Strategi pembalikan bawah multi timeframe

Penulis:ChaoZhang, Tanggal: 2023-10-18 12:27:29Tag:

Gambaran umum

Strategi ini menggabungkan beberapa indikator pola bawah untuk mengidentifikasi peluang pembalikan utama, mengadopsi tren mengikuti strategi stop loss untuk menargetkan keuntungan melebihi stop loss.

Prinsip

Strategi ini terutama menggunakan indikator berikut untuk menentukan pembalikan bawah:

-

Indikator Sensitivitas Bottom (Noro

s BottomSensitivity): Mendeteksi pola dasar tertentu pada grafik candlestick. -

Kepastian Indeks Volition (CVI): Menentukan pergeseran sentimen bullish/bearish.

-

Sinyal Siklus Akhir (UCS): Mendeteksi oversold di bawah rata-rata bergerak.

-

Relative Strength Index (RSI): Mengidentifikasi kondisi oversold.

-

Kombinasi pola: Termasuk candlestick, pin bar dan pola bawah lainnya.

Strategi ini menggabungkan beberapa indikator bawah, menghasilkan sinyal beli ketika jumlah pola bawah memenuhi pengaturan parameter. Untuk menyaring false break, RSI juga digunakan untuk memicu beli hanya dalam kondisi oversold.

Pengguna dapat menyesuaikan penggunaan dan parameter dari setiap indikator bawah, memberikan fleksibilitas yang tinggi.

Keuntungan

-

Keakuratan yang ditingkatkan dengan menggunakan beberapa indikator

-

Parameter yang dapat disesuaikan sesuai dengan produk yang berbeda

-

Filter SMA mencegah membeli puncak

-

Lilin merah opsional hanya mengurangi risiko

-

Peringatan memungkinkan pemantauan real-time

Risiko

-

Beberapa indikator mungkin tidak mencapai titik terendah.

-

Pola bawah tidak selalu terbalik

-

Harus melihat apakah volume mendukung pembalikan

Peningkatan

-

Mengoptimalkan parameter untuk produk yang berbeda

-

Tambahkan ukuran posisi ke dasar biaya yang lebih rendah

-

Mengimplementasikan stop loss untuk mengunci keuntungan

Ringkasan

Strategi ini secara efektif mengidentifikasi dasar dengan beberapa indikator, mengendalikan risiko dengan tren setelah stop loss.

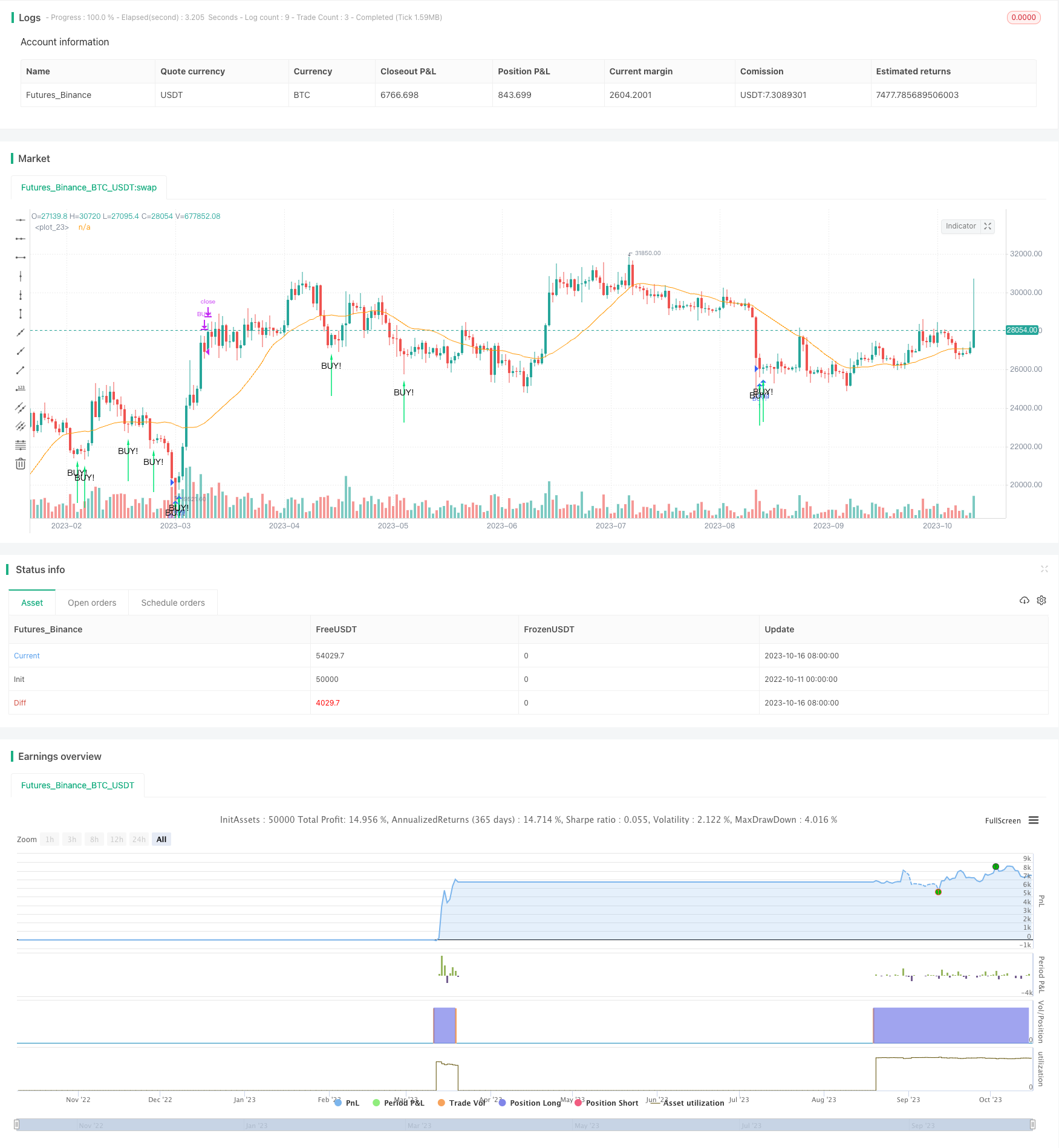

/*backtest

start: 2022-10-11 00:00:00

end: 2023-10-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// the original indicator is Noro's BottomSensivity v0.6

//@version=4

strategy("Noro's BottomSensivity v0.6 strategy + rsi + Alarm", shorttitle="Bottom 0.6 StRsiAlarm", overlay=true)

overSold = input(35)

overBought = input(70)

botsens = input(defval = 3, minval = 1, maxval = 4, title = "Bottom-Sensivity")

smalen = input(defval = 25, minval = 20, maxval = 200, title = "SMA Length")

bars = input(defval = 3, minval = 2, maxval = 4, title = "Bars of Locomotive")

useloc = input(true, title = "Use bottom-pattern Locomotive?")

usepin = input(true, title = "Use bottom-pattern Pin-bar?")

usecvi = input(true, title = "Use bottom-indicator CVI?")

useucs = input(true, title = "Use bottom-indicator UCS?")

usevix = input(true, title = "Use bottom-indicator WVF?")

usersi = input(true, title = "Use bottom-indicator RSI?")

usered = input(false, title = "Only red candles?")

usesma = input(true, title = "Use SMA Filter?")

showsma = input(false, title = "Show SMA Filter?")

//SMA Filter

sma = sma(close, smalen)

colsma = showsma == true ? red : na

plot(sma, color = colsma)

//VixFix method

//Start of ChrisMoody's code

pd = 22

bbl = 20

mult = 2

lb = 50

ph = .85

pl = 1.01

hp = false

sd = false

wvf = ((highest(close, pd)-low)/(highest(close, pd)))*100

sDev = mult * stdev(wvf, bbl)

midLine = sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (highest(wvf, lb)) * ph

rangeLow = (lowest(wvf, lb)) * pl

//End of ChrisMoody's code

//Locomotive mmethod

bar = close > open ? 1 : close < open ? -1 : 0

locob = bar == 1 and bar[1] == -1 and bar[2] == -1 and (bar[3] == -1 or bars < 3) and (bar[4] == -1 or bars < 4) ? 1 : 0

//PIN BAR

body = abs(close - open)

upshadow = open > close? (high - open) : (high - close)

downshadow = open > close ? (close - low) : (open - low)

pinbar = open[1] > close[1] ? (body[1] > body ? (downshadow > 0.5 * body ? (downshadow > 2 * upshadow ? 1 : 0 ) : 0 ) : 0 ) : 0

//CVI method

//Start of LazyBear's code

ValC=sma(hl2, 3)

bull=-.51

bear=.43

vol=sma(atr(3), 3)

cvi = (close-ValC) / (vol*sqrt(3))

cb= cvi <= bull ? green : cvi >=bear ? red : cvi > bull ? blue : cvi < bear ? blue : na

bull1 = cvi <= bull

bear1 = cvi >= bear

bull2 = bull1[1] and not bull1

bear2 = bear1[1] and not bear1

//End of LazyBear's code

//UCS method

//Start of UCS's code

ll = lowest(low, 5)

hh = highest(high, 5)

diff = hh - ll

rdiff = close - (hh+ll)/2

avgrel = ema(ema(rdiff,3),3)

avgdiff = ema(ema(diff,3),3)

mom = ((close - close[3])/close[3])*1000

SMI = avgdiff != 0 ? (avgrel/(avgdiff/2)*100) : 0

SMIsignal = ema(SMI,3)

ucslong = SMI < -35 and mom > 0 and mom[1] < 0 ? 1 : 0

//End of UCS's code

//RSI method

//Chris Moody's code

up = rma(max(change(close), 0), 2)

down = rma(-min(change(close), 0), 2)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsib = rsi < 10 ? 1 : 0

//Chris Moody's code

//sum

locobot = useloc == false ? 0 : locob

vixfixbot = usevix == false ? 0 : wvf >= upperBand or wvf >= rangeHigh ? 1 : 0

cvibot = usecvi == false ? 0 : bull2 == true ? 1 : 0

ucsbot = useucs == false ? 0 : ucslong == 1 ? 1 : 0

rsibot = usersi == false ? 0 : rsib

pinbot = usepin == false ? 0 : pinbar

score = vixfixbot + locobot + cvibot + ucsbot + rsibot + pinbot

//arrows

bottom = usered == false ? usesma == false ? score >= botsens ? 1 : 0 : high < sma and score >= botsens ? 1 : 0 : usesma == false ? score >= botsens and close < open ? 1 : 0 : high < sma and score >= botsens and close < open ? 1 : 0

plotarrow(bottom == 1 ? 1 : na, title="Buy arrow", colorup=lime, maxheight=60, minheight=50, transp=0)

data = bottom == 1

plotchar(data, char=" ", text="BUY!", location=location.belowbar, color=green, size=size.small)

//Market buy and exit

strategy.entry("BUY!", strategy.long, when =(bottom == 1) and(rsi(close,14)<overSold))

strategy.close("BUY!", when = (crossunder(rsi(close,14), overBought)))

alarm = bottom == 1 and(rsi(close,14)<overSold)

alertcondition(alarm == 1,title="BUY+RSI",message="BUY+RSI")

- Tren Mengikuti Strategi dengan Moving Averages dan SuperTrend

- Momentum Dual Moving Average Crossover Strategi

- Zigzag Breakout Strategi

- Strategi Volume Kuantum

- Strategi Perdagangan Emas VWAP MACD

- 123 Strategi Amplop Rata-rata Bergerak Pembalik

- Strategi SAR Parabolik Waktu Berganti

- Strategi Band Trailing Stop ATR

- Strategi perdagangan kombinasi Hull Moving Average dan Stochastic RSI

- Strategi Super Trend V

- Strategi Sistem Pembalikan Osilasi EMA

- Strategi Arah Multi-Bar

- Strategi RSI Crossover

- Ukuran Orde Inkremental Tren Retracement Fibonacci Mengikuti Strategi

- Strategi Beli dan Jual Multi-Indikator

- Strategi trading open-high cross over

- Strategi Double K Crossbow

- Strategi Crossover Indeks Tubuh Relatif

- Strategi Perdagangan Robot Batch Take Profit BTC Berbagai Tingkat

- Strategi perdagangan pembalikan rata-rata bergerak ganda dan RSI