2つの要素を組み合わせた反転と質量指数戦略

作者: リン・ハーンチャオチャン, 日付: 2023-12-26 12:20:57タグ:

概要

この戦略は,二要素モデルに基づいたコンボ逆転取引戦略である.123逆転パターンとマスインデックス要素を統合して戦略信号の累積効果を達成する.両要素が同時に購入または販売信号を発信した場合のみ,長または短に行く.

戦略の論理

123 逆転因数

この要因は123価格パターンに基づいて動作する.過去2日間の閉値関係が

質量指数因数

この要因は,価格変動範囲の拡大または収縮に基づいてトレンド逆転を判断する.範囲が拡大するにつれて,インデックスは上昇し,範囲が狭くなると,インデックスは低下する.インデックスは限界を超えると販売信号,限界を下回ると購入信号を生成する.

この戦略は,2つの要素が同じ方向に信号を発信するときにのみポジションを開くため,単一の要素からの誤った信号を避ける一方で,収益性の高い取引を達成する.

利点分析

- 双要素モデルでは,価格パターンと波動性指標を組み合わせて,より正確な信号を提示する.

- 123 パターンは地元の極限を捉える マス・インデックスは世界的なトレンド逆転点,補完的な強みを捉える

- 2つの要素が一致するときにのみ信号を受け取ると,誤った信号を避け,安定性を高めます

リスク分析

- 両方の要因が同時に誤った信号を発し,損失を引き起こす可能性があります

- 逆転の失敗率は存在し,ダウンサイドを制御するためにストップ損失を設定する必要があります

- パラメータの調節が不適切で,オーバーフィッティングにつながる可能性があります.

訓練セットを拡大し,厳格なストップ損失,マルチファクターフィルタリングなどによってリスクを軽減できます.

オプティマイゼーションの方向性

- 価格と変動指標の組み合わせをテストする

- 信号品質と動的サイズ位置を判断するためにMLモデルを追加

- ボリンジャー帯などを含めて,アルファをさらに発見します

- 安定性のために前向きに歩いて最適化

結論

この戦略は,価格パターンと変動指標という2つの要因を組み合わせ,単一の要因から誤った信号を避け,安定性を向上させ,一致するときにのみシグナルを受け取る.しかし,同時に誤った信号のリスクは残っています.データセットを拡大し,ストップ・ロスを設定し,因子組み合わせを最適化し,リスク調整されたリターンをさらに向上させることができます.

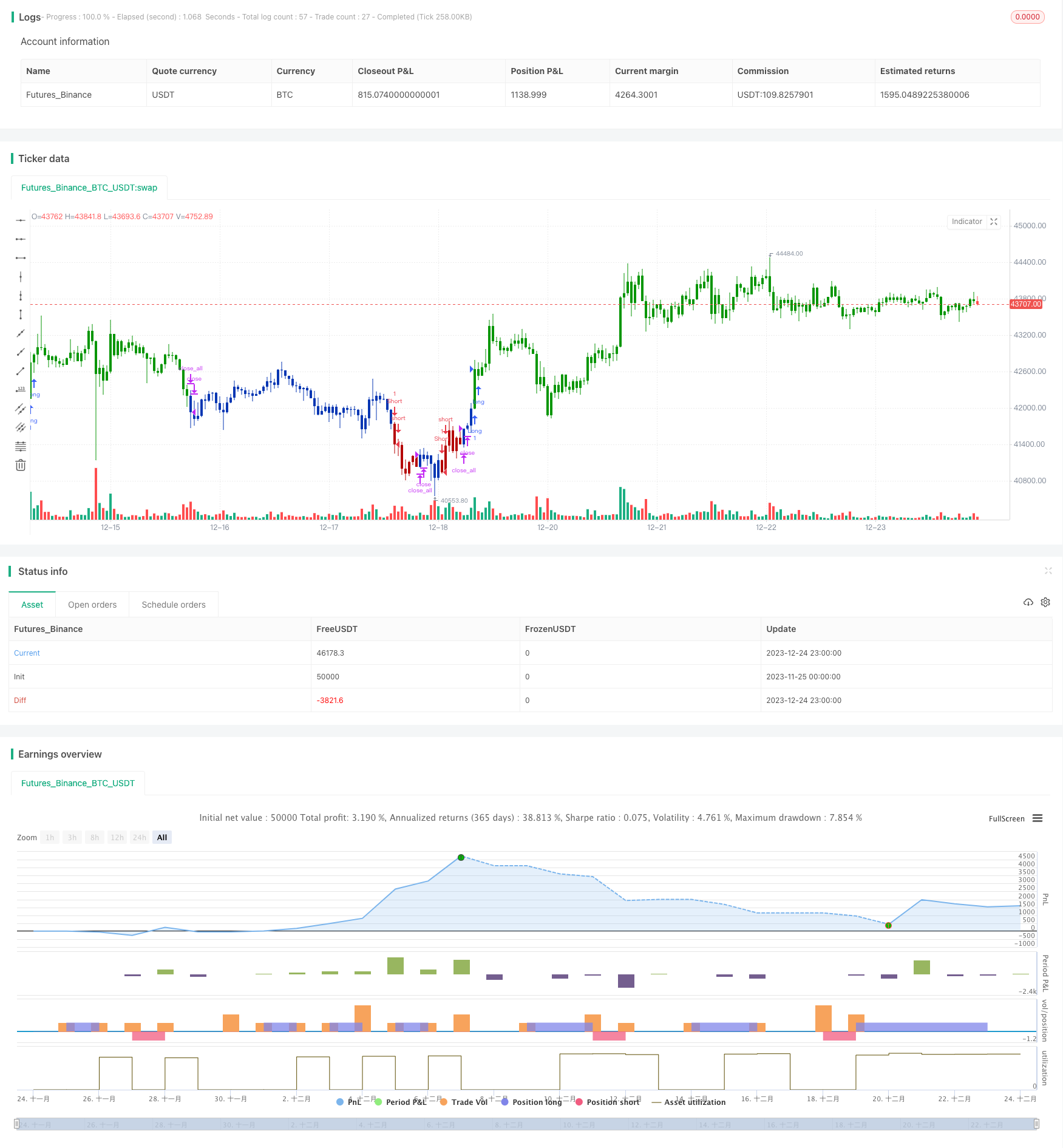

/*backtest

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 22/02/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Mass Index was designed to identify trend reversals by measuring

// the narrowing and widening of the range between the high and low prices.

// As this range widens, the Mass Index increases; as the range narrows

// the Mass Index decreases.

// The Mass Index was developed by Donald Dorsey.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

MASS(Length1,Length2,Trigger) =>

pos = 0.0

xPrice = high - low

xEMA = ema(xPrice, Length1)

xSmoothXAvg = ema(xEMA, Length1)

nRes = sum(iff(xSmoothXAvg != 0, xEMA / xSmoothXAvg, 0), Length2)

pos := iff(nRes > Trigger, -1,

iff(nRes < Trigger, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & MASS Index", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- MASS Index ----")

Length1 = input(9, minval=1)

Length2 = input(25, minval=1)

Trigger = input(26.5, step = 0.01)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posMASS = MASS(Length1,Length2,Trigger)

pos = iff(posReversal123 == 1 and posMASS == 1 , 1,

iff(posReversal123 == -1 and posMASS == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

もっと

- 移動平均的な封筒取引戦略

- 二重移動平均金十字量的な戦略

- 二重トレンドシグナルを統合する定量逆転指数戦略

- 慣性指標の取引戦略

- Bollinger Band RSI のデュアルライン戦略

- ダイナミックサポートレジスタンスのブレイクトレンド戦略

- レインボーオシレーターバックテスト戦略

- ラリー・ウィリアムズの移動平均のクロスオーバー戦略

- オシレーター差動移動平均のタイミング戦略

- ダイナミックストップ・ロスのDMIとストカスティック・トレーディング・戦略

- 二重トレンドフィルターに基づく定量的な取引戦略

- ストカスティックRSIモメントオシレーション取引戦略

- Bollinger 帯がRSI コールバックで価格を下回るときのショートセール取引戦略

- 移動平均のクロスオーバー戦略

- 動的ピボット帯に基づくトレンド追跡戦略

- ボリンジャー・バンド 戦略をフォローするモメント・トレンド

- ダイナミックな購入販売のボリュームブレークアウト戦略

- スーパートレンドMACD量的な戦略

- 4 EMAの動向戦略

- 数値指標に基づくビットコイン取引戦略