概要

この戦略は,枢軸分析に基づいた高度な取引システムで,市場の重要な転換点を特定して,潜在的なトレンドの逆転を予測する.この戦略は,革新的な”枢軸の枢軸”のアプローチを採用し,波動率指標ATRと組み合わせてポジション管理を行い,完全な取引システムを形成する.この戦略は,複数の市場に適用され,異なる市場の特性に応じてパラメータを最適化することができる.

戦略原則

戦略の核心は,市場逆転の機会を2層の枢軸分析で識別することです. 一層の枢軸は,基本的な高低点であり,二層の枢軸は,一層の枢軸から選択された顕著な転換点です. 価格がこれらの重要なレベルを突破すると,システムは取引信号を生成します. 同時に,戦略は,市場波動性を測定するためにATR指標を使用し,ストップ・ロストの位置とポジションの大きさを決定します.

戦略的優位性

- 適応性:戦略は,異なる市場環境に適応し,パラメータを調整することで,異なる変動率レベルに適応します.

- リスク管理の改善:ATRは,市場変動に応じて保護措置を自動的に調整できるダイナミックな止損設定を使用する.

- 多層確認: 2層のハブポイント分析により,偽突破のリスクを低減した.

- 柔軟なポジション管理:口座規模と市場の変動動向に応じてポジションのサイズを調整する.

- 明確な入場規則: 明確な信号確認メカニズムがあり,主観的な判断を減らす.

戦略リスク

- スライドリスク: 波動が強い市場では大きなスライドのリスクがある.

- 偽の突破リスク: 市場の揺れが誤ったシグナルを生む可能性があります.

- 過剰レバレッジの危険性:不正なレバレッジの使用は,重大な損失をもたらす可能性があります.

- パラメータ最適化のリスク: 過度な最適化は過適合につながる可能性があります.

戦略最適化の方向性

- シグナルフィルター: トレンドフィルターを追加して,主要トレンドの方向のみで取引する.

- ダイナミックパラメータ:市場の状況に応じて,枢軸ポイントパラメータを自動的に調整する.

- 多時間周期: 精度向上のために多時間周期確認を追加します.

- スマート・ストップ: ストップ・ストップを追跡するなど,よりスマートなストップ戦略を開発する.

- リスク管理:関連性分析などのリスク管理の追加

要約する

これは,よく設計されたトレンド反転取引戦略であり,二重軸点分析とATR変動率管理により,安定した取引システムを構築している.この戦略の優点は,その適応性が強く,リスク管理が完璧であることにあるが,依然として,トレーダーが利子を慎重に使用し,パラメータを継続的に最適化する必要がある.推奨された最適化方向によって,戦略は,向上する余地がある.この戦略は,安定したタイプのトレーダーに適しており,深入の研究と実践に値する取引システムである.

ストラテジーソースコード

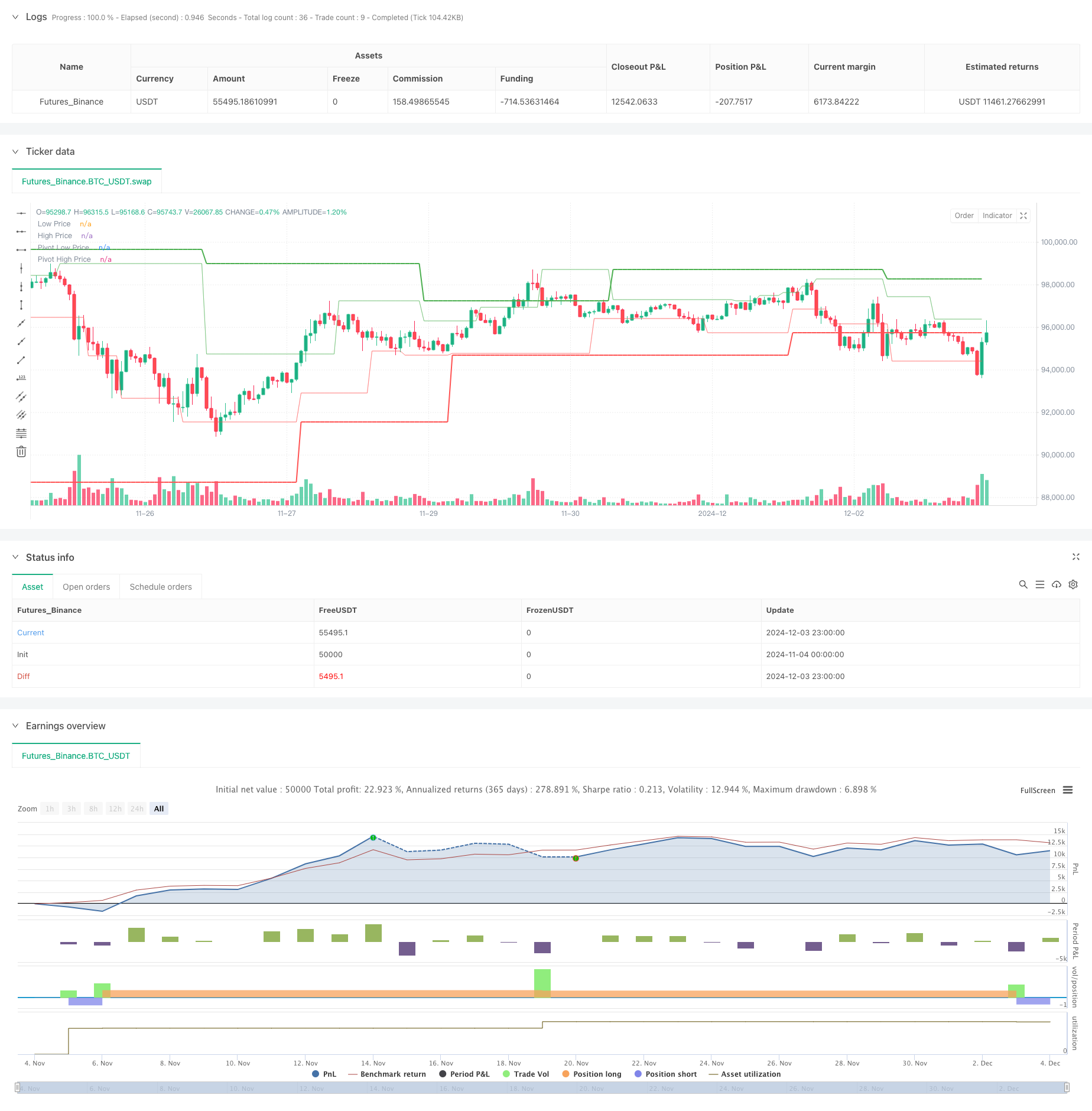

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Pivot of Pivot Reversal Strategy [MAD]", shorttitle="PoP Reversal Strategy", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// Inputs with Tooltips

leftBars = input.int(4, minval=1, title='PP Left Bars', tooltip='Number of bars to the left of the pivot point. Increasing this value makes the pivot more significant.')

rightBars = input.int(2, minval=1, title='PP Right Bars', tooltip='Number of bars to the right of the pivot point. Increasing this value delays the pivot detection but may reduce false signals.')

atr_length = input.int(14, minval=1, title='ATR Length', tooltip='Length for ATR calculation. ATR is used to assess market volatility.')

atr_mult = input.float(0.1, minval=0.0, step=0.1, title='ATR Multiplier', tooltip='Multiplier applied to ATR for pivot significance. Higher values require greater price movement for pivots.')

allowLongs = input.bool(true, title='Allow Long Positions', tooltip='Enable or disable long positions.')

allowShorts = input.bool(true, title='Allow Short Positions', tooltip='Enable or disable short positions.')

margin_amount = input.float(1.0, minval=1.0, maxval=100.0, step=1.0, title='Margin Amount (Leverage)', tooltip='Set the leverage multiplier (e.g., 3x, 5x, 10x). Note: Adjust leverage in strategy properties for accurate results.')

risk_reward_enabled = input.bool(false, title='Enable Risk/Reward Ratio', tooltip='Enable or disable the use of a fixed risk/reward ratio for trades.')

risk_reward_ratio = input.float(1.0, minval=0.1, step=0.1, title='Risk/Reward Ratio', tooltip='Set the desired risk/reward ratio (e.g., 1.0 for 1:1).')

risk_percent = input.float(1.0, minval=0.1, step=0.1, title='Risk Percentage per Trade (%)', tooltip='Percentage of entry price to risk per trade.')

trail_stop_enabled = input.bool(false, title='Enable Trailing Stop Loss', tooltip='Enable or disable the trailing stop loss.')

trail_percent = input.float(0.5, minval=0.0, step=0.1, title='Trailing Stop Loss (%)', tooltip='Percentage for trailing stop loss.')

start_year = input.int(2018, title='Start Year', tooltip='Backtest start year.')

start_month = input.int(1, title='Start Month', tooltip='Backtest start month.')

start_day = input.int(1, title='Start Day', tooltip='Backtest start day.')

end_year = input.int(2100, title='End Year', tooltip='Backtest end year.')

end_month = input.int(1, title='End Month', tooltip='Backtest end month.')

end_day = input.int(1, title='End Day', tooltip='Backtest end day.')

date_start = timestamp(start_year, start_month, start_day, 00, 00)

date_end = timestamp(end_year, end_month, end_day, 00, 00)

time_cond = time >= date_start and time <= date_end

// Pivot High Significant Function

pivotHighSig(left, right) =>

pp_ok = true

atr = ta.atr(atr_length)

for i = 1 to left

if high[right] < high[right + i] + atr * atr_mult

pp_ok := false

for i = 0 to right - 1

if high[right] < high[i] + atr * atr_mult

pp_ok := false

pp_ok ? high[right] : na

// Pivot Low Significant Function

pivotLowSig(left, right) =>

pp_ok = true

atr = ta.atr(atr_length)

for i = 1 to left

if low[right] > low[right + i] - atr * atr_mult

pp_ok := false

for i = 0 to right - 1

if low[right] > low[i] - atr * atr_mult

pp_ok := false

pp_ok ? low[right] : na

swh = pivotHighSig(leftBars, rightBars)

swl = pivotLowSig(leftBars, rightBars)

swh_cond = not na(swh)

var float hprice = 0.0

hprice := swh_cond ? swh : nz(hprice[1])

le = false

le := swh_cond ? true : (le[1] and high > hprice ? false : le[1])

swl_cond = not na(swl)

var float lprice = 0.0

lprice := swl_cond ? swl : nz(lprice[1])

se = false

se := swl_cond ? true : (se[1] and low < lprice ? false : se[1])

// Pivots of pivots

var float ph1 = 0.0

var float ph2 = 0.0

var float ph3 = 0.0

var float pl1 = 0.0

var float pl2 = 0.0

var float pl3 = 0.0

var float pphprice = 0.0

var float pplprice = 0.0

ph3 := swh_cond ? nz(ph2[1]) : nz(ph3[1])

ph2 := swh_cond ? nz(ph1[1]) : nz(ph2[1])

ph1 := swh_cond ? hprice : nz(ph1[1])

pl3 := swl_cond ? nz(pl2[1]) : nz(pl3[1])

pl2 := swl_cond ? nz(pl1[1]) : nz(pl2[1])

pl1 := swl_cond ? lprice : nz(pl1[1])

pphprice := swh_cond and ph2 > ph1 and ph2 > ph3 ? ph2 : nz(pphprice[1])

pplprice := swl_cond and pl2 < pl1 and pl2 < pl3 ? pl2 : nz(pplprice[1])

// Entry and Exit Logic

if time_cond

// Calculate order quantity based on margin amount

float order_qty = na

if margin_amount > 0

order_qty := (strategy.equity * margin_amount) / close

// Long Position

if allowLongs and le and not na(pphprice) and pphprice != 0

float entry_price_long = pphprice + syminfo.mintick

strategy.entry("PivRevLE", strategy.long, qty=order_qty, comment="PivRevLE", stop=entry_price_long)

if risk_reward_enabled or (trail_stop_enabled and trail_percent > 0.0)

float stop_loss_price = na

float take_profit_price = na

float trail_offset_long = na

float trail_points_long = na

if risk_reward_enabled

float risk_amount = entry_price_long * (risk_percent / 100)

stop_loss_price := entry_price_long - risk_amount

float profit_target = risk_amount * risk_reward_ratio

take_profit_price := entry_price_long + profit_target

if trail_stop_enabled and trail_percent > 0.0

trail_offset_long := (trail_percent / 100.0) * entry_price_long

trail_points_long := trail_offset_long / syminfo.pointvalue

strategy.exit("PivRevLE Exit", from_entry="PivRevLE",

stop=stop_loss_price, limit=take_profit_price,

trail_points=trail_points_long, trail_offset=trail_points_long)

// Short Position

if allowShorts and se and not na(pplprice) and pplprice != 0

float entry_price_short = pplprice - syminfo.mintick

strategy.entry("PivRevSE", strategy.short, qty=order_qty, comment="PivRevSE", stop=entry_price_short)

if risk_reward_enabled or (trail_stop_enabled and trail_percent > 0.0)

float stop_loss_price = na

float take_profit_price = na

float trail_offset_short = na

float trail_points_short = na

if risk_reward_enabled

float risk_amount = entry_price_short * (risk_percent / 100)

stop_loss_price := entry_price_short + risk_amount

float profit_target = risk_amount * risk_reward_ratio

take_profit_price := entry_price_short - profit_target

if trail_stop_enabled and trail_percent > 0.0

trail_offset_short := (trail_percent / 100.0) * entry_price_short

trail_points_short := trail_offset_short / syminfo.pointvalue

strategy.exit("PivRevSE Exit", from_entry="PivRevSE",

stop=stop_loss_price, limit=take_profit_price,

trail_points=trail_points_short, trail_offset=trail_points_short)

// Plotting

plot(lprice, color=color.new(color.red, 55), title='Low Price')

plot(hprice, color=color.new(color.green, 55), title='High Price')

plot(pplprice, color=color.new(color.red, 0), linewidth=2, title='Pivot Low Price')

plot(pphprice, color=color.new(color.green, 0), linewidth=2, title='Pivot High Price')