Stratégie de négociation double basée sur le MACD

Auteur:ChaoZhang est là., Date: 2023-12-07 17:11:52 Je suis désoléLes étiquettes:

Résumé

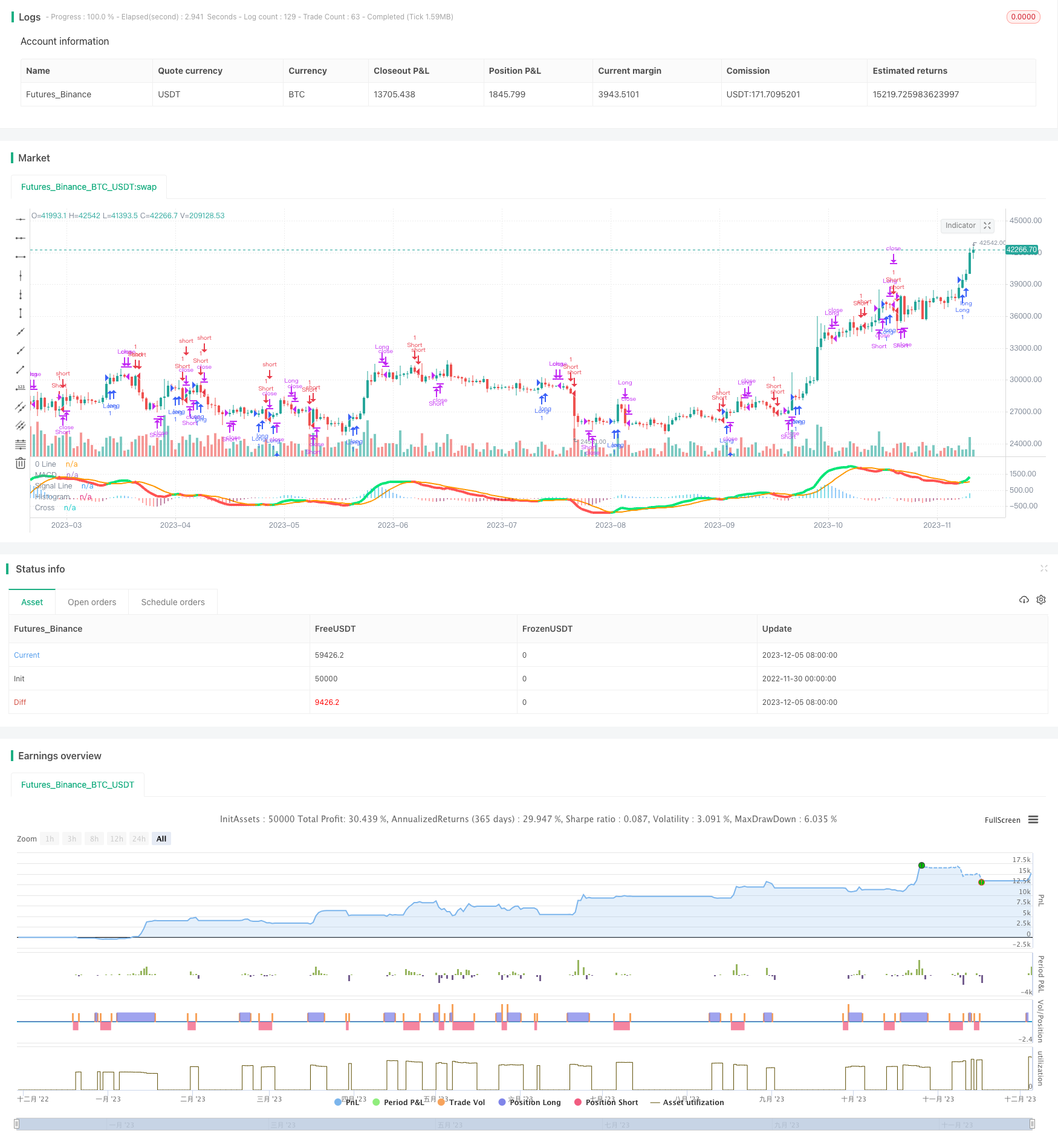

Cette stratégie implémente une double stratégie de trading basée sur l'indicateur MACD. Elle peut aller long quand il y a une croix dorée sur le MACD et aller court quand il y a une croix de mort, avec des filtres supplémentaires basés sur d'autres indicateurs pour éliminer certains signaux invalides.

Principe de stratégie

Le noyau de cette stratégie est l'utilisation de l'indicateur MACD pour réaliser le trading bidirectionnel. Plus précisément, il calcule la moyenne mobile rapide, la moyenne mobile lente et la ligne de signal MACD. Lorsque le MA rapide traverse le MA lent, une croix d'or est générée pour aller long. Lorsque le MA rapide traverse en dessous du MA lent, une croix de mort est générée pour aller court.

Pour filtrer certains signaux non valides, la stratégie définit également une plage de ±30 comme filtre, de sorte que les signaux de trading ne sont déclenchés que lorsque l'histogramme MACD dépasse cette plage.

Les avantages

- L'indicateur MACD est utilisé comme principal signal de négociation, qui est sensible aux mouvements de prix dans les deux sens.

- Les filtres ajoutés aident à éliminer certains signaux non valides

- La logique directionnelle à deux barres pour la clôture des positions évite dans une certaine mesure certaines fausses ruptures

Les risques

- L'indicateur MACD a tendance à générer des signaux de trading fréquents, ce qui conduit à une fréquence de trading élevée.

- Le fait de s'appuyer uniquement sur un indicateur rend la stratégie vulnérable aux retards de signal

- La logique de fermeture basée sur la direction de l'histogramme n'est pas suffisamment rigoureuse, elle risque de manquer certains signaux

Directions d'optimisation

- Considérez la combinaison avec d'autres indicateurs de confirmation du signal, tels que KDJ, bandes de Bollinger, etc.

- Recherchez des indicateurs plus avancés pour remplacer le MACD, comme le KD

- Optimiser la logique de clôture en définissant le stop loss et le profit pour contrôler les pertes de transaction unique

Conclusion

En résumé, il s'agit essentiellement d'une stratégie de trading bidirectionnelle réalisable. Il utilise les avantages de l'indicateur MACD et ajoute également quelques filtres pour contrôler la qualité du signal. Cependant, le MACD lui-même présente également quelques problèmes. Des tests et une optimisation supplémentaires dans le trading en direct sont encore nécessaires pour rendre la stratégie plus fiable.

]

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Created by user ChrisMoody updated 4-10-2014

//Regular MACD Indicator with Histogram that plots 4 Colors Based on Direction Above and Below the Zero Line

//Update allows Check Box Options, Show MacD & Signal Line, Show Change In color of MacD Line based on cross of Signal Line.

//Show Dots at Cross of MacD and Signal Line, Histogram can show 4 colors or 1, Turn on and off Histogram.

//Special Thanks to that incredible person in Tech Support whoem I won't say you r name so you don't get bombarded with emails

//Note the feature Tech Support showed me on how to set the default timeframe of the indicator to the chart Timeframe, but also allow you to choose a different timeframe.

//By the way I fully disclose that I completely STOLE the Dots at the MAcd Cross from "TheLark"

strategy("MACD Strategy", overlay=false)

// study(title="CM_MacD_Ult_MTF", shorttitle="CM_Ult_MacD_MTF")

source = close

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="60")

smd = input(true, title="Show MacD & Signal Line? Also Turn Off Dots Below")

sd = input(true, title="Show Dots When MacD Crosses Signal Line?")

sh = input(true, title="Show Histogram?")

macd_colorChange = input(true,title="Change MacD Line Color-Signal Line Cross?")

hist_colorChange = input(true,title="MacD Histogram 4 Colors?")

res = useCurrentRes ? timeframe.period : resCustom

fastLength = input(12, minval=1), slowLength=input(26,minval=1)

signalLength=input(9,minval=1)

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

signal = sma(macd, signalLength)

hist = macd - signal

outMacD = request.security(syminfo.tickerid, res, macd)

outSignal = request.security(syminfo.tickerid, res, signal)

outHist = request.security(syminfo.tickerid, res, hist)

histA_IsUp = outHist > outHist[1] and outHist > 0

histA_IsDown = outHist < outHist[1] and outHist > 0

histB_IsDown = outHist < outHist[1] and outHist <= 0

histB_IsUp = outHist > outHist[1] and outHist <= 0

//MacD Color Definitions

macd_IsAbove = outMacD >= outSignal

macd_IsBelow = outMacD < outSignal

// strategy.entry("Long", strategy.long, 1, when = shouldPlaceLong)

// strategy.close("Long", shouldExitLong)

// strategy.entry("Short", strategy.short, 1, when = shouldPlaceShort)

// strategy.close("Short", shouldExitShort)

isWithinZeroMacd = outHist < 30 and outHist > -30

delta = hist

// shouldExitShort = false//crossover(delta, 0)

// shouldExitLong = false//crossunder(delta, 0)

// if(crossover(delta, 0))// and not isWithinZeroMacd)

// strategy.entry("Long", strategy.long, comment="Long")

// if (crossunder(delta, 0))// and not isWithinZeroMacd)

// strategy.entry("Short", strategy.short, comment="Short")

shouldPlaceLong = crossover(delta, 0)

strategy.entry("Long", strategy.long, 1, when = shouldPlaceLong)

shouldExitLong = not histA_IsUp and histA_IsDown

shouldExitShort = not histA_IsUp and not histA_IsDown and not histB_IsDown and histB_IsUp

shouldPlaceShort = crossunder(delta, 0)

strategy.entry("Short", strategy.short, 1, when = shouldPlaceShort)

// plot_color = gray

plot_color = if(hist_colorChange)

if(histA_IsUp)

aqua

else

if(histA_IsDown)

//need to sell

// if(not isWithinZeroMacd)

// shouldExitLong = true

// strategy.entry("Short", strategy.short, comment="Short")

blue

else

if(histB_IsDown)

red

else

if(histB_IsUp)

//need to buy

// if(not isWithinZeroMacd)

// shouldExitShort = true

// strategy.entry("Long", strategy.long, comment="Long")

maroon

else

yellow

else

gray

// plot_color = hist_colorChange ? histA_IsUp ? aqua : histA_IsDown ? blue : histB_IsDown ? red : histB_IsUp ? maroon :yellow :gray

macd_color = macd_colorChange ? macd_IsAbove ? lime : red : red

signal_color = macd_colorChange ? macd_IsAbove ? orange : orange : lime

circleYPosition = outSignal

plot(smd and outMacD ? outMacD : na, title="MACD", color=macd_color, linewidth=4)

plot(smd and outSignal ? outSignal : na, title="Signal Line", color=signal_color, style=line ,linewidth=2)

plot(sh and outHist ? outHist : na, title="Histogram", color=plot_color, style=histogram, linewidth=4)

plot(sd and cross(outMacD, outSignal) ? circleYPosition : na, title="Cross", style=circles, linewidth=4, color=macd_color)

// plot( isWithinZeroMacd ? outHist : na, title="CheckSmallHistBars", style=circles, linewidth=4, color=black)

hline(0, '0 Line', linewidth=2, color=white)

strategy.close("Short", shouldExitShort)

strategy.close("Long", shouldExitLong)

// fastLength = input(12)

// slowlength = input(26)

// MACDLength = input(9)

// MACD = ema(close, fastLength) - ema(close, slowlength)

// aMACD = ema(MACD, MACDLength)

// delta = MACD - aMACD

// if (crossover(delta, 0))

// strategy.entry("MacdLE", strategy.long, comment="MacdLE")

//if last two macd bars are higher than current, close long position

// if (crossunder(delta, 0))

// strategy.entry("MacdSE", strategy.short, comment="MacdSE")

//if last two macd bars are higher than current, close long position

// plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

- Stratégie de négociation de renversement quantitatif au plus bas

- La stratégie double Bollinger + RSI (uniquement longue) v1.2

- La stratégie de négociation croisée zéro de la CCI

- Stratégie de rupture de la double inversion de la moyenne mobile des prix

- Stratégie de négociation de remise en arrière des moyennes mobiles

- Aggrégation moyenne mobile Stratégie de l'indicateur commercial de pression d'achat et d'achat

- Stratégie de suivi de l'inversion des moyennes mobiles doubles

- Stratégie MACD pour l'agrégation des moyennes mobiles

- Stratégie de l'EMA pour le squelette

- Stratégie de négociation quantitative basée sur des nombres aléatoires

- Stratégie SAR parabolique et CCI avec sortie de l'EMA pour le commerce de l'or

- Stratégie de croisement de la dynamique de la moyenne mobile de l'EMA

- Pivot Points de Camarilla Répercussion et renversement de l'élan Stratégie de la Croix d'or à faible absorption

- Canal de Donchian avec stratégie d'arrêt des pertes

- La tendance de l'oscillateur de vortex suivant la stratégie

- Stratégie de négociation des points pivots intraday

- Optimisation des stratégies de négociation de la pondération de volume de la courbe EMA inverse

- Stratégie DCA de la zone de Fibonacci

- Stratégie de renversement de tendance des bandes de Bollinger

- Stratégie de négociation quantitative basée sur StochRSI