Stratégie de percée à double EMA Golden Cross

Auteur:ChaoZhang est là., Date: 2023-12-20 16h34 et 58 minLes étiquettes:

Résumé

Cette stratégie est une stratégie de tendance basée sur les opérations de croix dorée et de croix de mort des lignes des moyennes mobiles exponentielles (EMA) de 5 minutes et 34 minutes. Elle va long lorsque l'EMA rapide traverse l'EMA lente de bas en bas, et court lorsque l'EMA rapide traverse l'EMA lente de haut en bas. Elle définit également le stop profit et le stop loss pour contrôler les risques.

Principe de stratégie

- L'EMA5 rapide et l'EMA34 lent forment des signaux de négociation.

- Lorsque l'EMA5 franchit l'EMA34, il s'agit d'une croix dorée, ce qui indique que la tendance à court terme est meilleure que la tendance à moyen terme.

- Lorsque l'EMA5 dépasse l'EMA34, il s'agit d'une croix de la mort, ce qui indique que la tendance à court terme est pire que la tendance à moyen terme.

- Définir le stop profit et le stop loss pour verrouiller les bénéfices et contrôler les risques.

Analyse des avantages

- Utiliser une double EMA filtre les fausses fuites et évite d'être pris au piège.

- Suivre les tendances à moyen terme augmente les possibilités de profit.

- La mise en place d'un stop profit et d'un stop loss permet de contrôler efficacement les risques.

Analyse des risques

- La double EMA a un effet de retard et peut manquer des opportunités de négociation à court terme.

- Un stop-loss trop large augmente les risques de perte.

- Un stop profit trop serré fait perdre les opportunités de maximiser les profits.

Directions d'optimisation

- Optimiser les paramètres EMA pour trouver la meilleure combinaison de paramètres.

- Optimisez les points d'arrêt des profits et des pertes pour obtenir des profits plus élevés.

- Ajouter d'autres indicateurs comme MACD, KDJ pour filtrer les signaux et améliorer la précision.

Résumé

Cette stratégie génère des signaux de trading à partir de croix dorées et de croix de mort des lignes EMA doubles, et définit un stop profit et un stop loss pour contrôler les risques.

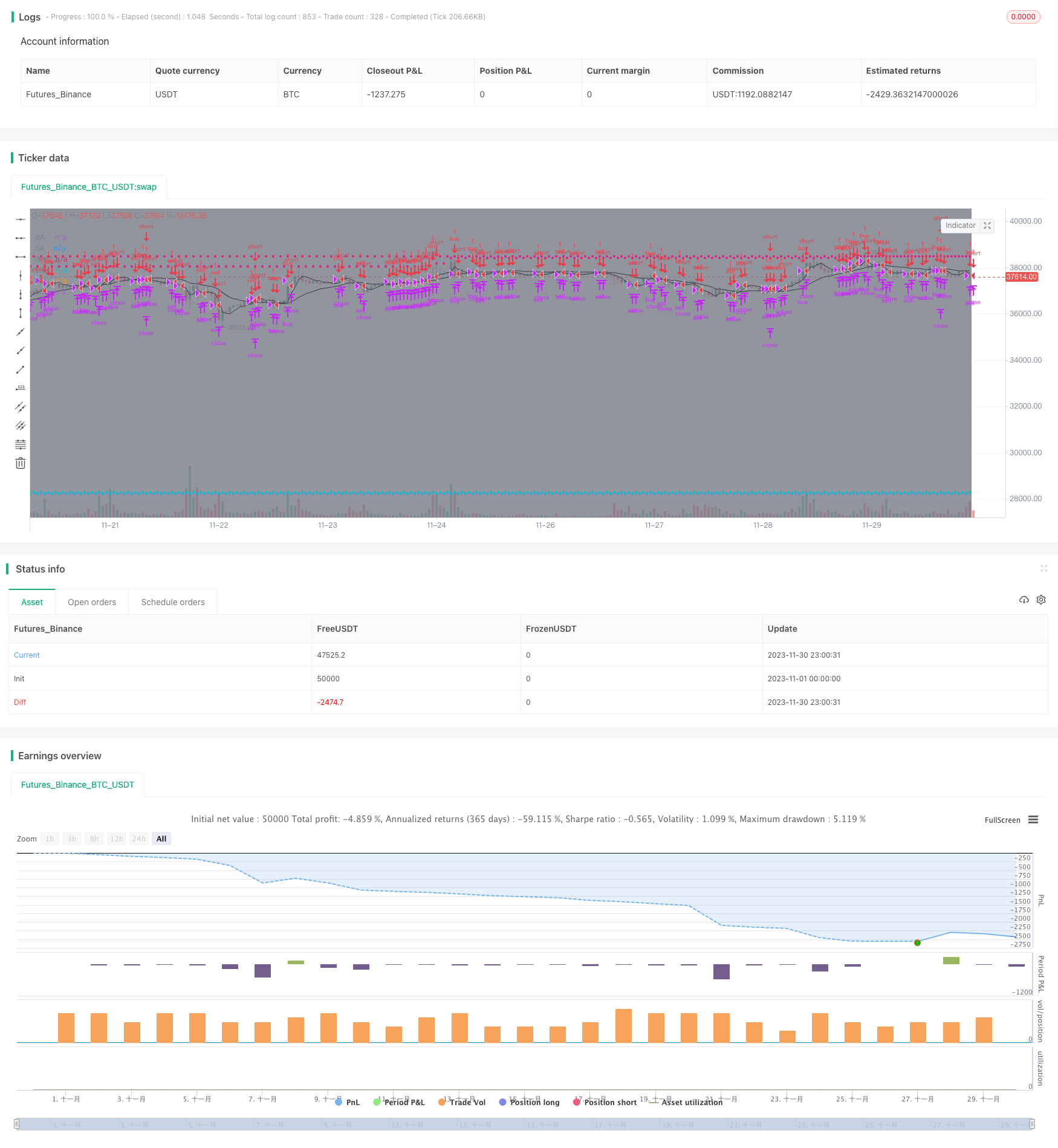

/*backtest

start: 2023-11-01 00:00:00

end: 2023-11-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title='[STRATEGY][RS]MicuRobert EMA cross V2', shorttitle='S', overlay=true, pyramiding=0, initial_capital=100000)

USE_TRADESESSION = input(title='Use Trading Session?', type=bool, defval=true)

USE_TRAILINGSTOP = input(title='Use Trailing Stop?', type=bool, defval=true)

trade_session = input(title='Trade Session:',defval='0400-1500', confirm=false)

istradingsession = not USE_TRADESESSION ? false : not na(time('1', trade_session))

bgcolor(istradingsession?gray:na)

trade_size = input(title='Trade Size:', type=float, defval=1)

tp = input(title='Take profit in pips:', type=float, defval=55.0) * (syminfo.mintick*10)

sl = input(title='Stop loss in pips:', type=float, defval=22.0) * (syminfo.mintick*10)

ma_length00 = input(title='EMA length:', defval=5)

ma_length01 = input(title='DEMA length:', defval=34)

price = input(title='Price source:', defval=open)

// ||--- NO LAG EMA, Credit LazyBear: ---||

f_LB_zlema(_src, _length)=>

_ema1=ema(_src, _length)

_ema2=ema(_ema1, _length)

_d=_ema1-_ema2

_zlema=_ema1+_d

// ||-------------------------------------||

ma00 = f_LB_zlema(price, ma_length00)

ma01 = f_LB_zlema(price, ma_length01)

plot(title='M0', series=ma00, color=black)

plot(title='M1', series=ma01, color=black)

isnewbuy = change(strategy.position_size)>0 and change(strategy.opentrades)>0

isnewsel = change(strategy.position_size)<0 and change(strategy.opentrades)>0

buy_entry_price = isnewbuy ? price : buy_entry_price[1]

sel_entry_price = isnewsel ? price : sel_entry_price[1]

plot(title='BE', series=buy_entry_price, style=circles, color=strategy.position_size <= 0 ? na : aqua)

plot(title='SE', series=sel_entry_price, style=circles, color=strategy.position_size >= 0 ? na : aqua)

buy_appex = na(buy_appex[1]) ? price : isnewbuy ? high : high >= buy_appex[1] ? high : buy_appex[1]

sel_appex = na(sel_appex[1]) ? price : isnewsel ? low : low <= sel_appex[1] ? low : sel_appex[1]

plot(title='BA', series=buy_appex, style=circles, color=strategy.position_size <= 0 ? na : teal)

plot(title='SA', series=sel_appex, style=circles, color=strategy.position_size >= 0 ? na : teal)

buy_ts = buy_appex - sl

sel_ts = sel_appex + sl

plot(title='Bts', series=buy_ts, style=circles, color=strategy.position_size <= 0 ? na : red)

plot(title='Sts', series=sel_ts, style=circles, color=strategy.position_size >= 0 ? na : red)

buy_cond1 = crossover(ma00, ma01) and (USE_TRADESESSION ? istradingsession : true)

buy_cond0 = crossover(price, ma00) and ma00 > ma01 and (USE_TRADESESSION ? istradingsession : true)

buy_entry = buy_cond1 or buy_cond0

buy_close = (not USE_TRAILINGSTOP ? low <= buy_entry_price - sl: low <= buy_ts) or high>=buy_entry_price+tp//high>=last_traded_price + tp or low<=last_traded_price - sl //high >= hh or

sel_cond1 = crossunder(ma00, ma01) and (USE_TRADESESSION ? istradingsession : true)

sel_cond0 = crossunder(price, ma00) and ma00 < ma01 and (USE_TRADESESSION ? istradingsession : true)

sel_entry = sel_cond1 or sel_cond0

sel_close = (not USE_TRAILINGSTOP ? high >= sel_entry_price + sl : high >= sel_ts) or low<=sel_entry_price-tp//low<=last_traded_price - tp or high>=last_traded_price + sl //low <= ll or

strategy.entry('buy', long=strategy.long, qty=trade_size, comment='buy', when=buy_entry)

strategy.close('buy', when=buy_close)

strategy.entry('sell', long=strategy.short, qty=trade_size, comment='sell', when=sel_entry)

strategy.close('sell', when=sel_close)

Plus de

- La stratégie de négociation quantitative du MACD inverse à double voie ergotique

- Stratégie quantitative à double indicateur

- Stratégie de négociation de bougies basée sur un modèle interactif

- Stratégie de combinaison DEMA MACD

- Ichimoku Yin Yang est une stratégie de rupture.

- Stratégie de tendance axée sur la liquidité - Stratégie de négociation quantitative basée sur l'indication de la tendance des flux

- Stratégie de croisement de l'EMA avec arrêt de perte de traînée

- La stratégie de vente soudaine et d'achat soudain

- Stratégie de suivi de l'inversion quantitative à deux facteurs

- La stratégie de tendance instantanée d' Ehlers

- Stratégie de négociation des moyennes mobiles de puissance haussière et baissière

- La stratégie quantitative: les bandes de Bollinger RSI et la stratégie croisée CCI

- La stratégie de suivi de l'évasion du VWAP

- Stratégie de négociation de renversement de l'élan

- Stratégie de négociation de suivi de l'élan

- Stratégie de tendance des moyennes mobiles pondérées multiples

- Stratégie de négociation basée sur les bandes de Bollinger et le MACD

- Stratégie d'effet de levier Macd bleu rouge

- Stratégie du canal de capture de l'élan

- Stratégie d'inversion de l'oscillation de couverture