株式曲線に基づく動的ポジションサイズ戦略

作者: リン・ハーンチャオチャン開催日:2024年01月16日15時06分39秒タグ:

戦略の概要

この戦略の主なアイデアは,株式曲線の傾向に基づいてポジションサイズを動的に調整すること - 利益の間にポジションサイズを増加させ,損失の間にサイズを減少させ,全体的なリスクを制御することです. 戦略はまた,チャンデモメント指標,スーパートレンド指標,モメント指標を組み合わせて,取引信号を識別します.

戦略名

株式曲線に基づく動的ポジションサイズ戦略

戦略の論理

戦略は,株式曲線がダウントレンドにあるかどうかを判断するための2つの方法を使用します. 1) 株式曲線の速いおよび遅い単純な移動平均を計算します. 速いSMAが遅いより低い場合は,ダウントレンドとみなされます. 2) 株式曲線を,より長い期間の単純な移動平均と比較して計算します.

株式曲線の下落傾向が決定されたとき,ポジションサイズは設定に基づいて一定パーセント減少または増加します.例えば,50%の削減が設定されている場合,元の10%のポジションサイズは5%に減少します.このメカニズムは,総リスクを管理するために,利益中にポジションサイズを増やし,損失中にサイズを減少させます.

利点

- 総利益/損失を判断するために株式率曲線を使用し,リスクを制御するためにポジションサイズを動的に調整します

- 複数の指標を組み合わせて 入国信号を特定することで 勝利率を上げる

- ポジション調整のパラメータは,異なるリスクアピートに対応します.

リスク

- 損失は,利益の発生時にポジションの大きさが増加すると増幅される.

- パラメータの設定が不適切であるため,攻撃的な調整

- ポジションサイズだけでは システムリスクは完全に回避できない

改善の方向性

- 異なる位置調整パラメータの試験効果

- 株式曲線傾向を決定するために他の指標を試す

- 勝利率を向上させるためにエントリー条件を最適化

結論

この戦略の全体的な論理は明らかである.これは,株式曲線に基づいてポジションサイズを動的に調整し,リスクを効果的に制御するのに役立ちます.攻撃的なマニュアルのリスクを避けるために,パラメータとストップロスの戦略のさらなるテストと最適化が必要です.

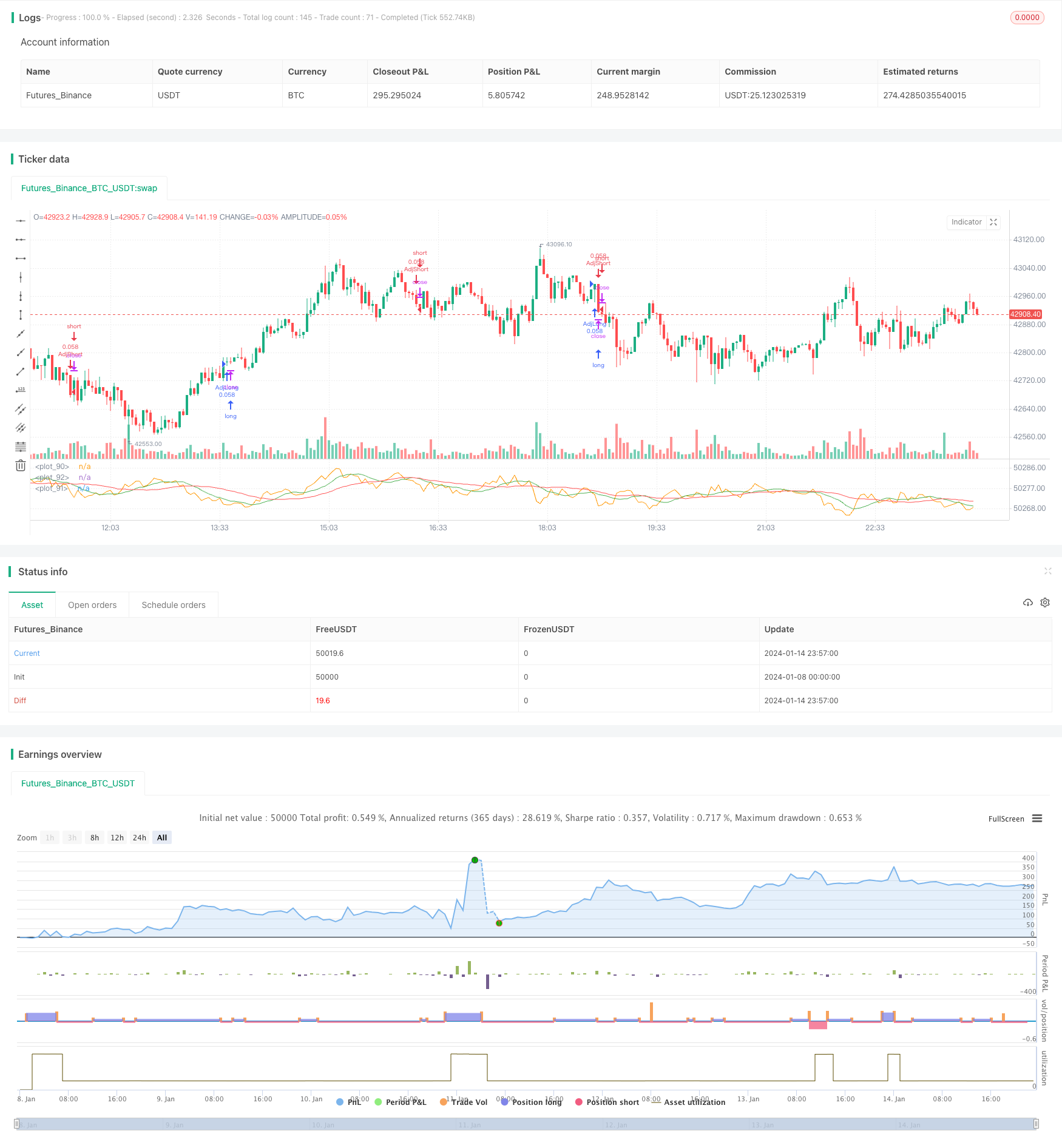

/*backtest

start: 2024-01-08 00:00:00

end: 2024-01-15 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shardison

//@version=5

//EXPLANATION

//"Trading the equity curve" as a risk management method is the

//process of acting on trade signals depending on whether a system’s performance

//is indicating the strategy is in a profitable or losing phase.

//The point of managing equity curve is to minimize risk in trading when the equity curve is in a downtrend.

//This strategy has two modes to determine the equity curve downtrend:

//By creating two simple moving averages of a portfolio's equity curve - a short-term

//and a longer-term one - and acting on their crossings. If the fast SMA is below

//the slow SMA, equity downtrend is detected (smafastequity < smaslowequity).

//The second method is by using the crossings of equity itself with the longer-period SMA (equity < smasloweequity).

//When "Reduce size by %" is active, the position size will be reduced by a specified percentage

//if the equity is "under water" according to a selected rule. If you're a risk seeker, select "Increase size by %"

//- for some robust systems, it could help overcome their small drawdowns quicker.

strategy("Use Trading the Equity Curve Postion Sizing", shorttitle="TEC", default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital = 100000)

//TRADING THE EQUITY CURVE INPUTS

useTEC = input.bool(true, title="Use Trading the Equity Curve Position Sizing")

defulttraderule = useTEC ? false: true

initialsize = input.float(defval=10.0, title="Initial % Equity")

slowequitylength = input.int(25, title="Slow SMA Period")

fastequitylength = input.int(9, title="Fast SMA Period")

seedequity = 100000 * .10

if strategy.equity == 0

seedequity

else

strategy.equity

slowequityseed = strategy.equity > seedequity ? strategy.equity : seedequity

fastequityseed = strategy.equity > seedequity ? strategy.equity : seedequity

smaslowequity = ta.sma(slowequityseed, slowequitylength)

smafastequity = ta.sma(fastequityseed, fastequitylength)

equitycalc = input.bool(true, title="Use Fast/Slow Avg", tooltip="Fast Equity Avg is below Slow---otherwise if unchecked uses Slow Equity Avg below Equity")

sizeadjstring = input.string("Reduce size by (%)", title="Position Size Adjustment", options=["Reduce size by (%)","Increase size by (%)"])

sizeadjint = input.int(50, title="Increase/Decrease % Equity by:")

equitydowntrendavgs = smafastequity < smaslowequity

slowequitylessequity = strategy.equity < smaslowequity

equitymethod = equitycalc ? equitydowntrendavgs : slowequitylessequity

if sizeadjstring == ("Reduce size by (%)")

sizeadjdown = initialsize * (1 - (sizeadjint/100))

else

sizeadjup = initialsize * (1 + (sizeadjint/100))

c = close

qty = 100000 * (initialsize / 100) / c

if useTEC and equitymethod

if sizeadjstring == "Reduce size by (%)"

qty := (strategy.equity * (initialsize / 100) * (1 - (sizeadjint/100))) / c

else

qty := (strategy.equity * (initialsize / 100) * (1 + (sizeadjint/100))) / c

//EXAMPLE TRADING STRATEGY INPUTS

CMO_Length = input.int(defval=9, minval=1, title='Chande Momentum Length')

CMO_Signal = input.int(defval=10, minval=1, title='Chande Momentum Signal')

chandeMO = ta.cmo(close, CMO_Length)

cmosignal = ta.sma(chandeMO, CMO_Signal)

SuperTrend_atrPeriod = input.int(10, "SuperTrend ATR Length")

SuperTrend_Factor = input.float(3.0, "SuperTrend Factor", step = 0.01)

Momentum_Length = input.int(12, "Momentum Length")

price = close

mom0 = ta.mom(price, Momentum_Length)

mom1 = ta.mom( mom0, 1)

[supertrend, direction] = ta.supertrend(SuperTrend_Factor, SuperTrend_atrPeriod)

stupind = (direction < 0 ? supertrend : na)

stdownind = (direction < 0? na : supertrend)

//TRADING CONDITIONS

longConditiondefault = ta.crossover(chandeMO, cmosignal) and (mom0 > 0 and mom1 > 0 and close > stupind) and defulttraderule

if (longConditiondefault)

strategy.entry("DefLong", strategy.long, qty=qty)

shortConditiondefault = ta.crossunder(chandeMO, cmosignal) and (mom0 < 0 and mom1 < 0 and close < stdownind) and defulttraderule

if (shortConditiondefault)

strategy.entry("DefShort", strategy.short, qty=qty)

longCondition = ta.crossover(chandeMO, cmosignal) and (mom0 > 0 and mom1 > 0 and close > stupind) and useTEC

if (longCondition)

strategy.entry("AdjLong", strategy.long, qty = qty)

shortCondition = ta.crossunder(chandeMO, cmosignal) and (mom0 < 0 and mom1 < 0 and close < stdownind) and useTEC

if (shortCondition)

strategy.entry("AdjShort", strategy.short, qty = qty)

plot(strategy.equity)

plot(smaslowequity, color=color.new(color.red, 0))

plot(smafastequity, color=color.new(color.green, 0))

もっと

- イチモク・キンコ・ヒョウ 脱出戦略

- ADXモメンタムトレンド戦略

- 123 逆転点とピボットポイントの組み合わせ戦略

- 移動平均値とストカスティックRSIの組み合わせの取引戦略

- 動的トレンド追跡逆転戦略

- 日々のDCA戦略とEMAの接触

- トレンド強度 バース戦略の確認

- 超トレンド 双動平均戦略

- WaveTrend と DER に 基づく スウィング トレーディング 戦略

- ハル・フィッシャー 適応型 インテリジェント 多要素戦略

- 双重トレンド追跡戦略

- アダプティブ・インテリジェント・グリッド・トレーディング・戦略

- トレンド追跡逆転戦略

- 価格チャネルブレイク戦略

- SAR 交代期間の取引戦略

- EMA/MAのクロスオーバーオプション取引戦略

- RMI トレンドシンクロ戦略

- マルチタイムフレームMACD移動平均取引戦略

- ADX ダイナミックトレンド戦略

- トレンド フォロー 戦略 ハルスの移動平均値と真の範囲をベースに