概要

この戦略は”Jancok Strategycs v3”と呼ばれ,移動平均 ((MA),移動平均の収束散度 ((MACD),相対的に強い指標 ((RSI) と平均実際の範囲 ((ATR) に基づく多指標のトレンド追跡戦略である.この戦略の主な構想は,複数の指標の組み合わせを使用して市場トレンドを判断し,トレンドの方向で取引することです.この戦略は,ダイナミックなストップとストップの方法,およびリスク管理を制御し,収益を最適化するためにATRに基づいたリスク管理も採用しています.

戦略原則

この戦略は,次の4つの指標を使って市場動向を判断します.

- 移動平均 ((MA):短期 ((9周期) と長期 ((21周期) の移動平均を計算し,短期平均線上を長期平均線に切ると上昇傾向を示し,短期平均線下を長期平均線に切ると下降傾向を示します.

- 移動平均線収束散度 ((MACD):MACD線と信号線を計算し,MACD線上を通過すると上昇傾向を示し,MACD線下を通過すると下降傾向を示します.

- 比較的強い指標 ((RSI):RSIを14サイクル計算し,RSIが70を超えると,市場が過剰買いする可能性を示し,RSIが30未満になると,市場が過剰売りする可能性を示します.

- 平均リアルレンジ ((ATR):市場の波動性を測定し,ストップ・ローズ・ストップポイントを設定するために14サイクルATRを計算する.

この戦略の取引論理は以下の通りです.

- 短期平均線が長期平均線,MACD線が信号線を穿越し,取引量が移動平均線より大きく,波動率が値より低いとき,多項を開きます.

- 短期平均線が長期平均線を横切り,MACD線が信号線を横切り,取引量が移動平均線より大きく,波動率が値より低いとき,空券を開く.

- 止損と止止点はATRの動的設定により,止損点はATRの2倍,止止点はATRの4倍である.

- ATR ベースの追跡ストップを選択できます.追跡ストップポイントはATR の2.5倍です.

戦略的優位性

- 複数の指標を組み合わせてトレンドを判断し,トレンド判断の精度を高めます.

- ダイナミックなストップとストップは,市場の波動性に応じて自律的に調整し,リスクをよりよく制御し,利益を最適化します.

- 取引量と波動率のフィルタを導入し,低流動性および高波動性の時に取引を避けるため,偽信号を減らす.

- ストップ・ロスを選択し,トレンドが続く限り,より多くの利益を保持できます.

戦略リスク

- 市場が揺れ動いた時やトレンドが逆転したときに,誤った信号が生み出され,損失を招く可能性があります.

- パラメータの設定は戦略のパフォーマンスに大きく影響し,異なる市場と資産に応じて最適化する必要があります.

- 過度に最適化されたパラメータは,過度に適合し,実際の取引で不良なパフォーマンスを引き起こす可能性があります.

- 市場の異常な波動やブラック・スウェン事件が発生した場合,戦略は大きな損失を負う可能性があります.

戦略最適化の方向性

- ブリン・バンドやランダムな指標などの指標を導入することで,トレンド判断の精度がさらに向上する.

- 遺伝的アルゴリズム,格子検索などの方法を使用して最適のパラメータの組み合わせを見つける.

- 異なる市場と資産に対して異なるパラメータとルールを設定し,戦略の適応性を向上させる.

- ポジション管理に参加し,市場トレンドの強さと口座のリスクに応じてポジションの大きさを動的に調整します.

- 最大引き出し制限を設定し,口座が最大引き出しに達すると取引を一時停止またはポジションを小さくし,リスクを制御する.

要約する

“Jancok Strategycs v3”は,複数の指標の組み合わせに基づいたトレンド追跡戦略で,移動平均,MACD,RSI,ATRなどの指標によって市場のトレンドを判断し,動的ストップとトラッキングストップなどのリスク管理手段を使用して,リスクを制御し,収益を最適化します.この戦略の優点は,トレンド判断の正確性が高く,リスク管理の柔軟性があり,適応性が強いということです.しかしながら,偽信号,パラメータ設定の感受性,黒天事件などの一定のリスクもあります.将来,より多くの指標,パラメータの最適化を選択し,ポジション管理に加わり,最大リトロール制限などの方法を設定することで,戦略の性能と安定性をさらに向上させることができます.

ストラテジーソースコード

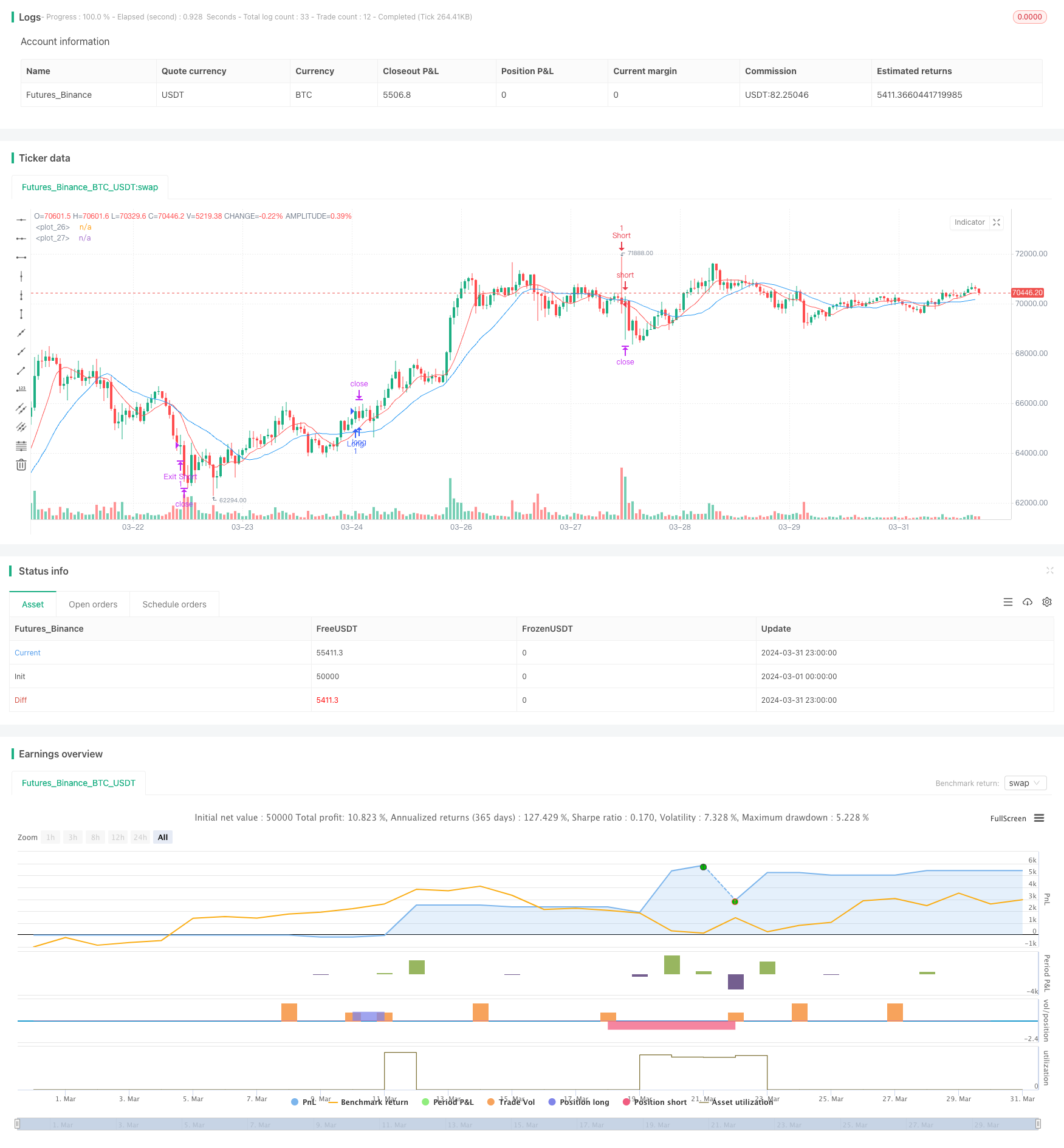

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © financialAccou42381

//@version=5

strategy("Jancok Strategycs v3", overlay=true, initial_capital=100, currency="USD")

// Inputs

short_ma_length = input.int(9, title="Short MA Length", minval=1)

long_ma_length = input.int(21, title="Long MA Length", minval=1)

atr_multiplier_for_sl = input.float(2, title="ATR Multiplier for Stop Loss", minval=1.0)

atr_multiplier_for_tp = input.float(4, title="ATR Multiplier for Take Profit", minval=1.0)

volume_ma_length = input.int(20, title="Volume MA Length", minval=1)

volatility_threshold = input.float(1.5, title="Volatility Threshold", minval=0.1, step=0.1)

use_trailing_stop = input.bool(false, title="Use Trailing Stop")

trailing_stop_atr_multiplier = input.float(2.5, title="Trailing Stop ATR Multiplier", minval=1.0)

// Calculating indicators

short_ma = ta.sma(close, short_ma_length)

long_ma = ta.sma(close, long_ma_length)

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

atr = ta.atr(14)

volume_ma = ta.sma(volume, volume_ma_length)

volatility = atr / close

// Plotting indicators

plot(short_ma, color=color.red)

plot(long_ma, color=color.blue)

// Defining entry conditions with added indicators and filters

long_condition = ta.crossover(short_ma, long_ma) and (macdLine > signalLine) and (volume > volume_ma) and (volatility < volatility_threshold)

short_condition = ta.crossunder(short_ma, long_ma) and (macdLine < signalLine) and (volume > volume_ma) and (volatility < volatility_threshold)

// Entering trades with dynamic stop loss and take profit based on ATR

if (long_condition)

strategy.entry("Long", strategy.long)

if use_trailing_stop

strategy.exit("Exit Long", "Long", trail_points=atr * trailing_stop_atr_multiplier, trail_offset=atr * 0.5)

else

strategy.exit("Exit Long", "Long", loss=atr * atr_multiplier_for_sl, profit=atr * atr_multiplier_for_tp)

if (short_condition)

strategy.entry("Short", strategy.short)

if use_trailing_stop

strategy.exit("Exit Short", "Short", trail_points=atr * trailing_stop_atr_multiplier, trail_offset=atr * 0.5)

else

strategy.exit("Exit Short", "Short", loss=atr * atr_multiplier_for_sl, profit=atr * atr_multiplier_for_tp)