デジタル通貨スポット多種性ダブルEMA戦略 (チュートリアル)

作者: リン・ハーンFMZ~リディア, 作成日:2022-11-08 12:50:56, 更新日:2023-09-15 20:57:25 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15 更新日:2021-09-15

デザイン参照のためにマルチ多様性ダブルEMA戦略を持つことを希望するコミュニティユーザーの要請により. この記事では,マルチ多様性ダブルEMA戦略を実装します. 戦略コードについてコメントは,便利な理解と学習のために書かれます. プログラミングと定量取引の新規参加者が早くスタートできるようにします.

戦略のアイデア

双 EMA 戦略の論理は非常に単純である.つまり,二つの EMA.小さなパラメータ期間を持つ EMA (速いライン) と大きなパラメータ期間を持つ EMA (スローライン).二つのラインが金色のクロス (速いラインがスローラインを下から上へと通る) を有すると,我々は買い,ロングに行く.そして2つのラインがデッドクロス (速いラインが上から下へとスローラインを通る) を有すると,我々は売り,ショートに行く.ここで EMA を使用する.

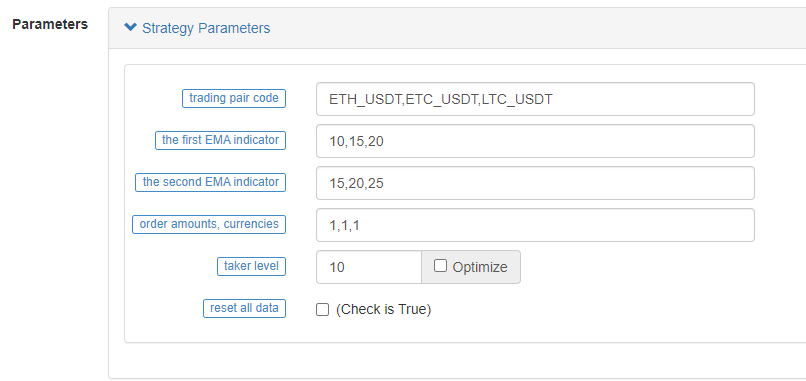

しかし,戦略は複数品種として設計されるべきで,各品種のパラメータは異なる可能性があります (異なる品種は異なるEMAパラメータを使用します).したがって,パラメータを設計するために"パラメータグループ"方法を使用する必要があります.

パラメータは文字列形式で設計され,各パラメータはコンマで分離されています. 戦略が実行開始時にこれらの文字列を解析します.実行論理は各種類 (取引ペア) にマッチします. ストラテジーローテーションは,各種類の市場,取引条件のトリガー,チャート印刷などを検出します. すべての種類が一度ローテーションされた後に,データを要約し,ステータスバーにテーブル情報を表示します.

この戦略は非常にシンプルで 新人学習に適しています 合計で200行以上のコードを使います

戦略コード

// Function: cancel all takers of the current trading pair

function cancelAll(e) {

while (true) {

var orders = _C(e.GetOrders)

if (orders.length == 0) {

break

} else {

for (var i = 0 ; i < orders.length ; i++) {

e.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// Functionn: calculate the profit/loss in real-time

function getProfit(account, initAccount, lastPrices) {

// account is the current account information, initAccount is the initial account information, lastPrices is the latest price of all varieties

var sum = 0

_.each(account, function(val, key) {

// Iterate through all current assets, calculate the currency difference of assets other than USDT, and the amount difference

if (key != "USDT" && typeof(initAccount[key]) == "number" && lastPrices[key + "_USDT"]) {

sum += (account[key] - initAccount[key]) * lastPrices[key + "_USDT"]

}

})

// Return to the profit and loss of the asset based on the current prices

return account["USDT"] - initAccount["USDT"] + sum

}

// Function: generate chart configuration

function createChartConfig(symbol, ema1Period, ema2Period) {

// symbol is the trading pair, ema1Period is the first EMA period, ema2Period is the second EMA period

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K-line data series

name: symbol,

id: symbol,

data: []

}, {

type: 'line', // EMA data series

name: symbol + ',EMA1:' + ema1Period,

data: [],

}, {

type: 'line', // EMA data series

name: symbol + ',EMA2:' + ema2Period,

data: []

}

]

}

return chart

}

function main() {

// Reset all data

if (isReset) {

_G(null) // Clear data of all persistent records

LogReset(1) // Clear all logs

LogProfitReset() // Clear all return logs

LogVacuum() //Release the resources occupied by the real bot database

Log("Reset all data", "#FF0000") // Print messages

}

// Parameter analysis

var arrSymbols = symbols.split(",") // Comma-separated string of trading varieties

var arrEma1Periods = ema1Periods.split(",") // Parameter string for splitting the first EMA

var arrEma2Periods = ema2Periods.split(",") // Parameter string for splitting the second EMA

var arrAmounts = orderAmounts.split(",") // Splitting the amount of orders placed for each variety

var account = {} // Variables used for recording current asset messages

var initAccount = {} // Variables used for recording initial asset messages

var currTradeMsg = {} // Variables used for recording whether current BAR trades

var lastPrices = {} // Variables used for recording the latest price of monitored varieties

var lastBarTime = {} // Variable used for recording the time of the last BAR, used to judge the update of BAR when drawing

var arrChartConfig = [] // Used for recording chart configuration message and draw

if (_G("currTradeMsg")) { // For example, restore currTradeMsg data when restarting

currTradeMsg = _G("currTradeMsg")

Log("Restore records", currTradeMsg)

}

// Initialize account

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol)

var arrCurrencyName = symbol.split("_")

var baseCurrency = arrCurrencyName[0]

var quoteCurrency = arrCurrencyName[1]

if (quoteCurrency != "USDT") {

throw "only support quoteCurrency: USDT"

}

if (!account[baseCurrency] || !account[quoteCurrency]) {

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

}

// Initialize chart-related data

lastBarTime[symbol] = 0

arrChartConfig.push(createChartConfig(symbol, arrEma1Periods[index], arrEma2Periods[index]))

})

if (_G("initAccount")) {

initAccount = _G("initAccount")

Log("Restore initial account records", initAccount)

} else {

// Initialize the initAccount variable with the current asset information

_.each(account, function(val, key) {

initAccount[key] = val

})

}

Log("account:", account, "initAccount:", initAccount) // Print asset information

// Initialize the chart object

var chart = Chart(arrChartConfig)

// Chart reset

chart.reset()

// Strategy main loop logic

while (true) {

// Iterate through all varieties and execute the double-EMA logic one by one

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol) // Switch the trading pair to the trading pair of symbol string record

var arrCurrencyName = symbol.split("_") // Split the trading pairs with the "_" symbol

var baseCurrency = arrCurrencyName[0] // String for trading currencies

var quoteCurrency = arrCurrencyName[1] // String for denominated currency

// Obtain the EMA parameters of the current trading pair according to the index

var ema1Period = parseFloat(arrEma1Periods[index])

var ema2Period = parseFloat(arrEma2Periods[index])

var amount = parseFloat(arrAmounts[index])

// Obtain the K-line data of the current trading pair

var r = exchange.GetRecords()

if (!r || r.length < Math.max(ema1Period, ema2Period)) { // Return directly if K-line length is insufficient

Sleep(1000)

return

}

var currBarTime = r[r.length - 1].Time // Record the current BAR timestamp

lastPrices[symbol] = r[r.length - 1].Close // Record the latest current price

var ema1 = TA.EMA(r, ema1Period) // Calculate EMA indicators

var ema2 = TA.EMA(r, ema2Period) // Calculate EMA indicators

if (ema1.length < 3 || ema2.length < 3) { // The length of EMA indicator array is too short, return directly

Sleep(1000)

return

}

var ema1Last2 = ema1[ema1.length - 2] // EMA on the penultimate BAR

var ema1Last3 = ema1[ema1.length - 3] // EMA on the third from the last BAR

var ema2Last2 = ema2[ema2.length - 2]

var ema2Last3 = ema2[ema2.length - 3]

// Write data to the chart

var klineIndex = index + 2 * index

// Iterate through the K-line data

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == lastBarTime[symbol]) { // Draw the chart, update the current BAR and indicators

// update

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

chart.add(klineIndex + 1, [r[i].Time, ema1[i]], -1)

chart.add(klineIndex + 2, [r[i].Time, ema2[i]], -1)

} else if (r[i].Time > lastBarTime[symbol]) { // Draw the charts, add BARs and indicators

// add

lastBarTime[symbol] = r[i].Time // Update timestamp

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

chart.add(klineIndex + 1, [r[i].Time, ema1[i]])

chart.add(klineIndex + 2, [r[i].Time, ema2[i]])

}

}

if (ema1Last3 < ema2Last3 && ema1Last2 > ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// Golden cross

var depth = exchange.GetDepth() // Obtain the depth data of current order book

var price = depth.Asks[Math.min(takeLevel, depth.Asks.length)].Price // Take the 10th grade price, taker

if (depth && price * amount <= account[quoteCurrency]) { // Obtain deep data normally with enough assets to place an order

exchange.Buy(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2) // Place a buy order

cancelAll(exchange) // Cancel all makers

var acc = _C(exchange.GetAccount) // Obtain account asset information

if (acc.Stocks != account[baseCurrency]) { // Detect changes in account assets

account[baseCurrency] = acc.Stocks // Update assets

account[quoteCurrency] = acc.Balance // Update assets

currTradeMsg[symbol] = currBarTime // Record that the current BAR has been traded

_G("currTradeMsg", currTradeMsg) // Persistent records

var profit = getProfit(account, initAccount, lastPrices) // Calculate profits

if (profit) {

LogProfit(profit, account, initAccount) // Print profits

}

}

}

} else if (ema1Last3 > ema2Last3 && ema1Last2 < ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// dead cross

var depth = exchange.GetDepth()

var price = depth.Bids[Math.min(takeLevel, depth.Bids.length)].Price

if (depth && amount <= account[baseCurrency]) {

exchange.Sell(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2)

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

if (acc.Stocks != account[baseCurrency]) {

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

currTradeMsg[symbol] = currBarTime

_G("currTradeMsg", currTradeMsg)

var profit = getProfit(account, initAccount, lastPrices)

if (profit) {

LogProfit(profit, account, initAccount)

}

}

}

}

Sleep(1000)

})

// Table variables in the status bar

var tbl = {

type : "table",

title : "Account Information",

cols : [],

rows : []

}

// Write data into the status bar table structure

tbl.cols.push("--")

tbl.rows.push(["initial"])

tbl.rows.push(["current"])

_.each(account, function(val, key) {

if (typeof(initAccount[key]) == "number") {

tbl.cols.push(key)

tbl.rows[0].push(initAccount[key]) // initial

tbl.rows[1].push(val) // current

}

})

// Show status bar table

LogStatus(_D(), "\n", "profit:", getProfit(account, initAccount, lastPrices), "\n", "`" + JSON.stringify(tbl) + "`")

}

}

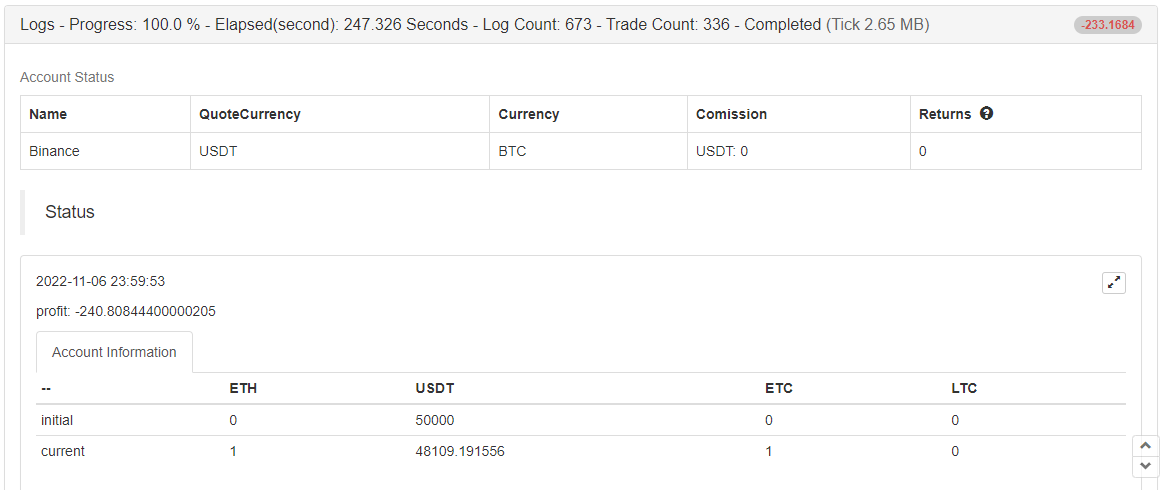

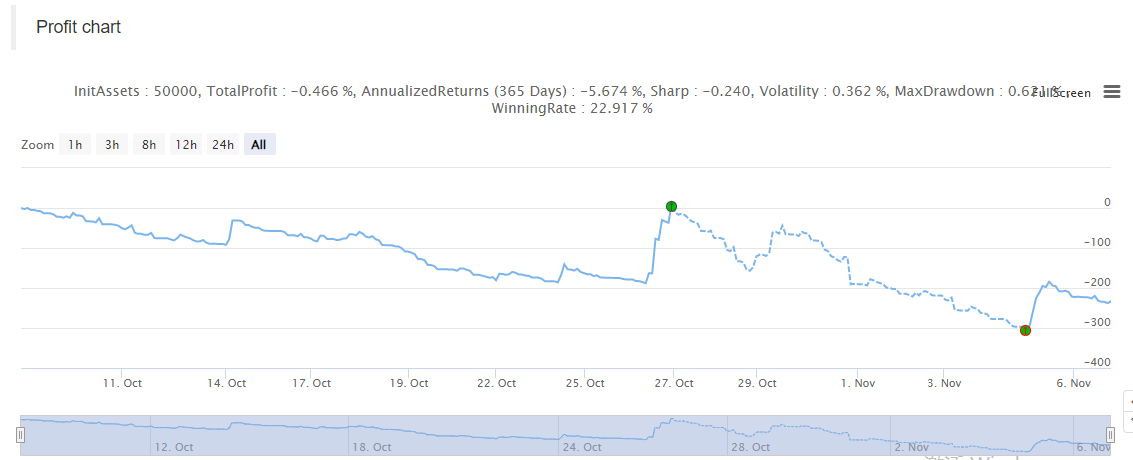

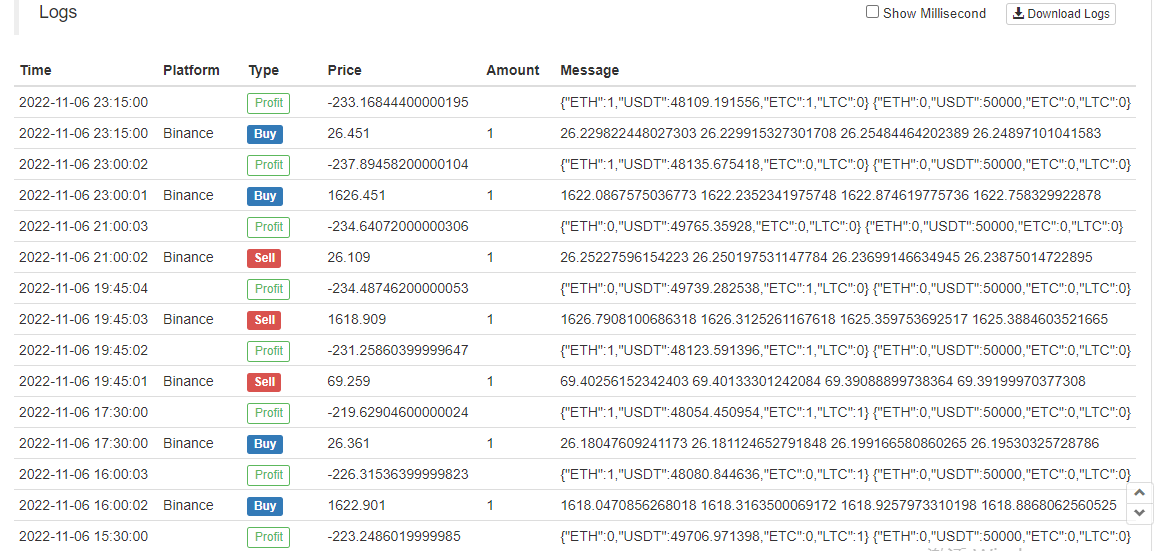

戦略のバックテスト

ETH,LTC,ETCは EMAのゴールデンクロスとデッドクロスによって起動され 取引が行われています

テスト用のシミュレーションボットも

戦略のソースコード:https://www.fmz.com/strategy/333783

戦略はバックテスト,学習戦略設計のみに使用され,実際のボットでは慎重に使用する必要があります.

- OKEXの資産移動を契約ヘッジ戦略で達成できない理由の簡潔な説明

- フューチャースの詳細な説明 バックハンドダブルアルゴリズム 戦略メモ

- 5日で80倍稼ぐ 高周波戦略の力

- メーカースポットと先物ヘジング戦略設計に関する研究と例

- SQLite で FMZ の量的なデータベースを構築する

- 戦略レンタルコードメタデータを使用して,レンタルされた戦略に異なるバージョンデータを割り当てる方法

- ビナンス永続資金調達の利息仲裁 (現在のブルマーケット年収100%)

- デジタル通貨先物 双 EMA ターニングポイント戦略 (チュートリアル)

- デジタル通貨スポットの新株戦略 (チュートリアル)

- 60行のコードでアイデアを実現する - 契約の下部漁業戦略

- FMZ Quant (2) をベースにした注文同期管理システムの設計

- デジタル通貨先物多種 ATR戦略 (チュートリアル)

- パイン言語を使用して半自動取引ツールを書く

- LeeksReaperのマジック・チェンジから 高周波戦略デザインを探索する

- リークスリーパー戦略分析 (2)

- YouTubeベテランの"マジック・ダブル・EMA戦略"

- フィッシャー指標のJavaScript言語の実装とFMZの描画

- dYdX 戦略設計の例

- FMZ Quant をベースにした注文同期管理システムの設計 (1)

- リークスリーパー戦略分析 (1)