Penelitian dan Contoh pada Maker Spots dan Futures Hedging Strategy Design

Penulis:FMZ~Lydia, Dibuat: 2022-11-09 14:49:29, Diperbarui: 2025-01-11 18:18:30

Untuk waktu yang lama, hedging berjangka dan spot umumnya dirancang untuk mendeteksi perbedaan harga. Ketika perbedaan harga terpenuhi, kita akan mengambil pesanan untuk hedge. Dapatkah itu dirancang sebagai maker hedging? Jawabannya benar-benar ya. Hari ini, saya akan membawa Anda ide desain dan prototipe kode untuk maker hedging.

Gagasan lindung nilai pembuat

Dalam pasar yang berbeda dari jenis subjek yang sama atau yang sama, peluang lindung nilai muncul ketika ada perbedaan besar antara pesanan jual dan pesanan beli dari dua pasar. Secara umum, kita akan melakukan pembuat yang memenuhi perbedaan harga dan memegang posisi lindung nilai. Oleh karena itu, ada dua tujuan untuk lindung nilai. Yang pertama adalah untuk lindung nilai posisi dan yang kedua adalah untuk memastikan bahwa perbedaan antara pesanan beli dan jual memenuhi harapan kita sejauh mungkin. Keuntungan dari perdagangan pembuat dalam hal ini adalah bahwa biaya komisi lebih rendah. Kelemahannya adalah tidak mudah untuk melakukan kesepakatan, dan mudah untuk melakukan kesepakatan pada satu posisi.

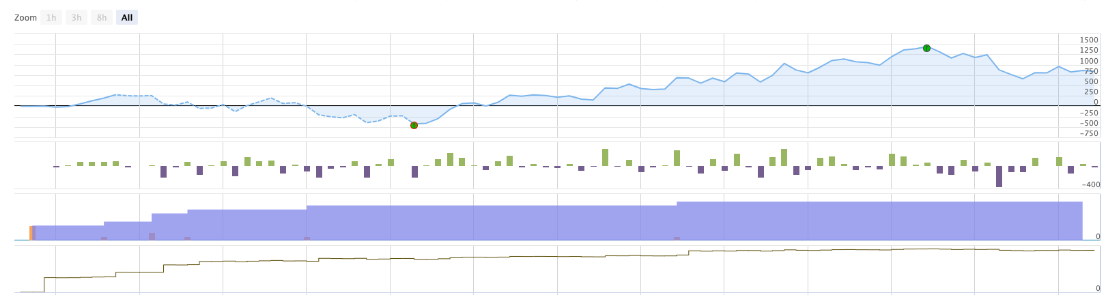

Ide trading yang kami rancang adalah untuk menempatkan order beli di buku order pasar A dan order jual di buku order pasar B. Kemudian kami memeriksa akun kami pending order, dan melakukan langkah selanjutnya untuk transaksi order pending yang diperiksa. Misalnya, jika kami menemukan perubahan dalam order pending, kami menyeimbangkan posisi lindung nilai spot dan futures segera, dan menutup atau menutup posisi overflow di posisi spot dan futures. Menurut peningkatan posisi lindung nilai, kami menyesuaikan jarak order pending pertama dalam order ke posisi berikutnya dalam order, dan lindung nilai untuk mendapatkan spread yang lebih besar secara bertahap.

Desain kode

Komentar ditulis dalam kode secara langsung. Contoh ini digunakan untuk desain referensi saja dan telah diuji pada demo OKEX V5. Contoh ini bukan strategi yang sempurna, silahkan gunakan untuk referensi saja.

// Temporary parameters

var fuContractType = "quarter" // Futures contracts

var fuSymbol = "ETH_USDT" // Futures trading pairs

var spSymbol = "ETH_USDT" // Spots trading pairs

var minAmount = 0.1 // Amount per transaction, minimum transaction amount, currency

var step = 40 // Difference step length

var buff = 5 // Buffer price difference

var balanceType = "open" // When the single position transaction is balanced, open the covering position and close the closing position

var depthManager = function(fuEx, spEx, fuCt, fuSymbol, spSymbol) {

var self = {}

self.fuExDepth = null

self.spExDepth = null

self.plusPrice = null

self.minusPrice = null

self.update = function() {

spEx.SetCurrency(spSymbol)

if (!IsVirtual()) {

fuEx.SetCurrency(fuSymbol)

}

fuEx.SetContractType(fuCt)

var fuRoutine = fuEx.Go("GetDepth")

var spRoutine = spEx.Go("GetDepth")

var fuDepth = fuRoutine.wait()

var spDepth = spRoutine.wait()

if (!fuDepth || !spDepth) {

return false

}

self.fuExDepth = fuDepth

self.spExDepth = spDepth

if (fuDepth.Bids.length == 0 || fuDepth.Asks.length == 0 || spDepth.Bids.length == 0 || spDepth.Asks.length == 0) {

return false

}

self.plusPrice = fuDepth.Bids[0].Price - spDepth.Asks[0].Price // futures Bid - spot Ask

self.minusPrice = fuDepth.Asks[0].Price - spDepth.Bids[0].Price // futures Ask - spot Bid

return true

}

self.getData = function() {

return {

"fuExDepth" : self.fuExDepth,

"spExDepth" : self.spExDepth,

"plusPrice" : self.plusPrice,

"minusPrice" : self.minusPrice

}

}

return self

}

var positionManager = function(fuEx, spEx, fuCt, fuSymbol, spSymbol, step, buffDiff, balanceType, initSpAcc) {

var self = {}

self.balanceType = balanceType

self.depth = null

self.level = 1

self.lastUpdateTs = 0

self.fuPos = []

self.spPos = []

self.initSpAcc = initSpAcc

self.spAcc = null

self.hedgePos = null

self.hedgePosPrice = 0

self.minAmount = 0.01

self.offset = ["", 0]

self.update = function() {

spEx.SetCurrency(spSymbol)

if (!IsVirtual()) {

fuEx.SetCurrency(fuSymbol)

}

fuEx.SetContractType(fuCt)

self.offset = ["", 0]

var fuRoutine = fuEx.Go("GetPosition")

var spRoutine = spEx.Go("GetAccount")

var fuPos = fuRoutine.wait()

var spAcc = spRoutine.wait()

if (!fuPos || !spAcc) {

return false

}

self.fuPos = fuPos

self.spAcc = spAcc

if (!self.initSpAcc) {

return false

}

self.spPos = (spAcc.Stocks + spAcc.FrozenStocks) - (self.initSpAcc.Stocks + self.initSpAcc.FrozenStocks) // Current one minus the initial one, positive number means going long

// Check fuPos

if (fuPos.length > 1) {

return false

}

fuPosAmount = fuPos.length == 0 ? 0 : (fuPos[0].Type == PD_LONG ? fuPos[0].Amount : -fuPos[0].Amount)

if ((fuPosAmount > 0 && self.spPos > 0) || (fuPosAmount < 0 && self.spPos < 0)) {

return false

}

fuPosAmount = self.piece2Coin(fuPosAmount)

self.hedgePos = (fuPosAmount == 0 || self.spPos == 0) ? 0 : (fuPosAmount < 0 && self.spPos > 0 ? Math.min(Math.abs(fuPosAmount), Math.abs(self.spPos)) : -Math.min(Math.abs(fuPosAmount), Math.abs(self.spPos)))

var diffBalance = (spAcc.Balance + spAcc.FrozenBalance) - (self.initSpAcc.Balance + self.initSpAcc.FrozenBalance)

if (self.hedgePos == 0) {

self.hedgePosPrice = 0

} else {

self.hedgePosPrice = fuPos[0].Price - (Math.abs(diffBalance) / Math.abs(self.spPos))

}

self.offset[1] = fuPosAmount + self.spPos // If positive, long positions overflow, if negative, short positions overflow

if (fuPosAmount > 0 && self.spPos < 0) { // Reverse arbitrage

self.offset[0] = "minus"

} else if (fuPosAmount < 0 && self.spPos > 0) {

self.offset[0] = "plus"

} else if (fuPosAmount == 0 && self.spPos < 0) {

self.offset[0] = "minus"

} else if (fuPosAmount > 0 && self.spPos == 0) {

self.offset[0] = "minus"

} else if (fuPosAmount == 0 && self.spPos > 0) {

self.offset[0] = "plus"

} else if (fuPosAmount < 0 && self.spPos == 0) {

self.offset[0] = "plus"

}

return true

}

self.getData = function() {

return {

"fuPos" : self.fuPos,

"spPos" : self.spPos,

"initSpAcc" : self.initSpAcc,

"spAcc" : self.spAcc,

"hedgePos" : self.hedgePos,

"hedgePosPrice" : self.hedgePosPrice,

}

}

self.keepBalance = function(depth) {

var fuDepth = depth.fuExDepth

var spDepth = depth.spExDepth

if (self.offset[0] == "plus") {

if (self.offset[1] >= self.minAmount) {

if (self.balanceType == "close") {

// If the spot long position is excessive, close the spot long position

spEx.Sell(-1, self.offset[1])

} else if (self.balanceType == "open") {

// If the spot long position is excessive, open the future short position

fuEx.SetDirection("sell")

fuEx.Sell(-1, self.coin2Piece(Math.abs(self.offset[1])))

}

} else if (self.offset[1] <= -self.minAmount) {

if (self.balanceType == "close") {

// If the future short position is excessive, close the future short position

fuEx.SetDirection("closesell")

fuEx.Buy(-1, self.coin2Piece(Math.abs(self.offset[1])))

} else if (self.balanceType == "open") {

// If the future short position is excessive, open the spot long position

spEx.Buy(-1, spDepth.Asks[0].Price * Math.abs(self.offset[1]))

}

}

return false

} else if (self.offset[0] == "minus") {

if (self.offset[1] >= self.minAmount) {

if (self.balanceType == "close") {

// If the future long position is excessive, close the future long position

fuEx.SetDirection("closebuy")

fuEx.Sell(-1, self.coin2Piece(self.offset[1]))

} else if (self.balanceType == "open") {

// If the future long position is excessive, open the spot short position

spEx.Sell(-1, self.offset[1])

}

} else if (self.offset[1] <= -self.minAmount) {

if (self.balanceType == "close") {

// If the spot short position is excessive, close the spot short position

spEx.Buy(-1, spDepth.Asks[0].Price * Math.abs(self.offset[1]))

} else if (self.balanceType == "open") {

// If the spot short position is excessive, open the future long position

fuEx.SetDirection("buy")

fuEx.Buy(-1, self.coin2Piece(Math.abs(self.offset[1])))

}

}

return false

}

return true

}

self.process = function(depthManager) {

var ts = new Date().getTime()

var depth = depthManager.getData()

var orders = self.getOrders()

if (!orders) {

return

}

self.depth = depth

var fuOrders = orders[0]

var spOrders = orders[1]

if (fuOrders.length == 0 && spOrders.length == 0) {

// Reset level

if (self.hedgePos == 0) {

self.level = 1

} else {

self.level = Math.max(1, _N(self.hedgePos / self.minAmount, 0))

}

// Limit the maximum position

if (Math.abs(self.hedgePos) > 1) {

return

}

// Pending orders

var fuDepth = depth.fuExDepth

var spDepth = depth.spExDepth

self.update()

if (self.hedgePos >= 0 && fuDepth.Bids[0].Price - spDepth.Asks[0].Price > 0) { // Positive arbitrage

var distance = (step * self.level - (fuDepth.Asks[0].Price - spDepth.Bids[0].Price)) / 2

fuEx.SetDirection("sell")

fuEx.Sell(fuDepth.Asks[0].Price + distance, self.coin2Piece(self.minAmount), fuDepth.Asks[0].Price, "Price difference of makers:", fuDepth.Asks[0].Price + distance - (spDepth.Bids[0].Price - distance))

spEx.Buy(spDepth.Bids[0].Price - distance, self.minAmount, spDepth.Bids[0].Price)

} else if (self.hedgePos <= 0 && spDepth.Bids[0].Price - fuDepth.Asks[0].Price > 0) { // Reverse arbitrage

var distance = (step * self.level - (spDepth.Asks[0].Price - fuDepth.Bids[0].Price)) / 2

fuEx.SetDirection("buy")

fuEx.Buy(fuDepth.Bids[0].Price - distance, self.coin2Piece(self.minAmount), fuDepth.Bids[0].Price, "Price difference of makers:", spDepth.Asks[0].Price + distance - (fuDepth.Bids[0].Price - distance))

spEx.Sell(spDepth.Asks[0].Price + distance, self.minAmount, spDepth.Asks[0].Price)

}

} else if (fuOrders.length == 1 && spOrders.length == 1) {

var fuDepth = depth.fuExDepth

var spDepth = depth.spExDepth

// Judge the position

var isCancelAll = false

if (self.hedgePos >= 0 && fuDepth.Bids[0].Price - spDepth.Asks[0].Price > 0) { // Positive arbitrage

var distance = (step * self.level - (fuDepth.Asks[0].Price - spDepth.Bids[0].Price)) / 2

if (Math.abs(fuOrders[0].Price - (fuDepth.Asks[0].Price + distance)) > buffDiff || Math.abs(spOrders[0].Price - (spDepth.Bids[0].Price - distance)) > buffDiff) {

isCancelAll = true

}

} else if (self.hedgePos <= 0 && spDepth.Bids[0].Price - fuDepth.Asks[0].Price > 0) { // Reverse arbitrage

var distance = (step * self.level - (spDepth.Asks[0].Price - fuDepth.Bids[0].Price)) / 2

if (Math.abs(spOrders[0].Price - (spDepth.Asks[0].Price + distance)) > buffDiff || Math.abs(fuOrders[0].Price - (fuDepth.Bids[0].Price - distance)) > buffDiff) {

isCancelAll = true

}

} else {

isCancelAll = true

}

if (isCancelAll) {

self.cancelAll(fuEx, fuOrders)

self.cancelAll(spEx, spOrders)

self.lastUpdateTs = 0

}

} else {

self.cancelAll(fuEx, fuOrders)

self.cancelAll(spEx, spOrders)

self.lastUpdateTs = 0

}

if (ts - self.lastUpdateTs > 1000 * 60 * 2) {

self.update()

self.keepBalance(depth)

self.update()

self.lastUpdateTs = ts

}

LogStatus(_D()) // The status bar can be designed to output the data and information to be observed

}

self.getOrders = function() {

spEx.SetCurrency(spSymbol)

if (!IsVirtual()) {

fuEx.SetCurrency(fuSymbol)

}

fuEx.SetContractType(fuCt)

var fuRoutine = fuEx.Go("GetOrders")

var spRoutine = spEx.Go("GetOrders")

var fuOrders = fuRoutine.wait()

var spOrders = spRoutine.wait()

if (!fuOrders || !spOrders) {

return false

}

return [fuOrders, spOrders]

}

// Number of currency converted into contracts

self.coin2Piece = function(amount) {

if (IsVirtual()) {

if (fuEx.GetName() == "Futures_Binance") {

return amount

} else if (fuEx.GetName() == "Futures_OKCoin") {

var price = (self.depth.fuExDepth.Bids[0].Price + self.depth.fuExDepth.Asks[0].Price) / 2

return _N(amount / (100 / price), 0)

} else {

throw "not support"

}

}

if (fuEx.GetName() == "Futures_OKCoin") {

if (fuEx.GetQuoteCurrency() == "USDT") {

return _N(amount * 10, 0)

} else if (fuEx.GetQuoteCurrency() == "USD") {

var price = (self.depth.fuExDepth.Bids[0].Price + self.depth.fuExDepth.Asks[0].Price) / 2

return _N(amount / (100 / price), 0)

} else {

throw "not support"

}

} else {

throw "not support"

}

}

// Number of contracts converted into currency

self.piece2Coin = function(amount) {

if (IsVirtual()) {

if (fuEx.GetName() == "Futures_Binance") {

return amount

} else if (fuEx.GetName() == "Futures_OKCoin") {

var price = (self.depth.fuExDepth.Bids[0].Price + self.depth.fuExDepth.Asks[0].Price) / 2

return amount * 100 / price

} else {

throw "not support"

}

}

if (fuEx.GetName() == "Futures_OKCoin") {

if (fuEx.GetQuoteCurrency() == "USDT") {

return amount * 0.1

} else if (fuEx.GetQuoteCurrency() == "USD") {

var price = (self.depth.fuExDepth.Bids[0].Price + self.depth.fuExDepth.Asks[0].Price) / 2

return amount * 100 / price

} else {

throw "not support"

}

} else {

throw "not support"

}

}

self.cancelAll = function(e, orders) {

var isFirst = true

while (true) {

Sleep(500)

if (orders && isFirst) {

isFirst = false

} else {

orders = e.GetOrders()

}

if (!orders) {

continue

} else {

for (var i = 0 ; i < orders.length ; i++) {

e.CancelOrder(orders[i].Id, orders[i])

}

}

if (orders.length == 0) {

break

}

}

}

self.CoverAll = function() {

// Close all positions

// Here we can realize one-click position closing

}

self.setMinAmount = function(minAmount) {

self.minAmount = minAmount

}

self.init = function() {

while(!self.spAcc) {

self.update()

Sleep(1000)

}

if (!self.initSpAcc) {

var positionManager_initSpAcc = _G("positionManager_initSpAcc")

if (!positionManager_initSpAcc) {

self.initSpAcc = self.spAcc

_G("positionManager_initSpAcc", self.initSpAcc)

} else {

self.initSpAcc = positionManager_initSpAcc

}

} else {

_G("positionManager_initSpAcc", self.initSpAcc)

}

// Print the initial information

Log("self.initSpAcc:", self.initSpAcc.Balance, self.initSpAcc.FrozenBalance, self.initSpAcc.Stocks, self.initSpAcc.FrozenStocks)

}

self.init()

return self

}

function main() {

_G(null) // Clear the persistent data

LogReset(1) // Reset logs

// The following code can be switchedto the OKEX Demo

// exchanges[0].IO("simulate", true)

// exchanges[1].IO("simulate", true)

var dm = depthManager(exchanges[0], exchanges[1], fuContractType, fuSymbol, spSymbol)

var pm = positionManager(exchanges[0], exchanges[1], fuContractType, fuSymbol, spSymbol, step, buff, balanceType)

pm.setMinAmount(minAmount)

while (true) {

if (!dm.update()) {

Sleep(3000)

continue

}

var cmd = GetCommand()

if (cmd) {

// Handle interactions

Log("Interaction command:", cmd)

var arr = cmd.split(":")

if (arr[0] == "") {

pm.CoverAll()

}

}

pm.process(dm)

Sleep(5000)

}

}

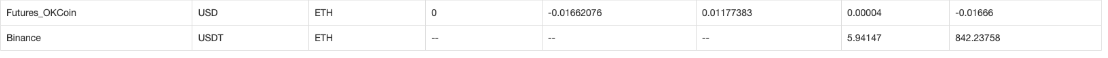

Analisis backtest

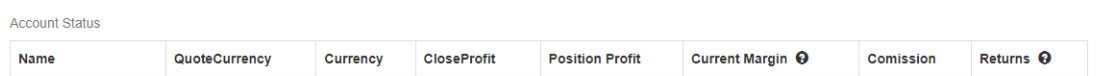

Dari statistik sistem backtesting, akun bursa berjangka kehilangan -0.01666 ETH dan bursa spot menghasilkan keuntungan sebesar 842.23758 USDT. Harga spot ETH adalah 4252 USDT pada akhir backtest, -0.01666 * 4252 = -70.83832000000001.

Tapi itu hanya pada backtest, dan pasti ada lebih banyak detail untuk digarap di bot nyata.

- Praktik Kuantitatif Bursa DEX (2) -- Panduan Pengguna Hyperliquid

- DEX Exchange Quantitative Practice ((2) -- Hyperliquid Panduan Penggunaan

- Praktik Kuantitatif Bursa DEX (1) -- DYdX v4 Panduan Pengguna

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (3)

- Praktik Kuantitatif DEX Exchange ((1)-- dYdX v4 Panduan Penggunaan

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (3)

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (2)

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (2)

- Pembahasan Penerimaan Sinyal Eksternal Platform FMZ: Solusi Lengkap untuk Penerimaan Sinyal dengan Layanan Http Terbina dalam Strategi

- FMZ platform eksplorasi penerimaan sinyal eksternal: strategi built-in https layanan solusi lengkap untuk penerimaan sinyal

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (1)

- Apa yang perlu Anda ketahui untuk membiasakan diri dengan MyLanguage di FMZ - Interface Charts

- Membawa Anda untuk menganalisis rasio Sharpe, penarikan maksimum, tingkat pengembalian dan indikator lain algoritma dalam strategi backtesting

- Dengan algoritma indikator seperti Sharp Rate, Maximum Recoil, Rate of Return dalam analisis strategi Anda

- Pemodelan dan Analisis Volatilitas Bitcoin Berdasarkan Model ARMA-EGARCH

- [Binance Championship] Strategi Kontrak Pengiriman Binance 3 - Hedging Kupu-kupu

- Penggunaan Server dalam Perdagangan Kuantitatif

- Solusi untuk mendapatkan pesan permintaan http yang dikirim oleh Docker

- Penjelasan singkat mengapa tidak mungkin untuk mencapai pergerakan aset di OKEX melalui strategi lindung nilai kontrak

- Penjelasan Rincian Futures Backhand Doubling Algorithm Strategi Catatan

- Dapatkan 80 kali dalam 5 hari, kekuatan strategi frekuensi tinggi

- Membangun Basis Data Kuantitatif FMZ dengan SQLite

- Cara Menugaskan Data Versi Berbeda ke Strategi Sewa Melalui Metadata Kode Sewa Strategi

- Arbitrage Bunga Binance Perpetual Funding Rate (Pasar Bull Saat Ini Dianalisis 100%)

- Strategi Titik Peralihan Mata Uang Digital Futures Double-EMA (Tutorial)

- Mendaftar Strategi Saham Baru untuk Spot Mata Uang Digital (Tutorial)

- Menerapkan ide dengan 60 baris kode -- Strategi Penangkapan Ikan Bagian Bawah Kontrak

- Strategi EMA Ganda Multi-varietas Mata Uang Digital Spot (Tutorial)

- Desain Sistem Manajemen Sinkronisasi Pesenan Berdasarkan FMZ Quant (2)

- Strategi ATR multi-spesies berjangka mata uang digital (tutorial)

- Menulis alat perdagangan semi-otomatis dengan menggunakan bahasa Pine