2', defval='BIST:TARKM')

// c3 = input.symbol(title='3', defval='BIST:TNZTP')

// c4 = input.symbol(title='4', defval='BIST:ERBOS')

// c5 = input.symbol(title='5', defval='BIST:BFREN')

// c6 = input.symbol(title='6', defval='BIST:ALARK')

// c7 = input.symbol(title='7', defval='BIST:ISMEN')

// c8 = input.symbol(title='8', defval='BIST:CVKMD')

// c9 = input.symbol(title='9', defval='BIST:TTRAK')

// c10 = input.symbol(title='10', defval='BIST:ASELS')

// c11 = input.symbol(title='11', defval='BIST:ATAKP')

// c12 = input.symbol(title='12', defval='BIST:MGROS')

// c13 = input.symbol(title='13', defval='BIST:BRSAN')

// c14 = input.symbol(title='14', defval='BIST:ALFAS')

// c15 = input.symbol(title='15', defval='BIST:CWENE')

// c16 = input.symbol(title='16', defval='BIST:THYAO')

// c17 = input.symbol(title='17', defval='BIST:EREGL')

// c18 = input.symbol(title='18', defval='BIST:TUPRS')

// c19 = input.symbol(title='19', defval='BIST:YYLGD')

// c20 = input.symbol(title='20', defval='BIST:KLSER')

// c21 = input.symbol(title='21', defval='BIST:MIATK')

// c22 = input.symbol(title='22', defval='BIST:ASTOR')

// c23 = input.symbol(title='23', defval='BIST:DOAS')

// c24 = input.symbol(title='24', defval='BIST:ERCB')

// c25 = input.symbol(title='25', defval='BIST:REEDR')

// c26 = input.symbol(title='26', defval='BIST:DNISI')

// c27 = input.symbol(title='27', defval='BIST:ARZUM')

// c28 = input.symbol(title='28', defval='BIST:EBEBK')

// c29 = input.symbol(title='29', defval='BIST:KLKIM')

// c30 = input.symbol(title='30', defval='BIST:ONCSM')

// c31 = input.symbol(title='31', defval='BIST:SOKE')

// c32 = input.symbol(title='32', defval='BIST:GUBRF')

// c33 = input.symbol(title='33', defval='BIST:KONTR')

// c34 = input.symbol(title='34', defval='BIST:DAPGM')

// c35 = input.symbol(title='35', defval='BIST:BVSAN')

// c36 = input.symbol(title='36', defval='BIST:ODAS')

// c37 = input.symbol(title='37', defval='BIST:OYAKC')

// c38 = input.symbol(title='38', defval='BIST:KRPLS')

// c39 = input.symbol(title='39', defval='BIST:BOBET')

// [v1,s1] = request.security(c1, per, func())

// [v2,s2] = request.security(c2, per, func())

// [v3,s3] = request.security(c3, per, func())

// [v4,s4] = request.security(c4, per, func())

// [v5,s5] = request.security(c5, per, func())

// [v6,s6] = request.security(c6, per, func())

// [v7,s7] = request.security(c7, per, func())

// [v8,s8] = request.security(c8, per, func())

// [v9,s9] = request.security(c9, per, func())

// [v10,s10] = request.security(c10, per, func())

// [v11,s11] = request.security(c11, per, func())

// [v12,s12] = request.security(c12, per, func())

// [v13,s13] = request.security(c13, per, func())

// [v14,s14] = request.security(c14, per, func())

// [v15,s15] = request.security(c15, per, func())

// [v16,s16] = request.security(c16, per, func())

// [v17,s17] = request.security(c17, per, func())

// [v18,s18] = request.security(c18, per, func())

// [v19,s19] = request.security(c19, per, func())

// [v20,s20] = request.security(c20, per, func())

// [v21,s21] = request.security(c21, per, func())

// [v22,s22] = request.security(c22, per, func())

// [v23,s23] = request.security(c23, per, func())

// [v24,s24] = request.security(c24, per, func())

// [v25,s25] = request.security(c25, per, func())

// [v26,s26] = request.security(c26, per, func())

// [v27,s27] = request.security(c27, per, func())

// [v28,s28] = request.security(c28, per, func())

// [v29,s29] = request.security(c29, per, func())

// [v30,s30] = request.security(c30, per, func())

// [v31,s31] = request.security(c31, per, func())

// [v32,s32] = request.security(c32, per, func())

// [v33,s33] = request.security(c33, per, func())

// [v34,s34] = request.security(c34, per, func())

// [v35,s35] = request.security(c35, per, func())

// [v36,s36] = request.security(c36, per, func())

// [v37,s37] = request.security(c37, per, func())

// [v38,s38] = request.security(c38, per, func())

// [v39,s39] = request.security(c39, per, func())

// roundn(x, n) =>

// mult = 1

// if n != 0

// for i = 1 to math.abs(n) by 1

// mult *= 10

// mult

// n >= 0 ? math.round(x * mult) / mult : math.round(x / mult) * mult

// scr_label = 'A/G İZSÜREN\n'

// scr_label := s1 ? scr_label + syminfo.ticker(c1) + ' ' + str.tostring(roundn(v1, 2)) + '\n' : scr_label

// scr_label := s2 ? scr_label + syminfo.ticker(c2) + ' ' + str.tostring(roundn(v2, 2)) + '\n' : scr_label

// scr_label := s3 ? scr_label + syminfo.ticker(c3) + ' ' + str.tostring(roundn(v3, 2)) + '\n' : scr_label

// scr_label := s4 ? scr_label + syminfo.ticker(c4) + ' ' + str.tostring(roundn(v4, 2)) + '\n' : scr_label

// scr_label := s5 ? scr_label + syminfo.ticker(c5) + ' ' + str.tostring(roundn(v5, 2)) + '\n' : scr_label

// scr_label := s6 ? scr_label + syminfo.ticker(c6) + ' ' + str.tostring(roundn(v6, 2)) + '\n' : scr_label

// scr_label := s7 ? scr_label + syminfo.ticker(c7) + ' ' + str.tostring(roundn(v7, 2)) + '\n' : scr_label

// scr_label := s8 ? scr_label + syminfo.ticker(c8) + ' ' + str.tostring(roundn(v8, 2)) + '\n' : scr_label

// scr_label := s9 ? scr_label + syminfo.ticker(c9) + ' ' + str.tostring(roundn(v9, 2)) + '\n' : scr_label

// scr_label := s10 ? scr_label + syminfo.ticker(c10) + ' ' + str.tostring(roundn(v10, 2)) + '\n' : scr_label

// scr_label := s11 ? scr_label + syminfo.ticker(c11) + ' ' + str.tostring(roundn(v11, 2)) + '\n' : scr_label

// scr_label := s12 ? scr_label + syminfo.ticker(c12) + ' ' + str.tostring(roundn(v12, 2)) + '\n' : scr_label

// scr_label := s13 ? scr_label + syminfo.ticker(c13) + ' ' + str.tostring(roundn(v13, 2)) + '\n' : scr_label

// scr_label := s14 ? scr_label + syminfo.ticker(c14) + ' ' + str.tostring(roundn(v14, 2)) + '\n' : scr_label

// scr_label := s15 ? scr_label + syminfo.ticker(c15) + ' ' + str.tostring(roundn(v15, 2)) + '\n' : scr_label

// scr_label := s16 ? scr_label + syminfo.ticker(c16) + ' ' + str.tostring(roundn(v16, 2)) + '\n' : scr_label

// scr_label := s17 ? scr_label + syminfo.ticker(c17) + ' ' + str.tostring(roundn(v17, 2)) + '\n' : scr_label

// scr_label := s18 ? scr_label + syminfo.ticker(c18) + ' ' + str.tostring(roundn(v18, 2)) + '\n' : scr_label

// scr_label := s19 ? scr_label + syminfo.ticker(c19) + ' ' + str.tostring(roundn(v19, 2)) + '\n' : scr_label

// scr_label := s20 ? scr_label + syminfo.ticker(c20) + ' ' + str.tostring(roundn(v20, 2)) + '\n' : scr_label

// scr_label := s21 ? scr_label + syminfo.ticker(c21) + ' ' + str.tostring(roundn(v21, 2)) + '\n' : scr_label

// scr_label := s22 ? scr_label + syminfo.ticker(c22) + ' ' + str.tostring(roundn(v22, 2)) + '\n' : scr_label

// scr_label := s23 ? scr_label + syminfo.ticker(c23) + ' ' + str.tostring(roundn(v23, 2)) + '\n' : scr_label

// scr_label := s24 ? scr_label + syminfo.ticker(c24) + ' ' + str.tostring(roundn(v24, 2)) + '\n' : scr_label

// scr_label := s25 ? scr_label + syminfo.ticker(c25) + ' ' + str.tostring(roundn(v25, 2)) + '\n' : scr_label

// scr_label := s26 ? scr_label + syminfo.ticker(c26) + ' ' + str.tostring(roundn(v26, 2)) + '\n' : scr_label

// scr_label := s27 ? scr_label + syminfo.ticker(c27) + ' ' + str.tostring(roundn(v27, 2)) + '\n' : scr_label

// scr_label := s28 ? scr_label + syminfo.ticker(c28) + ' ' + str.tostring(roundn(v28, 2)) + '\n' : scr_label

// scr_label := s29 ? scr_label + syminfo.ticker(c29) + ' ' + str.tostring(roundn(v29, 2)) + '\n' : scr_label

// scr_label := s30 ? scr_label + syminfo.ticker(c30) + ' ' + str.tostring(roundn(v30, 2)) + '\n' : scr_label

// scr_label := s31 ? scr_label + syminfo.ticker(c31) + ' ' + str.tostring(roundn(v31, 2)) + '\n' : scr_label

// scr_label := s32 ? scr_label + syminfo.ticker(c32) + ' ' + str.tostring(roundn(v32, 2)) + '\n' : scr_label

// scr_label := s33 ? scr_label + syminfo.ticker(c33) + ' ' + str.tostring(roundn(v33, 2)) + '\n' : scr_label

// scr_label := s34 ? scr_label + syminfo.ticker(c34) + ' ' + str.tostring(roundn(v34, 2)) + '\n' : scr_label

// scr_label := s35 ? scr_label + syminfo.ticker(c35) + ' ' + str.tostring(roundn(v35, 2)) + '\n' : scr_label

// scr_label := s36 ? scr_label + syminfo.ticker(c36) + ' ' + str.tostring(roundn(v36, 2)) + '\n' : scr_label

// scr_label := s37 ? scr_label + syminfo.ticker(c37) + ' ' + str.tostring(roundn(v37, 2)) + '\n' : scr_label

// scr_label := s38 ? scr_label + syminfo.ticker(c38) + ' ' + str.tostring(roundn(v38, 2)) + '\n' : scr_label

// scr_label := s39 ? scr_label + syminfo.ticker(c39) + ' ' + str.tostring(roundn(v39, 2)) + '\n' : scr_label

// var panel = table.new(position = position.top_right,columns = 10,rows = 10,bgcolor = color.green,frame_color = color.white,border_color = color.red)

// if barstate.islast

// table.cell(panel,0,0,text = str.tostring(scr_label))

// //------------------------------------------------------