メーカースポットと先物ヘジング戦略設計に関する研究と例

作者: リン・ハーンFMZ~リディア作成日:2022年11月09日 14:49:29 更新日:2025年11月11日 18:18:30

長い間,先物・先物ヘジングは,一般的に価格差を検出するために設計されています.価格差が満たされると,私たちはヘジングのオーダーを取ります. メーカーヘジングとして設計できますか? 答えは絶対イエスです. 今日,私はメーカーヘジングのためのデザインアイデアとコードプロトタイプを紹介します.

メーカー・ヘッジの考え

同じまたは同じタイプの主題の異なる市場で,セールスオーダーと2つの市場の購入オーダーの間に大きな差があるとき,ヘジングの機会が生じる.一般的に,我々は価格差を満たし,ヘジングポジションを保持するメーカーを行う.したがって,ヘジングには2つの目的があります.第一はポジションをヘッジすることであり,第二は,購入と販売オーダーの間の差が私たちの期待を最大限に満たすことを確保することです.この点でメーカーの取引の利点は,手数料が低いことです.デメリットは,取引を行うことは簡単ではなく,単一のポジションで取引を行うことは簡単です.

取引のアイデアは,A市場オーダーブックに購入オーダーとB市場オーダーブックに販売オーダーを配置することです.次に,アカウントの待機オーダーを確認し,チェックされた待機オーダー取引の次のステップを実行します.例えば,待機オーダーに変化が見られた場合,すぐにスポットと先物とのヘッジポジションをバランスさせ,スポットと先物とのオーバーフローポジションをカバーまたは閉鎖します.ヘッジポジションの増加に応じて,最初の待機オーダーの距離を順序の次の位置に調整し,徐々により大きなスプレッドを得るためにヘッジします.

コードデザイン

コメントはコードに直接書かれています.この例は参照設計のみに使用されており,OKEX V5 デモでテストされています.この例は完璧な戦略ではありません.参照のみに使用してください.

// Temporary parameters

var fuContractType = "quarter" // Futures contracts

var fuSymbol = "ETH_USDT" // Futures trading pairs

var spSymbol = "ETH_USDT" // Spots trading pairs

var minAmount = 0.1 // Amount per transaction, minimum transaction amount, currency

var step = 40 // Difference step length

var buff = 5 // Buffer price difference

var balanceType = "open" // When the single position transaction is balanced, open the covering position and close the closing position

var depthManager = function(fuEx, spEx, fuCt, fuSymbol, spSymbol) {

var self = {}

self.fuExDepth = null

self.spExDepth = null

self.plusPrice = null

self.minusPrice = null

self.update = function() {

spEx.SetCurrency(spSymbol)

if (!IsVirtual()) {

fuEx.SetCurrency(fuSymbol)

}

fuEx.SetContractType(fuCt)

var fuRoutine = fuEx.Go("GetDepth")

var spRoutine = spEx.Go("GetDepth")

var fuDepth = fuRoutine.wait()

var spDepth = spRoutine.wait()

if (!fuDepth || !spDepth) {

return false

}

self.fuExDepth = fuDepth

self.spExDepth = spDepth

if (fuDepth.Bids.length == 0 || fuDepth.Asks.length == 0 || spDepth.Bids.length == 0 || spDepth.Asks.length == 0) {

return false

}

self.plusPrice = fuDepth.Bids[0].Price - spDepth.Asks[0].Price // futures Bid - spot Ask

self.minusPrice = fuDepth.Asks[0].Price - spDepth.Bids[0].Price // futures Ask - spot Bid

return true

}

self.getData = function() {

return {

"fuExDepth" : self.fuExDepth,

"spExDepth" : self.spExDepth,

"plusPrice" : self.plusPrice,

"minusPrice" : self.minusPrice

}

}

return self

}

var positionManager = function(fuEx, spEx, fuCt, fuSymbol, spSymbol, step, buffDiff, balanceType, initSpAcc) {

var self = {}

self.balanceType = balanceType

self.depth = null

self.level = 1

self.lastUpdateTs = 0

self.fuPos = []

self.spPos = []

self.initSpAcc = initSpAcc

self.spAcc = null

self.hedgePos = null

self.hedgePosPrice = 0

self.minAmount = 0.01

self.offset = ["", 0]

self.update = function() {

spEx.SetCurrency(spSymbol)

if (!IsVirtual()) {

fuEx.SetCurrency(fuSymbol)

}

fuEx.SetContractType(fuCt)

self.offset = ["", 0]

var fuRoutine = fuEx.Go("GetPosition")

var spRoutine = spEx.Go("GetAccount")

var fuPos = fuRoutine.wait()

var spAcc = spRoutine.wait()

if (!fuPos || !spAcc) {

return false

}

self.fuPos = fuPos

self.spAcc = spAcc

if (!self.initSpAcc) {

return false

}

self.spPos = (spAcc.Stocks + spAcc.FrozenStocks) - (self.initSpAcc.Stocks + self.initSpAcc.FrozenStocks) // Current one minus the initial one, positive number means going long

// Check fuPos

if (fuPos.length > 1) {

return false

}

fuPosAmount = fuPos.length == 0 ? 0 : (fuPos[0].Type == PD_LONG ? fuPos[0].Amount : -fuPos[0].Amount)

if ((fuPosAmount > 0 && self.spPos > 0) || (fuPosAmount < 0 && self.spPos < 0)) {

return false

}

fuPosAmount = self.piece2Coin(fuPosAmount)

self.hedgePos = (fuPosAmount == 0 || self.spPos == 0) ? 0 : (fuPosAmount < 0 && self.spPos > 0 ? Math.min(Math.abs(fuPosAmount), Math.abs(self.spPos)) : -Math.min(Math.abs(fuPosAmount), Math.abs(self.spPos)))

var diffBalance = (spAcc.Balance + spAcc.FrozenBalance) - (self.initSpAcc.Balance + self.initSpAcc.FrozenBalance)

if (self.hedgePos == 0) {

self.hedgePosPrice = 0

} else {

self.hedgePosPrice = fuPos[0].Price - (Math.abs(diffBalance) / Math.abs(self.spPos))

}

self.offset[1] = fuPosAmount + self.spPos // If positive, long positions overflow, if negative, short positions overflow

if (fuPosAmount > 0 && self.spPos < 0) { // Reverse arbitrage

self.offset[0] = "minus"

} else if (fuPosAmount < 0 && self.spPos > 0) {

self.offset[0] = "plus"

} else if (fuPosAmount == 0 && self.spPos < 0) {

self.offset[0] = "minus"

} else if (fuPosAmount > 0 && self.spPos == 0) {

self.offset[0] = "minus"

} else if (fuPosAmount == 0 && self.spPos > 0) {

self.offset[0] = "plus"

} else if (fuPosAmount < 0 && self.spPos == 0) {

self.offset[0] = "plus"

}

return true

}

self.getData = function() {

return {

"fuPos" : self.fuPos,

"spPos" : self.spPos,

"initSpAcc" : self.initSpAcc,

"spAcc" : self.spAcc,

"hedgePos" : self.hedgePos,

"hedgePosPrice" : self.hedgePosPrice,

}

}

self.keepBalance = function(depth) {

var fuDepth = depth.fuExDepth

var spDepth = depth.spExDepth

if (self.offset[0] == "plus") {

if (self.offset[1] >= self.minAmount) {

if (self.balanceType == "close") {

// If the spot long position is excessive, close the spot long position

spEx.Sell(-1, self.offset[1])

} else if (self.balanceType == "open") {

// If the spot long position is excessive, open the future short position

fuEx.SetDirection("sell")

fuEx.Sell(-1, self.coin2Piece(Math.abs(self.offset[1])))

}

} else if (self.offset[1] <= -self.minAmount) {

if (self.balanceType == "close") {

// If the future short position is excessive, close the future short position

fuEx.SetDirection("closesell")

fuEx.Buy(-1, self.coin2Piece(Math.abs(self.offset[1])))

} else if (self.balanceType == "open") {

// If the future short position is excessive, open the spot long position

spEx.Buy(-1, spDepth.Asks[0].Price * Math.abs(self.offset[1]))

}

}

return false

} else if (self.offset[0] == "minus") {

if (self.offset[1] >= self.minAmount) {

if (self.balanceType == "close") {

// If the future long position is excessive, close the future long position

fuEx.SetDirection("closebuy")

fuEx.Sell(-1, self.coin2Piece(self.offset[1]))

} else if (self.balanceType == "open") {

// If the future long position is excessive, open the spot short position

spEx.Sell(-1, self.offset[1])

}

} else if (self.offset[1] <= -self.minAmount) {

if (self.balanceType == "close") {

// If the spot short position is excessive, close the spot short position

spEx.Buy(-1, spDepth.Asks[0].Price * Math.abs(self.offset[1]))

} else if (self.balanceType == "open") {

// If the spot short position is excessive, open the future long position

fuEx.SetDirection("buy")

fuEx.Buy(-1, self.coin2Piece(Math.abs(self.offset[1])))

}

}

return false

}

return true

}

self.process = function(depthManager) {

var ts = new Date().getTime()

var depth = depthManager.getData()

var orders = self.getOrders()

if (!orders) {

return

}

self.depth = depth

var fuOrders = orders[0]

var spOrders = orders[1]

if (fuOrders.length == 0 && spOrders.length == 0) {

// Reset level

if (self.hedgePos == 0) {

self.level = 1

} else {

self.level = Math.max(1, _N(self.hedgePos / self.minAmount, 0))

}

// Limit the maximum position

if (Math.abs(self.hedgePos) > 1) {

return

}

// Pending orders

var fuDepth = depth.fuExDepth

var spDepth = depth.spExDepth

self.update()

if (self.hedgePos >= 0 && fuDepth.Bids[0].Price - spDepth.Asks[0].Price > 0) { // Positive arbitrage

var distance = (step * self.level - (fuDepth.Asks[0].Price - spDepth.Bids[0].Price)) / 2

fuEx.SetDirection("sell")

fuEx.Sell(fuDepth.Asks[0].Price + distance, self.coin2Piece(self.minAmount), fuDepth.Asks[0].Price, "Price difference of makers:", fuDepth.Asks[0].Price + distance - (spDepth.Bids[0].Price - distance))

spEx.Buy(spDepth.Bids[0].Price - distance, self.minAmount, spDepth.Bids[0].Price)

} else if (self.hedgePos <= 0 && spDepth.Bids[0].Price - fuDepth.Asks[0].Price > 0) { // Reverse arbitrage

var distance = (step * self.level - (spDepth.Asks[0].Price - fuDepth.Bids[0].Price)) / 2

fuEx.SetDirection("buy")

fuEx.Buy(fuDepth.Bids[0].Price - distance, self.coin2Piece(self.minAmount), fuDepth.Bids[0].Price, "Price difference of makers:", spDepth.Asks[0].Price + distance - (fuDepth.Bids[0].Price - distance))

spEx.Sell(spDepth.Asks[0].Price + distance, self.minAmount, spDepth.Asks[0].Price)

}

} else if (fuOrders.length == 1 && spOrders.length == 1) {

var fuDepth = depth.fuExDepth

var spDepth = depth.spExDepth

// Judge the position

var isCancelAll = false

if (self.hedgePos >= 0 && fuDepth.Bids[0].Price - spDepth.Asks[0].Price > 0) { // Positive arbitrage

var distance = (step * self.level - (fuDepth.Asks[0].Price - spDepth.Bids[0].Price)) / 2

if (Math.abs(fuOrders[0].Price - (fuDepth.Asks[0].Price + distance)) > buffDiff || Math.abs(spOrders[0].Price - (spDepth.Bids[0].Price - distance)) > buffDiff) {

isCancelAll = true

}

} else if (self.hedgePos <= 0 && spDepth.Bids[0].Price - fuDepth.Asks[0].Price > 0) { // Reverse arbitrage

var distance = (step * self.level - (spDepth.Asks[0].Price - fuDepth.Bids[0].Price)) / 2

if (Math.abs(spOrders[0].Price - (spDepth.Asks[0].Price + distance)) > buffDiff || Math.abs(fuOrders[0].Price - (fuDepth.Bids[0].Price - distance)) > buffDiff) {

isCancelAll = true

}

} else {

isCancelAll = true

}

if (isCancelAll) {

self.cancelAll(fuEx, fuOrders)

self.cancelAll(spEx, spOrders)

self.lastUpdateTs = 0

}

} else {

self.cancelAll(fuEx, fuOrders)

self.cancelAll(spEx, spOrders)

self.lastUpdateTs = 0

}

if (ts - self.lastUpdateTs > 1000 * 60 * 2) {

self.update()

self.keepBalance(depth)

self.update()

self.lastUpdateTs = ts

}

LogStatus(_D()) // The status bar can be designed to output the data and information to be observed

}

self.getOrders = function() {

spEx.SetCurrency(spSymbol)

if (!IsVirtual()) {

fuEx.SetCurrency(fuSymbol)

}

fuEx.SetContractType(fuCt)

var fuRoutine = fuEx.Go("GetOrders")

var spRoutine = spEx.Go("GetOrders")

var fuOrders = fuRoutine.wait()

var spOrders = spRoutine.wait()

if (!fuOrders || !spOrders) {

return false

}

return [fuOrders, spOrders]

}

// Number of currency converted into contracts

self.coin2Piece = function(amount) {

if (IsVirtual()) {

if (fuEx.GetName() == "Futures_Binance") {

return amount

} else if (fuEx.GetName() == "Futures_OKCoin") {

var price = (self.depth.fuExDepth.Bids[0].Price + self.depth.fuExDepth.Asks[0].Price) / 2

return _N(amount / (100 / price), 0)

} else {

throw "not support"

}

}

if (fuEx.GetName() == "Futures_OKCoin") {

if (fuEx.GetQuoteCurrency() == "USDT") {

return _N(amount * 10, 0)

} else if (fuEx.GetQuoteCurrency() == "USD") {

var price = (self.depth.fuExDepth.Bids[0].Price + self.depth.fuExDepth.Asks[0].Price) / 2

return _N(amount / (100 / price), 0)

} else {

throw "not support"

}

} else {

throw "not support"

}

}

// Number of contracts converted into currency

self.piece2Coin = function(amount) {

if (IsVirtual()) {

if (fuEx.GetName() == "Futures_Binance") {

return amount

} else if (fuEx.GetName() == "Futures_OKCoin") {

var price = (self.depth.fuExDepth.Bids[0].Price + self.depth.fuExDepth.Asks[0].Price) / 2

return amount * 100 / price

} else {

throw "not support"

}

}

if (fuEx.GetName() == "Futures_OKCoin") {

if (fuEx.GetQuoteCurrency() == "USDT") {

return amount * 0.1

} else if (fuEx.GetQuoteCurrency() == "USD") {

var price = (self.depth.fuExDepth.Bids[0].Price + self.depth.fuExDepth.Asks[0].Price) / 2

return amount * 100 / price

} else {

throw "not support"

}

} else {

throw "not support"

}

}

self.cancelAll = function(e, orders) {

var isFirst = true

while (true) {

Sleep(500)

if (orders && isFirst) {

isFirst = false

} else {

orders = e.GetOrders()

}

if (!orders) {

continue

} else {

for (var i = 0 ; i < orders.length ; i++) {

e.CancelOrder(orders[i].Id, orders[i])

}

}

if (orders.length == 0) {

break

}

}

}

self.CoverAll = function() {

// Close all positions

// Here we can realize one-click position closing

}

self.setMinAmount = function(minAmount) {

self.minAmount = minAmount

}

self.init = function() {

while(!self.spAcc) {

self.update()

Sleep(1000)

}

if (!self.initSpAcc) {

var positionManager_initSpAcc = _G("positionManager_initSpAcc")

if (!positionManager_initSpAcc) {

self.initSpAcc = self.spAcc

_G("positionManager_initSpAcc", self.initSpAcc)

} else {

self.initSpAcc = positionManager_initSpAcc

}

} else {

_G("positionManager_initSpAcc", self.initSpAcc)

}

// Print the initial information

Log("self.initSpAcc:", self.initSpAcc.Balance, self.initSpAcc.FrozenBalance, self.initSpAcc.Stocks, self.initSpAcc.FrozenStocks)

}

self.init()

return self

}

function main() {

_G(null) // Clear the persistent data

LogReset(1) // Reset logs

// The following code can be switchedto the OKEX Demo

// exchanges[0].IO("simulate", true)

// exchanges[1].IO("simulate", true)

var dm = depthManager(exchanges[0], exchanges[1], fuContractType, fuSymbol, spSymbol)

var pm = positionManager(exchanges[0], exchanges[1], fuContractType, fuSymbol, spSymbol, step, buff, balanceType)

pm.setMinAmount(minAmount)

while (true) {

if (!dm.update()) {

Sleep(3000)

continue

}

var cmd = GetCommand()

if (cmd) {

// Handle interactions

Log("Interaction command:", cmd)

var arr = cmd.split(":")

if (arr[0] == "") {

pm.CoverAll()

}

}

pm.process(dm)

Sleep(5000)

}

}

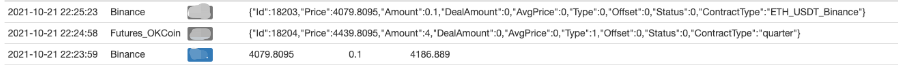

バックテスト分析

バックテストシステム

しかしこれはバックテストに過ぎません そして実際のボットでは 明らかにもっと詳細が 解明されなければなりません

- DEX取引所の定量実践 (2) -- ハイパーリキッドユーザーガイド

- DEX取引所の量化実践 (2) -- Hyperliquidの使用ガイド

- DEX取引所の定量実践 (1) -- dYdX v4 ユーザーガイド

- 暗号通貨におけるリード・レイグ・アービトラージへの導入 (3)

- DEX取引所の量化実践 ((1)-- dYdX v4 ユーザーガイド

- デジタル通貨におけるリード-ラグ套路の紹介 (3)

- 暗号通貨におけるリード・ラグ・アービトラージへの導入 (2)

- デジタル通貨におけるリード-ラグ套路の紹介 (2)

- FMZプラットフォームの外部信号受信に関する議論: 戦略におけるHttpサービス内蔵の信号受信のための完全なソリューション

- FMZプラットフォームの外部信号受信に関する探求:戦略内蔵Httpサービス信号受信の完全な方案

- 暗号通貨におけるリード・ラグ・アービトラージへの導入 (1)

- FMZ の MyLanguage に 馴染むために 知る 必要 な もの - インターフェース チャート

- 戦略のバックテストで,Sharpe比率,最大引き下げ,リターンレート,および他の指標アルゴリズムを分析します

- 分析戦略を復習する際に シャープ率,最大引き戻し,収益率などの指標のアルゴリズム

- ARMA-EGARCHモデルに基づくビットコイン変動のモデル化と分析

- [Binance Championship] ビナンス・デリバリー・コントラクト戦略3 - バターフライ・ヘッジ

- 定量取引におけるサーバーの使用

- Docker が送信した http リクエスト メッセージ を 取得 する 解決策

- OKEXの資産移動を契約ヘッジ戦略で達成できない理由の簡潔な説明

- フューチャースの詳細な説明 バックハンドダブルアルゴリズム 戦略メモ

- 5日で80倍稼ぐ 高周波戦略の力

- SQLite で FMZ の量的なデータベースを構築する

- 戦略レンタルコードメタデータを使用して,レンタルされた戦略に異なるバージョンデータを割り当てる方法

- ビナンス永続資金調達の利息仲裁 (現在のブルマーケット年収100%)

- デジタル通貨先物 双 EMA ターニングポイント戦略 (チュートリアル)

- デジタル通貨スポットの新株戦略 (チュートリアル)

- 60行のコードでアイデアを実現する - 契約の下部漁業戦略

- デジタル通貨スポット多種性ダブルEMA戦略 (チュートリアル)

- FMZ Quant (2) をベースにした注文同期管理システムの設計

- デジタル通貨先物多種 ATR戦略 (チュートリアル)

- パイン言語を使用して半自動取引ツールを書く