Tren Gelombang dan Tren Berbasis VWMA Mengikuti Strategi Quant

Penulis:ChaoZhang, Tanggal: 2024-01-26 17:35:29Tag:

Gambaran umum

Strategi ini menggabungkan osilator Trend Wave dan indikator VWMA untuk menerapkan tren mengikuti strategi perdagangan kuantum. Ini dapat mengidentifikasi tren pasar dan membuat keputusan beli atau jual berdasarkan sinyal dari osilator Trend Wave. Sementara itu, ukuran perdagangan ditentukan oleh sinyal dari indikator VWMA.

Logika Strategi

Strategi ini terutama didasarkan pada dua indikator berikut:

-

Wave Trend Oscillator: Ini adalah osilator yang diportasi ke TradingView oleh LazyBear, yang mengidentifikasi

waves dalam fluktuasi harga dan menghasilkan sinyal beli / jual. Perhitungan spesifik adalah: pertama menghitung harga rata-rata ap, kemudian menghitung EMA ap (disebut esa), kemudian menghitung EMA dari nilai absolut perbedaan antara ap dan esa (disebut d), akhirnya menghitung indeks konsistensi ci=(ap-esa) /(0.015*d), EMA ci adalah Wave Trend (wt1), dan SMA 4-periode wt1 adalah wt2. Ketika wt1 melintasi di atas wt2, itu adalah sinyal beli, dan ketika wt1 melintasi di bawah wt2, itu adalah sinyal jual. -

Indikator VWMA: Ini adalah garis rata-rata bergerak tertimbang volume. Berdasarkan apakah harga berada di dalam atau di luar Band VWMA (Band atas dan bawah VWMA), ini menghasilkan sinyal +1 (bullish), 0 (neutral) atau -1 (bearish).

Sinyal Trend Wave menentukan kapan harus membeli dan menjual. Sementara sinyal bullish/bearish dari indikator VWMA menentukan ukuran perdagangan spesifik untuk setiap perdagangan.

Keuntungan

- Menggabungkan sinyal dari dua indikator untuk meningkatkan keakuratan keputusan

- VWMA mempertimbangkan aliran volume untuk menilai kekuatan pasar

- Sesi perdagangan yang dapat disesuaikan untuk menghindari volatilitas dari berita

- Ukuran perdagangan disesuaikan berdasarkan sinyal VWMA untuk mengurangi risiko

Risiko

- Potensi sinyal palsu dari Trend Gelombang

- Data volume yang tidak akurat dapat mempengaruhi VWMA

- Membutuhkan data historis yang panjang untuk perhitungan indikator

- Tidak ada stop loss di tempat

Optimalisasi

- Uji kombinasi parameter yang berbeda untuk menemukan optimal

- Tambahkan strategi stop loss

- Pertimbangkan untuk menggabungkan dengan indikator lain untuk penyaringan sinyal

- Uji pengaturan yang berbeda untuk sesi perdagangan

- Mengatur secara dinamis perhitungan ukuran perdagangan

Kesimpulan

Strategi ini mengintegrasikan penilaian tren dan kemampuan volume untuk pendekatan trend berikut maju. Ini memiliki beberapa tepi tetapi juga risiko untuk dicatat. Perbaikan lebih lanjut dalam parameter dan aturan dapat meningkatkan stabilitas dan profitabilitas.

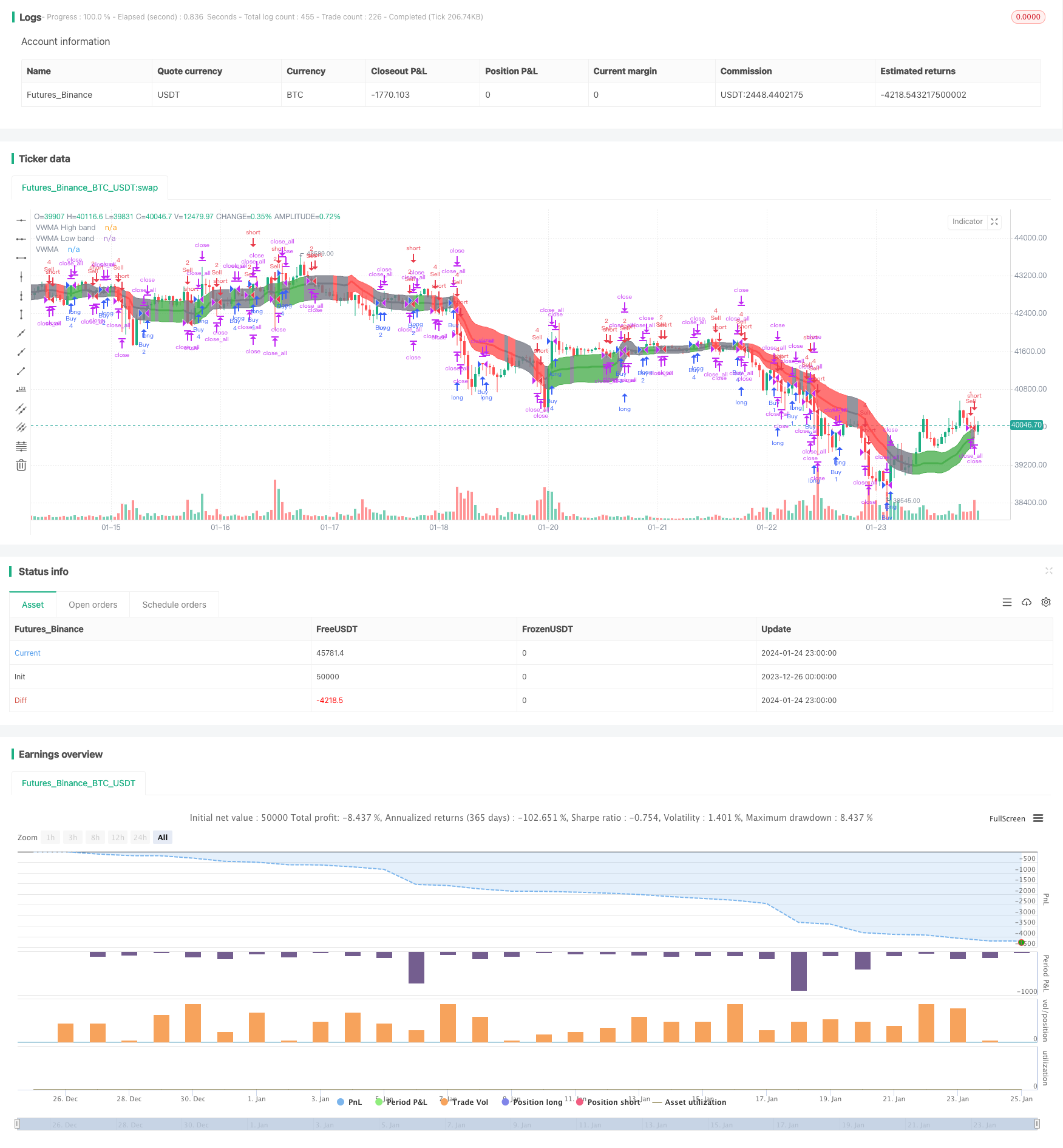

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at

// https://mozilla.org/MPL/2.0/

//

// Created by jadamcraig

//

// This strategy benefits from extracts taken from the following

// studies/authors. Thank you for developing and sharing your ideas in an open

// way!

// * Wave Trend Strategy by thomas.gigure

// * cRSI + Waves Strategy with VWMA overlay by Dr_Roboto

//

//@version=4

//==============================================================================

//==============================================================================

overlay = true // plots VWMA (need to close and re-add)

//overlay = false // plots Wave Trend (need to close and re-add)

strategy("Wave Trend w/ VWMA overlay", overlay=overlay)

baseQty = input(defval=1, title="Base Quantity", type=input.float, minval=1)

useSessions = input(defval=true, title="Limit Signals to Trading Sessions?")

sess1_startHour = input(defval=8, title="Session 1: Start Hour",

type=input.integer, minval=0, maxval=23)

sess1_startMinute = input(defval=25, title="Session 1: Start Minute",

type=input.integer, minval=0, maxval=59)

sess1_stopHour = input(defval=10, title="Session 1: Stop Hour",

type=input.integer, minval=0, maxval=23)

sess1_stopMinute = input(defval=25, title="Session 1: Stop Minute",

type=input.integer, minval=0, maxval=59)

sess2_startHour = input(defval=12, title="Session 2: Start Hour",

type=input.integer, minval=0, maxval=23)

sess2_startMinute = input(defval=55, title="Session 2: Start Minute",

type=input.integer, minval=0, maxval=59)

sess2_stopHour = input(defval=14, title="Session 2: Stop Hour",

type=input.integer, minval=0, maxval=23)

sess2_stopMinute = input(defval=55, title="Session 2: Stop Minute",

type=input.integer, minval=0, maxval=59)

sess1_closeAll = input(defval=false, title="Close All at End of Session 1")

sess2_closeAll = input(defval=true, title="Close All at End of Session 2")

//==============================================================================

//==============================================================================

// Volume Weighted Moving Average (VWMA)

//==============================================================================

//==============================================================================

plotVWMA = overlay

// check if volume is available for this equity

useVolume = input(

title="VWMA: Use Volume (uncheck if equity does not have volume)",

defval=true)

vwmaLen = input(defval=21, title="VWMA: Length", type=input.integer, minval=1,

maxval=200)

vwma = vwma(close, vwmaLen)

vwma_high = vwma(high, vwmaLen)

vwma_low = vwma(low, vwmaLen)

if not(useVolume)

vwma := wma(close, vwmaLen)

vwma_high := wma(high, vwmaLen)

vwma_low := wma(low, vwmaLen)

// +1 when above, -1 when below, 0 when inside

vwmaSignal(priceOpen, priceClose, vwmaHigh, vwmaLow) =>

sig = 0

color = color.gray

if priceClose > vwmaHigh

sig := 1

color := color.green

else if priceClose < vwmaLow

sig := -1

color := color.red

else

sig := 0

color := color.gray

[sig,color]

[vwma_sig, vwma_color] = vwmaSignal(open, close, vwma_high, vwma_low)

priceAboveVWMA = vwma_sig == 1 ? true : false

priceBelowVWMA = vwma_sig == -1 ? true : false

// plot(priceAboveVWMA?2.0:0,color=color.blue)

// plot(priceBelowVWMA?2.0:0,color=color.maroon)

//bandTrans = input(defval=70, title="VWMA Band Transparancy (100 invisible)",

// type=input.integer, minval=0, maxval=100)

//fillTrans = input(defval=70, title="VWMA Fill Transparancy (100 invisible)",

// type=input.integer, minval=0, maxval=100)

bandTrans = 60

fillTrans = 60

// ***** Plot VWMA *****

highband = plot(plotVWMA?fixnan(vwma_high):na, title='VWMA High band',

color = vwma_color, linewidth=1, transp=bandTrans)

lowband = plot(plotVWMA?fixnan(vwma_low):na, title='VWMA Low band',

color = vwma_color, linewidth=1, transp=bandTrans)

fill(lowband, highband, title='VWMA Band fill', color=vwma_color,

transp=fillTrans)

plot(plotVWMA?vwma:na, title='VWMA', color = vwma_color, linewidth=3,

transp=bandTrans)

//==============================================================================

//==============================================================================

// Wave Trend

//==============================================================================

//==============================================================================

plotWaveTrend = not(overlay)

n1 = input(10, "Wave Trend: Channel Length")

n2 = input(21, "Wave Trend: Average Length")

obLevel1 = input(60, "Wave Trend: Over Bought Level 1")

obLevel2 = input(53, "Wave Trend: Over Bought Level 2")

osLevel1 = input(-60, "Wave Trend: Over Sold Level 1")

osLevel2 = input(-53, "Wave Trend: Over Sold Level 2")

ap = hlc3

esa = ema(ap, n1)

d = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

plot(plotWaveTrend?0:na, color=color.gray)

plot(plotWaveTrend?obLevel1:na, color=color.red)

plot(plotWaveTrend?osLevel1:na, color=color.green)

plot(plotWaveTrend?obLevel2:na, color=color.red, style=3)

plot(plotWaveTrend?osLevel2:na, color=color.green, style=3)

plot(plotWaveTrend?wt1:na, color=color.green)

plot(plotWaveTrend?wt2:na, color=color.red, style=3)

plot(plotWaveTrend?wt1-wt2:na, color=color.blue, transp=80)

//==============================================================================

//==============================================================================

// Order Management

//==============================================================================

//==============================================================================

// Define Long and Short Conditions

longCondition = crossover(wt1, wt2)

shortCondition = crossunder(wt1, wt2)

// Define Quantities

orderQty = baseQty * 2

if (longCondition)

if (vwma_sig == 1)

if ( strategy.position_size >= (baseQty * 4 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 4 + abs(strategy.position_size)

else

orderQty := baseQty * 4

else if (vwma_sig == 0)

if ( strategy.position_size >= (baseQty * 2 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 2 + abs(strategy.position_size)

else

orderQty := baseQty * 2

else if (vwma_sig == -1)

if ( strategy.position_size >= (baseQty * 1 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 1 + abs(strategy.position_size)

else

orderQty := baseQty * 1

else if (shortCondition)

if (vwma_sig == -1)

if ( strategy.position_size <= (baseQty * 4) and

strategy.position_size > 0 )

orderQty := baseQty * 4 + strategy.position_size

else

orderQty := baseQty * 4

else if (vwma_sig == 0)

if ( strategy.position_size <= (baseQty * 2) and

strategy.position_size > 2 )

orderQty := baseQty * 2 + strategy.position_size

else

orderQty := baseQty * 2

else if (vwma_sig == 1)

if ( strategy.position_size <= (baseQty * 1) and

strategy.position_size > 0 )

orderQty := baseQty * 1 + strategy.position_size

else

orderQty := baseQty * 1

// Determine if new trades are permitted

newTrades = false

if (useSessions)

if ( hour == sess1_startHour and minute >= sess1_startMinute )

newTrades := true

else if ( hour > sess1_startHour and hour < sess1_stopHour )

newTrades := true

else if ( hour == sess1_stopHour and minute < sess1_stopMinute )

newTrades := true

else if ( hour == sess2_startHour and minute >= sess2_startMinute )

newTrades := true

else if ( hour > sess2_startHour and hour < sess2_stopHour )

newTrades := true

else if ( hour == sess2_stopHour and minute < sess2_stopMinute )

newTrades := true

else

newTrades := false

else

newTrades := true

// Long Signals

if ( longCondition )

strategy.order("Buy", strategy.long, orderQty)

// Short Signals

if ( shortCondition )

strategy.order("Sell", strategy.short, orderQty)

// Close open position at end of Session 1, if enabled

if (sess1_closeAll )

strategy.close_all()

// Close open position at end of Session 2, if enabled

if (sess2_closeAll )

strategy.close_all()

- Strategi Stop Loss dan Take Profit berbasis RSI

- Strategi Penembusan Saluran Rata-rata yang Bergerak

- Strategi pengujian breakback waktu tetap

- Strategi MACD Multi Timeframe yang Dioptimalkan Waktu dan Ruang

- Strategi perdagangan kuantitatif berdasarkan Stock RSI dan MFI

- Strategi perdagangan komposit multi-indikator

- Strategi perdagangan jangka pendek EMA lintas

- Tren Mengikuti Strategi Berdasarkan Stop Loss Dinamis dari Crossover EMA Dual

- Bursa Bursa Breakout Darvas Box Beli Strategi

- Strategi momentum relatif

- Strategi Crossover Rata-rata Bergerak

- Market Cypher Wave B Strategi Perdagangan Otomatis

- Strategi Pembalikan Kunci Backtest

- Reversal Candlestick Backtesting Strategi

- Swing High Low Price Channel Strategy V.1