개요

이 전략은 이동 평균, 진동 지표와 같은 여러 가지 기술 지표를 사용하여, 평균선 통과 형태와 결합하여, 주식 가격의 추세와 하락의 전환점을 식별하여, 매매를 한다.

원칙

이 전략은 다음과 같은 부분으로 구성됩니다.

구간을 선택: K 라인 그래프의 시간 구간 분수, 예를 들어 1분, 5분 등

이동 평균을 선택: 일반적으로 사용되는 EMA, SMA 등의 이동 평균의 파라미터를 구성합니다. 10일선, 20일선 등

흔들림 지표 선택: RSI, MACD, 윌리엄 지표 등 흔들림 지표의 파라미터를 구성한다.

구매 및 판매 신호를 계산합니다: 사용자 정의 함수를 사용하여 이동 평균과 진동 지표의 수치를 계산합니다. 단기 평균선 위에 장기 평균선을 통과하면 구매 신호가 발생하고, 단기 평균선 아래에 장기 평균선을 통과하면 판매 신호가 발생합니다.

등급 시스템: 각 지표의 구매 판매 신호를 수치화 스코어, 그리고 평균을 취하여 전체 등급 지수를 얻습니다. 등급 지수는 0보다 큰 구매 신호, 0보다 작은 판매 신호입니다.

거래 신호: 등급 지수가 0보다 크거나 작으면 최종 거래 신호를 생성하고, 구매 또는 판매 작업을 수행한다.

이 전략은 여러 가지 지표를 조합하여 가격의 추세와 전환점을 효과적으로 식별하여 신호의 신뢰성을 높입니다. 평행선 통과는 유효한 트렌드 기술 신호이며, 흔들림 지표와 결합하면 가짜 돌파구를 피하는 데 도움이됩니다. 등급 시스템은 거래 신호를 더 명확하게 만듭니다.

장점

- 평평선 통과와 여러 가지 진동 지표가 결합되어 거래 신호가 더 신뢰할 수 있으며 가짜 신호를 피합니다.

- 평가 시스템은 구매와 판매 신호를 더 명확하게 만듭니다.

- 사용자 정의 함수를 사용하여 모듈화 프로그래밍, 코드 구조가 명확하다

- 여러 시간 주기를 사용하여 조합 분석을 수행하여 정확도를 향상시킵니다.

- RSI 길이, MACD 속속 평균주기 등과 같은 변수 설정을 최적화합니다.

- 매개 변수 사용자 정의 지표와 평균선 매개 변수를 통해 유연성을 향상

위험성

- 대시장 추세에 따른 주가 성과에 차이가 있다.

- 거래 빈도가 높을 수 있으며 거래 비용과 지점 위험을 증가시킬 수 있습니다.

- 다양한 주식 특성에 맞게 최적화 변수를 반복적으로 테스트해야 합니다.

- 철수와 손실의 위험이 있습니다.

이 위험은 다음과 같은 방법으로 줄일 수 있습니다.

- 큰 시장의 흐름과 함께 주식을 선택하세요.

- 거래시간을 적절히 조정하고 거래 빈도를 낮추는 것

- 주식 특성에 맞는 최적화 변수 설정

- 손실을 통제하기 위한 전략

최적화 방향

이 전략은 다음의 몇 가지 측면에서 더 개선될 수 있습니다.

- 더 많은 지표, 예를 들어 변동률 지표, 강화 신호

- 기계 학습과 결합된 자동 최적화 매개 변수

- 주식 및 업계 선택 모듈을 추가합니다.

- 양적 선택 방법과 결합

- 적응적 손실, 추적적 손실을 방지하는 방법

- 큰 시장 상황을 고려하고 불확실한 환경을 피하십시오.

- 실물 거래 결과를 분석하고 평가 중량을 조정합니다.

종합적으로, 이 전략은 평균선 돌파와 여러 지표를 통합하여 가격 움직임을 효과적으로 식별할 수 있다. 그러나 지속적으로 최적화를 테스트하고 위험을 제어해야 한다. 포트폴리오 선택 주식, 매개 변수 최적화, 상쇄 측면에서 향후 개선할 수 있다.

요약하다

이 전략은 수평선을 통과하는 것을 주요 거래 신호로 하고, 여러 가지 충격 지표에 의해 확인되고, 점수 시스템을 사용하여 명확한 구매 판매 신호를 생성한다. 가격 추세와 전환점을 효과적으로 식별 할 수 있지만 거래 주파수를 제어하고 거래 비용과 위험을 줄이는 동시에 계속적인 최적화 매개 변수가 필요합니다.

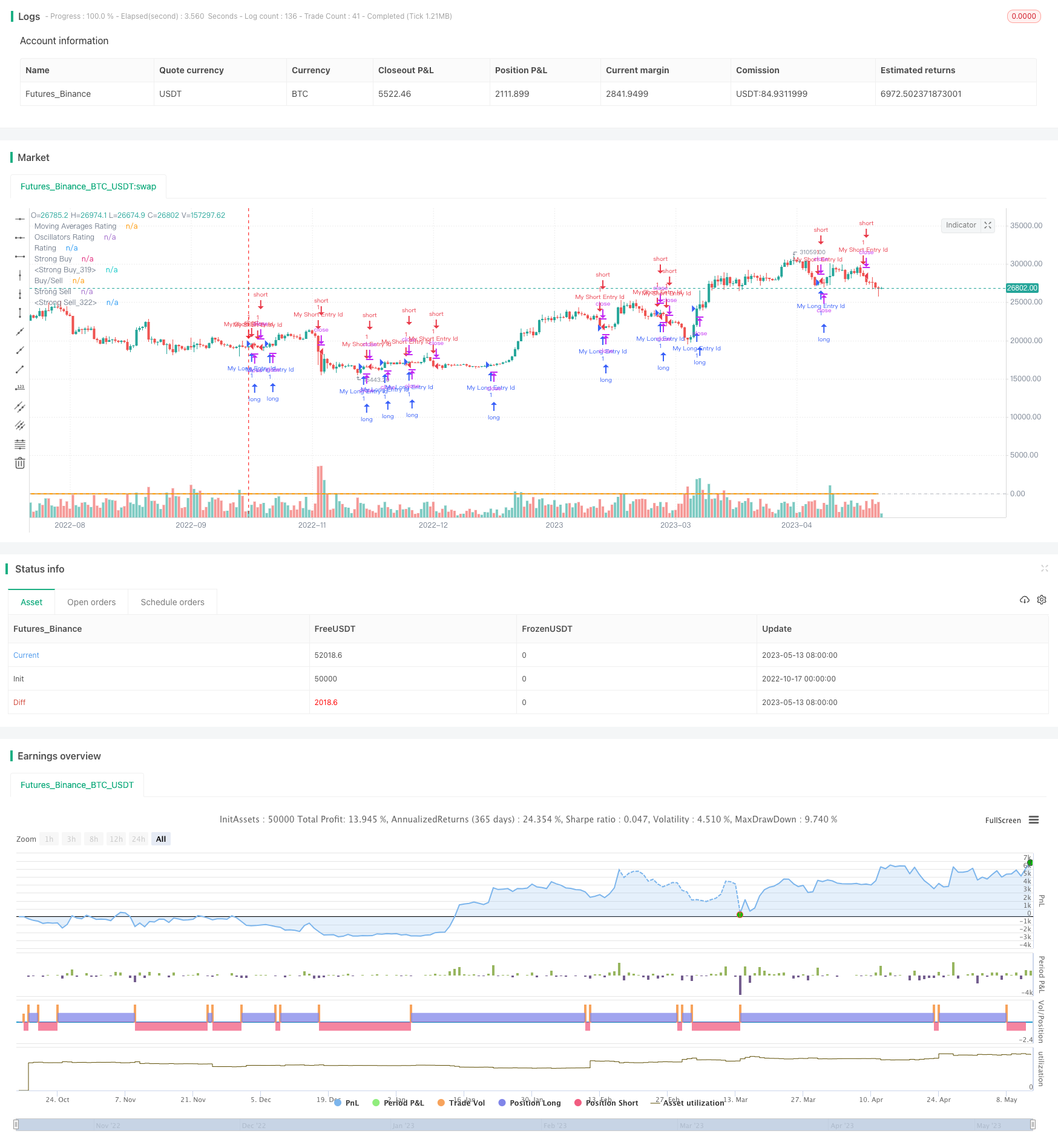

/*backtest

start: 2022-10-17 00:00:00

end: 2023-05-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("TV Signal", overlay=true, initial_capital = 500, currency = "USD")

// -------------------------------------- GLOBAL SELECTION --------------------------------------------- //

//res = input(defval="5" , title="resolution " , type=resolution)

res_num = input("240", title="Resolution (minutes)", options=["1", "5", "15", "60", "240"] )

res = res_num

src = close

// -----------------------------------MOVING AVERAGES SELECTION----------------------------------------- //

// EMAS input

ema10 = 10

ema20 = 20

ema30 = 30

ema50 = 50

ema100 = 100

ema200 = 200

// SMAS input

sma10 = 10

sma20 = 20

sma30 = 30

sma50 = 50

sma100 = 100

sma200 = 200

// Ichimoku - is not active in the calculation brought to you by TV TEAM for the lolz

// VWMA

vwma20 = 20

// Hull

hma9 = 9

// -----------------------------------OSCILLATORS SELECTION----------------------------------------- //

//RSI

rsi_len = input(14, minval=1, title="RSI Length")

//STOCH K

stoch_k = input(14, minval=1, title="STOCH K")

stoch_d = input(3, minval=1, title="STOCH D")

stoch_smooth = input(3, minval=1, title="STOCH Smooth")

//CCI

cci_len = input(20, minval=1, title="CCI Length")

//Momentum

momentum_len = input(10, minval=1, title="Momentum Length")

//MACD

macd_fast = input(12, title="MACD fast")

macd_slow = input(27, title="MACD slow")

//ADX

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

//BBP

bbp_len = input(13, title="BBP EMA Length")

//William Percentage Range

wpr_length = input(14, minval=1, title="William Perc Range Length")

//Ultimate Oscillator

uo_length7 = input(7, minval=1, title="UO Length 7"), uo_length14 = input(14, minval=1, title="UO Length 14"), uo_length28 = input(28, minval=1, title="UO Length 28")

// -------------------------------------- FUNCTIONS - Moving Averages -------------------------------------- //

// Simple Moving Averages Calculation Function - SELL indicator values < price // BUY – indicator values > price

calc_sma_index(len, src, res) =>

sma_val = request.security(syminfo.tickerid, res, sma(src, len))

sma_index = if( sma_val > close )

-1

else

1

sma_index

// Exponential Moving Averages Calculation Function - SELL indicator values < price // BUY – indicator values > price

calc_ema_index(len, src, res) =>

ema_val = request.security(syminfo.tickerid, res, sma(src, len))

ema_index = if( ema_val > close )

-1

else

1

ema_index

// Hull Moving Averages Calculation Function - SELL indicator values < price // BUY – indicator values > price

calc_hull_index(len, src, res) =>

hull_val = request.security(syminfo.tickerid, res, wma(2*wma(src, len/2)-wma(src, len), round(sqrt(len))))

hull_index = if( hull_val > close )

-1

else

1

hull_index

// VW Moving Averages Calculation Function - SELL indicator values < price // BUY – indicator values > price

calc_vwma_index(len, src, res) =>

vwma_val = request.security(syminfo.tickerid, res, vwma(src, len))

vwma_index = if( vwma_val > close )

-1

else

1

vwma_index

// -------------------------------------- FUNCTIONS - Oscillators -------------------------------------- //

// RSI indicator < lines that represent oversold conditions(70) and indicator values are rising = -1

// RSI indicator > lines that represent overbought conditions(30) and indicator values are falling = +1

calc_rsi_index(len, src, res) =>

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsi_res = request.security(syminfo.tickerid, res, rsi)

rsi_change = rsi_res - rsi_res[1]

rsi_index = 0

if( rsi_res > 70 and rsi_change < 0 )

rsi_index := -1

if( rsi_res < 30 and rsi_change > 0 )

rsi_index := 1

rsi_index

// STOCH indicator – main line < lower band (20) and main line crosses the signal line from bottom-up

// STOCH indicato – main line > upper band (80) and main line crosses the signal line from above-down

calc_stoch_index(len_k, len_d, smoothK, res) =>

stoch_k = sma(stoch(close, high, low, len_k), smoothK)

stoch_d = sma(stoch_k, len_d)

res_stoch_k = request.security(syminfo.tickerid, res, stoch_k)

res_stoch_d = request.security(syminfo.tickerid, res, stoch_d)

spread = (res_stoch_k/res_stoch_d -1)*100

stoch_index = 0

if( res_stoch_k > 80 and spread < 0 )

stoch_index := -1

if( res_stoch_k < 20 and spread > 0 )

stoch_index := 1

stoch_index

// CCI indicator – indicator < oversold level (-100) and reversed upwards

// CCI indicator – indicator > overbought level (100) and reversed downwards

calc_cci_index(len, src, res) =>

cci_ma = sma(src, len)

cci = (src - cci_ma) / (0.015 * dev(src, len))

cci_res = request.security(syminfo.tickerid, res, cci)

cci_change = cci_res - cci_res[1]

cci_index = 0

if( cci_res > 100 and cci_change > 0 )

cci_index := -1

if( cci_res < -100 and cci_change < 0 )

cci_index := 1

cci_index

//AWESOME OSCILLATOR – saucer and values are greater than 0 or zero line cross from bottom-up - BUY

//AWESOME OSCILLATOR – saucer and values are lower than 0 or zero line cross from above-down - SELL

calc_awesome_index(src, res) =>

ao = sma(hl2,5) - sma(hl2,34)

ao_res = request.security(syminfo.tickerid, res, ao)

ao_change = ao_res - ao_res[1]

ao_index = 0

if( ao_res > 0 and ao_change > 0 )

ao_index := 1

if( ao_res < 0 and ao_change < 0 )

ao_index := -1

ao_index

// Momentum indicator - indicator values are rising - BUY

// Momentum indicator - indicator values are falling - SELL

calc_momentum_index(len, src, res) =>

mom = src - src[len]

res_mom = request.security(syminfo.tickerid, res, mom)

mom_index = 0

if res_mom>= 0

mom_index := 1

if res_mom <= 0

mom_index := -1

mom_index

// MACD - main line values > signal line values - BUY

// MACD - main line values < signal line values - SELL

calc_macd_index(macd_fast, macd_slow, src, res) =>

macd = ema(src, macd_fast) - ema(src, macd_slow)

res_macd = request.security(syminfo.tickerid, res, macd)

macd_index = 0

if res_macd>= 0

macd_index := 1

if res_macd <= 0

macd_index := -1

macd_index

//STOCHRSI - main line < lower band (20) and main line crosses the signal line from bottom-up

//STOCHRSI - main line > upper band (80) and main line crosses the signal line from above-down

calc_stochrsi_index(len_rsi, len_stoch, smoothK, smoothD, src, res) =>

rsi = rsi(src, len_rsi)

stoch_k = sma(stoch(rsi, rsi, rsi, len_stoch), smoothK)

stoch_d = sma(stoch_k, smoothD)

res_stoch_k = request.security(syminfo.tickerid, res, stoch_k)

res_stoch_d = request.security(syminfo.tickerid, res, stoch_d)

spread = (res_stoch_k/res_stoch_d -1)*100

stochrsi_index = 0

if( res_stoch_k > 80 and spread < 0 )

stochrsi_index := -1

if( res_stoch_k < 20 and spread > 0 )

stochrsi_index := 1

stochrsi_index

//Williams % Range - line is above -20 and values are dropping - Overbough conditions - SELL

//Williams % Range - line is below -80 and values are rising - Oversold conditions - BUY

calc_wpr_index(len, src, res) =>

wpr_upper = highest(len)

wpr_lower = lowest(len)

wpr = 100 * (src - wpr_upper) / (wpr_upper - wpr_lower)

wpr_res = request.security(syminfo.tickerid, res, wpr)

wpr_change = wpr_res - wpr_res[1]

wpr_index = 0

if( wpr_res < -80 and wpr_change > 0 )

wpr_index := 1

if( wpr_res > -20 and wpr_change < 0 )

wpr_index := -1

wpr_index

//Ultimate Oscillator - line is above -20 and values are dropping - Overbough conditions - SELL

//Ultimate Oscillator - line is below -80 and values are rising - Oversold conditions - BUY

average(bp, tr_, length) => sum(bp, length) / sum(tr_, length)

calc_uo_index(len7, len14, len28, res) =>

high_ = max(high, close[1])

low_ = min(low, close[1])

bp = close - low_

tr_ = high_ - low_

avg7 = average(bp, tr_, len7)

avg14 = average(bp, tr_, len14)

avg28 = average(bp, tr_, len28)

uo = 100 * (4*avg7 + 2*avg14 + avg28)/7

uo_res = request.security(syminfo.tickerid, res, uo)

uo_index = 0

if uo_res >= 70

uo_index := 1

if uo_res <= 30

uo_index := -1

uo_index

//Average Directional Index - indicator > 20 and +DI line crossed -DI line from bottom-up

//Average Directional Index - indicator > 20 and +DI line crossed -DI line from above-down

dirmov(len) =>

up = change(high)

down = -change(low)

truerange = rma(tr, len)

plus = fixnan(100 * rma(up > down and up > 0 ? up : 0, len) / truerange)

minus = fixnan(100 * rma(down > up and down > 0 ? down : 0, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

adxHigh(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

plus

adxLow(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

minus

calc_adx_index(res) =>

sig = adx(dilen, adxlen) //ADX

sigHigh = adxHigh(dilen, adxlen) // DI+

sigLow = adxLow(dilen, adxlen) // DI-

res_sig = request.security(syminfo.tickerid, res, sig)

res_sigHigh = request.security(syminfo.tickerid, res, sigHigh)

res_sigLow = request.security(syminfo.tickerid, res, sigLow)

spread = (res_sigHigh/res_sigLow -1)*100

adx_index = 0

if res_sig >= 20 and spread > 0

adx_index := 1

if res_sig >= 20 and spread < 0

adx_index := -1

adx_index

//Bull Bear Power Index - bear power is below 0 and is weakening -> BUY

//Bull Bear Power Index - bull power is above 0 and is weakening -> SELL

calc_bbp_index(len, src, res ) =>

ema = ema(src, len)

bulls = high - ema

bears = low - ema

bulls_res = request.security(syminfo.tickerid, res, bulls)

bears_res = request.security(syminfo.tickerid, res, bears)

sum = bulls_res + bears_res

bbp_index = 0

if bears_res < 0 and bears_res > bears_res[1]

bbp_index := 1

if bulls_res > 0 and bulls_res < bulls_res[1]

bbp_index := -1

bbp_index

// --------------------------------MOVING AVERAGES CALCULATION------------------------------------- //

sma10_index = calc_sma_index(sma10, src, res)

sma20_index = calc_sma_index(sma20, src, res)

sma30_index = calc_sma_index(sma30, src, res)

sma50_index = calc_sma_index(sma50, src, res)

sma100_index = calc_sma_index(sma100, src, res)

sma200_index = calc_sma_index(sma200, src, res)

ema10_index = calc_ema_index(ema10, src, res)

ema20_index = calc_ema_index(ema20, src, res)

ema30_index = calc_ema_index(ema30, src, res)

ema50_index = calc_ema_index(ema50, src, res)

ema100_index = calc_ema_index(ema100, src, res)

ema200_index = calc_ema_index(ema200, src, res)

hull9_index = calc_ema_index(hma9, src, res)

vwma20_index = calc_ema_index(vwma20, src, res)

ichimoku_index = 0.0 //Ichimoku - is not active in the calculation brought to you by TV TEAM for the lolz

moving_averages_index = ( ema10_index + ema20_index + ema30_index + ema50_index + ema100_index + ema200_index +

sma10_index + sma20_index + sma30_index + sma50_index + sma100_index + sma200_index +

ichimoku_index + vwma20_index + hull9_index ) / 15

// -----------------------------------OSCILLATORS CALCULATION----------------------------------------- //

rsi_index = calc_rsi_index(rsi_len, src, res)

stoch_index = calc_stoch_index(stoch_k, stoch_d, stoch_smooth, res)

cci_index = calc_cci_index(cci_len, src, res)

ao_index = calc_awesome_index(src, res)

mom_index = calc_momentum_index(momentum_len, src, res)

macd_index = calc_macd_index(macd_fast, macd_slow, src, res)

stochrsi_index = calc_stochrsi_index(rsi_len, stoch_k, stoch_d, stoch_smooth, src, res)

wpr_index = calc_wpr_index(wpr_length, src, res)

uo_index = calc_uo_index(uo_length7, uo_length14, uo_length28, res)

adx_index = calc_adx_index(res)

bbp_index = calc_bbp_index(bbp_len , src, res)

oscillators_index = ( rsi_index + stoch_index + adx_index + cci_index + stochrsi_index + ao_index + mom_index + macd_index + wpr_index + uo_index + bbp_index ) / 11

rating_index = ( moving_averages_index + oscillators_index ) / 2

plot(moving_averages_index, color=green, linewidth = 1, title="Moving Averages Rating",transp = 70)

plot(oscillators_index , color=blue, linewidth = 1, title="Oscillators Rating",transp = 70)

plot(rating_index , color=orange, linewidth = 2, title="Rating")

strongbuy = hline(1, "Strong Buy" , color=silver )

buy = hline(0.5, "Strong Buy" , color=green )

normal = hline(0, "Buy/Sell" , color=silver )

sell = hline(-0.5,"Strong Sell", color=red )

strongsell = hline(-1, "Strong Sell", color=silver )

fill(strongbuy,buy, color=green, transp=90)

fill(buy,normal, color=#b2ffb2, transp=90)

fill(sell,normal, color=#F08080, transp=90)

fill(strongsell,sell, color=red, transp=90)

longCondition = rating_index > 0

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

shortCondition = rating_index < 0

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)