Stratégie de combinaison des bandes de Bollinger et de la ligne K

Aperçu

Il s’agit d’une stratégie de suivi de tendance qui utilise à la fois les bandes de Bollinger et la forme de la ligne K comme signal d’entrée. Il est conçu pour capturer les tendances sur de plus longues périodes de temps et s’applique au trading de devises.

Principe de stratégie

La stratégie consiste à construire des bandes de Bollinger en calculant une fourchette de décalage standard du prix. La largeur de la bande représente la volatilité du marché.

Plus précisément, le signal de multiplication est le suivant: le point bas vers le haut dépasse la voie descendante, et il y a une absorption multiple ou une ligne K longue vers le bas. Le signal d’arrêt est le suivant: le point haut vers le bas dépasse la voie descendante, et il y a une absorption vide ou une ligne K longue vers le haut.

La méthode de stop loss est une méthode de stop loss prédéfinie. La méthode de stop stop est une méthode de stop partiel lorsque le prix traverse la ligne médiane de Brin.

Analyse des avantages

Cette stratégie combine tendance et reprise. Les bandes Bollinger sont capables de reconnaître les tendances et les occasions de survente. Les lignes K sont capables de juger le moment de reprise et d’éviter les fausses ruptures.

Les paramètres de stop-loss sont clairs et les risques sont maîtrisés.

Analyse des risques

Le risque le plus important de cette stratégie est de ne pas suivre la tendance ou d’avoir de fortes secousses.

En outre, le stop est dépendant de la ligne médiane, ce qui peut entraîner un arrêt prématuré ou tardif.

L’optimisation peut être effectuée en ajustant la combinaison de paramètres, en identifiant des formes de ligne K plus fiables ou en modifiant les normes de freinage en fonction du taux de fluctuation.

Direction d’optimisation

Il peut être combiné avec d’autres indicateurs pour déterminer la tendance du grand cycle et éviter les opérations de contre-courant. Ou ajouter des algorithmes d’apprentissage automatique pour déterminer la meilleure combinaison de paramètres.

La méthode d’arrêt peut également être modifiée en arrêt mobile ou en arrêt de fluctuation, etc., pour maximiser les bénéfices.

Résumer

Il s’agit d’une stratégie de tendance à plus long terme basée sur des indicateurs techniques des bandes de Bollinger et des lignes K. Elle est adaptée à une stratégie de base, avec une certaine fiabilité et une marge de profit, mais nécessite toujours un test et une optimisation continus pour améliorer la stabilité.

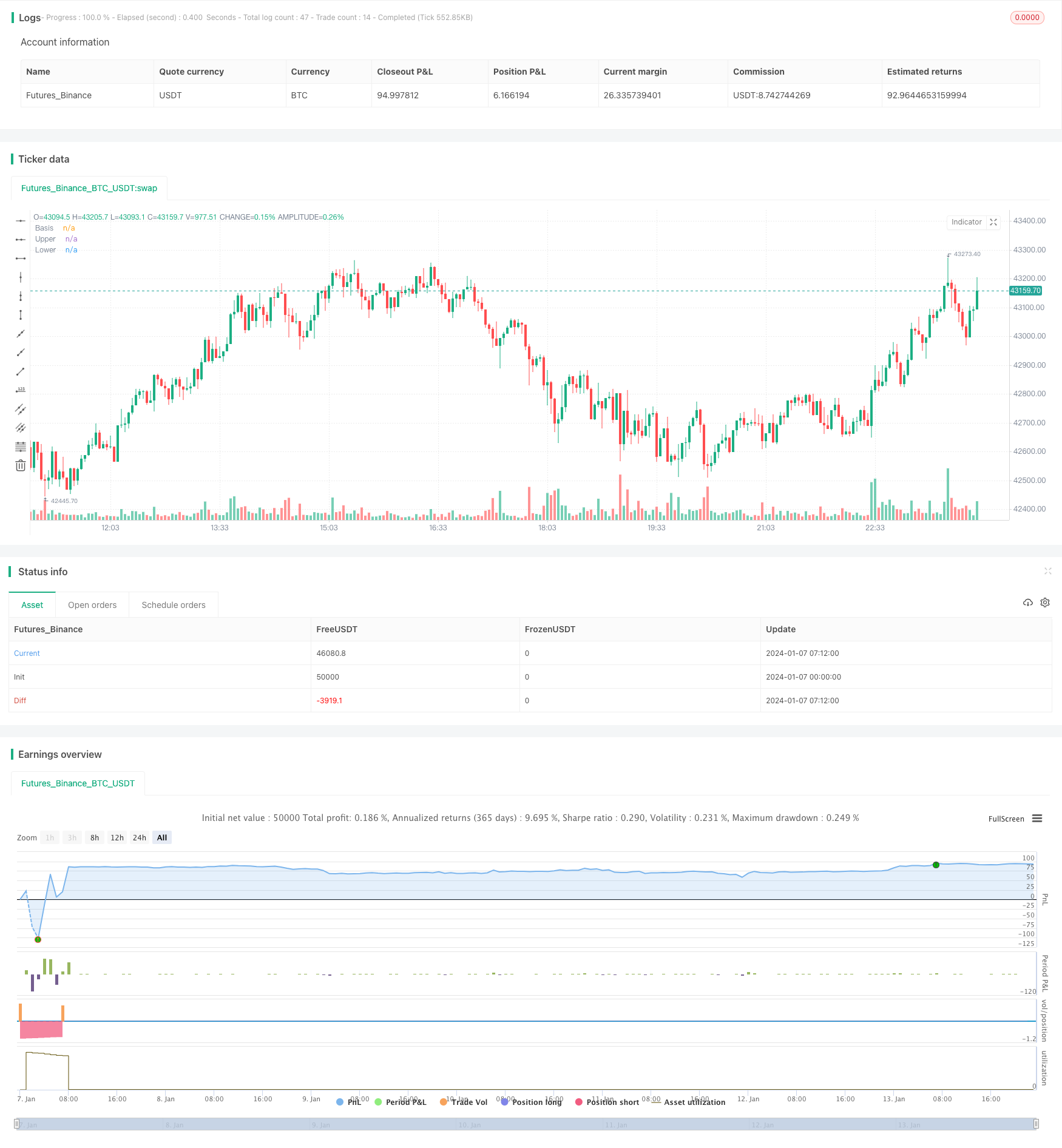

/*backtest

start: 2024-01-07 00:00:00

end: 2024-01-14 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("BB策略", overlay=true)

length = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

plot(basis, "Basis", color=#872323, offset = offset)

p1 = plot(upper, "Upper", color=color.teal, offset = offset)

p2 = plot(lower, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=#198787, transp=95)

diff=upper-lower

//plot(upper*0.9985, "Upper", color=color.white, offset = offset)

//plot(lower*1.0015, "Lower", color=color.white, offset = offset)

//Engulfing Candles

openBarPrevious = open[1]

closeBarPrevious = close[1]

openBarCurrent = open

closeBarCurrent = close

//If current bar open is less than equal to the previous bar close AND current bar open is less than previous bar open AND current bar close is greater than previous bar open THEN True

bullishEngulfing = openBarCurrent <= closeBarPrevious and openBarCurrent < openBarPrevious and

closeBarCurrent > openBarPrevious

//If current bar open is greater than equal to previous bar close AND current bar open is greater than previous bar open AND current bar close is less than previous bar open THEN True

bearishEngulfing = openBarCurrent >= closeBarPrevious and openBarCurrent > openBarPrevious and

closeBarCurrent < openBarPrevious

//bullishEngulfing/bearishEngulfing return a value of 1 or 0; if 1 then plot on chart, if 0 then don't plot

//plotshape(bullishEngulfing, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

//plotshape(bearishEngulfing, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

//alertcondition(bullishEngulfing, title="Bullish Engulfing", message="[CurrencyPair] [TimeFrame], Bullish candle engulfing previous candle")

//alertcondition(bearishEngulfing, title="Bearish Engulfing", message="[CurrencyPair] [TimeFrame], Bearish candle engulfing previous candle")

//Long Upper Shadow - Bearish

C_Len = 14 // ema depth for bodyAvg

C_ShadowPercent = 5.0 // size of shadows

C_ShadowEqualsPercent = 100.0

C_DojiBodyPercent = 5.0

C_Factor = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi = max(close, open)

C_BodyLo = min(close, open)

C_Body = C_BodyHi - C_BodyLo

C_BodyAvg = ema(C_Body, C_Len)

C_SmallBody = C_Body < C_BodyAvg

C_LongBody = C_Body > C_BodyAvg

C_UpShadow = high - C_BodyHi

C_DnShadow = C_BodyLo - low

C_HasUpShadow = C_UpShadow > C_ShadowPercent / 100 * C_Body

C_HasDnShadow = C_DnShadow > C_ShadowPercent / 100 * C_Body

C_WhiteBody = open < close

C_BlackBody = open > close

C_Range = high-low

C_IsInsideBar = C_BodyHi[1] > C_BodyHi and C_BodyLo[1] < C_BodyLo

C_BodyMiddle = C_Body / 2 + C_BodyLo

C_ShadowEquals = C_UpShadow == C_DnShadow or (abs(C_UpShadow - C_DnShadow) / C_DnShadow * 100) < C_ShadowEqualsPercent and (abs(C_DnShadow - C_UpShadow) / C_UpShadow * 100) < C_ShadowEqualsPercent

C_IsDojiBody = C_Range > 0 and C_Body <= C_Range * C_DojiBodyPercent / 100

C_Doji = C_IsDojiBody and C_ShadowEquals

patternLabelPosLow = low - (atr(30) * 0.6)

patternLabelPosHigh = high + (atr(30) * 0.6)

C_LongUpperShadowBearishNumberOfCandles = 1

C_LongShadowPercent = 75.0

C_LongUpperShadowBearish = C_UpShadow > C_Range/100*C_LongShadowPercent

//alertcondition(C_LongUpperShadowBearish, title = "Long Upper Shadow", message = "New Long Upper Shadow - Bearish pattern detected.")

//if C_LongUpperShadowBearish

// var ttBearishLongUpperShadow = "Long Upper Shadow\nTo indicate buyer domination of the first part of a session, candlesticks will present with long upper shadows, as well as short lower shadows, consequently raising bidding prices."

// label.new(bar_index, patternLabelPosHigh, text="LUS", style=label.style_label_down, color = color.red, textcolor=color.white, tooltip = ttBearishLongUpperShadow)

//gcolor(highest(C_LongUpperShadowBearish?1:0, C_LongUpperShadowBearishNumberOfCandles)!=0 ? color.red : na, offset=-(C_LongUpperShadowBearishNumberOfCandles-1))

C_Len1 = 14 // ema depth for bodyAvg

C_ShadowPercent1 = 5.0 // size of shadows

C_ShadowEqualsPercent1 = 100.0

C_DojiBodyPercent1 = 5.0

C_Factor1 = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi1 = max(close, open)

C_BodyLo1 = min(close, open)

C_Body1 = C_BodyHi1 - C_BodyLo1

C_BodyAvg1 = ema(C_Body1, C_Len1)

C_SmallBody1 = C_Body1 < C_BodyAvg1

C_LongBody1 = C_Body1 > C_BodyAvg1

C_UpShadow1 = high - C_BodyHi1

C_DnShadow1 = C_BodyLo1 - low

C_HasUpShadow1 = C_UpShadow1 > C_ShadowPercent1 / 100 * C_Body1

C_HasDnShadow1 = C_DnShadow1 > C_ShadowPercent1 / 100 * C_Body1

C_WhiteBody1 = open < close

C_BlackBody1 = open > close

C_Range1 = high-low

C_IsInsideBar1 = C_BodyHi1[1] > C_BodyHi1 and C_BodyLo1[1] < C_BodyLo1

C_BodyMiddle1 = C_Body1 / 2 + C_BodyLo1

C_ShadowEquals1 = C_UpShadow1 == C_DnShadow1 or (abs(C_UpShadow1 - C_DnShadow1) / C_DnShadow1 * 100) < C_ShadowEqualsPercent1 and (abs(C_DnShadow1 - C_UpShadow1) / C_UpShadow1 * 100) < C_ShadowEqualsPercent1

C_IsDojiBody1 = C_Range1 > 0 and C_Body1 <= C_Range1 * C_DojiBodyPercent1 / 100

C_Doji1 = C_IsDojiBody1 and C_ShadowEquals1

patternLabelPosLow1 = low - (atr(30) * 0.6)

patternLabelPosHigh1 = high + (atr(30) * 0.6)

C_LongLowerShadowBullishNumberOfCandles1 = 1

C_LongLowerShadowPercent1 = 75.0

C_LongLowerShadowBullish1 = C_DnShadow1 > C_Range1/100*C_LongLowerShadowPercent1

//alertcondition1(C_LongLowerShadowBullish1, title = "Long Lower Shadow", message = "New Long Lower Shadow - Bullish pattern detected.")

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2018, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=1, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=11, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2030, minval=1800, maxval=2100)

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

//多單

if ((bullishEngulfing or C_LongLowerShadowBullish1) and inDateRange and cross(low,lower))

strategy.entry("L", strategy.long, qty=1,stop=(low[1]))

//strategy.close("L",comment = "L exit",when=cross(basis,close),qty_percent=50)

if crossunder(close,upper*0.9985)

strategy.close("L",comment = "L exit",qty_percent=1)

//空單

if (((bullishEngulfing == 0) or C_LongUpperShadowBearish) and inDateRange and cross(close,upper))

strategy.entry("S", strategy.short,qty= 1,stop=(high[1]))

//strategy.close("S",comment = "S exit",when=cross(basis,close),qty_percent=50)

if crossunder(lower*1.0015,close)

strategy.close("S",comment = "S exit",qty_percent=1)