Strategi Perdagangan EMA Golden Cross Dual

Penulis:ChaoZhang, Tanggal: 2023-12-07 15:08:57Tag:

Gambaran umum

Strategi ini menggabungkan dua EMA golden cross, filter noise ATR yang ternormalized, dan indikator tren ADX untuk memberikan sinyal beli yang lebih andal bagi para trader.

Prinsip Strategi

Strategi ini menggunakan EMA 8 periode dan 20 periode untuk membangun sistem golden cross EMA ganda.

Selain itu, strategi telah menetapkan beberapa indikator tambahan untuk penyaringan:

-

14 periode ATR, dinormalisasi untuk menyaring fluktuasi harga kecil di pasar.

-

ADX 14 periode untuk mengidentifikasi kekuatan tren.

-

SMA volume 14 periode untuk menyaring titik waktu dengan volume perdagangan kecil.

-

Indikator Super Trend periode 4/14 untuk menilai arah pasar naik atau menurun.

Hanya ketika arah tren, nilai ATR normal, tingkat ADX dan kondisi volume terpenuhi, EMA golden cross akhirnya akan memicu sinyal beli.

Keuntungan Strategi

-

Keandalan dari kombinasi beberapa indikator

Mengintegrasikan indikator seperti EMA, ATR, ADX dan Super Trend membentuk sistem penyaringan sinyal yang kuat, keandalan yang lebih tinggi.

-

Lebih banyak fleksibilitas dalam pengaturan parameter

Nilai ambang ATR normal, ADX, periode penahan dll dapat dioptimalkan, fleksibilitas yang lebih besar.

-

Membedakan pasar bull dan bear

Mengidentifikasi pasar bull dan bear menggunakan Super Trend, menghindari kesempatan yang hilang.

Risiko Strategi

-

Kesulitan dalam pengoptimalan parameter

Terlalu banyak parameter, kesulitan dalam menemukan kombinasi yang optimal.

-

Risiko kegagalan indikator

Masih ada risiko sinyal palsu karena sifat indikator yang tertinggal.

-

Frekuensi perdagangan rendah

Frekuensi cenderung rendah karena banyak filter, durasi tidak perdagangan yang panjang mungkin.

Arahan Optimasi

-

Mengoptimalkan kombinasi parameter

Menemukan kombinasi yang optimal membutuhkan sejumlah besar data backtesting.

-

Mengintegrasikan pembelajaran mesin

Gunakan algoritma ML untuk mengoptimalkan parameter secara otomatis dari waktu ke waktu.

-

Pertimbangkan lebih banyak faktor pasar

Menggabungkan indikator struktur pasar, emosi dll meningkatkan keragaman.

Kesimpulan

Strategi ini secara komprehensif mempertimbangkan tren, volatilitas dan faktor harga volume. Melalui penyaringan multi-indikator dan penyesuaian parameter, ia membentuk sistem perdagangan yang dapat diandalkan. Keandalan tinggi dan dapat ditingkatkan lebih lanjut melalui optimasi.

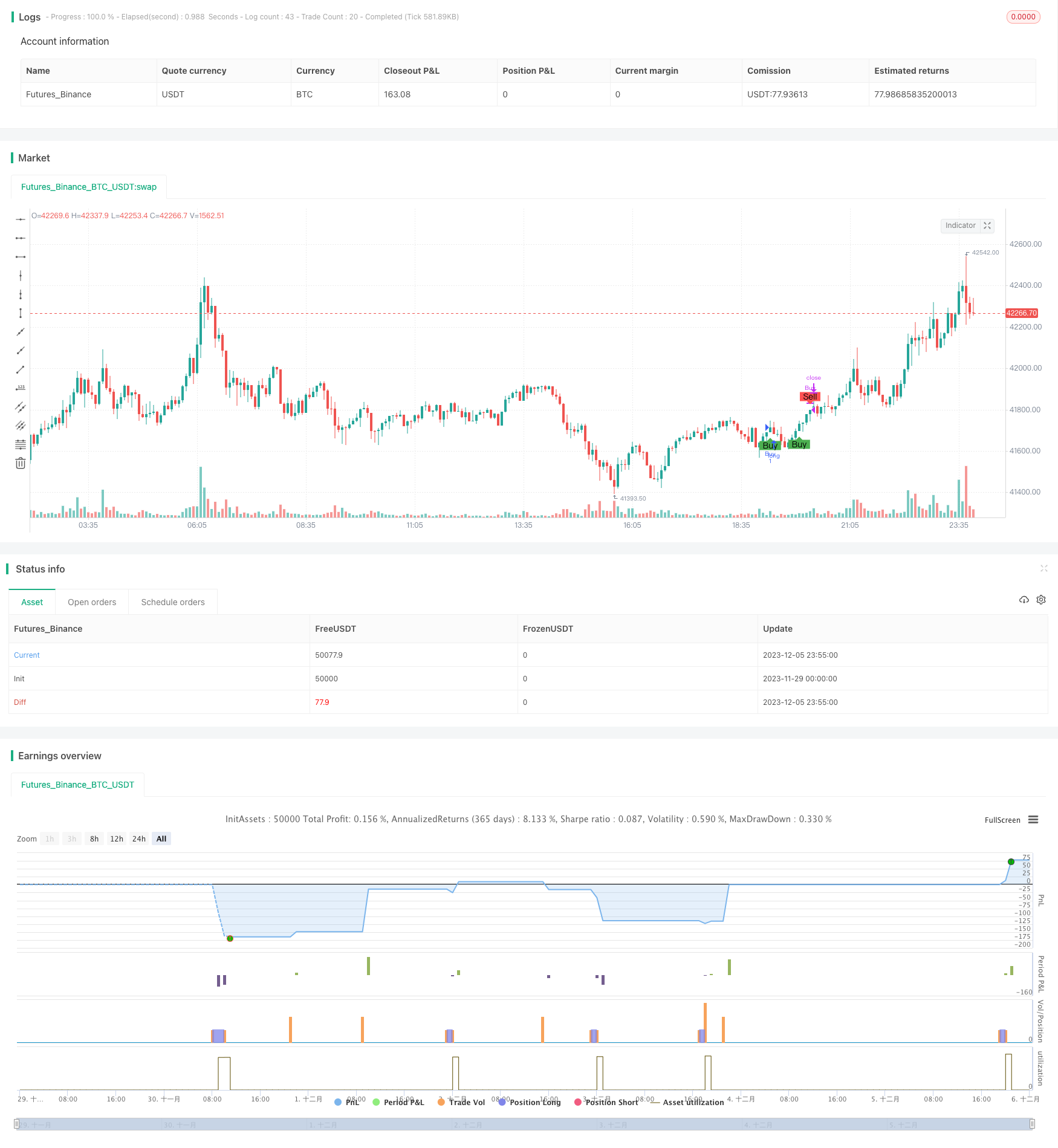

/*backtest

start: 2023-11-29 00:00:00

end: 2023-12-06 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Description:

//This strategy is a refactored version of an EMA cross strategy with a normalized ATR filter and ADX control.

//It aims to provide traders with signals for long positions based on market conditions defined by various indicators.

//How it Works:

//1. EMA: Uses short (8 periods) and long (20 periods) EMAs to identify crossovers.

//2. ATR: Uses a 14-period ATR, normalized to its 20-period historical range, to filter out noise.

//3. ADX: Uses a 14-period RMA to identify strong trends.

//4. Volume: Filters trades based on a 14-period SMA of volume.

//5. Super Trend: Uses a Super Trend indicator to identify the market direction.

//How to Use:

//- Buy Signal: Generated when EMA short crosses above EMA long, and other conditions like ATR and market direction are met.

//- Sell Signal: Generated based on EMA crossunder and high ADX value.

//Originality and Usefulness:

//This script combines EMA, ATR, ADX, and Super Trend indicators to filter out false signals and identify more reliable trading opportunities.

//USD Strength is not working, just simulated it as PSEUDO CODE: [close>EMA(50)]

//Strategy Results:

//- Account Size: $1000

//- Commission: Not considered

//- Slippage: Not considered

//- Risk: Less than 5% per trade

//- Dataset: Aim for more than 100 trades for sufficient sample size

//Note: This script should be used for educational purposes and should not be considered as financial advice.

//Chart:

//- The script's output is plotted as Buy and Sell signals on the chart.

//- No other scripts are included for clarity.

//- Have tested with 30mins period

//- You are encouraged to play with parameters, let me know if you

//@version=5

strategy("Advanced EMA Cross with Normalized ATR Filter, Controlling ADX", shorttitle="ALP V5", overlay=true )

// Initialize variables

var bool hasBought = false

var int barCountSinceBuy = 0

// Define EMA periods

emaShort = ta.ema(close, 8)

emaLong = ta.ema(close, 20)

// Define ATR parameters

atrLength = 14

atrValue = ta.atr(atrLength)

maxHistoricalATR = ta.highest(atrValue, 20)

minHistoricalATR = ta.lowest(atrValue, 20)

normalizedATR = (atrValue - minHistoricalATR) / (maxHistoricalATR - minHistoricalATR)

// Define ADX parameters

adxValue = ta.rma(close, 14)

adxHighLevel = 30

isADXHigh = adxValue > adxHighLevel

// Initialize risk management variables

var float stopLossPercent = na

var float takeProfitPercent = na

// Calculate USD strength

// That's not working as usd strenght, since I couldn't manage to get usd strength

//I've just simulated it as if the current close price is above 50 days average (it's likely a bullish trend), usd is strong (usd_strenth variable is positive)

usd_strength = close / ta.ema(close, 50) - 1

// Adjust risk parameters based on USD strength

if (usd_strength > 0)

stopLossPercent := 3

takeProfitPercent := 6

else

stopLossPercent := 4

takeProfitPercent := 8

// Initialize position variable

var float positionPrice = na

// Volume filter

minVolume = ta.sma(volume, 14) * 1.5

isVolumeHigh = volume > minVolume

// Market direction using Super Trend indicator

[supertrendValue, supertrendDirection] = ta.supertrend(4, 14)

bool isBullMarket = supertrendDirection < 0

bool isBearMarket = supertrendDirection > 0

// Buy conditions for Bull and Bear markets

buyConditionBull = isBullMarket and ta.crossover(emaShort, emaLong) and normalizedATR > 0.2

buyConditionBear = isBearMarket and ta.crossover(emaShort, emaLong) and normalizedATR > 0.5

buyCondition = buyConditionBull or buyConditionBear

// Sell conditions for Bull and Bear markets

sellConditionBull = isBullMarket and (ta.crossunder(emaShort, emaLong) or isADXHigh)

sellConditionBear = isBearMarket and (ta.crossunder(emaShort, emaLong) or isADXHigh)

sellCondition = sellConditionBull or sellConditionBear

// Final Buy and Sell conditions

if (buyCondition)

strategy.entry("Buy", strategy.long)

positionPrice := close

hasBought := true

barCountSinceBuy := 0

if (hasBought)

barCountSinceBuy := barCountSinceBuy + 1

// Stop-loss and take-profit levels

longStopLoss = positionPrice * (1 - stopLossPercent / 100)

longTakeProfit = positionPrice * (1 + takeProfitPercent / 100)

// Final Sell condition

finalSellCondition = sellCondition and hasBought and barCountSinceBuy >= 3 and isVolumeHigh

if (finalSellCondition)

strategy.close("Buy")

positionPrice := na

hasBought := false

barCountSinceBuy := 0

// Implement stop-loss and take-profit

strategy.exit("Stop Loss", "Buy", stop=longStopLoss)

strategy.exit("Take Profit", "Buy", limit=longTakeProfit)

// Plot signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=finalSellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

- Strategi Perdagangan Alligator RSI

- Strategi kombinasi RSI dan RSI stokastik

- Strategi Crossover Rata-rata Bergerak Rel Ganda

- Strategi perdagangan jangka pendek berdasarkan SMA dan EMA

- Strategi Momentum Dinamis

- Strategi Perdagangan Bitcoin Intraday John Berdasarkan Beberapa Indikator

- Strategi Rata-rata Gerak Perlahan

- Strategi price breakout Z-Score

- Fibonacci Retracement Reversal Strategi

- Strategi Perdagangan Kuantitas Faktor Dua

- Strategi Trading BTC Berdasarkan Moving Average Crossover

- Indikator MACD Strategi Peringatan Awal Pemberontakan Dasar

- Strategi Rata-rata Gerak Adaptif Mala

- Rasio Emas Rata-rata Reversi Tren Strategi Trading

- Strategi Trading Trend Berdasarkan Rata-rata Bergerak Ganda

- Dual Indicator Filtered Strategi Sinyal Beli

- Strategi perdagangan lintas rata-rata bergerak ganda

- Strategi Crossover EMA Dual

- Momentum Breakout Camarilla Dukungan Strategi

- Honey Trend ATR Breakout Strategi