Stratégie de bande moyenne mobile lissée

Aperçu

Cette stratégie est typique des stratégies de suivi de tendance en utilisant des moyennes mobiles pour construire des bandes de prix et en intégrant plusieurs moyennes mobiles pour filtrer les tendances en temps réel.

Principe de stratégie

- Il est possible de suivre les variations de prix de manière fluide en construisant des bandes de prix lisse et en utilisant des moyennes mobiles lisse.

- La stratégie prend en charge l’entrée de plusieurs types de moyennes mobiles en tant que types de calcul de moyennes mobiles lisses, comme EMA, SMMA, KAMA, etc.

- Prend en charge une superposition de 1 à 5 de ces moyennes mobiles pour obtenir une bande de prix plus lisse.

- Il est également possible d’utiliser des bandes de Brin entre les prix et les moyennes mobiles pour mieux capturer les variations de prix.

- Les filtres permettent de mieux filtrer les fluctuations et de mieux identifier les tendances en activant le filtre de moyenne mobile supplémentaire. Le filtre prend également en charge plusieurs types de moyennes mobiles.

- La combinaison de l’indicateur de reconnaissance de forme permet une reconnaissance automatique des signaux d’achat et de vente.

Cette stratégie, qui capture les tendances des prix en construisant des bandes de prix lisses et en intégrant des filtres de moyenne mobile pour confirmer la direction de la tendance, est une stratégie typique de suivi de tendance. En ajustant les paramètres, il est possible de s’adapter de manière flexible à différents types de conditions de marché et à différentes périodes.

Avantages stratégiques

- La construction d’une bande de prix permet de suivre plus facilement les tendances de changement de prix et de réduire efficacement la probabilité de manquer des opportunités.

- La prise en charge de plusieurs types de moyennes mobiles permet de sélectionner les moyennes mobiles appropriées en fonction des différentes périodes et variétés, ce qui améliore l’adaptabilité des stratégies.

- La suppression de 1 à 5 fois de la superposition peut améliorer considérablement la capacité de suivre les variations de prix et de saisir plus précisément les points de basculement des tendances.

- Les filtres de moyenne mobile permettent de réduire efficacement les signaux inefficaces et d’améliorer le taux de réussite.

- En ajustant la longueur des moyennes mobiles, il est possible de s’adapter à des périodes de temps différentes et même de vérifier les valeurs sur plusieurs périodes de temps, ce qui améliore l’efficacité de la stratégie.

- Le système d’affichage en verre noirci permet de voir clairement et intuitivement les mouvements des bandes de prix.

Risque stratégique

- Le suivi des tendances à long terme est plus fort, mais le suivi et la réaction aux fluctuations à court terme sont moins bons et peuvent générer plus de signaux inefficaces dans des situations de choc.

- Les moyennes mobiles lisses peuvent avoir un certain retard dans les fluctuations rapides des prix de la chute de la tempête et peuvent manquer les meilleurs moments d’entrée.

- Les moyennes mobiles superposées peuvent être trop lisse pour les variations de prix, ce qui conduit à des points d’achat et de vente mal identifiés.

- Si les paramètres de longueur des moyennes mobiles activées sont mal configurés, cela peut entraîner la génération d’un grand nombre de faux signaux.

La solution est simple:

- Réduire la longueur des moyennes mobiles de manière appropriée pour accélérer la réaction aux variations des prix.

- Ajustez le nombre de superpositions pour réduire la probabilité d’une sur-glissure.

- Optimiser et tester les combinaisons de moyennes mobiles pour sélectionner les meilleurs paramètres

- La vérification de plusieurs périodes, combinée à d’autres indicateurs, réduit le taux de faux signaux.

Orientation de l’optimisation de la stratégie

- Tester une combinaison optimisée de types de moyennes mobiles et choisir les meilleurs paramètres.

- Les tests optimisent les paramètres de longueur des moyennes mobiles pour une variété plus large et une période de temps plus longue.

- Essayez différents types de superposition pour trouver le meilleur équilibre.

- Essayez d’ajouter des bandes Brin comme indicateur auxiliaire.

- Testez différentes moyennes mobiles additionnelles comme filtres.

- La vérification des délais multiples en combinaison avec d’autres indicateurs.

Résumer

Cette stratégie est une stratégie de suivi de tendance typique, qui permet de suivre en permanence la tendance des prix en construisant des bandes de moyennes mobiles lisses, combinées à des filtres auxiliaires pour éviter les signaux inefficaces. L’avantage de la stratégie réside dans la construction de bandes de prix lisses, qui permettent de mieux capturer le virage de la tendance des prix. Il existe également un certain risque de retard.

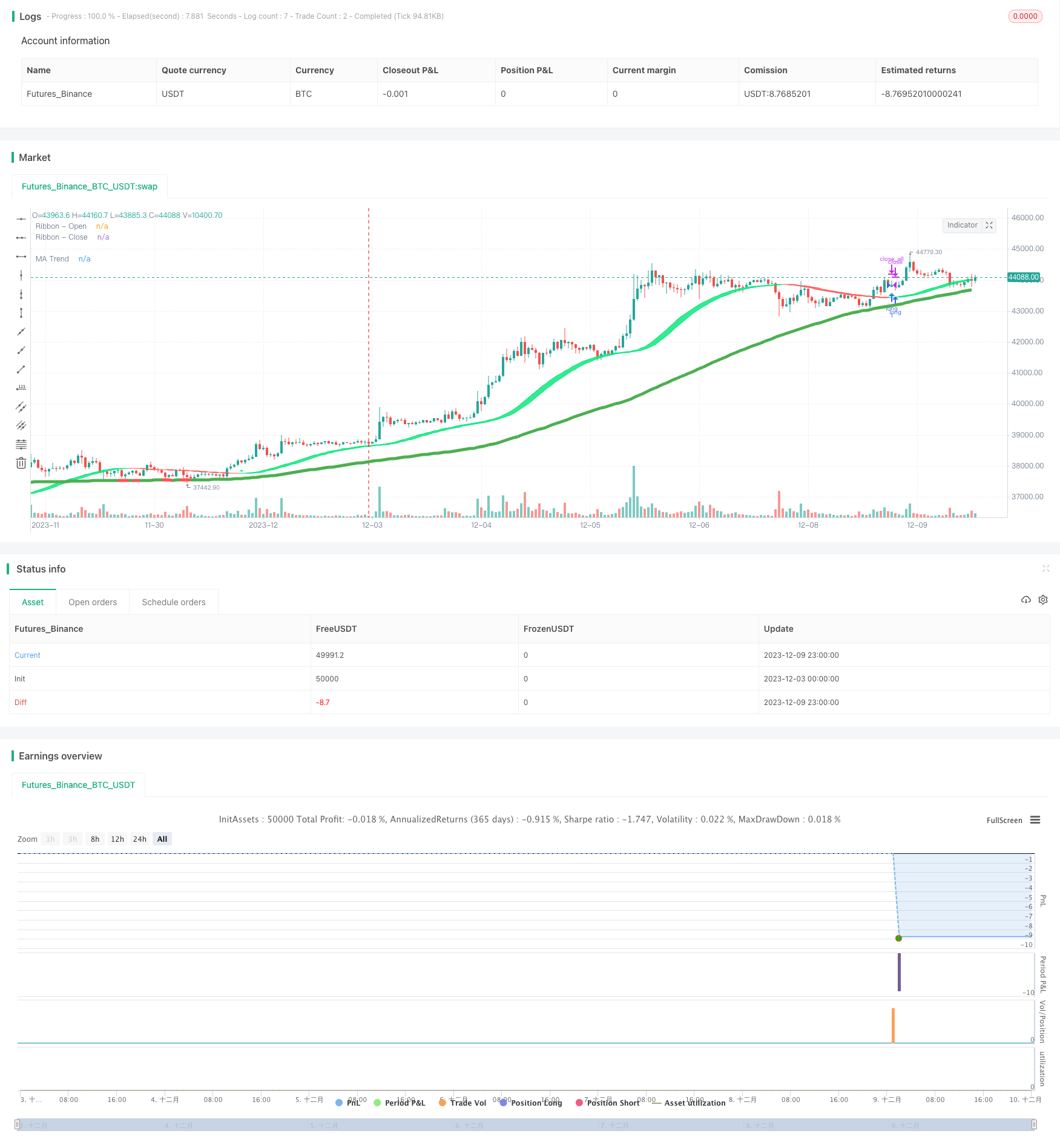

/*backtest

start: 2023-12-03 00:00:00

end: 2023-12-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Copyright (c) 2007-present Jurik Research and Consulting. All rights reserved.

// Copyright (c) 2018-present, Alex Orekhov (everget)

// Thanks to everget for code for more advanced moving averages

// Smooth Moving Average Ribbon [STRATEGY] @PuppyTherapy script may be freely distributed under the MIT license.

strategy( title="Smooth Moving Average Ribbon [STRATEGY] @PuppyTherapy", overlay=true )

// ---- CONSTANTS ----

lsmaOffset = 1

almaOffset = 0.85

almaSigma = 6

phase = 2

power = 2

// ---- GLOBAL FUNCTIONS ----

kama(src, len)=>

xvnoise = abs(src - src[1])

nfastend = 0.666

nslowend = 0.0645

nsignal = abs(src - src[len])

nnoise = sum(xvnoise, len)

nefratio = iff(nnoise != 0, nsignal / nnoise, 0)

nsmooth = pow(nefratio * (nfastend - nslowend) + nslowend, 2)

nAMA = 0.0

nAMA := nz(nAMA[1]) + nsmooth * (src - nz(nAMA[1]))

t3(src, len)=>

xe1_1 = ema(src, len)

xe2_1 = ema(xe1_1, len)

xe3_1 = ema(xe2_1, len)

xe4_1 = ema(xe3_1, len)

xe5_1 = ema(xe4_1, len)

xe6_1 = ema(xe5_1, len)

b_1 = 0.7

c1_1 = -b_1*b_1*b_1

c2_1 = 3*b_1*b_1+3*b_1*b_1*b_1

c3_1 = -6*b_1*b_1-3*b_1-3*b_1*b_1*b_1

c4_1 = 1+3*b_1+b_1*b_1*b_1+3*b_1*b_1

nT3Average_1 = c1_1 * xe6_1 + c2_1 * xe5_1 + c3_1 * xe4_1 + c4_1 * xe3_1

// The general form of the weights of the (2m + 1)-term Henderson Weighted Moving Average

getWeight(m, j) =>

numerator = 315 * (pow(m + 1, 2) - pow(j, 2)) * (pow(m + 2, 2) - pow(j, 2)) * (pow(m + 3, 2) - pow(j, 2)) * (3 * pow(m + 2, 2) - 11 * pow(j, 2) - 16)

denominator = 8 * (m + 2) * (pow(m + 2, 2) - 1) * (4 * pow(m + 2, 2) - 1) * (4 * pow(m + 2, 2) - 9) * (4 * pow(m + 2, 2) - 25)

denominator != 0

? numerator / denominator

: 0

hwma(src, termsNumber) =>

sum = 0.0

weightSum = 0.0

termMult = (termsNumber - 1) / 2

for i = 0 to termsNumber - 1

weight = getWeight(termMult, i - termMult)

sum := sum + nz(src[i]) * weight

weightSum := weightSum + weight

sum / weightSum

get_jurik(length, phase, power, src)=>

phaseRatio = phase < -100 ? 0.5 : phase > 100 ? 2.5 : phase / 100 + 1.5

beta = 0.45 * (length - 1) / (0.45 * (length - 1) + 2)

alpha = pow(beta, power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

variant(src, type, len ) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = 2 * v2 - ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v5 = wma(src, len) // Weighted

v6 = vwma(src, len) // Volume Weighted

v7 = na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len // Smoothed

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

v9 = linreg(src, len, lsmaOffset) // Least Squares

v10 = alma(src, len, almaOffset, almaSigma) // Arnaud Legoux

v11 = kama(src, len) // KAMA

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v13 = t3(src, len) // T3

v14 = ema1+(ema1-ema2) // Zero Lag Exponential

v15 = hwma(src, len) // Henderson Moving average thanks to @everget

ahma = 0.0

ahma := nz(ahma[1]) + (src - (nz(ahma[1]) + nz(ahma[len])) / 2) / len //Ahrens Moving Average

v16 = ahma

v17 = get_jurik( len, phase, power, src)

type=="EMA"?v2 : type=="DEMA"?v3 : type=="TEMA"?v4 : type=="WMA"?v5 : type=="VWMA"?v6 :

type=="SMMA"?v7 : type=="Hull"?v8 : type=="LSMA"?v9 : type=="ALMA"?v10 : type=="KAMA"?v11 :

type=="T3"?v13 : type=="ZEMA"?v14 : type=="HWMA"?v15 : type=="AHMA"?v16 : type=="JURIK"?v17 : v1

smoothMA(o, h, l, c, maLoop, type, len) =>

ma_o = 0.0

ma_h = 0.0

ma_l = 0.0

ma_c = 0.0

if maLoop == 1

ma_o := variant(o, type, len)

ma_h := variant(h, type, len)

ma_l := variant(l, type, len)

ma_c := variant(c, type, len)

if maLoop == 2

ma_o := variant(variant(o ,type, len),type, len)

ma_h := variant(variant(h ,type, len),type, len)

ma_l := variant(variant(l ,type, len),type, len)

ma_c := variant(variant(c ,type, len),type, len)

if maLoop == 3

ma_o := variant(variant(variant(o ,type, len),type, len),type, len)

ma_h := variant(variant(variant(h ,type, len),type, len),type, len)

ma_l := variant(variant(variant(l ,type, len),type, len),type, len)

ma_c := variant(variant(variant(c ,type, len),type, len),type, len)

if maLoop == 4

ma_o := variant(variant(variant(variant(o ,type, len),type, len),type, len),type, len)

ma_h := variant(variant(variant(variant(h ,type, len),type, len),type, len),type, len)

ma_l := variant(variant(variant(variant(l ,type, len),type, len),type, len),type, len)

ma_c := variant(variant(variant(variant(c ,type, len),type, len),type, len),type, len)

if maLoop == 5

ma_o := variant(variant(variant(variant(variant(o ,type, len),type, len),type, len),type, len),type, len)

ma_h := variant(variant(variant(variant(variant(h ,type, len),type, len),type, len),type, len),type, len)

ma_l := variant(variant(variant(variant(variant(l ,type, len),type, len),type, len),type, len),type, len)

ma_c := variant(variant(variant(variant(variant(c ,type, len),type, len),type, len),type, len),type, len)

[ma_o, ma_h, ma_l, ma_c]

smoothHA( o, h, l, c ) =>

hao = 0.0

hac = ( o + h + l + c ) / 4

hao := na(hao[1])?(o + c / 2 ):(hao[1] + hac[1])/2

hah = max(h, max(hao, hac))

hal = min(l, min(hao, hac))

[hao, hah, hal, hac]

// ---- Main Ribbon ----

haSmooth = input(true, title=" Use HA as source ? " )

length = input(11, title=" MA1 Length", minval=1, maxval=1000)

maLoop = input(3, title=" Nr. of MA1 Smoothings ", minval=1, maxval=5)

type = input("EMA", title="MA Type", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "Hull", "LSMA", "ALMA", "KAMA", "ZEMA", "HWMA", "AHMA", "JURIK", "T3"])

haSmooth2 = input(true, title=" Use HA as source ? " )

// ---- Trend ----

ma_use = input(true, title=" ----- Use MA Filter ( For Lower Timeframe Swings / Scalps ) ? ----- " )

ma_source = input(defval = close, title = "MA - Source", type = input.source)

ma_length = input(100,title="MA - Length", minval=1 )

ma_type = input("SMA", title="MA - Type", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "Hull", "LSMA", "ALMA", "KAMA", "ZEMA", "HWMA", "AHMA", "JURIK", "T3"])

ma_useHA = input(defval = false, title = "Use HA Candles as Source ?")

ma_rsl = input(true, title = "Use Rising / Falling Logic ?" )

// ---- BODY SCRIPT ----

[ ha_open, ha_high, ha_low, ha_close ] = smoothHA(open, high, low, close)

_open_ma = haSmooth ? ha_open : open

_high_ma = haSmooth ? ha_high : high

_low_ma = haSmooth ? ha_low : low

_close_ma = haSmooth ? ha_close : close

[ _open, _high, _low, _close ] = smoothMA( _open_ma, _high_ma, _low_ma, _close_ma, maLoop, type, length)

[ ha_open2, ha_high2, ha_low2, ha_close2 ] = smoothHA(_open, _high, _low, _close)

_open_ma2 = haSmooth2 ? ha_open2 : _open

_high_ma2 = haSmooth2 ? ha_high2 : _high

_low_ma2 = haSmooth2 ? ha_low2 : _low

_close_ma2 = haSmooth2 ? ha_close2 : _close

ribbonColor = _close_ma2 > _open_ma2 ? color.lime : color.red

p_open = plot(_open_ma2, title="Ribbon - Open", color=ribbonColor, transp=70)

p_close = plot(_close_ma2, title="Ribbon - Close", color=ribbonColor, transp=70)

fill(p_open, p_close, color = ribbonColor, transp = 40 )

// ----- FILTER

ma = 0.0

if ma_use == true

ma := variant( ma_useHA ? ha_close : ma_source, ma_type, ma_length )

maFilterShort = ma_use ? ma_rsl ? falling(ma,1) : ma_useHA ? ha_close : close < ma : true

maFilterLong = ma_use ? ma_rsl ? rising(ma,1) : ma_useHA ? ha_close : close > ma : true

colorTrend = rising(ma,1) ? color.green : color.red

plot( ma_use ? ma : na, title="MA Trend", color=colorTrend, transp=80, transp=70, linewidth = 5)

long = crossover(_close_ma2, _open_ma2 ) and maFilterLong

short = crossunder(_close_ma2, _open_ma2 ) and maFilterShort

closeAll = cross(_close_ma2, _open_ma2 )

plotshape( short , title="Short", color=color.red, transp=80, style=shape.triangledown, location=location.abovebar, size=size.small)

plotshape( long , title="Long", color=color.lime, transp=80, style=shape.triangleup, location=location.belowbar, size=size.small)

//* Backtesting Period Selector | Component *//

//* Source: https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

if testPeriod() and long

strategy.entry( "long", strategy.long )

if testPeriod() and short

strategy.entry( "short", strategy.short )

if closeAll

strategy.close_all( when = closeAll )