तरंग प्रवृत्तियों पर आधारित ट्रेडिंग रणनीतियाँ

अवलोकन

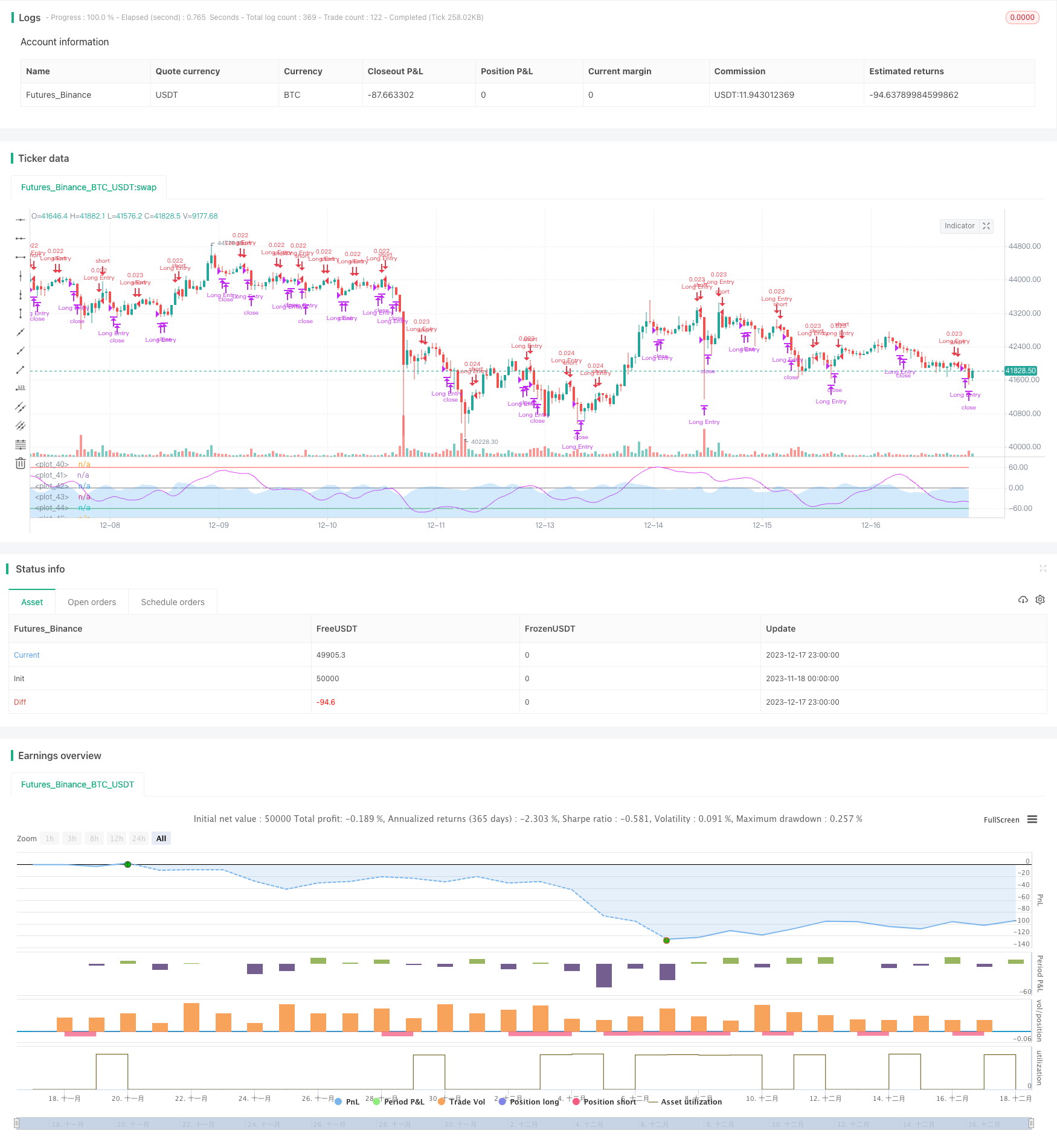

यह एक ट्रेडिंग रणनीति है जो LazyBear के लहर प्रवृत्ति सूचक पर आधारित है। यह रणनीति कीमतों में उतार-चढ़ाव के लहर प्रवृत्ति की गणना करके बाजार में ओवरबॉय और ओवरसोल की स्थिति का आकलन करती है।

रणनीति सिद्धांत

यह रणनीति मुख्य रूप से LazyBear के लहर प्रवृत्ति सूचक पर आधारित है। सबसे पहले कीमतों की औसत कीमतों की गणना की जाती है (एपी), फिर एपी के सूचकांक चलती औसत (ईएसए) और निरपेक्ष मूल्य परिवर्तन की सूचकांक चलती औसत (डी) की गणना की जाती है। इसके आधार पर, अस्थिरता सूचकांक (सीआई) की गणना की जाती है, फिर सीआई के सूचकांक चलती औसत की गणना की जाती है, जिससे लहर प्रवृत्ति रेखा (डब्ल्यूटी) प्राप्त होती है। डब्ल्यूटी के बाद में डब्ल्यूटी 1 और डब्ल्यूटी 2 का उत्पादन सरल चलती औसत के माध्यम से किया जाता है। जब डब्ल्यूटी 1 डब्ल्यूटी 2 को पार करता है, तो इसे सोने के रूप में क्रॉस करता है, अधिक; जब डब्ल्यूटी 1 डब्ल्यूटी 2 को पार करता है, तो क्रॉस के रूप में मर जाता है, शून्य।

श्रेष्ठता विश्लेषण

यह एक बहुत ही सरल लेकिन बहुत ही व्यावहारिक ट्रेंड ट्रैकिंग रणनीति है। इसके मुख्य फायदे हैंः

- तरंग प्रवृत्ति सूचक के आधार पर, मूल्य प्रवृत्ति और बाजार की भावना को स्पष्ट रूप से पहचाना जा सकता है

- डब्ल्यूटी के गोल्ड क्रॉस और डेथ क्रॉस के माध्यम से ओवर और डाउन पॉइंट्स का आकलन करें, ऑपरेशन सरल

- अनुकूलित पैरामीटर WT लाइन की संवेदनशीलता को समायोजित करने के लिए अलग-अलग चक्रों के लिए

- अतिरिक्त सशर्त फ़िल्टरिंग सिग्नल जोड़े जा सकते हैं, जैसे कि ट्रेडिंग समय विंडो को सीमित करना

जोखिम विश्लेषण

इस रणनीति के कुछ जोखिम भी हैं:

- एक प्रवृत्ति-अनुसरण रणनीति के रूप में, बाजारों को समेकित करने के लिए बहुत सारे गलत संकेत उत्पन्न करने के लिए प्रवण

- डब्ल्यूटी लाइन खुद ही बहुत पिछड़ी हुई है, कीमतों में तेजी से बदलाव के बिंदु को याद कर सकती है

- डिफ़ॉल्ट पैरामीटर सभी किस्मों और चक्रों के लिए उपयुक्त नहीं हो सकता है, अनुकूलन की आवश्यकता है

- कोई स्टॉपलॉस तंत्र नहीं, एकतरफा होल्डिंग समय बहुत लंबा हो सकता है

मुख्य समाधान हैंः

- WT लाइन की संवेदनशीलता को अनुकूलित करने के लिए पैरामीटर

- गलत संकेतों से बचने के लिए सत्यापन के लिए अन्य संकेतक जोड़ें

- स्टॉप और स्टॉप सेट करें

- प्रति दिन ट्रेडों या पदों की संख्या को सीमित करना

अनुकूलन दिशा

इस रणनीति को और भी बेहतर बनाने के लिए जगह हैः

- WT के पैरामीटर को अनुकूलित करें ताकि यह अधिक संवेदनशील या अधिक स्थिर हो सके

- विभिन्न चक्रों के आधार पर विभिन्न मापदंडों का संयोजन

- मूल्य सूचक, उतार-चढ़ाव सूचक आदि को जोड़ना

- स्टॉप लॉस और स्टॉप लॉजिक जोड़ें

- रिच होल्डिंग मोड, जैसे कि पिरामिड स्टॉक, ग्रिड ट्रेडिंग आदि

- बेहतर सुविधाओं और ट्रेडिंग नियमों के लिए मशीन लर्निंग जैसे तरीकों का उपयोग करना

संक्षेप

यह रणनीति एक बहुत ही सरल और व्यावहारिक तरंग प्रवृत्ति ट्रैकिंग रणनीति है। यह कीमतों में उतार-चढ़ाव की प्रवृत्ति की गणना करके, बाजार में ओवरबॉय और ओवरसोल की स्थिति की पहचान करके, डब्ल्यूटी लाइन के गोल्ड क्रॉस और डेथ क्रॉस का उपयोग करके एक व्यापार संकेत भेजता है। रणनीति संचालित करने के लिए सरल है और इसे लागू करना आसान है। लेकिन एक प्रवृत्ति रणनीति के रूप में, इसे शेयर की कीमतों की संवेदनशीलता और स्थिरता के लिए और अधिक अनुकूलन की आवश्यकता है, साथ ही साथ अन्य संकेतकों और तर्क के साथ संरेखित करने की आवश्यकता है ताकि गलत संकेतों से बचा जा सके। कुल मिलाकर, यह एक बहुत ही व्यावहारिक रणनीति टेम्पलेट है जिसमें अनुकूलन के लिए बहुत जगह है।

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//

// @author LazyBear

//

// If you use this code in its original/modified form, do drop me a note.

//

//@version=4

// === INPUT BACKTEST RANGE ===

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2021, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

// === INPUT SHOW PLOT ===

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

n1 = input(10, "Channel Length")

n2 = input(21, "Average Length")

obLevel1 = input(60, "Over Bought Level 1")

obLevel2 = input(53, "Over Bought Level 2")

osLevel1 = input(-60, "Over Sold Level 1")

osLevel2 = input(-53, "Over Sold Level 2")

ap = hlc3

esa = ema(ap, n1)

d = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

plot(0, color=color.gray)

plot(obLevel1, color=color.red)

plot(osLevel1, color=color.green)

plot(obLevel2, color=color.red, style=3)

plot(osLevel2, color=color.green, style=3)

plot(wt1, color=color.white)

plot(wt2, color=color.fuchsia)

plot(wt1-wt2, color=color.new(color.blue, 80), style=plot.style_area)

//Strategy

strategy(title="T!M - Wave Trend Strategy", overlay = false, precision = 8, max_bars_back = 200, pyramiding = 0, initial_capital = 1000, currency = currency.NONE, default_qty_type = strategy.cash, default_qty_value = 1000, commission_type = "percent", commission_value = 0.1, calc_on_every_tick=false, process_orders_on_close=true)

longCondition = crossover(wt1, wt2)

shortCondition = crossunder(wt1, wt2)

strategy.entry(id="Long Entry", comment="buy", long=true, when=longCondition and window())

strategy.close("Long Entry", comment="sell", when=shortCondition and window())

//strategy.entry(id="Short Entry", long=false, when=shortCondition)