1

フォロー

1625

フォロワー

概要

この戦略は、指数移動平均 (EMA) と時間間隔を組み合わせた双方向取引システムです。システムは、ユーザーが定義した一定の時間間隔内の異なる期間のEMAの位置関係に応じて、主な取引方向を決定します。同時に、別のEMAインジケータセットのクロスオーバー信号を監視したり、時間が次のEMAインジケータに近づいたときに、取引サイクルに応じて、システムは適切なタイミングを選択してリバースヘッジ取引を実行します。これにより、双方向の取引機会の把握を実現します。

戦略原則

戦略の運用は、固定時間間隔でのプライマリ取引と柔軟なリバーサル取引という 2 つのコア メカニズムに基づいています。メイントランザクションは、5/40分EMAの相対位置に基づいてトレンド方向を決定し、取引間隔ごとにトランザクションを実行します(デフォルトは30分)。リバース取引は、5/10 分 EMA のクロスオーバー信号、または次の主要取引の 1 分前のいずれか早い方を監視することによって行われます。トランザクションの適時性を確保するために、トランザクション全体はユーザーが定義した時間枠内で実行されます。

戦略的優位性

- トレンド追跡と平均回帰取引のアイデアを組み合わせることで、さまざまな市場環境で取引の機会を捉えることができます。

- 過剰取引を避けるために時間間隔で取引頻度を制御する

- 逆取引メカニズムはリスクヘッジ機能を提供し、ドローダウンを制御するのに役立ちます。

- パラメータはEMAサイクル、取引時間間隔など、高度にカスタマイズ可能で、適応性が高い

- 取引時間枠は調整可能で、さまざまな市場特性に応じて最適化するのに便利です。

戦略リスク

- EMA インジケーターには遅延があり、不安定な市場では遅延シグナルを生成する可能性があります。

- 一定の間隔で取引を行うと、重要な市場機会を逃す可能性がある

- 逆張り取引はトレンドが強いときに不必要な損失を引き起こす可能性がある

- パラメータの選択が不適切だと、取引シグナルが多すぎたり少なすぎたりする可能性がある。

- 取引コストが戦略のリターンに与える影響を考慮する必要がある

戦略最適化の方向性

- ボラティリティ指標を導入し、EMAパラメータを動的に調整し、戦略の適応性を向上させる

- 取引シグナルの信頼性を向上させるためにボリューム分析を追加する

- 市場活動に応じて取引頻度を調整するための動的な時間間隔メカニズムを開発する

- ストップロスと利益目標管理を追加して資金管理を最適化します

- 取引の精度を向上させるために、クロス検証として他のテクニカル指標を導入することを検討する

要約する

トレンド追跡と逆張りを組み合わせた総合戦略で、時間間隔とEMA指標の連携により、双方向の取引機会把握を実現します。この戦略はカスタマイズ性が高く、リスク管理の可能性も高いですが、実際の市場状況に基づいたパラメータの最適化とリスク管理の改善が必要です。リアルタイムで適用する場合は、十分なバックテストとパラメータの最適化を実施し、市場特性に基づいて的を絞った調整を行うことをお勧めします。

ストラテジーソースコード

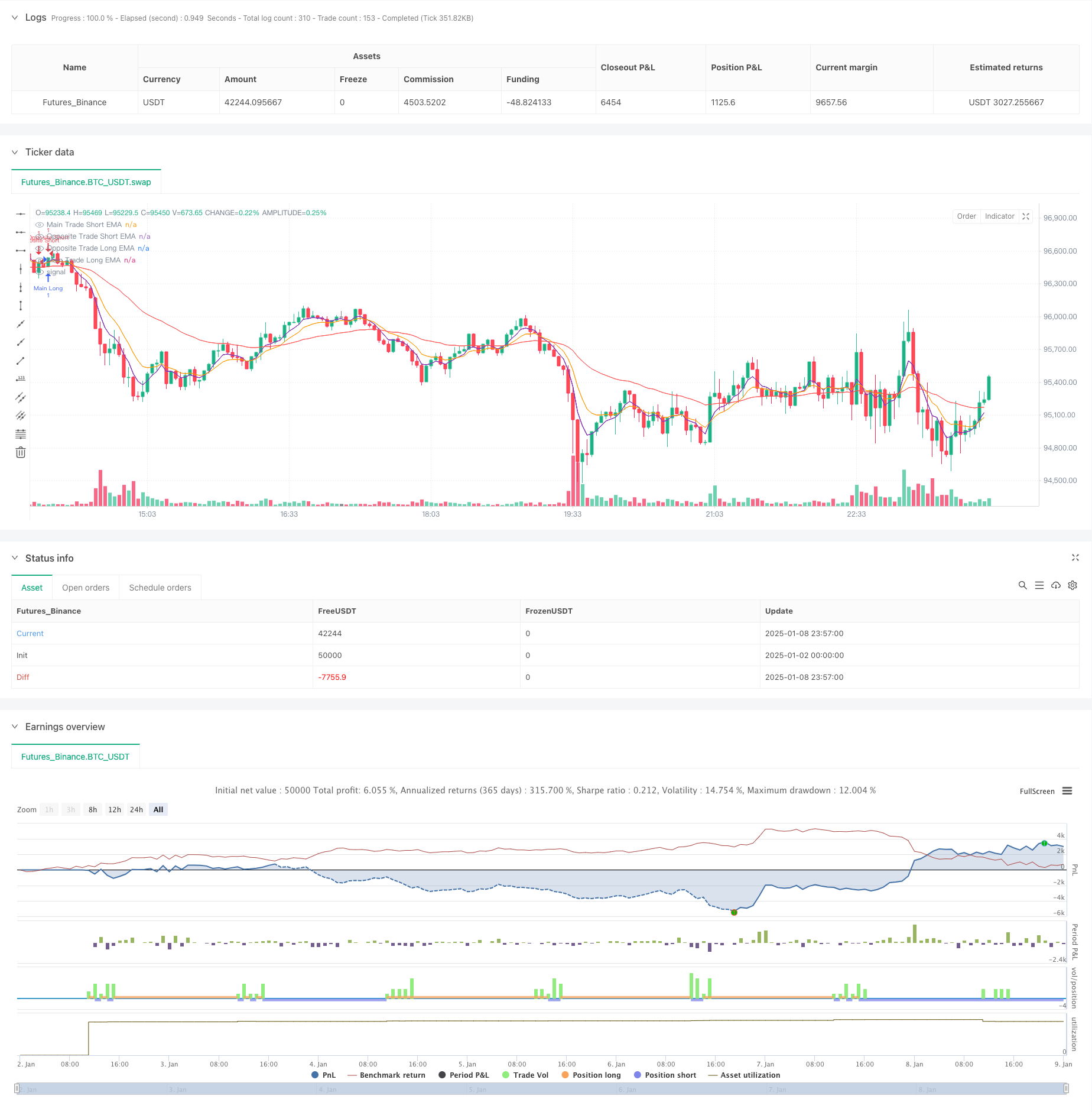

/*backtest

start: 2025-01-02 00:00:00

end: 2025-01-09 00:00:00

period: 3m

basePeriod: 3m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SPX EMA Strategy with Opposite Trades", overlay=true)

// User-defined inputs

tradeIntervalMinutes = input.int(30, title="Main Trade Interval (in minutes)", minval=1)

oppositeTradeDelayMinutes = input.int(1, title="Opposite Trade time from next trade (in minutes)", minval=1) // Delay of opposite trade (1 min before the next trade)

startHour = input.int(10, title="Start Hour", minval=0, maxval=23)

startMinute = input.int(30, title="Start Minute", minval=0, maxval=59)

stopHour = input.int(15, title="Stop Hour", minval=0, maxval=23)

stopMinute = input.int(0, title="Stop Minute", minval=0, maxval=59)

// User-defined EMA periods for main trade and opposite trade

mainEmaShortPeriod = input.int(5, title="Main Trade EMA Short Period", minval=1)

mainEmaLongPeriod = input.int(40, title="Main Trade EMA Long Period", minval=1)

oppositeEmaShortPeriod = input.int(5, title="Opposite Trade EMA Short Period", minval=1)

oppositeEmaLongPeriod = input.int(10, title="Opposite Trade EMA Long Period", minval=1)

// Calculate the EMAs for main trade

emaMainShort = ta.ema(close, mainEmaShortPeriod)

emaMainLong = ta.ema(close, mainEmaLongPeriod)

// Calculate the EMAs for opposite trade (using different periods)

emaOppositeShort = ta.ema(close, oppositeEmaShortPeriod)

emaOppositeLong = ta.ema(close, oppositeEmaLongPeriod)

// Condition to check if it is during the user-defined time window

startTime = timestamp(year, month, dayofmonth, startHour, startMinute)

stopTime = timestamp(year, month, dayofmonth, stopHour, stopMinute)

currentTime = timestamp(year, month, dayofmonth, hour, minute)

// Ensure the script only trades within the user-defined time window

isTradingTime = currentTime >= startTime and currentTime <= stopTime

// Time condition: Execute the trade every tradeIntervalMinutes

var float lastTradeTime = na

timePassed = na(lastTradeTime) or (currentTime - lastTradeTime) >= tradeIntervalMinutes * 60 * 1000

// Entry Conditions for Main Trade

longCondition = emaMainShort > emaMainLong // Enter long if short EMA is greater than long EMA

shortCondition = emaMainShort < emaMainLong // Enter short if short EMA is less than long EMA

// Detect EMA crossovers for opposite trade (bullish or bearish)

bullishCrossoverOpposite = ta.crossover(emaOppositeShort, emaOppositeLong) // Opposite EMA short crosses above long

bearishCrossoverOpposite = ta.crossunder(emaOppositeShort, emaOppositeLong) // Opposite EMA short crosses below long

// Track the direction of the last main trade (true for long, false for short)

var bool isLastTradeLong = na

// Track whether an opposite trade has already been executed after the last main trade

var bool oppositeTradeExecuted = false

// Execute the main trades if within the time window and at the user-defined interval

if isTradingTime and timePassed

if longCondition

strategy.entry("Main Long", strategy.long)

isLastTradeLong := true // Mark the last trade as long

oppositeTradeExecuted := false // Reset opposite trade status

lastTradeTime := currentTime

// label.new(bar_index, low, "Main Long", color=color.green, textcolor=color.white, size=size.small)

else if shortCondition

strategy.entry("Main Short", strategy.short)

isLastTradeLong := false // Mark the last trade as short

oppositeTradeExecuted := false // Reset opposite trade status

lastTradeTime := currentTime

// label.new(bar_index, high, "Main Short", color=color.red, textcolor=color.white, size=size.small)

// Execute the opposite trade only once after the main trade

if isTradingTime and not oppositeTradeExecuted

// 1 minute before the next main trade or EMA crossover

if (currentTime - lastTradeTime) >= (tradeIntervalMinutes - oppositeTradeDelayMinutes) * 60 * 1000 or bullishCrossoverOpposite or bearishCrossoverOpposite

if isLastTradeLong

// If the last main trade was long, enter opposite short trade

strategy.entry("Opposite Short", strategy.short)

//label.new(bar_index, high, "Opposite Short", color=color.red, textcolor=color.white, size=size.small)

else

// If the last main trade was short, enter opposite long trade

strategy.entry("Opposite Long", strategy.long)

//label.new(bar_index, low, "Opposite Long", color=color.green, textcolor=color.white, size=size.small)

// After entering the opposite trade, set the flag to true so no further opposite trades are placed

oppositeTradeExecuted := true

// Plot the EMAs for visual reference

plot(emaMainShort, title="Main Trade Short EMA", color=color.blue)

plot(emaMainLong, title="Main Trade Long EMA", color=color.red)

plot(emaOppositeShort, title="Opposite Trade Short EMA", color=color.purple)

plot(emaOppositeLong, title="Opposite Trade Long EMA", color=color.orange)