Stratégie du point de basculement des contrats à terme sur devises numériques à double EMA (tutoriel)

Auteur:FMZ~Lydia, Créé à: 2022-11-09 09:44:38, Mis à jour à: 2023-09-20 10:25:53

Dans cet article, nous expliquerons comment concevoir une stratégie de tendance simple, uniquement au niveau de la conception de la stratégie, pour aider les débutants à apprendre à concevoir une stratégie simple et à comprendre le processus d'exécution de la stratégie.

Conception de la stratégie

Nous utilisons deux indicateurs EMA lorsque les deux moyennes EMA ont des points tournants. Le point tournant est utilisé comme un signal pour ouvrir des positions (ou vendre la position d'ouverture) pour ouvrir des positions longues, ouvrir des positions courtes, et une position de clôture différentielle de profit cible fixe est conçue. Les commentaires sont écrits directement dans le code de stratégie pour une lecture pratique.

Code de stratégie

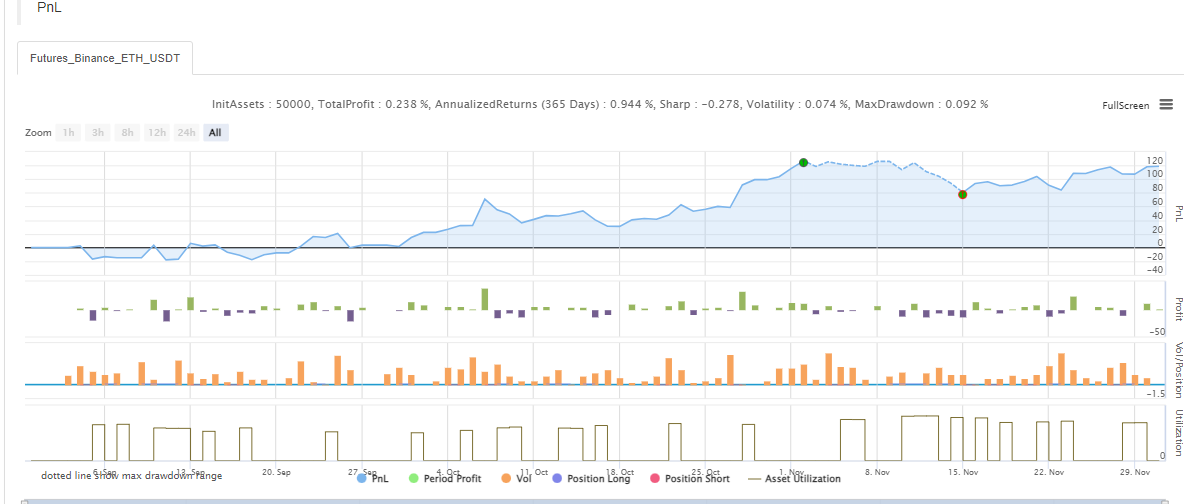

/*backtest

start: 2021-09-01 00:00:00

end: 2021-12-02 00:00:00

period: 1h

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// The above /**/ is the default setting for backtesting, you can reset it on the backtesting page by using the relevant controls

var LONG = 1 // Markers for holding long positions, enum constant

var SHORT = -1 // Markers for holding short positions, enum constant

var IDLE = 0 // Markers without holding positions, enum constant

// Obtain positions in the specified direction. Positions is the position data, and direction is the position direction to be obtained

function getPosition(positions, direction) {

var ret = {Price : 0, Amount : 0, Type : ""} // Define a structure when no position is held

// Iterate through the positions and find the positions that match the direction

_.each(positions, function(pos) {

if (pos.Type == direction) {

ret = pos

}

})

// Return to found positions

return ret

}

// Cancel all makers of current trading pairs and contracts

function cancellAll() {

// Dead loop, keep detecting until break is triggered

while (true) {

// Obtain the makers' data of the current trading pair and contract, i.e. orders

var orders = _C(exchange.GetOrders)

if (orders.length == 0) {

// When orders is an empty array, i.e. orders.length == 0, break is executed to exit the while loop

break

} else {

// Iterate through all current makers and cancel them one by one

for (var i = 0 ; i < orders.length ; i++) {

// The function to cancel the specific order, cancel the order with ID: orders[i].Id

exchange.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// The closing function, used for closing positions according to the trading function-tradeFunc and direction passed in

function cover(tradeFunc, direction) {

var mapDirection = {"closebuy": PD_LONG, "closesell": PD_SHORT}

var positions = _C(exchange.GetPosition) //Obtain the position data of the current trading pair and contract

var pos = getPosition(positions, mapDirection[direction]) // Find the position information in the specified closing position direction

// When the position is greater than 0 (the position can be closed only when there is a position)

if (pos.Amount > 0) {

// Cancel all possible makers

cancellAll()

// Set the trading direction

exchange.SetDirection(direction)

// Execute closing position trade functions

if (tradeFunc(-1, pos.Amount)) {

// Return to true if the order is placed

return true

} else {

// Return to false if the order is failed to place

return false

}

}

// Return to true if there is no position

return true

}

// Strategy main functions

function main() {

// For switching to OKEX V5 Demo

if (okexSimulate) {

exchange.IO("simulate", true) // Switch to OKEX V5 Demo for a test

Log("Switch to OKEX V5 Demo")

}

// Set the contract code, if ct is swap, set the current contract to be a perpetual contract

exchange.SetContractType(ct)

// Initialization status is open position

var state = IDLE

// The initialized position price is 0

var holdPrice = 0

// Timestamp for initialization comparison, used to compare whether the current K-Line BAR has changed

var preTime = 0

// Strategy main loop

while (true) {

// Obtain the K-line data for current trading pairs and contracts

var r = _C(exchange.GetRecords)

// Obtain the length of the K-line data, i.e. l

var l = r.length

// Judge the K-line length that l must be greater than the indicator period (if not, the indicator function cannot calculate valid indicator data), or it will be recycled

if (l < Math.max(ema1Period, ema2Period)) {

// Wait for 1,000 milliseconds, i.e. 1 second, to avoid rotating too fast

Sleep(1000)

// Ignore the code after the current if, and execute while loop again

continue

}

// Calculate ema indicator data

var ema1 = TA.EMA(r, ema1Period)

var ema2 = TA.EMA(r, ema2Period)

// Drawing chart

$.PlotRecords(r, 'K-Line') // Drawing the K-line chart

// When the last BAR timestamp changes, i.e. when a new K-line BAR is created

if(preTime !== r[l - 1].Time){

// The last update of the last BAR before the new BAR appears

$.PlotLine('ema1', ema1[l - 2], r[l - 2].Time)

$.PlotLine('ema2', ema2[l - 2], r[l - 2].Time)

// Draw the indicator line of the new BAR, i.e. the indicator data on the current last BAR

$.PlotLine('ema1', ema1[l - 1], r[l - 1].Time)

$.PlotLine('ema2', ema2[l - 1], r[l - 1].Time)

// Update the timestamp used for comparison

preTime = r[l - 1].Time

} else {

// When no new BARs are generated, only the indicator data of the last BAR on the chart is updated

$.PlotLine('ema1', ema1[l - 1], r[l - 1].Time)

$.PlotLine('ema2', ema2[l - 1], r[l - 1].Time)

}

// Conditions for opening long positions, turning points

var up = (ema1[l - 2] > ema1[l - 3] && ema1[l - 4] > ema1[l - 3]) && (ema2[l - 2] > ema2[l - 3] && ema2[l - 4] > ema2[l - 3])

// Conditions for opening short positions, turning points

var down = (ema1[l - 2] < ema1[l - 3] && ema1[l - 4] < ema1[l - 3]) && (ema2[l - 2] < ema2[l - 3] && ema2[l - 4] < ema2[l - 3])

// The condition of opening a long position is triggered and the current short position is held, or the condition of opening a long position is triggered and no position is held

if (up && (state == SHORT || state == IDLE)) {

// If you have a short position, close it first

if (state == SHORT && cover(exchange.Buy, "closesell")) {

// Mark open positions after closing them

state = IDLE

// The price of reset position is 0

holdPrice = 0

// Mark on the chart

$.PlotFlag(r[l - 1].Time, 'coverShort', 'CS')

}

// Open a long position after closing the position

exchange.SetDirection("buy")

if (exchange.Buy(-1, amount)) {

// Mark the current status

state = LONG

// Record the current price

holdPrice = r[l - 1].Close

$.PlotFlag(r[l - 1].Time, 'openLong', 'L')

}

} else if (down && (state == LONG || state == IDLE)) {

// The same as the judgment of up condition

if (state == LONG && cover(exchange.Sell, "closebuy")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverLong', 'CL')

}

exchange.SetDirection("sell")

if (exchange.Sell(-1, amount)) {

state = SHORT

holdPrice = r[l - 1].Close

$.PlotFlag(r[l - 1].Time, 'openShort', 'S')

}

}

// Stop profits

if (state == LONG && r[l - 1].Close - holdPrice > profitTarget && cover(exchange.Sell, "closebuy")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverLong', 'CL')

} else if (state == SHORT && holdPrice - r[l - 1].Close > profitTarget && cover(exchange.Buy, "closesell")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverShort', 'CS')

}

// Display time on the status bar

LogStatus(_D())

Sleep(500)

}

}

Le code source de la stratégie:https://www.fmz.com/strategy/333269

La stratégie est pour le tutoriel de conception de programme seulement, s'il vous plaît ne l'utilisez pas dans le vrai bot.

- Pratiques quantitatives des échanges DEX (2) -- Guide de l'utilisateur des hyperliquides

- Expérience de la quantification sur les échanges DEX (2) -- Guide d'utilisation de Hyperliquid

- Pratique quantitative des échanges DEX (1) -- Guide de l'utilisateur dYdX v4

- Introduction à l'arbitrage au retard de plomb dans les crypto-monnaies (3)

- Pratiques de quantification de l'échange DEX ((1) -- dYdX v4 Guide d'utilisation

- Introduction à la suite de Lead-Lag dans les monnaies numériques (3)

- Introduction à l'arbitrage au retard de plomb dans les crypto-monnaies (2)

- Introduction à la suite de Lead-Lag dans les monnaies numériques (2)

- Discussion sur la réception de signaux externes de la plateforme FMZ: une solution complète pour la réception de signaux avec un service Http intégré dans la stratégie

- Exploration de la réception de signaux externes sur la plateforme FMZ: stratégie intégrée pour la réception de signaux sur le service HTTP

- Introduction à l'arbitrage au retard de plomb dans les crypto-monnaies (1)

- [Binance Championship] Stratégie 3 du contrat de livraison de Binance - Couverture par papillon

- Utilisation des serveurs dans le commerce quantitatif

- Solution pour obtenir le message de demande http envoyé par le Docker

- Une brève explication des raisons pour lesquelles il n'est pas possible de réaliser un mouvement d'actifs sur l'OKEX par une stratégie de couverture contractuelle

- Explication détaillée de l'algorithme de doublement des contrats à terme Notes de stratégie

- Gagner 80 fois en 5 jours, le pouvoir de la stratégie haute fréquence

- Recherche et exemple sur la conception de la stratégie de couverture des Maker Spots et des futures

- Construire une base de données quantitative de FMZ avec SQLite

- Comment attribuer des données de version différentes à une stratégie louée via les métadonnées du code de location de stratégie

- Arbitrage des intérêts du taux de financement perpétuel de Binance (marché haussier actuel annualisé à 100%)

- Souscrire une nouvelle stratégie d'actions pour le spot de monnaie numérique (tutoriel)

- Réaliser une idée avec 60 lignes de code - Stratégie de pêche au fond du contrat

- La valeur de l'échange de titres est la valeur de l'échange de titres de titres.

- Conception d'un système de gestion de la synchronisation des commandes basé sur FMZ Quant (2)

- Stratégie ATR multi-espèces de contrats à terme sur devises numériques (tutoriel)

- Écrire un outil de trading semi-automatique en utilisant le langage Pine

- Explorez la conception de la stratégie à haute fréquence du changement magique de LeeksReaper

- Analyse de la stratégie de LeeksReaper (2)

- La "Magic Double EMA Strategy" des anciens combattants de YouTube

- Mise en œuvre du langage JavaScript des indicateurs Fisher et dessin sur FMZ