두 개의 트레이딩뷰 지표를 간단하게 옮기고, 다시 테스트를 해보세요 (교류 학습만, 실제 결과 자존심)

저자:루키0212, 창작: 2022-11-22 19:57:12, 업데이트: 2022-11-23 11:13:30전략에서 사용되는 지표

SSL 하이브리드

2, STOCH RSI 지표 이 둘은 트레이딩 뷰에 있는 지표이고, 직접 트레이딩 뷰로 가서 소스 코드를 옮깁니다.

이 둘은 트레이딩 뷰에 있는 지표이고, 직접 트레이딩 뷰로 가서 소스 코드를 옮깁니다.

SSL 하이브리드 코드, 275 줄

//@version=4

//By Mihkel00

// This script is designed for the NNFX Method, so it is recommended for Daily charts only.

// Tried to implement a few VP NNFX Rules

// This script has a SSL / Baseline (you can choose between the SSL or MA), a secondary SSL for continiuation trades and a third SSL for exit trades.

// Alerts added for Baseline entries, SSL2 continuations, Exits.

// Baseline has a Keltner Channel setting for "in zone" Gray Candles

// Added "Candle Size > 1 ATR" Diamonds from my old script with the criteria of being within Baseline ATR range.

// Credits

// Strategy causecelebre https://www.tradingview.com/u/causecelebre/

// SSL Channel ErwinBeckers https://www.tradingview.com/u/ErwinBeckers/

// Moving Averages jiehonglim https://www.tradingview.com/u/jiehonglim/

// Moving Averages everget https://www.tradingview.com/u/everget/

// "Many Moving Averages" script Fractured https://www.tradingview.com/u/Fractured/

study("SSL Hybrid", overlay=true)

show_Baseline = input(title="Show Baseline", type=input.bool, defval=true)

show_SSL1 = input(title="Show SSL1", type=input.bool, defval=false)

show_atr = input(title="Show ATR bands", type=input.bool, defval=true)

//ATR

atrlen = input(14, "ATR Period")

mult = input(1, "ATR Multi", step=0.1)

smoothing = input(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"])

ma_function(source, atrlen) =>

if smoothing == "RMA"

rma(source, atrlen)

else

if smoothing == "SMA"

sma(source, atrlen)

else

if smoothing == "EMA"

ema(source, atrlen)

else

wma(source, atrlen)

atr_slen = ma_function(tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input(title="SSL1 / Baseline Type", type=input.string, defval="HMA", options=["SMA","EMA","DEMA","TEMA","LSMA","WMA","MF","VAMA","TMA","HMA", "JMA", "Kijun v2", "EDSMA","McGinley"])

len = input(title="SSL1 / Baseline Length", defval=60)

SSL2Type = input(title="SSL2 / Continuation Type", type=input.string, defval="JMA", options=["SMA","EMA","DEMA","TEMA","WMA","MF","VAMA","TMA","HMA", "JMA","McGinley"])

len2 = input(title="SSL 2 Length", defval=5)

//

SSL3Type = input(title="EXIT Type", type=input.string, defval="HMA", options=["DEMA","TEMA","LSMA","VAMA","TMA","HMA","JMA", "Kijun v2", "McGinley", "MF"])

len3 = input(title="EXIT Length", defval=15)

src = input(title="Source", type=input.source, defval=close)

//

tema(src, len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

ema3 = ema(ema2, len)

(3 * ema1) - (3 * ema2) + ema3

kidiv = input(defval=1,maxval=4, title="Kijun MOD Divider")

jurik_phase = input(title="* Jurik (JMA) Only - Phase", type=input.integer, defval=3)

jurik_power = input(title="* Jurik (JMA) Only - Power", type=input.integer, defval=1)

volatility_lookback = input(10, title="* Volatility Adjusted (VAMA) Only - Volatility lookback length")

//MF

beta = input(0.8,minval=0,maxval=1,step=0.1, title="Modular Filter, General Filter Only - Beta")

feedback = input(false, title="Modular Filter Only - Feedback")

z = input(0.5,title="Modular Filter Only - Feedback Weighting",step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input(title="EDSMA - Super Smoother Filter Length", type=input.integer, minval=1, defval=20)

ssfPoles = input(title="EDSMA - Super Smoother Filter Poles", type=input.integer, defval=2, options=[2, 3])

//----

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = sqrt(2) * PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(arg)

c2 = b1

c3 = -pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

get3PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(1.738 * arg)

c1 = pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ma(type, src, len) =>

float result = 0

if type=="TMA"

result := sma(sma(src, ceil(len / 2)), floor(len / 2) + 1)

if type=="MF"

ts=0.,b=0.,c=0.,os=0.

//----

alpha = 2/(len+1)

a = feedback ? z*src + (1-z)*nz(ts[1],src) : src

//----

b := a > alpha*a+(1-alpha)*nz(b[1],a) ? a : alpha*a+(1-alpha)*nz(b[1],a)

c := a < alpha*a+(1-alpha)*nz(c[1],a) ? a : alpha*a+(1-alpha)*nz(c[1],a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta*b+(1-beta)*c

lower = beta*c+(1-beta)*b

ts := os*upper+(1-os)*lower

result := ts

if type=="LSMA"

result := linreg(src, len, 0)

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VAMA" // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid=ema(src,len)

dev=src-mid

vol_up=highest(dev,volatility_lookback)

vol_down=lowest(dev,volatility_lookback)

result := mid+avg(vol_up,vol_down)

if type=="HMA" // Hull

result := wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len)))

if type=="JMA" // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

if type=="Kijun v2"

kijun = avg(lowest(len), highest(len))//, (open + close)/2)

conversionLine = avg(lowest(len/kidiv), highest(len/kidiv))

delta = (kijun + conversionLine)/2

result :=delta

if type=="McGinley"

mg = 0.0

mg := na(mg[1]) ? ema(src, len) : mg[1] + (src - mg[1]) / (len * pow(src/mg[1], 4))

result :=mg

if type=="EDSMA"

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2

? get2PoleSSF(avgZeros, ssfLength)

: get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = stdev(ssf, len)

scaledFilter = stdev != 0

? ssf / stdev

: 0

alpha = 5 * abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input(0.2, step=0.05, title="Base Channel Multiplier")

Keltma = ma(maType, src, len)

range = useTrueRange ? tr : high - low

rangema = ema(range, len)

upperk =Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open*1

close_pos = close*1

difference = abs(close_pos-open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

candlesize_violation = atr_violation and InRange

plotshape(candlesize_violation, color=color.white, size=size.tiny,style=shape.diamond, location=location.top, transp=0,title="Candle Size > 1xATR")

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//SSL2 VALUES

Hlv2 = int(na)

Hlv2 := close > maHigh ? 1 : close < maLow ? -1 : Hlv2[1]

sslDown2 = Hlv2 < 0 ? maHigh : maLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = crossover(close, sslExit)

base_cross_Short = crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title="Color Bars", type=input.bool, defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=#00c3ff, colordown=#ff0062,title="Exit Arrows", transp=20, maxheight=20, offset=0)

p1 = plot(show_Baseline ? BBMC : na, color=color_bar, linewidth=4,transp=0, title='MA Baseline')

DownPlot = plot( show_SSL1 ? sslDown : na, title="SSL1", linewidth=3, color=color_ssl1, transp=10)

barcolor(show_color_bar ? color_bar : na)

up_channel = plot(show_Baseline ? upperk : na, color=color_bar, title="Baseline Upper Channel")

low_channel = plot(show_Baseline ? lowerk : na, color=color_bar, title="Basiline Lower Channel")

fill(up_channel, low_channel, color=color_bar, transp=90)

////SSL2 Continiuation from ATR

atr_crit = input(0.9, step=0.1, title="Continuation ATR Criteria")

upper_half = atr_slen * atr_crit + close

lower_half = close - atr_slen * atr_crit

buy_inatr = lower_half < sslDown2

sell_inatr = upper_half > sslDown2

sell_cont = close < BBMC and close < sslDown2

buy_cont = close > BBMC and close > sslDown2

sell_atr = sell_inatr and sell_cont

buy_atr = buy_inatr and buy_cont

atr_fill = buy_atr ? color.green : sell_atr ? color.purple : color.white

LongPlot = plot(sslDown2, title="SSL2", linewidth=2, color=atr_fill, style=plot.style_circles, transp=0)

u = plot(show_atr ? upper_band : na, "+ATR", color=color.white, transp=80)

l = plot(show_atr ? lower_band : na, "-ATR", color=color.white, transp=80)

//ALERTS

alertcondition(crossover(close, sslDown), title='SSL Cross Alert', message='SSL1 has crossed.')

alertcondition(crossover(close, sslDown2), title='SSL2 Cross Alert', message='SSL2 has crossed.')

alertcondition(sell_atr, title='Sell Continuation', message='Sell Continuation.')

alertcondition(buy_atr, title='Buy Continuation', message='Buy Continuation.')

alertcondition(crossover(close, sslExit), title='Exit Sell', message='Exit Sell Alert.')

alertcondition(crossover(sslExit, close), title='Exit Buy', message='Exit Buy Alert.')

alertcondition(crossover(close, upperk ), title='Baseline Buy Entry', message='Base Buy Alert.')

alertcondition(crossover(lowerk, close ), title='Baseline Sell Entry', message='Base Sell Alert.')

// 이것은 Stoch RSI의 코드입니다.

//@version=5

indicator(title="Stochastic RSI", shorttitle="Stoch RSI", format=format.price, precision=2, timeframe="", timeframe_gaps=true)

smoothK = input.int(3, "K", minval=1)

smoothD = input.int(3, "D", minval=1)

lengthRSI = input.int(14, "RSI Length", minval=1)

lengthStoch = input.int(14, "Stochastic Length", minval=1)

src1 = input(close, title="RSI Source") //src重名了,改为src1

rsi1 = ta.rsi(src1, lengthRSI) //src重名了,改为src1

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ta.sma(k, smoothD)

plot(k, "K", color=#2962FF)

plot(d, "D", color=#FF6D00)

h0 = hline(80, "Upper Band", color=#787B86)

hline(50, "Middle Band", color=color.new(#787B86, 50))

h1 = hline(20, "Lower Band", color=#787B86)

fill(h0, h1, color=color.rgb(33, 150, 243, 90), title="Background")

// 여기서 문제가 생기는 것은, 이 두 지표에 있는src 변수가 다시 이름이 바뀌어서, 스톡 rsi의 두 번의src가src1으로 바뀌는 것입니다. // 전략의 끝에서 거래 기능을 더합니다.

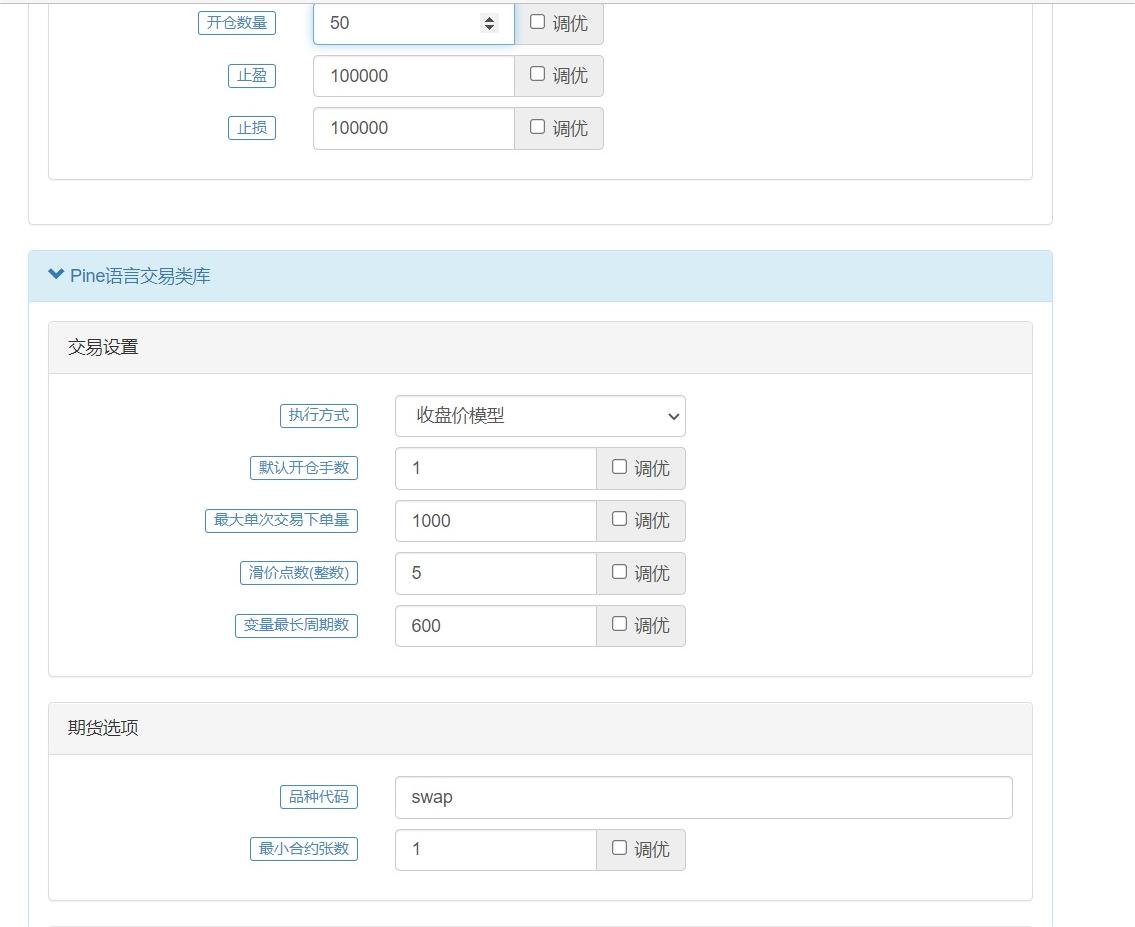

BASEMONEY = input(50, '开仓数量') //开仓数量,回测50000u开50eth还是很靠谱的,如果是btc当然不能这么多

prof = input(10, '止盈') //止盈止损百分比,回测不带止盈止损,直接设置10000

los = input(5,'止损')

if base_cross_Long and k < 20 and d <20 //base_cross_Long ,ssl hybird指标里向上的买入箭头

strategy.entry("Enter Long", strategy.long, BASEMONEY) //k,d <20 ,stoch rsi 超卖信号。同时出现这两个指标,买入

strategy.exit("exit", profit = prof, loss = los )

if base_cross_Short and k > 80 and d > 80 //base_cross_Long ,ssl hybird指标里向下的卖出箭头

strategy.entry("Enter Short", strategy.short, BASEMONEY) //k,d >80 ,stoch rsi 超买信号。同时出现这两个指标,卖出

strategy.exit("exit", profit = prof, loss = los)

// 완료, 위의 코드는 바로 새 정책을 파인 언어에 직접 사용할 수 있습니다.

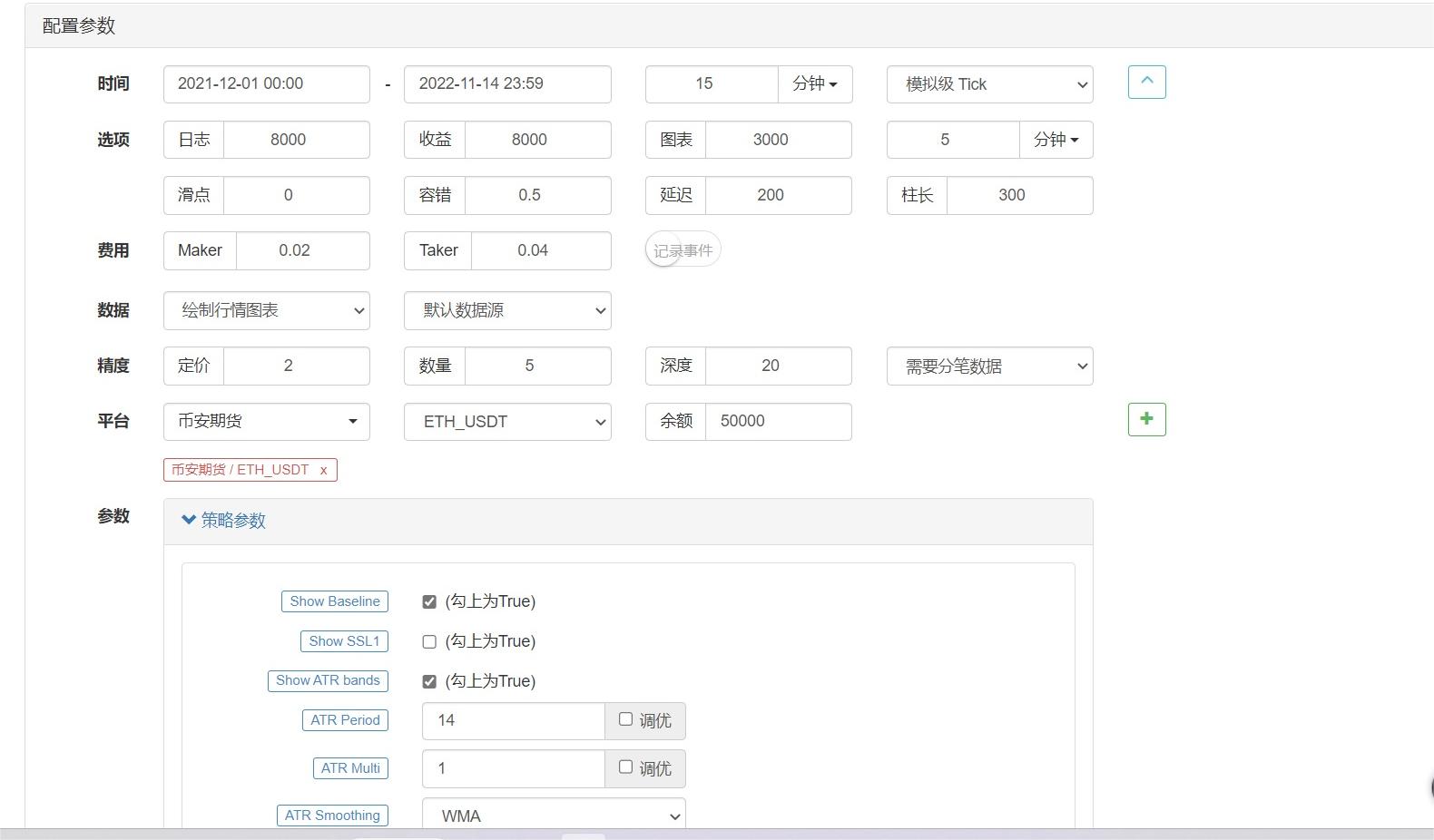

ETH 15분 리테스트, 기본 10배 지렛대, 10000, 나머지 지표 전체 기본

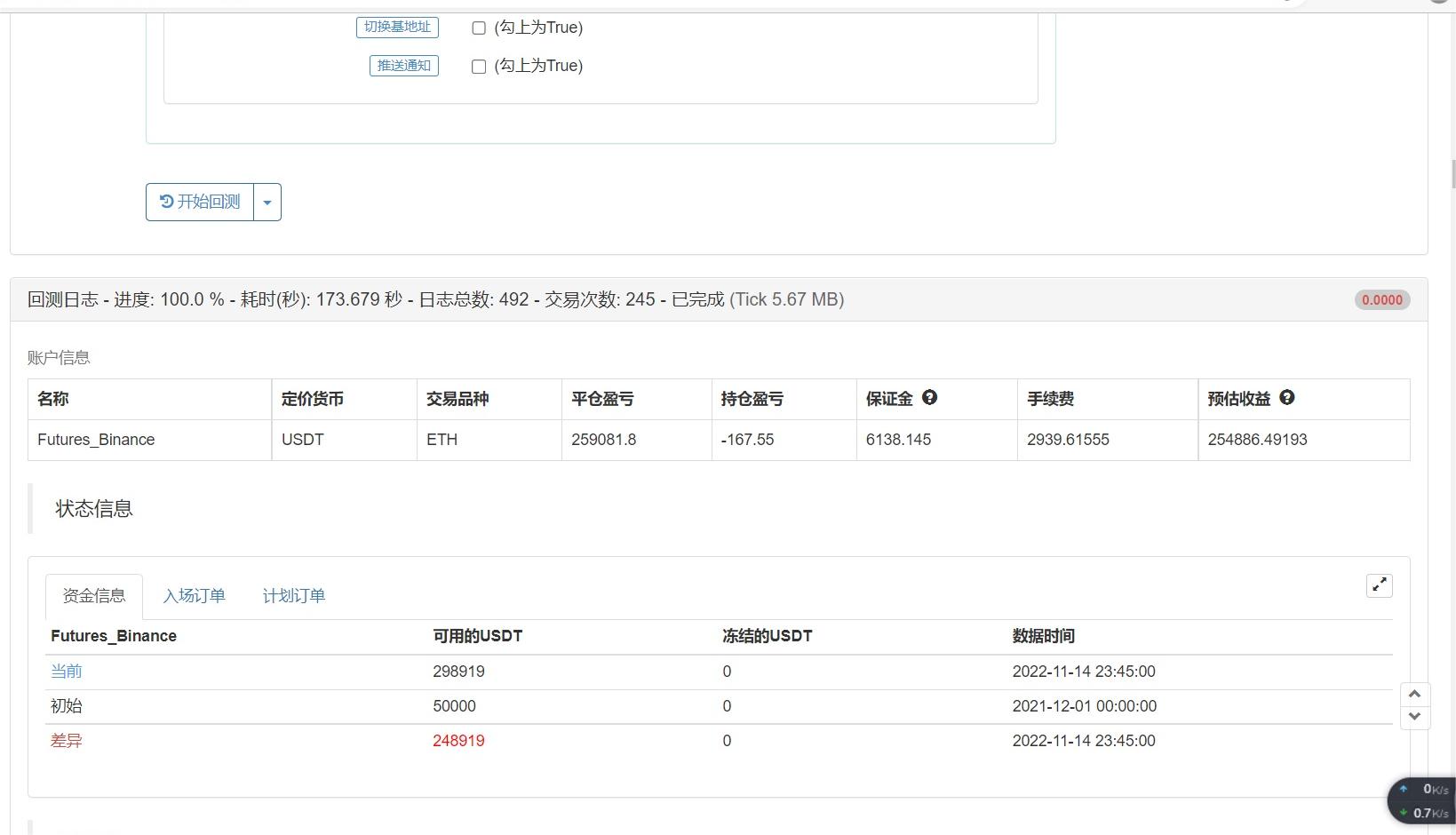

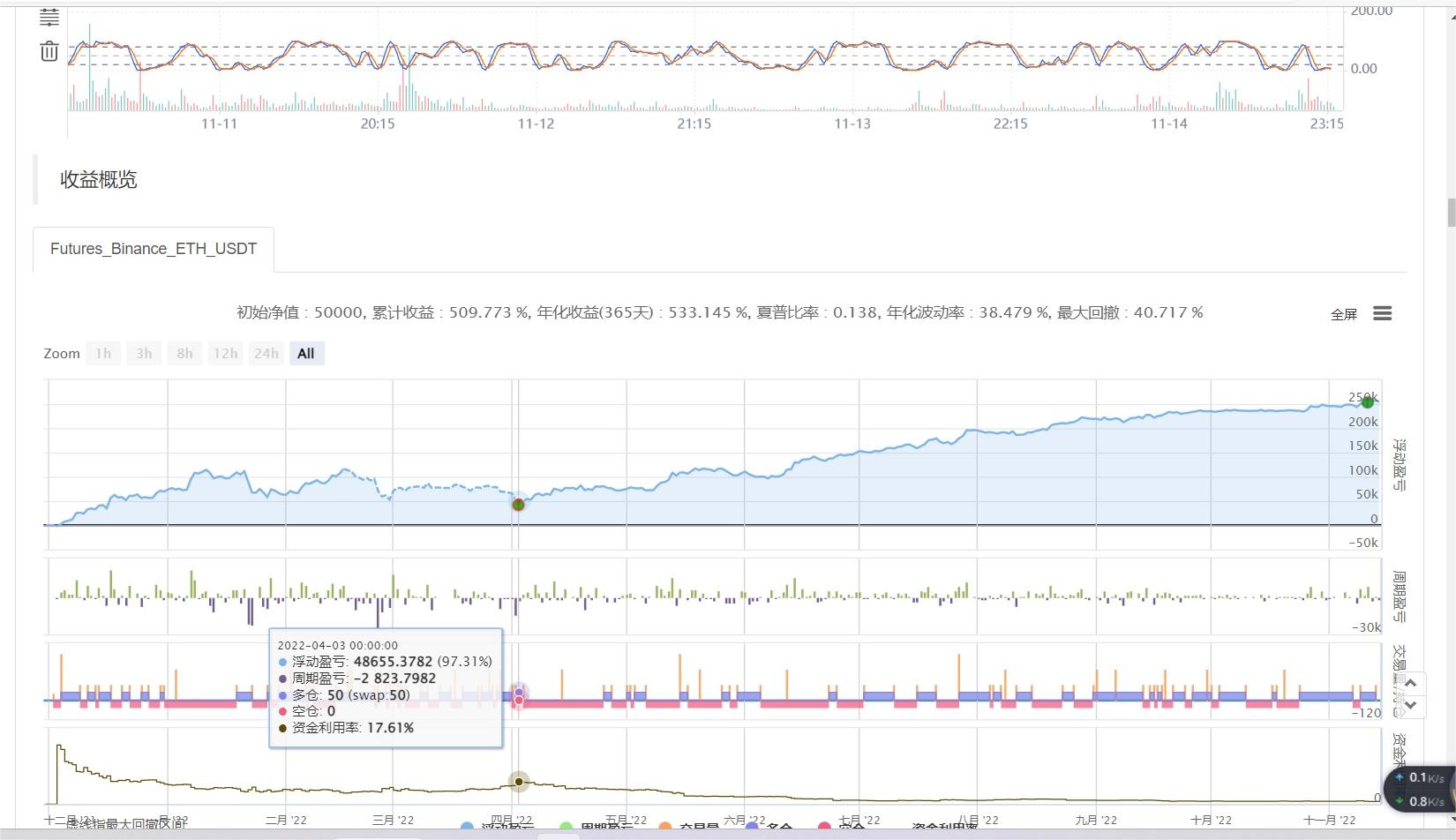

재검토 시간 2021.12.1-2022.11.14, 124,512,618,119 다양한 주요 이벤트 포함

리테스트 결과 폭발, 리테스트 시간만을 위한 즐거움, 실제 결과 자부심

리테스트 결과 폭발, 리테스트 시간만을 위한 즐거움, 실제 결과 자부심

더 많은

- 어떻게 여러 거래 쌍을 동시에 하나의 전략으로 거래할 수 있을까요?

- 코인마켓캡에서 100배짜리 동전을 구하세요?

- 거래소 인터페이스 로컬레이션 빠른 탐색 때 랭킹 사다리 오류 Max retries exceed with url 문제 처리

- 비안안의 통화 정확도와 주문 최소 가격은 어디서 볼 수 있습니까?

- 순서 시스템

- YFII 계약에 가입하는 것을 재검토하는 것이 좋습니다. 전략이 YFII에서 살아남을 수 있다면, 악마의 시장은 두려워하지 않습니다.

- FMZ는 어떻게 증권거래소에 접근하는가?

- 원조를 요청하고, 비안아 선물 거래소 오류

- 구해줘요, 대우를 불러봐요, 이게 뭐야?

- 해결되었습니다.

- 구해, 왜 Bitcoin 현금 BTCUSDT GetDepth (() 은 작은 양의 데이터를 반환 할 수 있으며 깊이가 충분하지 않습니까?

- KDJ JS 버전의 예를 보실 수 있나요?

- 해결되었습니다.

- 다중 거래가 복귀에 대한 오류: 품종 구독 실패

- 마어의 판단 마지막 시간에는 이윤 함수 TRADE_REF가 없습니다. 다른 글씨가 이 기능을 구현합니까?

- 피인은 어떻게 여러 거래소를 작성합니까?

- 피라미딩에 대한 도움

- OKX 계약 거래 논쟁 무료 배송 전략

- 도움말: 디스크가 자주 발생 error bad operand type for unary +:'str' 111 오류

- 자, 파이인 언어 전략은 어떻게 다음 문자를 반복할 수 있는지 알려주세요.

q102133어떻게 복사해서 실행되지 않는지 다른 문제가 있나요?

스토커이 사진이 어떻게 생겼는지 보여드리겠습니다.

루키0212만약 여러분이 TV에서 유용한 지표를 발견하고, 이해하기 쉽고, 바꾸기 쉽다면, 저는 무료로 FMZ의 전략을 바꿀 수 있습니다.

루키0212이 문장 아래의 실행 문장이 모두 압축되어 있어야 한다는 것을 알 수 없습니다.

발명가들의 수량화 - 작은 꿈OK~ FMZ 양성을 지원해주셔서 감사합니다.

루키0212자, 업데이트를 해봤습니다.

발명가들의 수량화 - 작은 꿈FMZ에 붙여진 코드 형식은 다음과 같습니다. ` ` ` 코드 ` ` `