Descripción general

La estrategia es un sistema de trading inteligente que combina el seguimiento de tendencias y el filtrado de volatilidad. Identifica las tendencias del mercado a través de la media móvil exponencial (EMA), utiliza el rango verdadero (TR) y filtros de volatilidad dinámicos para determinar el momento de entrada y gestiona el riesgo con un mecanismo dinámico de stop-profit y stop-loss basado en la volatilidad. La estrategia admite dos modos comerciales: Scalp y Swing, que se pueden cambiar de forma flexible según diferentes entornos de mercado y estilos comerciales.

Principio de estrategia

La lógica central de la estrategia incluye los siguientes componentes clave:

- Identificación de tendencias: utilice la EMA de 50 períodos como filtro de tendencia y solo opere en largo cuando el precio esté por encima de la EMA y en corto cuando el precio esté por debajo de la EMA.

- Filtrado de volatilidad: calcula la EMA del rango verdadero (TR) y utiliza un factor de filtro ajustable (predeterminado 1,5) para filtrar el ruido del mercado.

- Condiciones de entrada: Combinado con el análisis morfológico de tres líneas K consecutivas, el movimiento del precio debe ser continuo y acelerado.

- Take Profit y Stop Loss: en el modo de corto plazo, se establece en función del TR actual; en el modo de banda, se establece en función de los puntos altos y bajos anteriores para lograr una gestión dinámica del riesgo.

Ventajas estratégicas

- Fuerte adaptabilidad: mediante la combinación de filtrado de volatilidad dinámica y seguimiento de tendencias, puede adaptarse a diferentes entornos de mercado.

- Gestión de riesgos perfecta: proporciona mecanismos dinámicos de stop-profit y stop-loss para dos modos de negociación, que se pueden seleccionar de forma flexible según las características del mercado.

- Buena capacidad de ajuste de parámetros: parámetros clave como el coeficiente de filtro, el ciclo de tendencia, etc. se pueden optimizar de acuerdo con las características de los productos comerciales.

- Buen efecto de visualización: proporciona marcas de señales de compra y venta claras y visualizaciones de posición de stop-profit y stop-loss para facilitar el monitoreo de transacciones.

Riesgo estratégico

- Riesgo de inversión de tendencia: pueden producirse paradas consecutivas en puntos de inflexión de la tendencia.

- Riesgo de ruptura falsa: pueden activarse señales falsas cuando la volatilidad aumenta repentinamente.

- Sensibilidad de los parámetros: una configuración incorrecta de los coeficientes de filtro puede generar demasiada o muy poca señal.

- Impacto del deslizamiento: en un mercado rápido, puede enfrentar un gran deslizamiento, que puede afectar el rendimiento de su estrategia.

Dirección de optimización de la estrategia

- Agregar filtrado de fuerza de tendencia: se pueden introducir indicadores como ADX para evaluar la fuerza de la tendencia y mejorar los efectos de seguimiento de tendencias.

- Optimice el take-profit y el stop-loss: considere introducir un stop-loss móvil para proteger más ganancias.

- Mejorar el modelo de swing trading: se pueden agregar más condiciones de juicio específicas para el swing trading a fin de mejorar las capacidades de tenencia a mediano y largo plazo.

- Agregar análisis de volumen: combine los cambios de volumen para confirmar la validez del avance.

Resumir

Esta estrategia construye un sistema de trading completo combinando orgánicamente el seguimiento de tendencias, el filtrado de volatilidad y la gestión dinámica de riesgos. La ventaja de la estrategia es que es altamente adaptable y controla el riesgo, al tiempo que ofrece un gran espacio para la optimización. Al establecer parámetros de manera razonable y elegir modos comerciales apropiados, la estrategia puede mantener un rendimiento estable en diferentes entornos de mercado. Se recomienda que los traders realicen pruebas retrospectivas y optimización de parámetros suficientes antes del uso real, y que realicen los ajustes correspondientes en función de las características de los productos comerciales específicos.

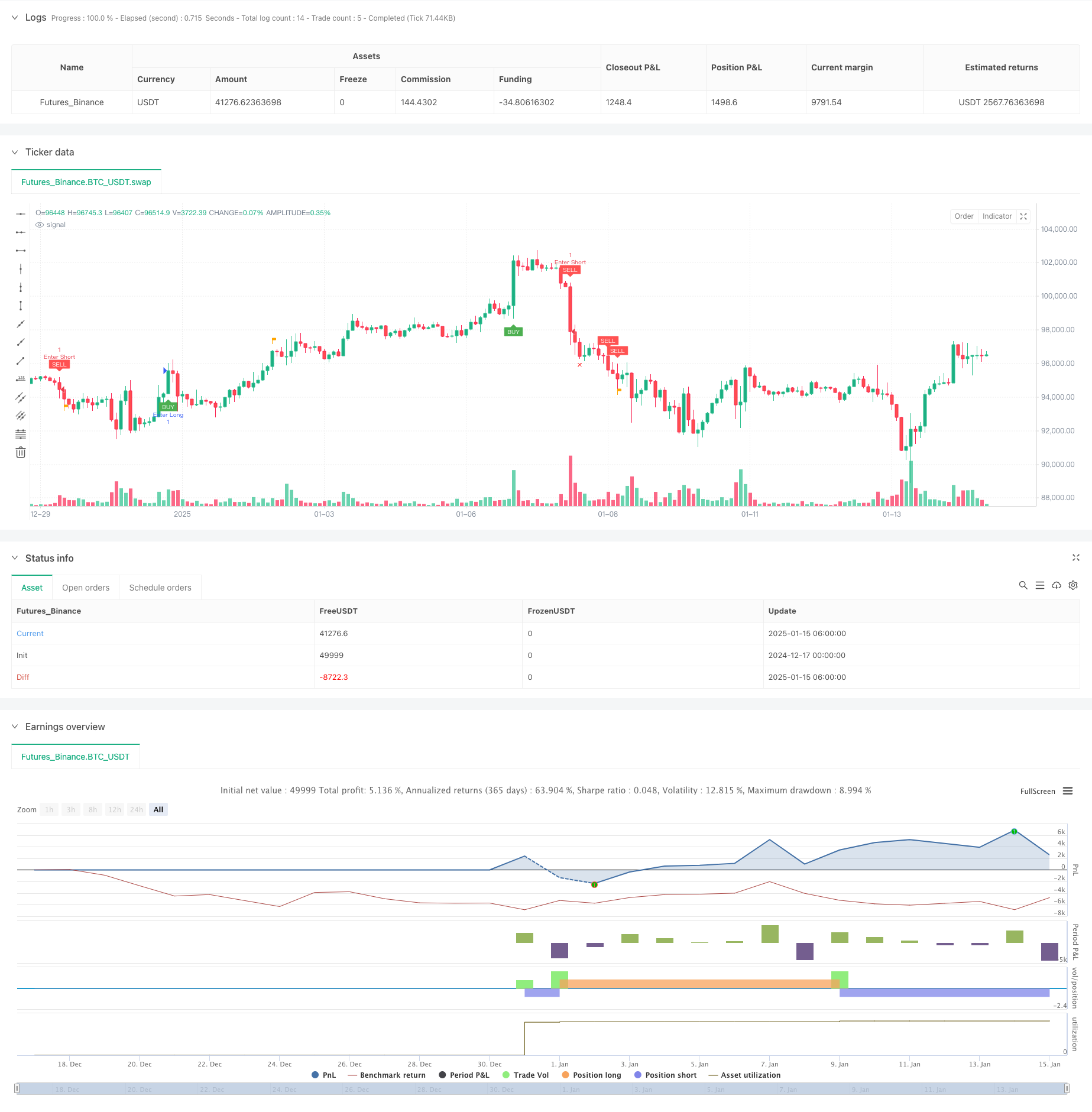

/*backtest

start: 2024-12-17 00:00:00

end: 2025-01-15 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Creativ3mindz

//@version=5

strategy("Scalp Slayer (I)", overlay=true)

// Input Parameters

filterNumber = input.float(1.5, "Filter Number", minval=1.0, maxval=10.0, tooltip="Higher = More aggressive Filter, Lower = Less aggressive")

emaTrendPeriod = input.int(50, "EMA Trend Period", minval=1, tooltip="Period for the EMA used for trend filtering")

lookbackPeriod = input.int(20, "Lookback Period for Highs/Lows", minval=1, tooltip="Period for determining recent highs/lows")

colorTP = input.color(title='Take Profit Color', defval=color.orange)

colorSL = input.color(title='Stop Loss Color', defval=color.red)

// Inputs for visibility

showBuyLabels = input.bool(true, title="Show Buy Labels")

showSellLabels = input.bool(true, title="Show Sell Labels")

// Alert Options

alertOnCondition = input.bool(true, title="Alert on Condition Met", tooltip="Enable to alert when condition is met")

// Trade Mode Toggle

tradeMode = input.bool(false, title="Trade Mode (ON = Swing, OFF = Scalp)", tooltip="Swing-mode you can use your own TP/SL.")

// Calculations

tr = high - low

ema = filterNumber * ta.ema(tr, 50)

trendEma = ta.ema(close, emaTrendPeriod) // Calculate the EMA for the trend filter

// Highest and lowest high/low within lookback period for swing logic

swingHigh = ta.highest(high, lookbackPeriod)

swingLow = ta.lowest(low, lookbackPeriod)

// Variables to track the entry prices and SL/TP levels

var float entryPriceLong = na

var float entryPriceShort = na

var float targetPriceLong = na

var float targetPriceShort = na

var float stopLossLong = na

var float stopLossShort = na

var bool tradeActive = false

// Buy and Sell Conditions with Trend Filter

buyCondition = close > trendEma and // Buy only if above the trend EMA

close[2] > open[2] and close[1] > open[1] and close > open and

(math.abs(close[2] - open[2]) > math.abs(close[1] - open[1])) and

(math.abs(close - open) > math.abs(close[1] - open[1])) and

close > close[1] and close[1] > close[2] and tr > ema

sellCondition = close < trendEma and // Sell only if below the trend EMA

close[2] < open[2] and close[1] < open[1] and close < open and

(math.abs(close[2] - open[2]) > math.abs(close[1] - open[1])) and

(math.abs(close - open) > math.abs(close[1] - open[1])) and

close < close[1] and close[1] < close[2] and tr > ema

// Entry Rules

if (buyCondition and not tradeActive)

entryPriceLong := close // Track entry price for long position

stopLossLong := tradeMode ? ta.lowest(low, lookbackPeriod) : swingLow // Scalping: recent low, Swing: lowest low of lookback period

targetPriceLong := tradeMode ? close + tr : swingHigh // Scalping: close + ATR, Swing: highest high of lookback period

tradeActive := true

if (sellCondition and not tradeActive)

entryPriceShort := close // Track entry price for short position

stopLossShort := tradeMode ? ta.highest(high, lookbackPeriod) : swingHigh // Scalping: recent high, Swing: highest high of lookback period

targetPriceShort := tradeMode ? close - tr : swingLow // Scalping: close - ATR, Swing: lowest low of lookback period

tradeActive := true

// Take Profit and Stop Loss Logic

signalBuyTPPrint = (not na(entryPriceLong) and close >= targetPriceLong)

signalSellTPPrint = (not na(entryPriceShort) and close <= targetPriceShort)

signalBuySLPrint = (not na(entryPriceLong) and close <= stopLossLong)

signalSellSLPrint = (not na(entryPriceShort) and close >= stopLossShort)

if (signalBuyTPPrint or signalBuySLPrint)

entryPriceLong := na // Reset entry price for long position

targetPriceLong := na // Reset target price for long position

stopLossLong := na // Reset stop-loss for long position

tradeActive := false

if (signalSellTPPrint or signalSellSLPrint)

entryPriceShort := na // Reset entry price for short position

targetPriceShort := na // Reset target price for short position

stopLossShort := na // Reset stop-loss for short position

tradeActive := false

// Plot Buy and Sell Labels with Visibility Conditions

plotshape(showBuyLabels and buyCondition, "Buy", shape.labelup, location=location.belowbar, color=color.green, text="BUY", textcolor=color.white, size=size.tiny)

plotshape(showSellLabels and sellCondition, "Sell", shape.labeldown, location=location.abovebar, color=color.red, text="SELL", textcolor=color.white, size=size.tiny)

// Plot Take Profit Flags

plotshape(showBuyLabels and signalBuyTPPrint, title="Take Profit (buys)", text="TP", style=shape.flag, location=location.abovebar, color=colorTP, textcolor=color.white, size=size.tiny)

plotshape(showSellLabels and signalSellTPPrint, title="Take Profit (sells)", text="TP", style=shape.flag, location=location.belowbar, color=colorTP, textcolor=color.white, size=size.tiny)

// Plot Stop Loss "X" Marker

plotshape(showBuyLabels and signalBuySLPrint, title="Stop Loss (buys)", text="X", style=shape.xcross, location=location.belowbar, color=colorSL, textcolor=color.white, size=size.tiny)

plotshape(showSellLabels and signalSellSLPrint, title="Stop Loss (sells)", text="X", style=shape.xcross, location=location.abovebar, color=colorSL, textcolor=color.white, size=size.tiny)

// Alerts

alertcondition(buyCondition and alertOnCondition, title="Buy Alert", message='{"content": "Buy {{ticker}} at {{close}}"}')

alertcondition(sellCondition and alertOnCondition, title="Sell Alert", message='{"content": "Sell {{ticker}} at {{close}}"}')

alertcondition(signalBuyTPPrint and alertOnCondition, title="Buy TP Alert", message='{"content": "Buy TP {{ticker}} at {{close}}"}')

alertcondition(signalSellTPPrint and alertOnCondition, title="Sell TP Alert", message='{"content": "Sell TP {{ticker}} at {{close}}"}')

alertcondition(signalBuySLPrint and alertOnCondition, title="Buy SL Alert", message='{"content": "Buy SL {{ticker}} at {{close}}"}')

alertcondition(signalSellSLPrint and alertOnCondition, title="Sell SL Alert", message='{"content": "Sell SL {{ticker}} at {{close}}"}')

if buyCondition

strategy.entry("Enter Long", strategy.long)

else if sellCondition

strategy.entry("Enter Short", strategy.short)