Strategi perdagangan R-Breaker

Penulis:Kebaikan, Dibuat: 2018-08-24 11:36:30, Diperbarui: 2020-06-03 17:16:34Dalam sistem trading Forex, metode trading Pivot Points adalah strategi trading klasik. Pivot Points adalah sistem support resistance yang sangat sederhana. Berdasarkan harga tertinggi, terendah dan penutupan kemarin, tujuh titik harga dihitung, termasuk satu pivot point, tiga level resistance dan tiga level support. Garis resistensi dan garis dukungan adalah salah satu alat yang sering digunakan dalam analisis teknis, dan peran garis dukungan dan garis tekanan dapat saling bertransformasi. Dari sudut pandang perdagangan, Pivot Point seperti peta tempur, menunjukkan harga dukungan dan resistensi yang harus diperhatikan oleh investor. Untuk strategi perdagangan ini, investor dapat dengan fleksibel merumuskan strategi berdasarkan harga intraday dan tren terkait pada titik pivot, level support dan level resistance, dan bahkan dapat mengelola penyesuaian posisi berdasarkan titik kunci.

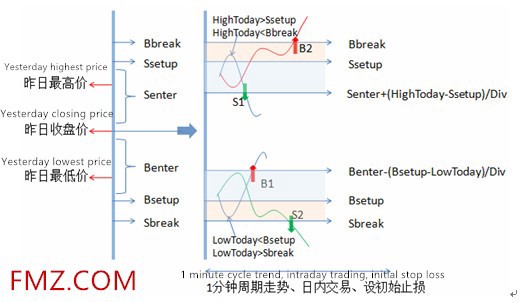

Diagram skema strategi R-Breaker

R-Breaker menghitung enam titik harga berdasarkan harga kemarin sebagai harga referensi untuk perdagangan intraday hari ini, tetapi hanya satu titik pivot kurang dari pengaturan Pivot Points.

Menurut pergerakan harga intraday, strategi pelacakan tren dan pembalikan diadopsi pada saat yang sama. Daerah dengan latar belakang warna dalam gambar dapat dianggap sebagai area observasi. Ketika harga tertinggi pada hari itu mencapai Settingup dan jatuh kembali, dan jatuh di bawah garis resistensi Referensi Senter, strategi terbalik diadopsi,

yaitu, posisi pendek dibuka pada titik S1; jika tidak ada posisi yang dipegang, jika harga intraday menembus garis resistensi Bbreak, strategi pelacakan tren diadopsi, yaitu, posisi panjang dibuka pada titik B2.

R-Breaker menghitung enam titik harga berdasarkan harga kemarin sebagai harga referensi untuk perdagangan intraday hari ini, tetapi hanya satu titik pivot kurang dari pengaturan Pivot Points.

Menurut pergerakan harga intraday, strategi pelacakan tren dan pembalikan diadopsi pada saat yang sama. Daerah dengan latar belakang warna dalam gambar dapat dianggap sebagai area observasi. Ketika harga tertinggi pada hari itu mencapai Settingup dan jatuh kembali, dan jatuh di bawah garis resistensi Referensi Senter, strategi terbalik diadopsi,

yaitu, posisi pendek dibuka pada titik S1; jika tidak ada posisi yang dipegang, jika harga intraday menembus garis resistensi Bbreak, strategi pelacakan tren diadopsi, yaitu, posisi panjang dibuka pada titik B2.

Karena kondisi pemicu untuk membuka posisi melibatkan beberapa posisi harga dan sensitif terhadap pergerakan harga intraday, strategi ini berlaku untuk perdagangan dalam periode waktu satu menit.

NPeriod=2 //period

f1=0.47 //Middle rail upper and lower top section coefficient

f2=0.07 //Mid-rail upper and lower interval coefficient

f3=0.25 //Upper and lower rail coefficients

//==========================================

//API: A simple example of the Chart function (drawing function)

var chart = { // This chart is an object in the JS language. Before using the Chart function, we need to declare an object variable chart that configures the chart.

__isStock: true, // Whether the markup is a general chart, if you are interested, you can change it to false and run it.

tooltip: {xDateFormat: '%Y-%m-%d %H:%M:%S, %A'}, // Zoom tool

title : { text : 'Market analysis chart'}, // title

rangeSelector: { // Selection range

buttons: [{type: 'hour',count: 1, text: '1h'}, {type: 'hour',count: 3, text: '3h'}, {type: 'hour', count: 8, text: '8h'}, {type: 'all',text: 'All'}],

selected: 0,

inputEnabled: false

},

xAxis: { type: 'datetime'}, // The horizontal axis of the coordinate axis is: x axis. The currently set type is: time.

yAxis : { // The vertical axis of the coordinate axis is the y-axis. The default value is adjusted according to the data size.

title:{text: 'Market calculus'}, // title

opposite:false, // Whether to enable the right vertical axis

},

series : [ // Data series, this property holds the various data series (line, K-line diagram, label, etc..)

{name:"0X",id:"0",color:'#FF83FA',data:[]},

{name:"1X",id:"1",color:'#FF3E96',dashStyle:'shortdash',data:[]},

{name:"2X",id:"2",color:'#FF0000',data:[]},

{name:"3X",id:"3",color:'#7D26CD',dashStyle:'shortdash',data:[]},

{name:"4X",id:"4",color:'#2B2B2B',data:[]},

{name:"5X",id:"5",color:'#707070',dashStyle:'shortdash',data:[]},

{name:"6X",id:"6",color:'#778899',data:[]},

{name:"7X",id:"7",color:'#0000CD',data:[]},

//RGB color comparison table http://www.114la.com/other/rgb.htm

]

};

/*

//Pivot Points strategy

chart["series"][0]["name"]="resistance3:";

chart["series"][1]["name"]="resistance2:";

chart["series"][2]["name"]="resistance1:";

chart["series"][3]["name"]="Pivot point:";

chart["series"][4]["name"]="Support position1:";

chart["series"][5]["name"]="Support position2:";

chart["series"][6]["name"]="Support position3:";

chart["series"][6]["name"]="Current price:";

*/

///*

//R-Breaker strategy

chart["series"][0]["name"]="Bbreak_A1:";

chart["series"][1]["name"]="Ssetup_A2:";

chart["series"][2]["name"]="Senter_A3:";

chart["series"][4]["name"]="Benter_B1:";

chart["series"][5]["name"]="Sbreak_B2:";

chart["series"][6]["name"]="Bsetup_B3:";

chart["series"][7]["name"]="Current price:";

//*/

var ObjChart = Chart(chart); // Call the Chart function to initialize the chart.

ObjChart.reset(); // clear

function onTick(e){

var records = _C(e.GetRecords); //Return a K-line history data

var ticker = _C(e.GetTicker); //Return a Ticker structure

var account = _C(e.GetAccount); //Return the main exchange account information

var High = TA.Highest(records, NPeriod, 'High'); //Highest price

var Close = TA.Lowest(records, NPeriod, 'Close'); //Closing price

var Low = TA.Lowest(records, NPeriod, 'Low'); //Lowest price

/*

//Pivot Points strategy

//A up 7235 A middle 7259 A down 7275 B up 7195 B middle 7155 B down 7179

Pivot = (High+Close+Low)/3 //Pivot point

var Senter=High+2*(Pivot-Low) //resistance3

var Ssetup=Pivot+(High-Low) //resistance2

var Bbreak=2*Pivot-Low //resistance1

var Benter=2*Pivot-High //Support position1

var Sbreak=Pivot-(High-Low) //Support position2

var Bsetup=Low-2*(High-Pivot) //Support position3

//Draw line

var nowTime = new Date().getTime(); //Get the timestamp,

ObjChart.add([0, [nowTime,_N(Senter,3)]]); //resistance3

ObjChart.add([1, [nowTime,_N(Ssetup,3)]]); //resistance2

ObjChart.add([2, [nowTime,_N(Bbreak,3)]]); //resistance1

ObjChart.add([3, [nowTime,_N(Pivot,3)]]); //Pivot point

ObjChart.add([4, [nowTime,_N(Benter,3)]]); //support point1

ObjChart.add([5, [nowTime,_N(Sbreak,3)]]); //support point2

ObjChart.add([6, [nowTime,_N(Bsetup,3)]]); //support point3

ObjChart.add([7, [nowTime,_N(ticker.Last,3)]]); //Last transaction price

ObjChart.update(chart); // Update the chart to display it.

*/

///*

//R-Breaker strategy

//A up 7261.46 A middle 7246.76 A down 7228.68 B up 7204.48 B middle 7187.96 B down 7173.26

var Ssetup = High + f1 * (Close - Low); //A middle

var Bsetup = Low - f1 * (High - Close); //B down

var Bbreak = Ssetup + f3 * (Ssetup - Bsetup); //A up

var Senter = ((1 + f2) / 2) * (High + Close) - f2 * Low; //A down

var Benter = ((1 + f2) / 2) * (Low + Close) - f2 * High; //B up

var Sbreak = Bsetup - f3 * (Ssetup - Bsetup); //B middle

//Draw line

var nowTime = new Date().getTime(); //Get timestamp

ObjChart.add([0, [nowTime,_N(Bbreak,3)]]); //A up

ObjChart.add([1, [nowTime,_N(Ssetup,3)]]); //A middle

ObjChart.add([2, [nowTime,_N(Senter,3)]]); //A down

//ObjChart.add([3, [nowTime,_N(Pivot,3)]]); //Pivot point

ObjChart.add([4, [nowTime,_N(Benter,3)]]); //B up

ObjChart.add([5, [nowTime,_N(Sbreak,3)]]); //B middle

ObjChart.add([6, [nowTime,_N(Bsetup,3)]]); //B down

ObjChart.add([7, [nowTime,_N(ticker.Last,3)]]); //Last transaction price

ObjChart.update(chart); // Update the chart to display it.

//*/

Log('A up',_N(Bbreak,3),'A middle',_N(Ssetup,3),'A down',_N(Senter,3),'B up',_N(Benter,3),'B middle',_N(Bsetup,3),'B down',_N(Sbreak,3));

}

function main() {

Log("Strategy Startup");

while(true){

onTick(exchanges[0]);

Sleep(1000);

}

}

- Versi baru dari Dynamic Balance

- Kursus Seri Investasi Kuantitatif Blockchain (3)

Arbitrase Spread Kalender - Bagaimana untuk menembus batas penerimaan Tick komoditas berjangka

- Multi-platform Hedging Stabilization Arbitrage V2.1 (Edisi Anotasi)

- Kesalahan:Error: (Decrypt): Abort at __decrypt (__FILE__:2) at Register (__FILE__:2) at __reg__ (__FILE__:16) at global (__FILE__:27) preventsyield Kesalahan:

- Versi bahasa Inggris murni dari e-book tentang beberapa keterampilan dasar sistematis perdagangan

- Kesalahan Futures_OP 4: Get https://www.bitmex.comuser/affiliateStatus: lookup www.bitmex.comuser: no such host

- Sepuluh ide model klasik strategi perdagangan programatik

- Memeriksa kembali data ticker analog 1 menit

- OKex langsung mendapatkan informasi akun, dan tidak ada masalah dengan test disk, tetapi pada disk nyata telah melaporkan kesalahan.

- Strategi perdagangan jaringan

- Python merampingkan kerangka strategi tren MACD multi-varietas

- Kenapa tidak ada antarmuka retest di dalam API ekstensi, bagaimana jika saya ingin melakukan retest?

- Permintaan pesanan dilaporkan salah.

- BITMEX XBTUSD retest bagaimana cara melakukannya, tidak terlihat di opsi retest kode

- Tidak ada yang tahu mengapa mereka melaporkan kesalahan dalam daftar harga Binance.

- Harga mata uang kripto tunggal BUG

Permintaan perbaikan kecepatan dukungan. - Bagaimana variabel global bisa tetap sama dengan 0.

- Strategi Manajemen Mobilitas

- dalam utama TypeError: IO() mengambil paling banyak 3 argumen (5 diberikan)