MyLanguage ドック

作者: リン・ハーン発明者 量化 - 微かな夢, 作成日:2022-06-30 18:24:06, 更新日:2024-02-06 17:36:19[TOC]

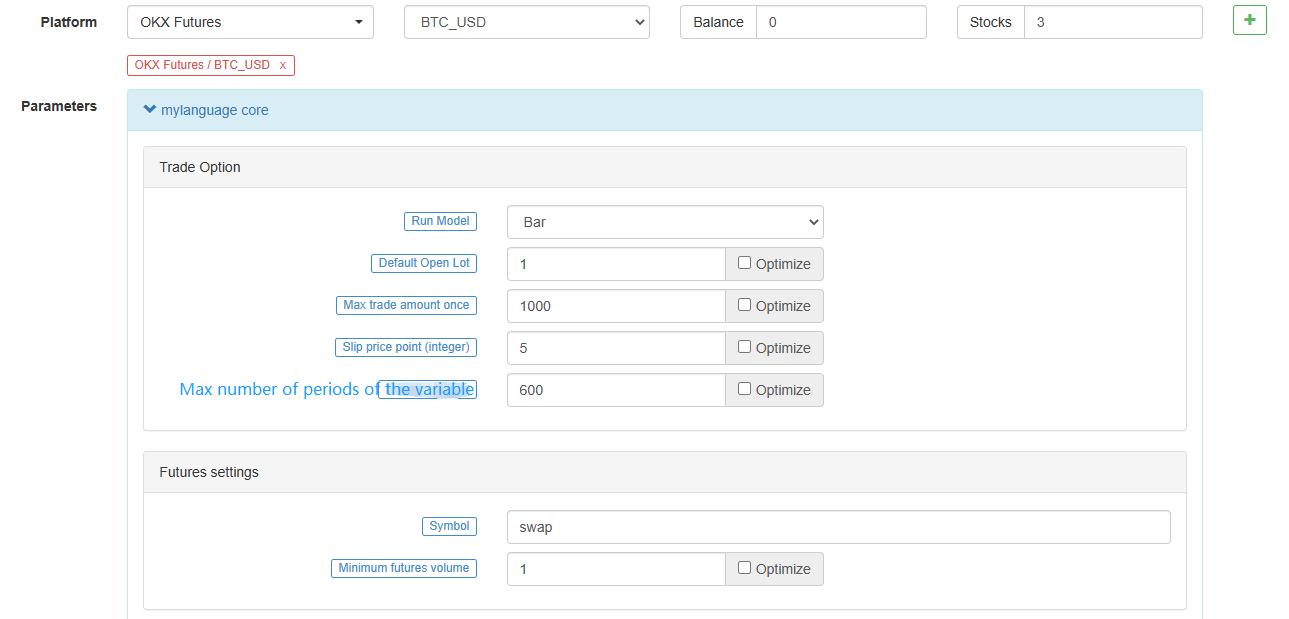

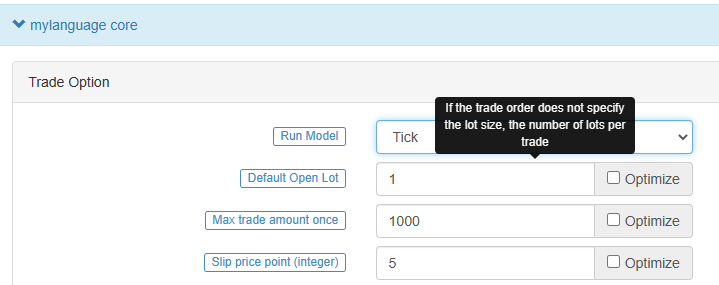

MyLanguageは,MyLanguageと互換性があり,強化されたプログラミング取引言語です. FMZ QuantのMyLanguageは,厳格な文法チェックを受けます.例えば,JavaScript言語コードを埋め込むために言語強化を使用する場合,文字の後に追加のスペース文字が表示されます.%%操作者がエラーを報告させる

-

基本指示

- ## 契約

暗号通貨契約

暗号通貨契約

this_week cryptocurrency futures contract this week next_week cryptocurrency futures contract next week month cryptocurrency futures contract month quarter cryptocurrency futures contract quarter next_quarter cryptocurrency futures contract next quarter third_quarter cryptocurrency futures contract third quarter last_quarter contract last quarter XBTUSD BITMEX perpetual contract swap cryptocurrency futures perpetual contracts other than BITMEX exchange For details, please refer to the exchange.SetContractType() function section of the JavaScript/Python/C++ documentation

- ## 変数

変数とは,データを保存するためにコンピュータのメモリに開かれたスペースである.簡単に言えば,データを保存するために使用される.

最初の変数を開きます.

// assign 1 to variable a a:=1;中へ

MyLanguage簡単に区別できます.data volume:- 単値データ: 値が1つだけあります.

0,1,'abc'. - 配列データ: 一つの値を持つデータからなるデータ配列,例えば:

Close(決済価格)Close閉じる価格を含んでいるnperiods.[ 10.1 , 10.2 , 10.3 , 10.4 , 10.5 ...]

変数型 と区別する - 文字列の種類: ヽ で包まれなければならない

''文字列タイプは直接使用することはできません. 機能で表示される必要があります.

INFO(CLSOE>OPEN,'OK!');- 値タイプ:整数,浮動小数点数 (小数点数) を含む.

// integer int:=2; // decimal float:=3.1;- ブル式タイプ, true (真) と 0 (偽) を使います. 1, 0, true (真) と false (偽) です.例えば:

A:=1>0;このコードが実行された後,A1 になります.

// The closing price of the current period is greater than -999, you will find that the return value of each period is 1, which means true, because the closing price is almost impossible to be negative. is_true:=Close>-999;- グローバル変数

VARIABLE:VALUE1:10; // Declare a global variable, assign the value 10, and execute it only once.バックテストの際に注意してください

VARIABLE:NX:0; // The initial global variable NX is 0 NX..NX+1; // Accumulate 1 each time INFO(1,NX); // Print NX every time初期には,

INFO証明書印刷101違うかもしれない0初めは? 100のK線が既に実行されており 100回累積されています テストの初期K線が100回あります 実際の値段は,最初にどれだけのK線が手に入るかによって決まります- ### 名前付けのルール

ほとんどのシステムでは,変数命名は,システム

予約された単語 (内蔵変数名,関数名) の使用を許可しません. Close,Cさらに,純粋数や素数も許されない.最後に,非常に長いことは許されない.そして異なるシステムには異なる長さの制限がある. 実際には,中国語の解析の効率について心配する必要はありません. 私は"MyLanguage"が中国語に非常に友好的であると考えています. 経験豊富なプログラマは,以下の2つの命名規則を使用することをお勧めします:1. Chinese name// elegant output 5-day moving average:=MA(C,5);2. English + underline// Output move_avg_5:=MA(C,5);英語を好む場合は,変数の意味をできるだけ理解できるようにしてください.

A1,AAA,BBB数日後に再びインディケーターコードを レビューすると 記憶喪失が原因で とても惨めな気分になります 同様に コードを 他人に輸出すると 読者は 壊滅するでしょうMyLanguage を最大限に活用してください! 分析と意思決定の強力なツールになることを願っています. - ## データの種類

データ型は基本的な概念です. 変数に明確なデータを書き込みで割り当てると,変数もデータの型になります.

- 1. 価値の種類:

1.2.3.1.1234.2.23456 ...- 2. 文字列の種類 (str):

'1' .'2' .'3' ,String types must be wrapped with ''- 3. 配列データ

A collection of data consisting of a series of single-valued data- 4. ブル式 (ブル式):

使用

1代表するtrueそして0についてfalse.例

// declare a variable of value type var_int := 1; // Declare a variable for sequence data var_arr := Close; // The string type cannot be declared alone, it needs to be combined with the function INFO(C>O, 'positive line');- ## オペレーター

インディケーターコードを実行するために使用される操作と計算は,単に操作に関わるシンボルです.

- ### 割り当てオペレーター

変数に値を代入する

- 1. `:` ```:```, represents assignment and output to the graph (subgraph). ``` Close1:Close; // Assign Close to the variable Close1 and output to the figure ``` - 2. `:=` ```:=```, represents assignment, but is not output to the graph (main graph, sub graph...), nor is it displayed in the status bar table. ``` Close2:=Close; // Assign Close to the variable Close2 ``` - 3. `^^` ```^^```, Two ```^``` symbols represent assignment, assign values to variables and output to the graph (main graph). ``` lastPrice^^C; ``` - 4. `..` ```..```, two ```.``` symbols represent assignment, assign values to variables and display variable names and values in the chart, but do not draw pictures to the chart (main picture, sub-picture...). ``` openPrice..O ```- ### 関連演算子

関連演算子は,二次演算子で,条件式で2つのデータとの関係を決定するために使用されます.

返される値: ブール式

true(1) またはfalse(0).- 1. more than```>``` ``` // Assign the operation result of 2>1 to the rv1 variable, at this time rv1=1 rv1:=2>1; ``` - 2. less than```<``` ``` // Returns false, which is 0, because 2 is greater than 1 rv3:=2<1; ``` - 3. more than or equal to```>=``` ``` x:=Close; // Assign the result of the operation that the closing price is more than or equal to 10 to the variable rv2 // Remark that since close is a sequence of data, when close>=10 is performed, the operation is performed in each period, so each period will have a return value of 1 and 0 rv2:=Close>=10; ``` - 4. less than or equal to```<=``` ``` omitted here ``` - 5. equal to```=``` ``` A:=O=C; // Determine whether the opening price is equal to the closing price. ``` - 6. Not equal to```<>``` ``` 1<>2 // To determine whether 1 is not equal to 2, the return value is 1 (true) ```- ### 論理演算子

返される値: ブール式

true(1) またはfalse(0).1. The logical and ```&&```, can be replaced by ```and```, and the left and right sides of the and connection must be established at the same time.// Determine whether cond_a, cond_b, cond_c are established at the same time cond_a:=2>1; cond_b:=4>3; cond_c:=6>5; cond_a && cond_b and cond_c; // The return value is 1, established2. Logical or ```||```, you can use ```or``` to replace the left and right sides of the or link, one side is true (true), the whole is true (return value true).cond_a:=1>2; cond_b:=4>3; cond_c:=5>6; cond_a || cond_b or cond_c; // The return value is 1, established3. ```()``` operator, the expression in parentheses will be evaluated first.1>2 AND (2>3 OR 3<5) // The result of the operation is false 1>2 AND 2>3 OR 3<5 // The result of the operation is true- ### 算術演算子

Return value: numeric type算術演算子とは算術演算子である.基本算術演算子 (算術演算子) を完了するためのシンボルである.これは4つの算術演算を処理するために使用されるシンボルである.

- **plus +** ``` A:=1+1; // return 2 ``` - **minus -** ``` A:=2-1; // return 1 ``` - **multiply \** ``` A:=2*2; // return 4 ``` - **divide /** ``` A:=4/2; // return 2 ```-

機能

- ###機能

プログラミングの世界では,

関数 は,特定の関数を実装するコードの部分である.また,他のコードで呼び出されることもあり,一般的な形式は以下のとおりである. function(param1,param2,...)- Composition: Function name (parameter1, parameter2, ...), may have no parameters or have multiple parameters. For example, ```MA(x,n);``` means to return to the simple moving average of ```x``` within ```n``` periods. Among them, ```MA()``` is a function, ```x``` and ```n``` are the parameters of the function. When using a function, we need to understand the basic definition of the function, that is, what data can be obtained by calling the function. Generally speaking, functions have parameters. When we pass in parameters, we need to ensure that the incoming data type is consistent. At this stage, the code hinting function of most IDEs is very imperfect. There is a data type of the parameter given, which brings some trouble to our use, and ```MA(x,n);``` is interpreted as: ``` Return to simple moving average Usage: AVG:=MA(X,N): N-day simple moving average of X, algorithm (X1+X2+X3+...+Xn)/N, N supports variables ``` This is very unfriendly to beginners, but next, we will dissect the function thoroughly, trying to find a quick way to learn and use the function.- ### 返した値

概念を理解する必要があります. これは"返り値"と呼ばれます.戻る

は,その名前からわかるように, 返却 を意味し,その値は 特定値 を表す. // Because it will be used in the following code, the variable return_value is used to receive and save the return value of function() // retrun_value := function(param1,param2); // For example: AVG:=MA(C,10); // AVG is retrun_value, function is MA function, param1 parameter: C is the closing price sequence data, param2 parameter: 10.- ### パラメーター

2つ目は,関数の第2の重要な概念はパラメータであり,異なるパラメータを通過することによって異なる返却値を得ることができる.

// The variable ma5 receives the 5-day moving average of closing prices ma5:=MA(C,5); // The variable ma10 receives the 10-day moving average of closing prices ma10:=MA(C,10);第1パラメータ

X上記の変数からma5,ma10はC(決済価格) 実際にはCまた関数である (開封から現在までの閉じる価格の順序を返します),しかしパラメータがありません.第2パラメータの5と10は,閉じる価格を表示するために使用されます.MA()数日間の閉店価格の移動平均値を得たい関数です. この関数はパラメータを通して使用するのにより柔軟になります.-

学ぶ方法

- 1. まず,関数が何をするか,つまり,この関数が私たちに返してくれるデータについて理解する必要があります.

- 2番目は,返した値の種類を理解することです.結局,返した値を得るには関数を使います.

- パラメータのデータタイプを知らなければなりません.

MA(x,n)パラメータのデータタイプがわからない場合x,n返した値が正常に返ってくるわけではありません.

次の機能の導入と使用において,上記の3つの原則に従います.

-

言語の強化

MyLanguageそしてJavaScript言語混合プログラミング

%% // This can call any API quantified of FMZ scope.TEST = function(obj) { return obj.val * 100; } %% Closing price: C; Closing price magnified 100 times: TEST(C); The last closing price is magnified by 100 times: TEST(REF(C, 1)); // When the mouse moves to the K-line of the backtest, the variable value will be prompted- ```scope```object The ```scope``` object can add attributes and assign anonymous functions to attributes, and the anonymous function referenced by this attribute can be called in the code part of MyLanguage. - ```scope.getRefs(obj)```function In ```JavaScript``` code block, call the ```scope.getRefs(obj)``` function to return the data of the passed in ```obj``` object. The ```JavaScript``` code wrapped with the following ```%% %%``` will get the ```C``` passed in when the ```TEST(C)``` function in MyLanguage code is called Close price. The ```scope.getRefs``` function will return all the closing prices of this K-line data. Because of the use of ```throw "stop"``` to interrupt the program, the variable ```arr``` contains the closing price of the first bar only. You can try to delete ```throw "stop"```, it will execute the ```return``` at the end of the ```JavaScript``` code, and return all closing price data. ``` %% scope.TEST = function(obj){ var arr = scope.getRefs(obj) Log("arr:", arr) throw "stop" return } %% TEST(C); ``` - scope.bars Access all K-line bars in the ``JavaScript`` code block. The ```TEST``` function returns a value. 1 is a negative line and 0 is a positive line. ``` %% scope.TEST = function(){ var bars = scope.bars return bars[bars.length - 1].Open > bars[bars.length - 1].Close ? 1 : 0 // Only numeric values can be returned } %% arr:TEST; ``` ``` # Attention: # An anonymous function received by TEST, the return value must be a numeric value. # If the anonymous function has no parameters, it will result in an error when calling TEST, writing VAR:=TEST; and writing VAR:=TEST(); directly. # TEST in scope.TEST must be uppercase. ``` - scope.bar In the ```JavaScript``` code block, access the current bar. Calculate the average of the high opening and low closing prices. ``` %% scope.TEST = function(){ var bar = scope.bar var ret = (bar.Open + bar.Close + bar.High + bar.Low) / 4 return ret } %% avg^^TEST; ``` - scope.depth Access to market depth data (order book). ``` %% scope.TEST = function(){ Log(scope.depth) throw "stop" // After printing the depth data once, throw an exception and pause } %% TEST; ``` - scope.symbol Get the name string of current trading pair. ``` %% scope.TEST = function(){ Log(scope.symbol) throw "stop" } %% TEST; ``` - scope.barPos Get the Bar position of the K-line. ``` %% scope.TEST = function(){ Log(scope.barPos) throw "stop" } %% TEST; ``` - scope.get\_locals('name') This function is used to get the variables in the code section of MyLanguage. ``` V:10; %% scope.TEST = function(obj){ return scope.get_locals('V') } %% GET_V:TEST(C); ``` ``` # Attention: # If a variable cannot calculate the data due to insufficient periods, call the scope.get_locals function in the JavaScript code at this time # When getting this variable, an error will be reported: line:XX - undefined locals A variable name is undefined ``` - scope.canTrade The ```canTrade``` attribute marks whether the current bar can be traded (whether the current Bar is the last one) For example, judging that the market data is printed when the strategy is in a state where the order can be traded ``` %% scope.LOGTICKER = function() { if(exchange.IO("status") && scope.canTrade){ var ticker = exchange.GetTicker(); if(ticker){ Log("ticker:", ticker); return ticker.Last; } } } %% LASTPRICE..LOGTICKER; ```応用例:

%% scope.TEST = function(a){ if (a.val) { throw "stop" } } %% O>C,BK; C>O,SP; TEST(ISLASTSP);ポジションを1回開封すると戦略を停止する.

-

多期参照

システムでは,適切な基幹K線周期を自動的に選択し,この基幹K線周期データを利用して,参照されたすべてのK線データを合成し,データの正確性を確保します.

- 使用方法:

#EXPORT formula_name ... #END公式が計算されるのは,異なる期間のデータを得るためではない場合,空の公式も書ける.

- 使用方法:

空の式は

#EXPORT TEST NOP; #END // end- 使用方法:

#IMPORT [MIN,period,formula name] AS variable value設定された期間の様々なデータ (変数値で得られる閉値,開値,など) を取得します.

について

MINについてIMPORTコマンドの意味分間レベル.MyLanguage FMZ Quant プラットフォーム,そして,MINレベルがサポートされています.IMPORT標準でない期間がサポートされています.例えば,#IMPORT [MIN, 240, TEST] AS VAR240240分 (4時間) のKラインなどのデータをインポートする.コード例:

// This code demonstrates how to reference formulas of different periods in the same code // #EXPORT extended grammar, ending with #END marked as a formula, you can declare multiple #EXPORT TEST Mean value 1: EMA(C, 20); Mean value 2: EMA(C, 10); #END // end #IMPORT [MIN,15,TEST] AS VAR15 // Quoting the formula, the K-line period takes 15 minutes #IMPORT [MIN,30,TEST] AS VAR30 // Quoting the formula, the K-line period takes 30 minutes CROSSUP(VAR15.Mean value is 1, VAR30.Mean value is 1),BPK; CROSSDOWN(VAR15.Mean value is 2, VAR30.Mean value is 2),SPK; The highest price in fifteen minutes:VAR15.HIGH; The highest price in thirty minutes:VAR30.HIGH; AUTOFILTER;- 服用する際に注意する必要があります.

REF,LLV,HHV複数の期間のデータを参照する際のデータ参照の他の指示.

(*backtest start: 2021-08-05 00:00:00 end: 2021-08-05 00:15:00 period: 1m basePeriod: 1m exchanges: [{"eid":"Futures_OKCoin","currency":"ETH_USD"}] args: [["TradeAmount",100,126961],["ContractType","swap",126961]] *) %% scope.PRINTTIME = function() { var bars = scope.bars; return _D(bars[bars.length - 1].Time); } %% BARTIME:PRINTTIME; #EXPORT TEST REF1C:REF(C,1); REF1L:REF(L,1); #END // end #IMPORT [MIN,5,TEST] AS MIN5 INFO(1, 'C:', C, 'MIN5.REF1C:', MIN5.REF1C, 'REF(MIN5.C, 1):', REF(MIN5.C, 1), 'Trigger BAR time:', BARTIME, '#FF0000'); INFO(1, 'L:', L, 'MIN5.REF1L:', MIN5.REF1L, 'REF(MIN5.L, 1):', REF(MIN5.L, 1), 'Trigger BAR time:', BARTIME, '#32CD32'); AUTOFILTER;この2つの違いを比較すると

MIN5.REF1CそしてREF(MIN5.C, 1)発見できるのは```REF(MIN5.C, 1)``` is the K -line period of the current model (the above code backtest period is set to 1 minute, i.e. ```period: 1m``), the closing price of the 5-minute period where the penultimate BAR is located at the current moment. These two definitions are differentiated, and they can be used as needed. - ## Mode Description - ### Signal filtering model of one opening and one leveling In the model, the ```AUTOFILTER``` function is written to control and realize the signal filtering of one opening and one closing. When there are multiple opening signals that meet the conditions, the first signal is taken as the valid signal, and the same signal on the K-line will be filtered out. Instructions supported by filtering model: BK, BP, BPK, SK, SP, SPK, CLOSEOUT, etc. Instructions with lot numbers such as BK(5) are not supported. For exampleMA1:MA(CLOSE,5); MA2:MA(CLOSE,10) CROSSUP ((C,MA1),BK; CROSSUP ((MA1,MA2),BK; C>BKPRICE+10 について

分かりました 上記の例のように,AUTOFILTERが設定されていないとき,第3行BK,第4行BK,第5行SPが順番に起動し,各K線が1回信号を起動します.ポジションを開いて,ポジションを閉じると,モデル状態がリセットされます.

AUTOFILTERが設定されている場合,BKをトリガーした後,SPのみがトリガーされ,他のBK信号は無視され,各K線が一度信号をトリガーします.- ### Increase and decrease position model The ```AUTOFILTER``` function is not written in the model, allowing continuous opening signals or continuous closing signals, which can increase and decrease positions. Supported instructions: BK(N), BP(N), SK(N), SP(N), CLOSEOUT, BPK(N), SPK(N), open and close orders without lot size are not supported. (1)Instruction grouping is supported. (2)When multiple instruction conditions are satisfied at the same time, the signals are executed in the order in which the conditional statements are written. For example:MA1:MA(CLOSE,5); MA2:MA(CLOSE,10) CROSSUP ((C,MA1),BK ((1)) CROSSUP ((MA1,MA2),BK ((1)) C>BKPRICE+10 について

Use ```TRADE\_AGAIN``` It is possible to make the same command line, multiple signals in succession.分かりました 上記の例は"つずつ実行され,実行後の信号はもはやトリガーされません. ポジションを閉じるとモデル状態をリセットします. K線は一度信号をトリガーします.

- ### Model with one K-line and one signal Regardless of whether the K-line is finished, the signal is calculated in real-time orders, that is, the K-line is placed before the order is completed; the K-line is reviewed at the end. If the position direction does not match the signal direction at the end of the K-line, the position will be automatically synchronized. For example:MA1:MA(CLOSE,5); MA2:MA(CLOSE,10) CROSSUP ((MA1,MA2),BPK; //5期間の移動平均は上向きに移動し,10期間の移動平均は長向きに移動します. CROSSDOWN ((MA1,MA2),SPK; //5期間の移動平均は下回り,10期間の移動平均は短くなっています. 自動フィルター

- ### A model of multiple signals on one K-line The model uses ```multsig``` to control and implement multiple signals from one K-line. Regardless of whether the K-line is finished, the signal is calculated in real-time. The signal is not reviewed, there is no signal disappearance, and the direction of the signal is always consistent with the direction of the position. If multiple signal conditions are met in one K-line, it can be executed repeatedly.例えば: MA1:MA(CLOSE,5); MA2:MA(CLOSE,10) CROSSUP ((MA1,MA2),BK; C>BKPRICE+10 について

```MULTSIG``` can execute multiple command lines within one K-line. A command line is only signaled once.O,BK; // これらの条件はすべてK線バーで実行できますが,1行あたり1つの信号のみです 10+O,BK; // ストラテジープラスTRADE_AGAIN(10);一行あたり複数の信号を作成することができます 20+O,BK 40+O,BK MULTSIG ((1,1,10);

Supplement: 1.The model of adding and reducing positions, two ways of one signal and one K-line: placing an order at the closing price and placing an order at the order price, are both supported. 2.The model of adding and reducing positions also supports ordering of multiple signals from one K-line. The model of adding and reducing positions, write the ```multsig``` function to realize multiple additions or multiple reductions on one K-line. - ## Execution mode  - ### Bar model The Bar model refers to the model that is executed after the current BAR is completed, and the trading is executed when the next BAR starts. - ### Tick model The Tick model means that the model is executed once for each price movement and trades immediately when there is a signal. The Tick model ignores the previous day's signal (the previous day's signal is executed immediately on the same day), and the Tick model focuses only on the current market data to determine whether the signal is triggered. - ## Chart display - ### Additional indicators for main chart > Use operator ```^^```, set indicators are displayed on the main chart while assigning values to variables.MA60^^MA(C, 60); // 60 のパラメータで平均指標を計算する

- ### Additional Indicators for sub-chart Use operator ```:```, set indicators are displayed on the sub-chart while assigning values to variables.ATR:MA(MAX(MAX(((HIGH-LOW),ABS(REF(CLOSE,1)-HIGH)),ABS(REF(CLOSE,1)-LOW)),26); //ATR変数に値を代入し,記号

: が続いて,ATRを計算する式  If you don't want it to be displayed on the main or subchart, use the "..." operator.MA60..MA(C, 60); // 60 のパラメータで平均指標を計算する

You can use ```DOT``` and ```COLORRED``` to set the line type and color of the line, etc., in line with the habits of users familiar with the MyLanguage. - ## Common problems > Introduce the **problems** commonly encountered in the process of writing indicators, usually the points that need to be paid attention to when writing (continuously added). - Remark the semicolon ```;``` at the end. - Remark that system keywords cannot be declared as variables. - Remark that the string uses **single quotes**, for example: the string ```'Open position'```. - ### Remark Annotation - ```// The Remark content ``` (input method can be typed in both Chinese and English) means that the code is not compiled during the execution process, that is, the content after ```//``` is not executed. Usually we use it to mark the meaning of the code, when it is convenient for code review, it can be quickly understood and recalled. - ```{ Remark content }```Block Remark. ``` A:=MA(C,10); {The previous line of code is to calculate the moving average.} ``` - ```(* Remark content *)```Block Remark. ``` A:=MA(C,10); (*The previous line of code is to calculate the moving average.*) ``` - ### Input When writing code, because the input method is often switched between Chinese and English, resulting in symbol errors. The common errors are as follows: colon ```:```, terminator ```;```, comma ```, ```, brackets ```()```, etc. These characters in different states of Chinese and English need attention. > If you use Sogou, Baidu, or Bing input methods, you can quickly switch between Chinese and English by pressing the ```shift``` key once. - ### Error-prone logic 1. At least, not less than, not less than: the corresponding relational operator ```>=```. 2. Up to, at most, no more than: the corresponding relational operator ```<=```. - ### Strategy launch synchronization In the futures strategy, if there is a manually opened position before the strategy robot starts, when the robot starts, it will detect the position information and synchronize it to the actual position status. In the strategy, you can use the ```SP```, ```BP```, ```CLOSEOUT``` commands to close the position.%% if (!scope.init) { について var ticker = exchange.GetTicker ((() を取得する 交換.買 (か) える.売 (た) える+10, 1 scope.init = true について { \ pos (192,220) } %% C>0, CLOSEOUT (閉じる)

` - ### 双方向位置はサポートされていません

MyLanguageは,同じ契約を,ロングとショートの両方でサポートしません.

-

K線データ引用

- ## オープン

K線チャートのオープニング価格を取得します.

オープニング価格

機能:OPEN,Oの略

パラメータ: 無

説明: 開始価格を返します.

配列データ

OPEN gets the opening price of the K-line chart. Remark: 1.It can be abbreviated as O. Example 1: OO:=O; //Define OO as the opening price; Remark that the difference between O and 0. Example 2: NN:=BARSLAST(DATE<>REF(DATE,1)); OO:=REF(O,NN); //Take the opening price of the day Example 3: MA5:=MA(O,5); //Define the 5-period moving average of the opening price (O is short for OPEN).- ## HIGH (高い)

K線チャートで最高値を取ろう

最高価格

機能:HIGH,略してH

パラメータ: 無

説明: この期間の最高価格を返します.

配列データ

HIGH achieved the highest price on the K-line chart. Remark: 1.It can be abbreviated as H. Example 1: HH:=H; // Define HH as the highest price Example 2: HH:=HHV(H,5); // Take the maximum value of the highest price in 5 periods Example 3: REF(H,1); // Take the highest price of the previous K-line- ## 低い

K線チャートで 最安値を取れ

最安値

機能: LOW,略してL

パラメータ: 無

説明: この期間の最低価格を返します.

配列データ

LOW gets the lowest price on the K-line chart. Remark: 1.It can be abbreviated as L. Example 1: LL:=L; // Define LL as the lowest price Example 2: LL:=LLV(L,5); // Get the minimum value of the lowest price in 5 periods Example 3: REF(L,1); // Get the lowest price of the previous K-line- ## 近く

K線グラフの閉値を取得します.

閉店価格

機能: CLOSE,略してC

パラメータ: 無

説明: この期間の閉じる価格を返します.

配列データ

CLOSE Get the closing price of the K-line chart Remarks: 1.Obtain the latest price when the intraday K-line has not finished. 2.It can be abbreviated as C. Example 1: A:=CLOSE; //Define the variable A as the closing price (A is the latest price when the intraday K-line has not finished) Example 2: MA5:=MA(C,5); //Define the 5-period moving average of the closing price (C is short for CLOSE) Example 3: A:=REF(C,1); //Get the closing price of the previous K-line- ## VOL

K線グラフの取引量を取得する.

取引量

機能:VOL,略してV

パラメータ: 無

解説:

この期間の取引量を返します 配列データ

VOL obtains the trading volume of the K-line chart. Remarks: It can be abbreviated as V. The return value of this function on the current TICK is the cumulative value of all TICK trading volume on that day. Example 1: VV:=V; // Define VV as the trading volume Example 2: REF(V,1); // Indicates the trading volume of the previous period Example 3: V>=REF(V,1); // The trading volume is greater than the trading volume of the previous period, indicating that the trading volume has increased (V is the abbreviation of VOL)- ## OPI

フューチャー (コントラクト) 市場の現在の総ポジションを取ります.

OpenInterest:OPI;- ## REF

前向きの引用

Reference the value of X before N periods. Remarks: 1.When N is a valid value, but the current number of K-lines is less than N, returns null; 2.Return the current X value when N is 0; 3.Return a null value when N is null. 4.N can be a variable. Example 1: REF(CLOSE,5);Indicate the closing price of the 5th period before the current period is referenced Example 2: AA:=IFELSE(BARSBK>=1,REF(C,BARSBK),C);//Take the closing price of the K-line of the latest position opening signal // 1)When the BK signal is sent, the bar BARSBK returns null, then the current K-line REF(C, BARSBK) that sends out the BK signal returns null; // 2)When the BK signal is sent out, the K-line BARSBK returns null, and if BARSBK>=1 is not satisfied, it is the closing price of the K-line. // 3)The K-line BARSBK after the BK signal is sent, returns the number of periods from the current K-line between the K-line for purchasing and opening a position, REF(C,BARSBK) Return the closing price of the opening K-line. // 4)Example: three K-lines: 1, 2, and 3, 1 K-line is the current K-line of the position opening signal, then returns the closing price of the current K-line, 2, 3 The K-line returns the closing price of the 1 K-line.- ## ユニット

データ契約の取引ユニットを取れ

Get the trading unit of the data contract. Usage: UNIT takes the trading unit of the loaded data contract.仮想通貨スポット

UNIT 値は 1 です.

仮想通貨先物

UNIT の値は,契約通貨に関連しています.

OKEX futures currency standard contracts: 1 contract for BTC represents $100, 1 contract for other currencies represents $10- ## MINPRICE

データ契約の最低変動価格

Take the minimum variation price of the data contract. Usage: MINPRICE; Take the minimum variation price of the loaded data contract.- ## MINPRICE1

取引契約の最低変動価格

Take the minimum variation price of a trading contract. Usage: MINPRICE1; Take the minimum variation price of a trading contract. -

時間関数

- ## BARPOS

K線の位置を取れ

BARPOS, Returns the number of periods from the first K-line to the current one. Remarks: 1.BARPOS returns the number of locally available K-line, counting from the data that exists on the local machine. 2.The return value of the first K-line existing in this machine is 1. Example 1:LLV(L,BARPOS); // Find the minimum value of locally available data. Example 2:IFELSE(BARPOS=1,H,0); // The current K-line is the first K-line that already exists in this machine, and it takes the highest value, otherwise it takes 0.- ## デイバーポス

この日のK線BARは,現在のK線BARです.

- ## 期間

周期値は分数である.

1, 3, 5, 15, 30, 60, 1440- ## デート

日付函数DATEは,1900年以降の年,月,日を取得します.

Example 1: AA..DATE; // The value of AA at the time of testing is 220218, which means February 18, 2022- ## タイム

K線を引く時間だ

TIME, the time of taking the K-line. Remarks: 1.The function returns in real time in the intraday, and returns the starting time of the K-line after the K-line is completed. 2.This function returns the exchange data reception time, which is the exchange time. 3.The TIME function returns a six-digit form when used on a second period, namely: HHMMSS, and displays a four-digit form on other periods, namely: HHMM. 4.The TIME function can only be loaded in periods less than the daily period, and the return value of the function is always 1500 in the daily period and periods above the daily period. 5. It requires attention when use the TIME function to close a position at the end of the day (1).It is recommended to set the time for closing positions at the end of the market to the time that can actually be obtained from the return value of the K-line (for example: the return time of the last K-line in the 5-minute period of the thread index is 1455, and the closing time at the end of the market is set to TIME>=1458, CLOSEOUT; the signal of closing the position at the end of the market cannot appear in the effect test) (2).If the TIME function is used as the condition for closing the position at the end of the day, it is recommended that the opening conditions should also have a corresponding time limit (for example, if the condition for closing the position at the end of the day is set to TIME>=1458, CLOSEOUT; then the condition TIME needs to be added to the corresponding opening conditions. <1458; avoid re-opening after closing) Example 1: C>O&&TIME<1450,BK; C<O&&TIME<1450,SK; TIME>=1450,SP; TIME>=1450,BP; AUTOFILTER; // Close the position after 14:50. Example 2: ISLASTSK=0&&C>O&&TIME>=0915,SK;- ## 年

Year.

YEAR, year of acquisition. Remark: The value range of YEAR is 1970-2033. Example 1: N:=BARSLAST(YEAR<>REF(YEAR,1))+1; HH:=REF(HHV(H,N),N); LL:=REF(LLV(L,N),N); OO:=REF(VALUEWHEN(N=1,O),N); CC:=REF(C,N); // Take the highest price, lowest price, opening price, and closing price of the previous year Example 2: NN:=IFELSE(YEAR>=2000 AND MONTH>=1,0,1);- ## 月

月を取って

MONTH, returns the month of a period. Remark: The value range of MONTH is 1-12. Example 1: VALUEWHEN(MONTH=3&&DAY=1,C); // Take its closing price when the K-line date is March 1 Example 2: C>=VALUEWHEN(MONTH<REF(MONTH,1),O),SP;- ## DAY (日)

期間中の日数を取得します.

DAY, returns the number of days in a period. Remark: The value range of DAY is 1-31. Example 1: DAY=3&&TIME=0915,BK; // 3 days from the same day, at 9:15, buy it Example 2: N:=BARSLAST(DATE<>REF(DATE,1))+1; CC:=IFELSE(DAY=1,VALUEWHEN(N=1,O),0); // When the date is 1, the opening price is taken, otherwise the value is 0- ## 時間

Hour.

HOUR, returns the number of hours in a period. Remark: The value range of HOUR is 0-23 Example 1: HOUR=10; // The return value is 1 on the K-line at 10:00, and the return value on the remaining K-lines is 0- ## MINUTE (一分)

Minute.

MINUTE, returns the number of minutes in a period. Remarks: 1: The value range of MINUTE is 0-59 2: This function can only be loaded in the minute period, and returns the number of minutes when the K-line starts. Example 1: MINUTE=0; // The return value of the minute K-line at the hour is 1, and the return value of the other K-lines is 0 Example 2: TIME>1400&&MINUTE=50,SP; // Sell and close the position at 14:50- ## 週日

週の番号を取れ

WEEKDAY, get the number of the week. Remark: 1: The value range of WEEKDAY is 0-6. (Sunday ~ Saturday) Example 1: N:=BARSLAST(MONTH<>REF(MONTH,1))+1; COUNT(WEEKDAY=5,N)=3&&TIME>=1450,BP; COUNT(WEEKDAY=5,N)=3&&TIME>=1450,SP; AUTOFILTER; // Automatically close positions at the end of the monthly delivery day Example 2: C>VALUEWHEN(WEEKDAY<REF(WEEKDAY,1),O)+10,BK; AUTOFILTER; -

論理判断機能

- ## BARSTATUS (バーストータス)

現時点の位置状態を返します.

BARSTATUS returns the position status for the current period. Remark: The function returns 1 to indicate that the current period is the first period, returns 2 to indicate that it is the last period, and returns 0 to indicate that the current period is in the middle. Example: A:=IFELSE(BARSTATUS=1,H,0); // If the current K-line is the first period, variable A returns the highest value of the K-line, otherwise it takes 0- ## その間

Between.

BETWEEN(X,Y,Z) indicates whether X is between Y and Z, returns 1 (Yes) if established, otherwise returns 0 (No). Remark: 1.The function returns 1(Yse) if X=Y, X=Z, or X=Y and Y=Z. Example 1: BETWEEN(CLOSE,MA5,MA10); // It indicates that the closing price is between the 5-day moving average and the 10-day moving average- ## BARSLASTCOUNT バースラストカウント

BARSLASTCOUNT(COND) は,この条件を満たす連続期間の数を計算し,現在の期間に先を行います.

Remark: 1. The return value is the number of consecutive non zero periods calculated from the current period 2. the first time the condition is established when the return value of the current K-line BARSLASTCOUNT(COND) is 1 Example: BARSLASTCOUNT(CLOSE>OPEN); //Calculate the number of consecutive positive periods within the current K-line- ## クロス

クロス機能

CROSS(A,B) means that A crosses B from bottom to top, and returns 1 (Yes) if established, otherwise returns 0 (No) Remark: 1.To meet the conditions for crossing, the previous k-line must satisfy A<=B, and when the current K-line satisfies A>B, it is considered to be crossing. Example 1: CROSS(CLOSE,MA(CLOSE,5)); // Indicates that the closing line crosses the 5-period moving average from below- ## クロスダウン

クロスダウン

CROSSDOWN(A,B): indicates that when A passes through B from top to bottom, it returns 1 (Yes) if it is established, otherwise it returns 0 (No) Remark: 1.CROSSDOWN(A,B) is equivalent to CROSS(B,A), and CROSSDOWN(A,B) is easier to understand Example 1: MA5:=MA(C,5); MA10:=MA(C,10); CROSSDOWN(MA5,MA10),SK; // MA5 crosses down MA10 to sell and open a position // CROSSDOWN(MA5,MA10),SK; Same meaning as CROSSDOWN(MA5,MA10)=1,SK;- ## クロスアップ

Crossup.

CROSSUP(A,B) means that when A crosses B from the bottom up, it returns 1 (Yes) if it is established, otherwise it returns 0 (No) Remark: 1.CROSSUP(A,B) is equivalent to CROSS(A,B), and CROSSUP(A,B) is easier to understand. Example 1: MA5:=MA(C,5); MA10:=MA(C,10); CROSSUP(MA5,MA10),BK; // MA5 crosses MA10, buy open positions // CROSSUP(MA5,MA10),BK;与CROSSUP(MA5,MA10)=1,BK; express the same meaning- ## すべて

継続的に満たされているかどうかを判断します.

EVERY(COND,N), Determine whether the COND condition is always satisfied within N periods. The return value of the function is 1 if it is satisfied, and 0 if it is not satisfied. Remarks: 1.N contains the current K-line. 2.If N is a valid value, but there are not so many K-lines in front, or N is a null value, it means that the condition is not satisfied, and the function returns a value of 0. 3.N can be a variable. Example 1: EVERY(CLOSE>OPEN,5); // Indicates that it has been a positive line for 5 periods Example 2: MA5:=MA(C,5); // Define a 5-period moving average MA10:=MA(C,10); // Define a 10-period moving average EVERY(MA5>MA10,4),BK; // If MA5 is greater than MA10 within 4 periods, then buy the open position // EVERY(MA5>MA10,4),BK; has the same meaning as EVERY(MA5>MA10,4)=1,BK;- ## 存在する

満足度があるかどうか判断する.

EXIST(COND, N) judges whether there is a condition that satisfies COND within N periods. Remarks: 1.N contains the current K-line. 2.N can be a variable. 3.If N is a valid value, but there are not so many K-lines in front, it is calculated according to the actual number of periods. Example 1: EXIST(CLOSE>REF(HIGH,1),10); // Indicates whether there is a closing price greater than the highest price of the previous period in 10 periods, returns 1 if it exists, and returns 0 if it does not exist Example 2: N:=BARSLAST(DATE<>REF(DATE,1))+1; EXIST(C>MA(C,5),N); // Indicates whether there is a K-line that satisfies the closing price greater than the 5-period moving average on the day, returns 1 if it exists, returns 0 if it does not exist- ## もし

条件関数

IF(COND,A,B)Returns A if the COND condition is true, otherwise returns B. Remarks: 1.COND is a judgment condition; A and B can be conditions or values. 2.This function supports the variable circular reference to the previous period's own variable, that is, supports the following writing Y: IF(CON,X,REF(Y,1)). Example 1: IF(ISUP,H,L); // The K-line is the positive line, the highest price is taken, otherwise the lowest price is taken Example 2: A:=IF(MA5>MA10,CROSS(DIFF,DEA),IF(CROSS(D,K),2,0)); // When MA5>MA10, check whether it satisfies the DIFF and pass through DEA, otherwise (MA5 is not greater than MA10), when K and D are dead fork, let A be assigned a value of 2, if none of the above conditions are met, A is assigned a value of 0 A=1,BPK; // When MA5>MA10, the condition for opening a long position is to cross DEA above the DIFF A=2,SPK; // When MA5 is not greater than MA10, use K and D dead forks as the conditions for opening short positions- ## IFELSE

条件関数

` IFELSE(COND,A,B) COND条件が正しければ A を返します.そうでなければ B を返します. コメント: 1.CONDは判断条件であり,AとBは条件または値である. 2.この関数は,前期

の自己変数に対する変数の円回参照をサポートします.つまり,次の文字Yをサポートします: IFELSE(CON,X,REF(Y,1)); 例1: IFELSE ((ISUP,H,L); // K線は正線で,最も高い価格が取られ,そうでなければ最も低い価格が取られます 例2: A:=IFELSE(MA5>MA10,CROSS(DIFF,DEA),IFELSE(CROSS(D,K,2,0)); // MA5>MA10がDIFFを満たし,DEAを通過するかどうかをチェックする場合は (MA5はMA10より大きくありません),KとDがデッドフォークである場合,Aに2の値が割り当てられます.上記の条件が満たされていない場合は,Aに0の値が割り当てられます. A=1,BPK; // MA5>MA10の場合,ロングポジションを開設する条件は,DIFFの上のDEAを横切ることです A=2,SPK; // MA5 が MA10 よりも大きくない場合,K と D のデッドフォークを条件として使用します

- エマの傾き計算

- 高周波取引の問題

- 新しい発見: チェーンデータ + フィールド内の取引データ = 主要なエントリー・アウトプット

- プロセス・フレームワークと多戦略の組み合わせの問題で助けを求める

- ピンスクリプトは市場データを直接切り替えるのか?

- ウェブページ 充電問題

- このグラフは数千のデータしか表示できないのか?

- 指標の王MACDは,大手同貨指数を掌握している

- tv戦略警報 FMZで注文をどのように実現するか

- この新しいTV回路のアイコンは便利ではありません.

- オーダーウォールを掌握する最先端の取引方法!

- 単位の単位は何ですか?

- 最近の年収は,正向料金の利和と逆向料金の利率で,どちらが高くなったか?

- 信号からFMZまでの遅延は1〜2秒です.

- 複数のアカウントを 1 つのディスクで操作する

- 微信は政策の通知を受けられないのか?

- 価格分布図 平均コストを把握するためにチップの分布を観察する

- リアルディスクのエラー報告問題

- なぜ小銭が再評価されないのか?

- 格子戦略