기울기 적응 이동 평균

저자:차오장, 날짜: 2022-05-31 18:07:34태그:AMA

소개

이 스크립트는

트렌드 탐지 녹색 색: 가격 동력을 가진 강한 상승 추세 빨간색: 강한 하향 추세 노란 색: 시장은 불안정하고, 옆으로 움직이고, 또는 고집하고 있습니다. 새로운 입장을 취하는 것을 피하는 것이 더 낫습니다.

기본 설정 AMA 길이는 200입니다 (1H 이상의 시간 프레임에 더 좋습니다) 작은 길이는 6 주요 길이는 14 기울기 기간은 초기 범위의 25와 34로 설정됩니다. 통합은 항상 17 아래입니다. 경보 구매/판매 알레르트는 기울기가 통합/부진 영역에서 벗어날 때 계속됩니다. 절대 알레르트 타이밍에서 가장 좋은 입력이 있지만 다른 거래는 트렌드 상태에 따라 중간에서 시작할 수 있습니다.

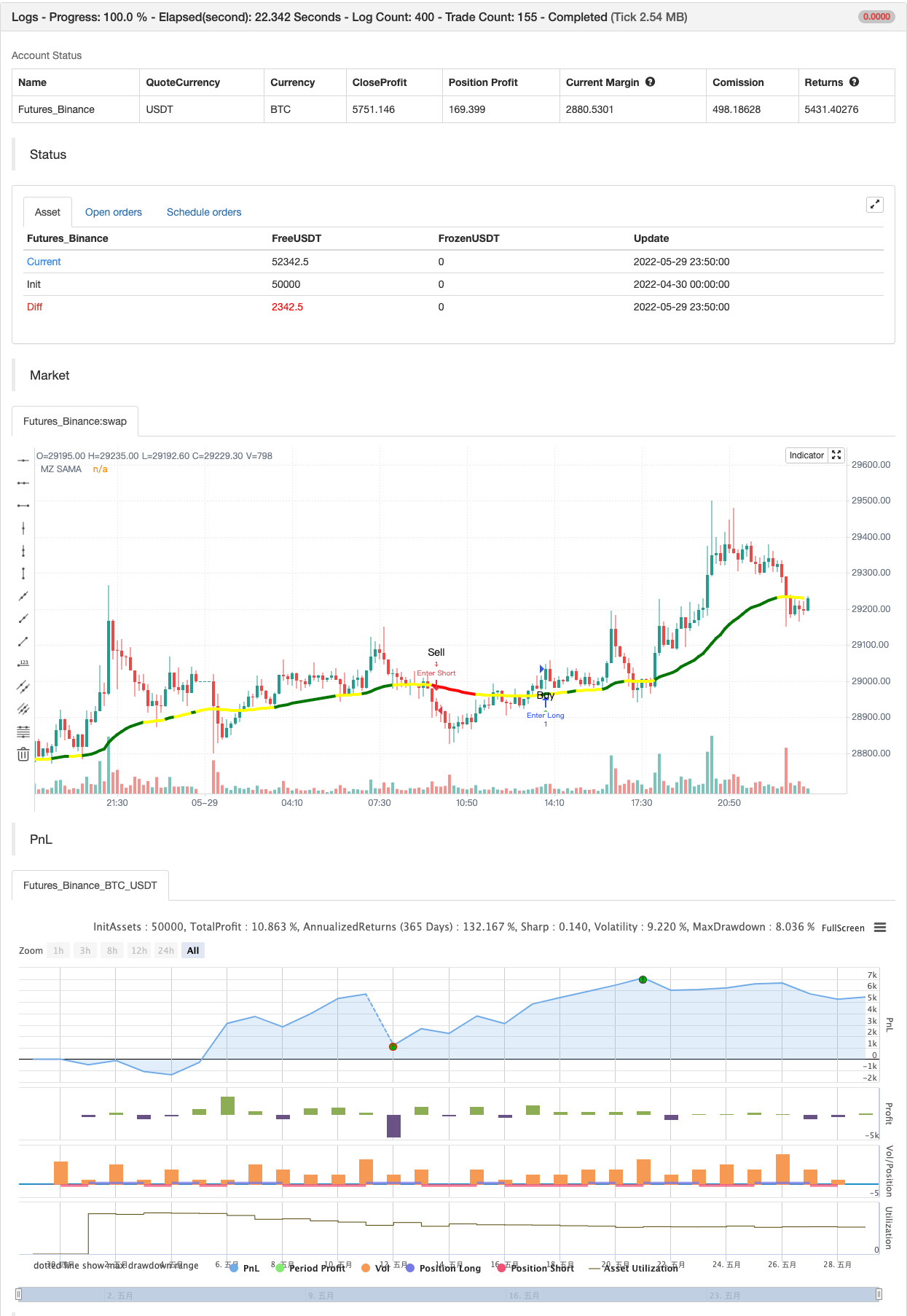

백테스트

/*backtest

start: 2022-04-30 00:00:00

end: 2022-05-29 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MightyZinger

//@version=5

indicator('Slope Adaptive Moving Average (MZ SAMA)', shorttitle='MZ SAMA', overlay=true)

/////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////////////////////////////

///// MZ SAMA //////

/////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////////////////////////////

chartResolution = input.timeframe('', title='Chart Resolution')

src = input.source(close, 'Source')

// Length Inputs

string grp_1 = 'SAMA Length Inputs'

length = input(200, title='Adaptive MA Length', group = grp_1) // To check for Highest and Lowest value within provided period

majLength = input(14, title='Major Length', group = grp_1) // For Major alpha calculations to detect recent price changes

minLength = input(6, title='Minor Length', group = grp_1) // For Minor alpha calculations to detect recent price changes

// Slope Inputs

string grp_2 = 'Slope and Dynamic Coloring Parameters'

slopePeriod = input.int(34, title='Slope Period', group = grp_2)

slopeInRange = input.int(25, title='Slope Initial Range', group = grp_2)

flat = input.int(17, title='Consolidation area is when slope below:', group = grp_2)

bull_col = input.color(color.green, 'Bull Color ', inline='dyn_col', group = grp_2)

bear_col = input.color(color.red, 'Bear Color ', inline='dyn_col', group = grp_2)

conc_col = input.color(color.yellow, 'Reversal/Consolidation/Choppiness Color ', inline='dyn_col', group = grp_2)

showSignals = input.bool(true, title='Show Signals on Chart', group='Plot Parameters')

//Slope calculation Function to check trend strength i.e. consolidating, choppy, or near reversal

calcslope(_ma, src, slope_period, range_1) =>

pi = math.atan(1) * 4

highestHigh = ta.highest(slope_period)

lowestLow = ta.lowest(slope_period)

slope_range = range_1 / (highestHigh - lowestLow) * lowestLow

dt = (_ma[2] - _ma) / src * slope_range

c = math.sqrt(1 + dt * dt)

xAngle = math.round(180 * math.acos(1 / c) / pi)

maAngle = dt > 0 ? -xAngle : xAngle

maAngle

//MA coloring function to mark market dynamics

dynColor(_flat, slp, col_1, col_2, col_r) =>

var col = color.new(na,0)

// Slope supporting bullish uprtrend color

col := slp > _flat ? col_1:

// Slope supporting bearish downtrend color

slp <= -_flat ? col_2:

// Reversal/Consolidation/Choppiness color

slp <= _flat and slp > -_flat ? col_r : col_r

col

//AMA Calculations

ama(src,length,minLength,majLength)=>

minAlpha = 2 / (minLength + 1)

majAlpha = 2 / (majLength + 1)

hh = ta.highest(length + 1)

ll = ta.lowest(length + 1)

mult = hh - ll != 0 ? math.abs(2 * src - ll - hh) / (hh - ll) : 0

final = mult * (minAlpha - majAlpha) + majAlpha

final_alpha = math.pow(final, 2) // Final Alpha calculated from Minor and Major length along with considering Multiplication factor calculated using Highest / Lowest value within provided AMA overall length

var _ama = float(na)

_ama := (src - nz(_ama[1])) * final_alpha + nz(_ama[1])

_ama

// SAMA Definition

sama = request.security(syminfo.tickerid, chartResolution, ama(src,length,minLength,majLength))

// Slope Calculation for Dynamic Coloring

slope = calcslope(sama, src, slopePeriod, slopeInRange)

// SAMA Dynamic Coloring from slope

sama_col = request.security(syminfo.tickerid, chartResolution, dynColor(flat, slope, bull_col, bear_col, conc_col))

// SAMA Plot

plot(sama, 'MZ SAMA', sama_col, 4)

// BUY & SELL CONDITIONS AND ALERTS

_up = sama_col == bull_col

_downn = sama_col == bear_col

_chop = sama_col == conc_col

buy = _up and not _up[1]

sell = _downn and not _downn[1]

chop_zone = _chop and not _chop[1]

_signal() =>

var sig = 0

if buy and sig <= 0

sig := 1

if sell and sig >= 0

sig := -1

sig

sig = _signal()

longsignal = sig == 1 and (sig != 1)[1]

shortsignal = sig == -1 and (sig != -1)[1]

// Plotting Signals on Chart

atrOver = 1 * ta.atr(5) // Atr to place alert shape on chart

plotshape(showSignals and longsignal ? (sama - atrOver) : na , style=shape.triangleup, color=color.new(color.green, 30), location=location.absolute, text='Buy', size=size.small)

plotshape(showSignals and shortsignal ? (sama + atrOver): na , style=shape.triangledown, color=color.new(color.red, 30), location=location.absolute, text='Sell', size=size.small)

// Signals Alerts

alertcondition(longsignal, "Buy", "Go Long" )

alertcondition(shortsignal, "Sell", "Go Short")

alertcondition(chop_zone, "Chop Zone", "Possible Reversal/Consolidation/Choppiness")

if longsignal

alert("Buy at" + str.tostring(close), alert.freq_once_per_bar_close)

if shortsignal

alert("Sell at" + str.tostring(close), alert.freq_once_per_bar_close)

if longsignal

strategy.entry("Enter Long", strategy.long)

else if shortsignal

strategy.entry("Enter Short", strategy.short)

관련 내용

더 많은 내용