の共有 -棒分析 多空の強弱指標

作者: リン・ハーン脚本家 トレッドマン, 日付: 2023-01-16 09:19:30タグ:

FMZのプラットフォームとコミュニティに返信して,戦略&コード&アイデア&テンプレートを共有する

ブログの記事 直接呼び出すことができます. K線根分析 市場多空強弱は,K線自身の閉じる位置と最近2つのK線との関係を比較することによって測定する.

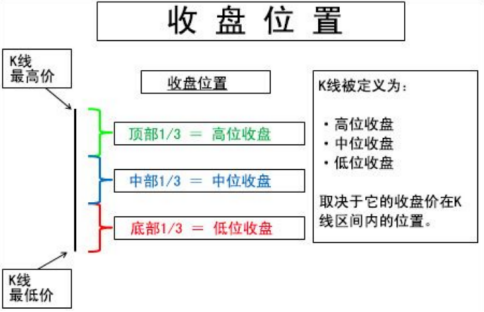

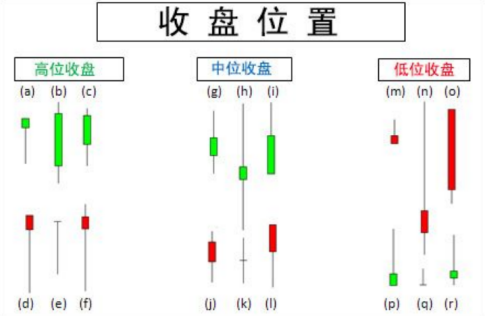

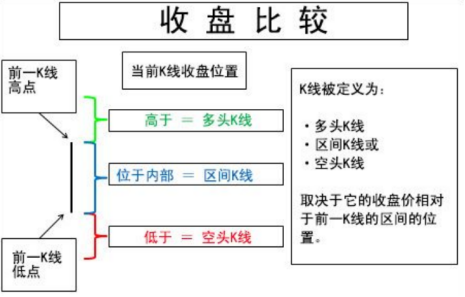

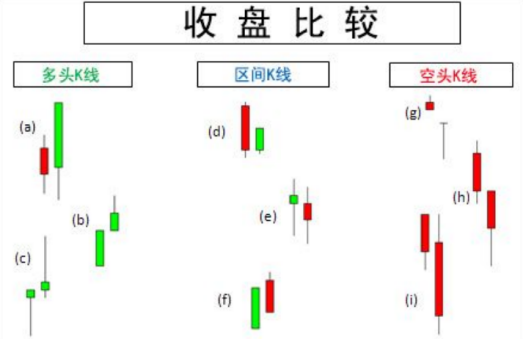

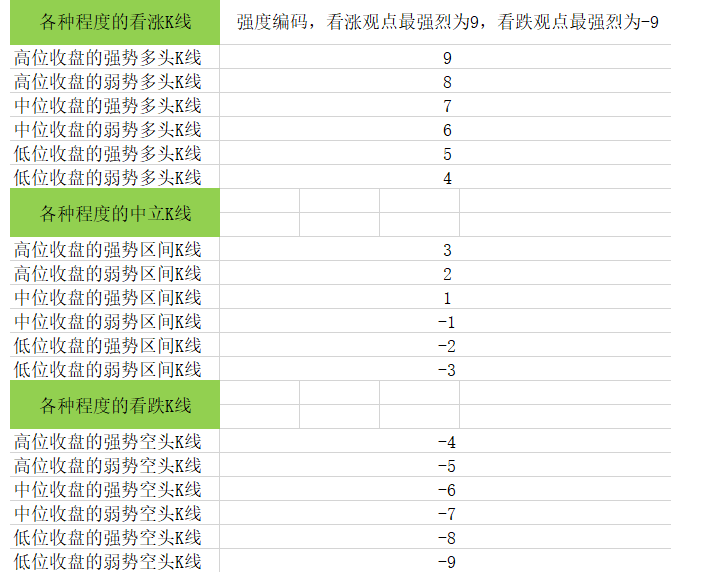

ほとんどの場合,我々は,価格運動を観察する際,閉じる価格または根K線の形状にのみ注意する.K線をよりよい方法で読み,多空間の強さを理解する方向は,より深く研究する方向である.この研究では,K線の種類を本K線と上下K線の位置と比較して多空の強さをコードする解決法を提案している.図のように,この研究では,K線を18種類に分類する.その分類には主に2つの方法がある.一つは閉じる位置が単一のK線の視点 (単一のK線の視点) を決定するのに役立つこと,二次閉じる位置の比較 (連結のK線の視点) である.閉じる位置が単一のK線を決定するのに役立つ.我々は,K線の閉じる価格が単一の価格の最高値から最低値までの範囲内にある低位を基準に,これを高位盤K線,高位盤K線の收益率と低位盤K線の收益率に分類するために定義することができます.KK線の収束は,K線の価格の強度と低位盤 (強度,強度,弱度,

合計すると,6つのK線閉盘関係と3つのK線閉盘関係を比較して合計18つのK線強弱関係を生み出します.多頭目で最も強いK線を9でコードし,最も弱いK線を-9でコードし,残りのものは順番に強い弱い関係でコードされ,結果は図のように表示されます.

合計すると,6つのK線閉盘関係と3つのK線閉盘関係を比較して合計18つのK線強弱関係を生み出します.多頭目で最も強いK線を9でコードし,最も弱いK線を-9でコードし,残りのものは順番に強い弱い関係でコードされ,結果は図のように表示されます.

協力交流,共同学習,共同進歩を歓迎します~ v:haiyanyydss

$.getClosezhubang = function(rds){

var arrclose = [];

var arropen = [];

var arrhigh = [];

var arrlow = [];

var arrzhubang = [];

for(var i in rds){

arrclose[i] = rds[i].Close;

arropen[i] = rds[i].Open;

arrhigh[i] = rds[i].High;

arrlow[i] = rds[i].Low;

if(i>1){

if(arrclose[i] >= arrhigh[i-1]){

if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*1.09;

}else if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*1.08;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*1.07;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*1.06;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*1.05;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*1.04;

}

}

else if(arrclose[i] < arrhigh[i-1] && arrclose[i] > arrlow[i-1]){

if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*1.03;

}else if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*1.02;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*1.01;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*0.99;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*0.98;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*0.97;

}

}

else if(arrclose[i] <= arrlow[i-1]){

if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*0.96;

}else if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*0.95;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*0.94;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*0.93;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*0.92;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*0.91;

}

}

}else{

arrzhubang[i] = arrclose[i];

}

}

return arrzhubang;

}

もっと

- TypeScript デモ

- サマーPlot1.0

- トップ/ボトム偏差指標監視システム with 止まり止まり

- TradingView信号実行戦略2 (教材)

- ネイティブマルチスレッドJavaScriptとWASMの性能比較

- SMA pine言語教育戦略スクリプト

- thenaスワップ取引類目録

- Uniswap V3 トレードテンプレート

共有 -ATR例平均値計算におけるエラー容認チュートリアル 共有 -ADX値が条件に達すると通知する - 断捨離する脚本

- ZT取引所のインターフェース,

プラットフォームが一時的にサポートされていない冷门取引所 ZTを接続するために使用できます - 特定のエントリからの出口

- 最高高低低止まり

- FMZ チュートリアル-Python スピードマニュアル

- FMZ チュートリアル-JavaScript ガイド

- スタンダード上昇5波減少5波戦略

- OKEX & Binance Websocket 高周波マルチシンボル取引テンプレート

- ランダムな数字で推測する

- OKXの資金移転

ウウオヤンこれはどう使われますか?