MACD をベースとした二重取引戦略

作者: リン・ハーンチャオチャン, 日付: 2023-12-07 17:11:52タグ:

概要

この戦略は,MACD指標に基づいた二重取引戦略を実装する.MACDに黄金十字がある場合,長行し,死十字がある場合,短行し,いくつかの無効なシグナルを排除するために,他の指標に基づく追加のフィルターを使用する.

戦略原則

この戦略の核心は,MACDインジケーターを使用して二方向取引を実現することである.具体的には,高速移動平均線,スロー移動平均線,MACD信号線を計算する.高速MAがスローMAを横切ると,ロングに行くための黄金十字が生成される.高速MAがスローMAを下回ると,ショートに行くための死亡十字が生成される.

いくつかの無効な信号をフィルタリングするために,戦略はフィルターとして ± 30 の範囲を設定し,MACD ヒストグラムがこの範囲を超えると取引信号が起動する.また,ポジションを閉じる時,MACD ヒストグラムの方向も判断します. 2 つの連続したヒストグラムバーの方向が変化するときにのみポジションが閉まります.

利点

- MACD指標は,両方向の価格動向に敏感な主要な取引信号として使用されます.

- 追加されたフィルタは,いくつかの無効な信号を排除するのに役立ちます.

- ポジションを閉じるための2バーの指向論理は,ある程度誤ったブレイクを回避します.

リスク

- MACD インディケーターは頻繁に取引信号を生成し,取引頻度が高くなります.

- 単一の指標に頼ると 戦略が信号遅延に脆弱になる

- ヒストグラムの方向に基づいた閉じるロジックは十分厳格ではないため,いくつかの信号を逃すリスクがあります

オプティマイゼーションの方向性

- KDJ,ボリンジャー帯など,信号確認のための他の指標と組み合わせることを検討します.

- MACDを代用するより高度な指標,例えばKDを研究する

- ストップ・ロスを設定し,単一の取引損失を制御するために利益を取ることで閉じるロジックを最適化します.

結論

概要すると,これは基本的には実行可能な二方向取引戦略である.MACD指標の利点を利用し,信号品質を制御するためにいくつかのフィルターを追加する.しかし,MACD自体にもいくつかの問題がある.戦略をより信頼性のあるものにするために,ライブ取引でのさらなるテストと最適化はまだ必要である.全体的に言えば,この戦略は二方向取引戦略の基礎を築き,強力な定量的な取引戦略になるために徐々にさらに最適化することができる.

]

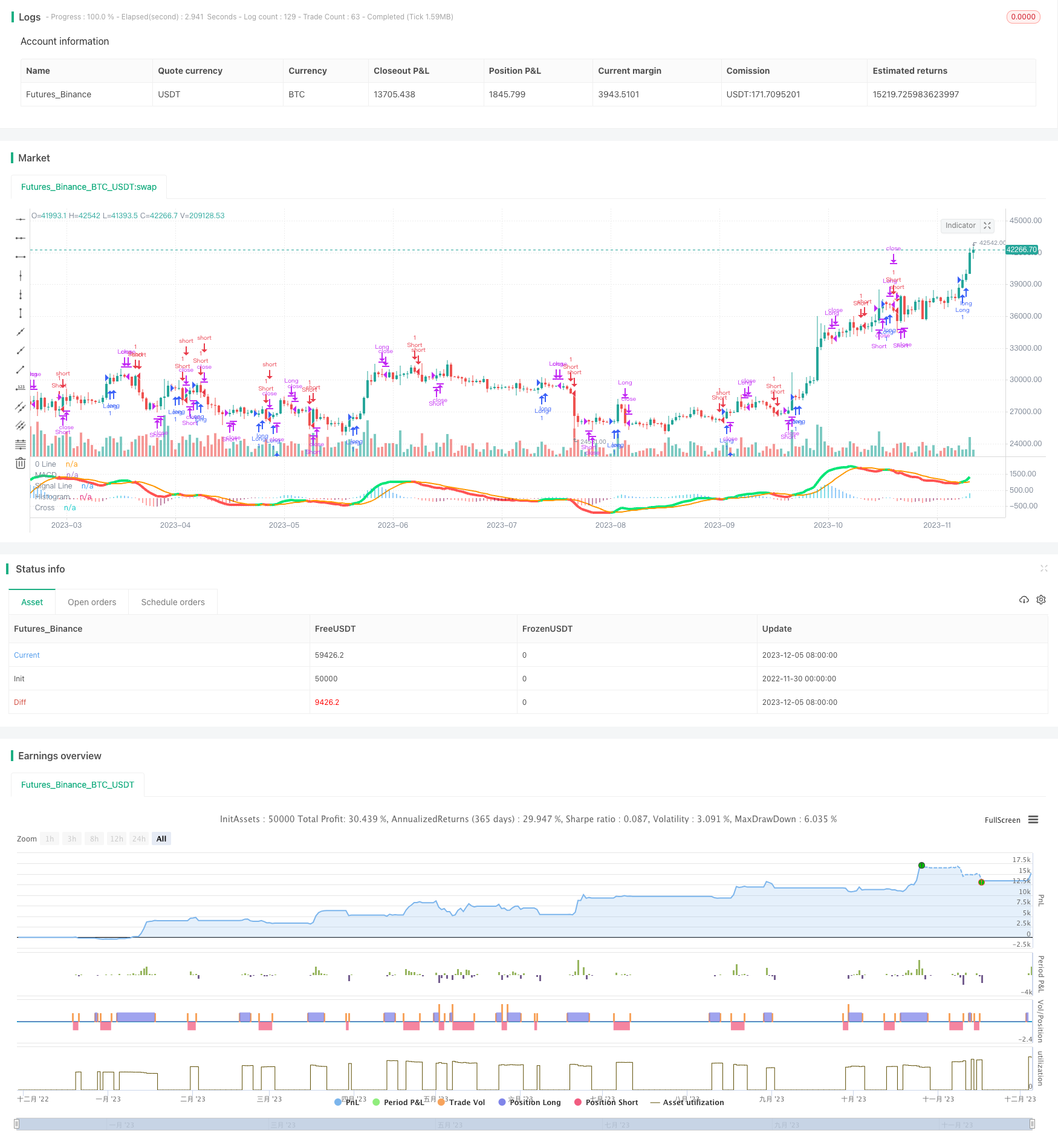

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Created by user ChrisMoody updated 4-10-2014

//Regular MACD Indicator with Histogram that plots 4 Colors Based on Direction Above and Below the Zero Line

//Update allows Check Box Options, Show MacD & Signal Line, Show Change In color of MacD Line based on cross of Signal Line.

//Show Dots at Cross of MacD and Signal Line, Histogram can show 4 colors or 1, Turn on and off Histogram.

//Special Thanks to that incredible person in Tech Support whoem I won't say you r name so you don't get bombarded with emails

//Note the feature Tech Support showed me on how to set the default timeframe of the indicator to the chart Timeframe, but also allow you to choose a different timeframe.

//By the way I fully disclose that I completely STOLE the Dots at the MAcd Cross from "TheLark"

strategy("MACD Strategy", overlay=false)

// study(title="CM_MacD_Ult_MTF", shorttitle="CM_Ult_MacD_MTF")

source = close

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="60")

smd = input(true, title="Show MacD & Signal Line? Also Turn Off Dots Below")

sd = input(true, title="Show Dots When MacD Crosses Signal Line?")

sh = input(true, title="Show Histogram?")

macd_colorChange = input(true,title="Change MacD Line Color-Signal Line Cross?")

hist_colorChange = input(true,title="MacD Histogram 4 Colors?")

res = useCurrentRes ? timeframe.period : resCustom

fastLength = input(12, minval=1), slowLength=input(26,minval=1)

signalLength=input(9,minval=1)

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

signal = sma(macd, signalLength)

hist = macd - signal

outMacD = request.security(syminfo.tickerid, res, macd)

outSignal = request.security(syminfo.tickerid, res, signal)

outHist = request.security(syminfo.tickerid, res, hist)

histA_IsUp = outHist > outHist[1] and outHist > 0

histA_IsDown = outHist < outHist[1] and outHist > 0

histB_IsDown = outHist < outHist[1] and outHist <= 0

histB_IsUp = outHist > outHist[1] and outHist <= 0

//MacD Color Definitions

macd_IsAbove = outMacD >= outSignal

macd_IsBelow = outMacD < outSignal

// strategy.entry("Long", strategy.long, 1, when = shouldPlaceLong)

// strategy.close("Long", shouldExitLong)

// strategy.entry("Short", strategy.short, 1, when = shouldPlaceShort)

// strategy.close("Short", shouldExitShort)

isWithinZeroMacd = outHist < 30 and outHist > -30

delta = hist

// shouldExitShort = false//crossover(delta, 0)

// shouldExitLong = false//crossunder(delta, 0)

// if(crossover(delta, 0))// and not isWithinZeroMacd)

// strategy.entry("Long", strategy.long, comment="Long")

// if (crossunder(delta, 0))// and not isWithinZeroMacd)

// strategy.entry("Short", strategy.short, comment="Short")

shouldPlaceLong = crossover(delta, 0)

strategy.entry("Long", strategy.long, 1, when = shouldPlaceLong)

shouldExitLong = not histA_IsUp and histA_IsDown

shouldExitShort = not histA_IsUp and not histA_IsDown and not histB_IsDown and histB_IsUp

shouldPlaceShort = crossunder(delta, 0)

strategy.entry("Short", strategy.short, 1, when = shouldPlaceShort)

// plot_color = gray

plot_color = if(hist_colorChange)

if(histA_IsUp)

aqua

else

if(histA_IsDown)

//need to sell

// if(not isWithinZeroMacd)

// shouldExitLong = true

// strategy.entry("Short", strategy.short, comment="Short")

blue

else

if(histB_IsDown)

red

else

if(histB_IsUp)

//need to buy

// if(not isWithinZeroMacd)

// shouldExitShort = true

// strategy.entry("Long", strategy.long, comment="Long")

maroon

else

yellow

else

gray

// plot_color = hist_colorChange ? histA_IsUp ? aqua : histA_IsDown ? blue : histB_IsDown ? red : histB_IsUp ? maroon :yellow :gray

macd_color = macd_colorChange ? macd_IsAbove ? lime : red : red

signal_color = macd_colorChange ? macd_IsAbove ? orange : orange : lime

circleYPosition = outSignal

plot(smd and outMacD ? outMacD : na, title="MACD", color=macd_color, linewidth=4)

plot(smd and outSignal ? outSignal : na, title="Signal Line", color=signal_color, style=line ,linewidth=2)

plot(sh and outHist ? outHist : na, title="Histogram", color=plot_color, style=histogram, linewidth=4)

plot(sd and cross(outMacD, outSignal) ? circleYPosition : na, title="Cross", style=circles, linewidth=4, color=macd_color)

// plot( isWithinZeroMacd ? outHist : na, title="CheckSmallHistBars", style=circles, linewidth=4, color=black)

hline(0, '0 Line', linewidth=2, color=white)

strategy.close("Short", shouldExitShort)

strategy.close("Long", shouldExitLong)

// fastLength = input(12)

// slowlength = input(26)

// MACDLength = input(9)

// MACD = ema(close, fastLength) - ema(close, slowlength)

// aMACD = ema(MACD, MACDLength)

// delta = MACD - aMACD

// if (crossover(delta, 0))

// strategy.entry("MacdLE", strategy.long, comment="MacdLE")

//if last two macd bars are higher than current, close long position

// if (crossunder(delta, 0))

// strategy.entry("MacdSE", strategy.short, comment="MacdSE")

//if last two macd bars are higher than current, close long position

// plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

もっと

- 賢明な定量的な底辺逆転取引戦略

- Bollinger + RSI ダブル戦略 (ロングのみ) v1.2

- CCIのゼロ・クロス・トレーディング戦略

- 2つの移動平均価格逆転のブレイクアウト戦略

- 移動平均回帰取引戦略

- 移動平均 総和 ウィリアムズ 商業 買取圧力指標 戦略

- 双動平均逆転追跡戦略

- 移動平均総和 MACD 戦略

- EMAの骨格戦略

- ランダム数に基づく定量的な取引戦略

- 黄金取引のためのEMA離脱とパラボリックSARとCCI戦略

- EMAモメンタム移動平均クロスオーバー戦略

- カマリラピホットポイント 突破と勢力の逆転 低吸収金十字戦略

- ドンチアン・チャネル ストップ・ロスト戦略

- ストラテジーをフォローする渦振動器のトレンド

- 日中のピボットポイント取引戦略

- Comb リバース EMA ボリューム ウェイト オプティマイゼーション 取引戦略

- フィボナッチゾーンDCA戦略

- ボリンジャー・バンドの逆転傾向戦略

- ストックRSIに基づく量的な取引戦略