傾斜調整動平均

作者: リン・ハーンチャオチャン開催日:2022年5月31日 (月) 18:07:34タグ:AMA

紹介

このスクリプトは"Vitali Apirine (Stocks & Commodities V.36:5: Adaptive Moving Averages) "と"Dynamic Volume Adaptive Moving Average (MZ DVAMA) "の訂正からインスピレーションを得ました.より良い取引のために傾向をより正確に適応するために傾斜フィルタリングを使用しました. 傾斜調整により,適応動平均がトレンド状態を検出し,市場の強い価格動向,統合,ブレイクアウトに基づく意思決定を容易にする.これは単に適応動平均を使用することで不可能です. アダプティブ・ムービング・平均線曲線は傾斜に基づいて長さを変化させないが,傾向強度を検出するために傾斜適応色を使用する.

トレンド検出 緑色: 強い上昇傾向で 良い価格の勢い 赤色: 強いダウントレンド 黄色 市場が動揺したり 横向的に動いたり 安定している時です 新しいポジションを取らない方が良いのです

デフォルト設定 AMA長さは200 (時間枠が1H以上ならよりよい) 短距離は6 主要長さは14 傾斜期間は34で25が初期範囲です. 統合は常に17以下です. 警告 傾きが統合/不安定領域の外にあるとき,買い/売るアラートは続く.最高のエントリは絶対的なアラートのタイミングで,しかし他の取引はトレンド状態に基づいて中途半端に開始することができます.

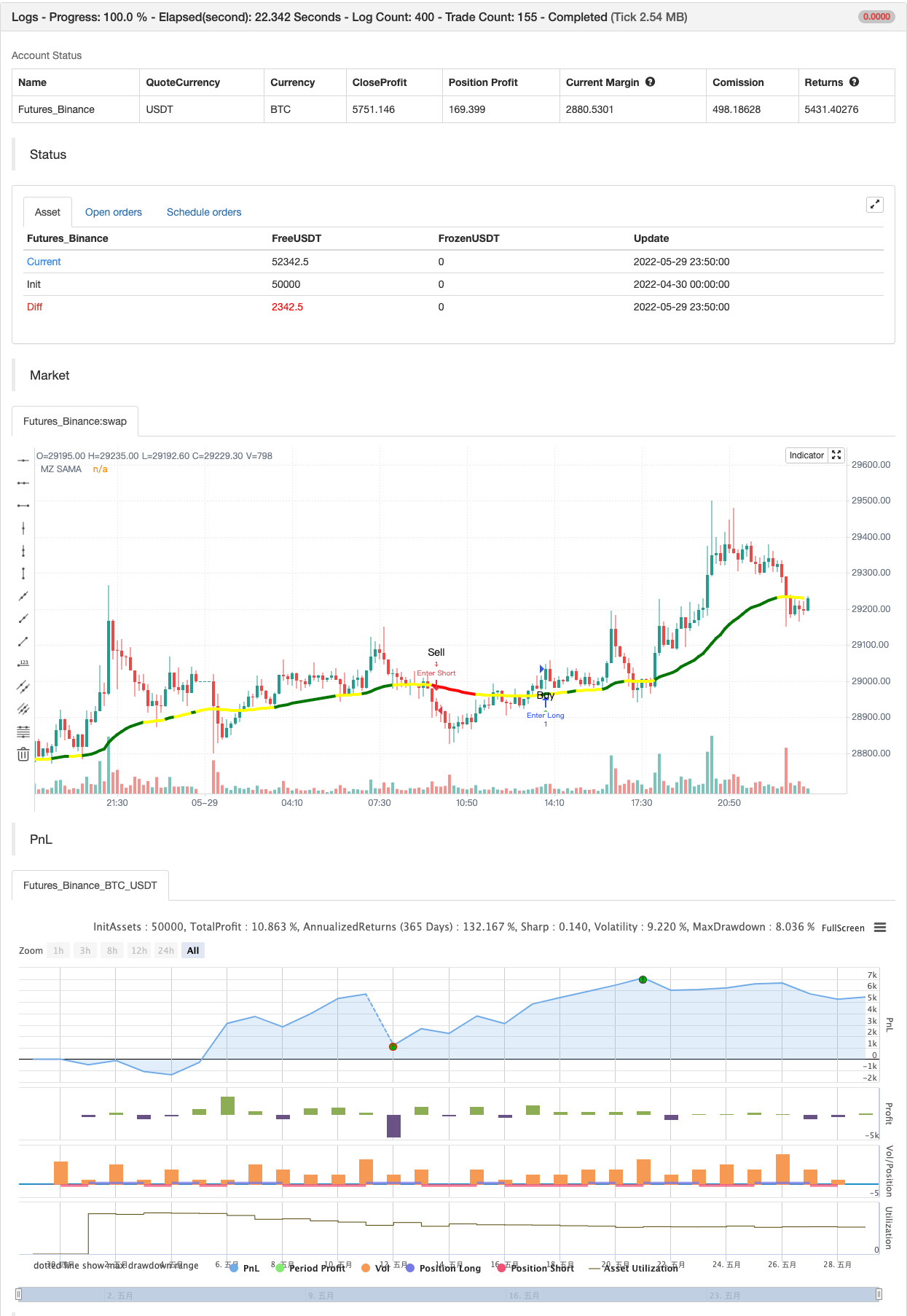

バックテスト

/*backtest

start: 2022-04-30 00:00:00

end: 2022-05-29 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MightyZinger

//@version=5

indicator('Slope Adaptive Moving Average (MZ SAMA)', shorttitle='MZ SAMA', overlay=true)

/////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////////////////////////////

///// MZ SAMA //////

/////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////////////////////////////

chartResolution = input.timeframe('', title='Chart Resolution')

src = input.source(close, 'Source')

// Length Inputs

string grp_1 = 'SAMA Length Inputs'

length = input(200, title='Adaptive MA Length', group = grp_1) // To check for Highest and Lowest value within provided period

majLength = input(14, title='Major Length', group = grp_1) // For Major alpha calculations to detect recent price changes

minLength = input(6, title='Minor Length', group = grp_1) // For Minor alpha calculations to detect recent price changes

// Slope Inputs

string grp_2 = 'Slope and Dynamic Coloring Parameters'

slopePeriod = input.int(34, title='Slope Period', group = grp_2)

slopeInRange = input.int(25, title='Slope Initial Range', group = grp_2)

flat = input.int(17, title='Consolidation area is when slope below:', group = grp_2)

bull_col = input.color(color.green, 'Bull Color ', inline='dyn_col', group = grp_2)

bear_col = input.color(color.red, 'Bear Color ', inline='dyn_col', group = grp_2)

conc_col = input.color(color.yellow, 'Reversal/Consolidation/Choppiness Color ', inline='dyn_col', group = grp_2)

showSignals = input.bool(true, title='Show Signals on Chart', group='Plot Parameters')

//Slope calculation Function to check trend strength i.e. consolidating, choppy, or near reversal

calcslope(_ma, src, slope_period, range_1) =>

pi = math.atan(1) * 4

highestHigh = ta.highest(slope_period)

lowestLow = ta.lowest(slope_period)

slope_range = range_1 / (highestHigh - lowestLow) * lowestLow

dt = (_ma[2] - _ma) / src * slope_range

c = math.sqrt(1 + dt * dt)

xAngle = math.round(180 * math.acos(1 / c) / pi)

maAngle = dt > 0 ? -xAngle : xAngle

maAngle

//MA coloring function to mark market dynamics

dynColor(_flat, slp, col_1, col_2, col_r) =>

var col = color.new(na,0)

// Slope supporting bullish uprtrend color

col := slp > _flat ? col_1:

// Slope supporting bearish downtrend color

slp <= -_flat ? col_2:

// Reversal/Consolidation/Choppiness color

slp <= _flat and slp > -_flat ? col_r : col_r

col

//AMA Calculations

ama(src,length,minLength,majLength)=>

minAlpha = 2 / (minLength + 1)

majAlpha = 2 / (majLength + 1)

hh = ta.highest(length + 1)

ll = ta.lowest(length + 1)

mult = hh - ll != 0 ? math.abs(2 * src - ll - hh) / (hh - ll) : 0

final = mult * (minAlpha - majAlpha) + majAlpha

final_alpha = math.pow(final, 2) // Final Alpha calculated from Minor and Major length along with considering Multiplication factor calculated using Highest / Lowest value within provided AMA overall length

var _ama = float(na)

_ama := (src - nz(_ama[1])) * final_alpha + nz(_ama[1])

_ama

// SAMA Definition

sama = request.security(syminfo.tickerid, chartResolution, ama(src,length,minLength,majLength))

// Slope Calculation for Dynamic Coloring

slope = calcslope(sama, src, slopePeriod, slopeInRange)

// SAMA Dynamic Coloring from slope

sama_col = request.security(syminfo.tickerid, chartResolution, dynColor(flat, slope, bull_col, bear_col, conc_col))

// SAMA Plot

plot(sama, 'MZ SAMA', sama_col, 4)

// BUY & SELL CONDITIONS AND ALERTS

_up = sama_col == bull_col

_downn = sama_col == bear_col

_chop = sama_col == conc_col

buy = _up and not _up[1]

sell = _downn and not _downn[1]

chop_zone = _chop and not _chop[1]

_signal() =>

var sig = 0

if buy and sig <= 0

sig := 1

if sell and sig >= 0

sig := -1

sig

sig = _signal()

longsignal = sig == 1 and (sig != 1)[1]

shortsignal = sig == -1 and (sig != -1)[1]

// Plotting Signals on Chart

atrOver = 1 * ta.atr(5) // Atr to place alert shape on chart

plotshape(showSignals and longsignal ? (sama - atrOver) : na , style=shape.triangleup, color=color.new(color.green, 30), location=location.absolute, text='Buy', size=size.small)

plotshape(showSignals and shortsignal ? (sama + atrOver): na , style=shape.triangledown, color=color.new(color.red, 30), location=location.absolute, text='Sell', size=size.small)

// Signals Alerts

alertcondition(longsignal, "Buy", "Go Long" )

alertcondition(shortsignal, "Sell", "Go Short")

alertcondition(chop_zone, "Chop Zone", "Possible Reversal/Consolidation/Choppiness")

if longsignal

alert("Buy at" + str.tostring(close), alert.freq_once_per_bar_close)

if shortsignal

alert("Sell at" + str.tostring(close), alert.freq_once_per_bar_close)

if longsignal

strategy.entry("Enter Long", strategy.long)

else if shortsignal

strategy.entry("Enter Short", strategy.short)

関連コンテンツ

もっと見る