Stratégie de suivi de tendance de moyenne mobile basée sur SSL

Aperçu

Cette stratégie est une stratégie qui utilise les indicateurs de la passerelle SSL pour déterminer les tendances du marché et suivre les tendances sur la ligne moyenne. Elle s’applique aux lignes de 4 heures et de jour sur les lignes moyennes et longues.

Principe de stratégie

Le canal SSL est constitué de la courbe de Kelt et de l’amplitude réelle. Il permet de déterminer la direction de la tendance du marché. Il est un signal de hausse lorsque le prix franchit la trajectoire supérieure et un signal de baisse lorsque le prix franchit la trajectoire inférieure.

La stratégie utilise des indicateurs de moyenne comme l’EMA pour calculer une moyenne de référence. Cette moyenne permet de filtrer certaines fausses ruptures.

La stratégie va faire plus lorsque le prix franchit la ligne supérieure de la trajectoire SSL, faire moins lorsque le prix franchit la ligne inférieure de la trajectoire SSL.

Les méthodes de stop loss sont les suivantes: Stop Percentage, Stop ATR et Stop Minimum/Maximum. Le stop loss est N fois supérieur au stop stop. Les paramètres sont déterminés par l’utilisateur.

Analyse des avantages

Le canal SSL détermine la direction de la tendance avec précision, réduisant les faux signaux. La coopération avec la jonction homogène est la base de l’entrée en bourse, évitant de rattraper le fond.

Il est possible de choisir avec souplesse les différents types de courbes moyennes qui s’adapteront à un plus large éventail de conditions de marché.

Les modes de stop loss sont flexibles et les risques sont contrôlables. Le multiplicateur de stop loss peut également être réglé de manière flexible pour répondre à différentes préférences.

Il est possible de faire plus de blanchiment en même temps pour exploiter pleinement les opportunités bidirectionnelles du marché.

Analyse des risques

Les indicateurs de la ligne moyenne sont en retard, ce qui peut entraîner des pertes cumulées.

Le tremblement de terre a des répercussions négatives sur la circulation des véhicules et peut être facilement détecté.

L’ATR et le stop-loss rétrospectif peuvent être trop relâchés en cas de rupture anormale, ce qui augmente les pertes.

Les mesures de prévention:

- Ajustez les paramètres de la ligne moyenne ou choisissez d’autres types de ligne moyenne.

- Il est important d’augmenter le stop loss et de le faire en temps opportun.

- Ajouter un facteur de multiplication dans l’ATR, ou ajuster la période de révision.

Direction d’optimisation

- Testez plus de types d’indicateurs de moyenne pour trouver le paramètre optimal.

- Optimiser les paramètres de cycle ATR de l’arrêt des pertes.

- Tester les différents paramètres du multiplicateur d’arrêt.

- Test de différents facteurs de risque d’épilepsie.

Résumer

Cette stratégie utilise SSL pour juger les tendances et les indicateurs de la ligne de parité pour confirmer l’entrée sur le marché, ce qui permet un suivi efficace des tendances. Elle offre une méthode de stop loss et d’arrêt flexible pour obtenir des rendements plus élevés tout en contrôlant les risques.

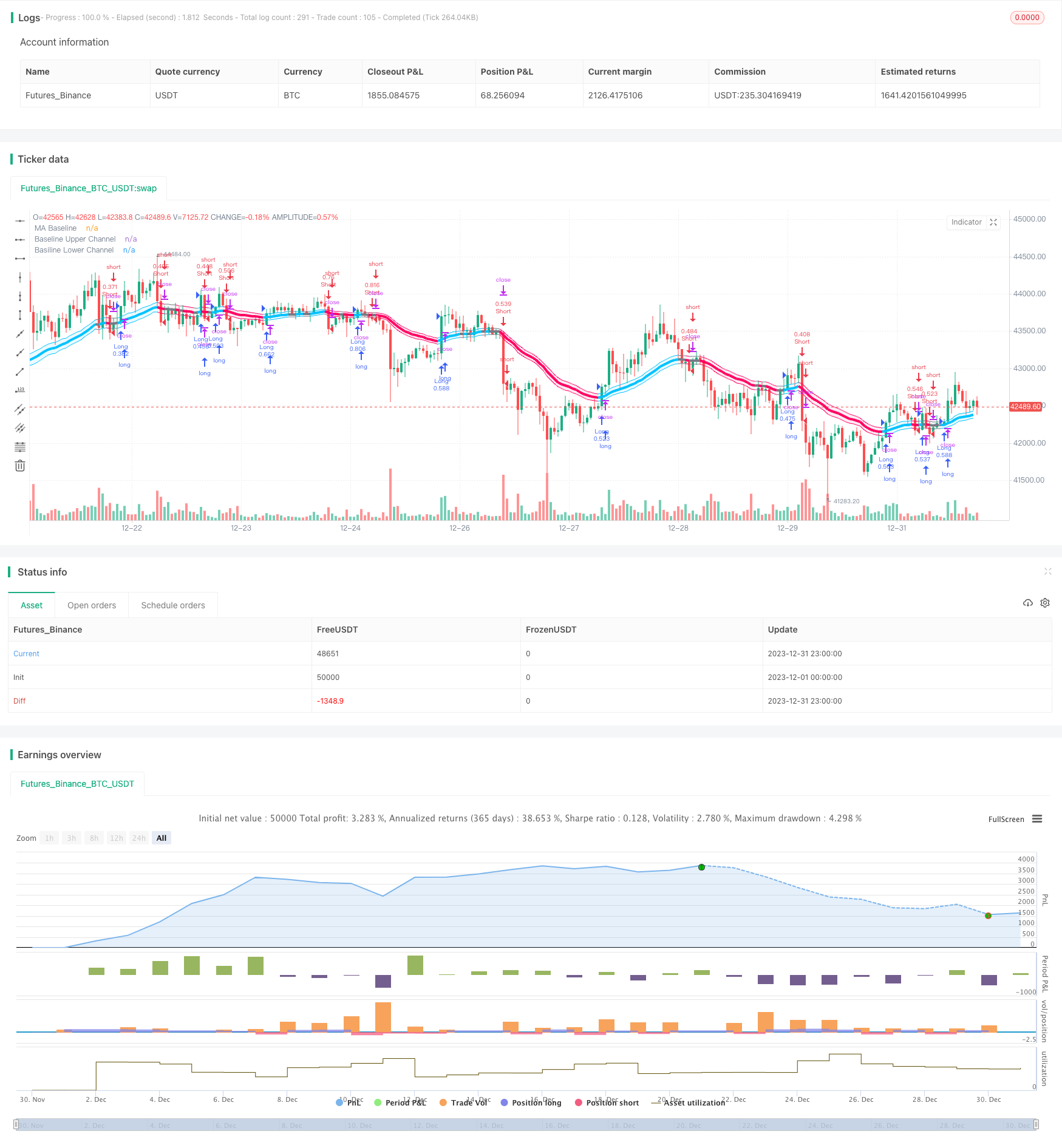

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Thanks to @kevinmck100 for opensource strategy template and @Mihkel00 for SSL Hybrid

// @fpemehd

// @version=5

strategy(title = '[fpemehd] SSL Baseline Strategy',

shorttitle = '[f] SSL',

overlay = true)

// # ========================================================================= #

// # Inputs

// # ========================================================================= #

// 1. Time

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

inDateRange = true

// 2. Inputs for direction: Long? Short? Both?

// i_longEnabled = input.bool(defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "1", group = "Long / Short" )

// i_shortEnabled = input.bool(defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "1", group = "Long / Short" )

// 3. Shared inputs for Long and Short

//// 3-1. Inputs for Stop Loss Type: ATR or Percent?

i_slType = input.string (defval = "ATR", title = "SL Type ", group = "Strategy: Stop Loss Conditions", options = ["Percent", "ATR", "Previous LL / HH"], tooltip = "Stop Loss based on %? ATR?", inline = "1")

i_slPercent = input.float (defval = 3, title = "SL % ", group = "Strategy: Stop Loss Conditions", inline = "2")

i_slAtrLength = input.int (14, "SL ATR Length ", group = "Strategy: Stop Loss Conditions", inline = "3", minval = 0, maxval = 10000)

i_slAtrMultiplier = input.float (4, "SL ATR Multiplier", group = "Strategy: Stop Loss Conditions", inline = "3", minval = 0, step = 0.1, tooltip = "Length of ATR used to calculate Stop Loss. \nSize of StopLoss is determined by multiplication of ATR value. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

i_slLookBack = input.int(30, "Lowest Price Before Entry", group = "Strategy: Stop Loss Conditions", inline = "4", minval = 30, step = 1, tooltip = "Lookback to find the Lowest Price. \nStopLoss is determined by the Lowest price of the look back period. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

//// 3-2. Inputs for Quantity & Risk Manangement: Take Profit

i_riskReward = input.float(2, "Risk : Reward Ratio ", group = "Strategy: Risk Management", inline = "1", minval = 0, step = 0.1, tooltip = "Previous high or low (long/short dependant) is used to determine TP level. 'Risk : Reward' ratio is then used to calculate SL based of previous high/low level.\n\nIn short, the higher the R:R ratio, the smaller the SL since TP target is fixed by previous high/low price data.")

i_accountRiskPercent = input.float(1, "Portfolio Risk %", group = "Strategy: Risk Management", inline = "1", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

// 4. Inputs for Drawings

i_showTpSlBoxes = input.bool(false, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

i_showLabels = input.bool(false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "1", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

i_showDashboard = input.bool(false, "Show Dashboard", group = "Strategy: Drawings", inline = "1", tooltip = "Show Backtest Results")

i_show_color_bar = input.bool(false , "Color Bars", group = "Strategy: Drawings", inline = "1")

// 5. Inputs for Indicators

//// 5-1. Inputs for Indicator - 1: SSL Hybrid

i_useTrueRange = input.bool(defval = true , title = "use true range for Keltner Channel?", tooltip = "", inline = " ", group = "1: SSL Hybrid")

i_maType = input.string(defval='EMA', title='Baseline Type', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'],group = "1: SSL Hybrid")

i_len = input.int(defval=30,title='Baseline Length', group = "1: SSL Hybrid")

i_multy = input.float(0.2, step=0.05, title='Base Channel Multiplier', group = "1: SSL Hybrid")

// Input for Baseline

i_kidiv = input.int(defval=1, maxval=4, minval=0, title='Kijun MOD Divider',inline="Kijun v2", group="1: SSL Hybrid")

i_jurik_phase = input.int(defval=3, title='Baseline Type = JMA -> Jurik Phase', inline='JMA',group="1: SSL Hybrid")

i_jurik_power = input.int(defval=1, title='Baseline Type = JMA -> Jurik Power', inline='JMA',group="1: SSL Hybrid")

i_volatility_lookback = input.int(defval=10, title='Baseline Type = VAMA -> Volatility lookback length', inline='VAMA',group="1: SSL Hybrid")

// MF

i_beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Baseline Type = MF (Modular Filter, General Filter) ->Beta', inline='MF',group="1: SSL Hybrid")

i_feedback = input.bool(defval=false, title='Baseline Type = MF (Modular Filter) -> Use Feedback?', inline='MF',group="1: SSL Hybrid")

i_z = input.float(0.5, title='Baseline Type = MF (Modular Filter) -> Feedback Weighting', step=0.1, minval=0, maxval=1, inline='MF',group="1: SSL Hybrid")

// EDSMA

i_ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20, inline='EDSMA',group="1: SSL Hybrid")

i_ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3], inline='EDSMA',group="1: SSL Hybrid")

// # ========================================================================= #

// # Functions for Stop Loss & Take Profit & Plots

// # ========================================================================= #

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if i_showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if i_showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if i_showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##") + "\nExit Price: " + str.tostring(close,"#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + " " + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// # ========================================================================= #

// # Entry, Close Logic

// # ========================================================================= #

// 1. Calculate Indicators

//// 1-1. Calculate Indicators for SSL Hybrid Baseline

////// TEMA

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

////// EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = i_feedback ? i_z * src + (1 - i_z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = i_beta * b + (1 - i_beta) * c

lower = i_beta * c + (1 - i_beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, i_volatility_lookback)

vol_down = ta.lowest(dev, i_volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = i_jurik_phase < -100 ? 0.5 : i_jurik_phase > 100 ? 2.5 : i_jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, i_jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / i_kidiv), ta.highest(len / i_kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = i_ssfPoles == 2 ? get2PoleSSF(avgZeros, i_ssfLength) : get3PoleSSF(avgZeros, i_ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

////// Keltner Baseline Channel (Baseline)

BBMC = ma(i_maType, close, i_len)

Keltma = ma(i_maType, close, i_len)

range_1 = i_useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, i_len)

upperk = Keltma + rangema * i_multy

lowerk = Keltma - rangema * i_multy

// 2. Entry Condition for Long and Short

// Condition 1

bullSSL = close > upperk

bearSSL = close < lowerk

// Enter Position based on Condition 1

goLong = inDateRange and bullSSL

goShort = inDateRange and bearSSL

// # ========================================================================= #

// # Position Control Logic (Entry & Exit)

// # ========================================================================= #

// 1. Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

// 2. Entry decisions

openLong = (goLong and not inLong) // Long entry condition & not in long position

openShort = (goShort and not inShort) // Short entry condition & not in short position

flippingSides = (goLong and inShort) or (goShort and inLong) // (Long entry condition & in short position) and the opposite

enteringTrade = openLong or openShort // Entering Long or Short Condition

inTrade = inLong or inShort

// 3. Stop Loss & Take Profit Percent

lowestLow = ta.lowest(source = low, length = i_slLookBack)

highestHigh = ta.highest(source = high, length = i_slLookBack)

llhhSLPercent = openLong ? math.abs((close - lowestLow) / close) * 100 : openShort ? math.abs((highestHigh - close) / close) * 100 : na

atr = ta.atr(i_slAtrLength)

slAmount = atr * i_slAtrMultiplier

slPercent = i_slType == 'ATR' ? math.abs((1 - (close - slAmount) / close) * 100) : i_slType == 'Percent' ? i_slPercent : llhhSLPercent

tpPercent = slPercent * i_riskReward

// 4. Risk calculations & Quantity Management

riskAmt = strategy.equity * i_accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

// 5. Open Position

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

// Can add more take profit Actions

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// # ========================================================================= #

// # Plots (Bar Color, Plot, Label, Boxes)

// # ========================================================================= #

// 1. SSL Hybrid Baseline

longColor = #00c3ff

shortColor = #ff0062

color_bar = close > upperk ? longColor : close < lowerk ? shortColor : color.gray

p1 = plot(BBMC, color=color.new(color=color_bar, transp=0), linewidth=4, title='MA Baseline')

// 2. Bar color Based On SSL Hybrid Baseline

barcolor(i_show_color_bar ? color_bar : na)

up_channel = plot(upperk, color=color_bar, title='Baseline Upper Channel')

low_channel = plot(lowerk, color=color_bar, title='Basiline Lower Channel')

fill(up_channel, low_channel, color.new(color=color_bar, transp=90))

// 3. Stoploss Boxes

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

entryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

if (inTrade and exitTriggered)

inShort := false

inLong := false

printTpSlHitBox(tradeEntryBar + 1, bar_index, slHit, tpHit, entryPrice, slPrice, tpPrice)

printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, entryPrice, pnl)

if barstate.islastconfirmedhistory and strategy.position_size != 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// 4. Data Windows

plotchar(slPrice, "Stop Loss Price", "")

plotchar(tpPrice, "Take Profit Price", "")

// 5. Showing Labels

plotDebugLabels = false

if plotDebugLabels

if bar_index == tradeEntryBar

printLabel(bar_index, "Position size: " + str.tostring(entryQty * close, "#.##"))

// 6. Showing Dashboard

if i_showDashboard

var bgcolor = color.new(color.black,0)

// Keep track of Wins/Losses streaks

newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

varip int winRow = 0

varip int lossRow = 0

varip int maxWinRow = 0

varip int maxLossRow = 0

if newWin

lossRow := 0

winRow := winRow + 1

if winRow > maxWinRow

maxWinRow := winRow

if newLoss

winRow := 0

lossRow := lossRow + 1

if lossRow > maxLossRow

maxLossRow := lossRow

// Prepare stats table

var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

if barstate.islastconfirmedhistory

// Update table

dollarReturn = strategy.netprofit

f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

_profit = (strategy.netprofit / strategy.initial_capital) * 100

f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

_numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

_winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)