개요: 이 전략은 전형적인 기술적 분석 전략으로, 일반적으로 사용되는 몇 가지 평균선 지표인 EMA와 RSI, MACD, PSR과 같은 보조 지표를 사용하여, 다른 주기적인 평균선 구성과 지표 신호의 조합을 통해 입점 및 중지 규칙을 형성하여, 낮은 가격과 높은 가격의 기회를 찾습니다.

전략 원칙: 이 전략의 핵심은 5, 9, 21 일 평균선이다. 짧은 주기 평균선 위에 긴 주기 평균선 을 가로질러 볼 때, 그리고 짧은 주기 평균선 아래 긴 주기 평균선 을 가로질러 볼 때 볼 수 없다. 또한, RSI 지표와 결합하여 과매매 과매매, MACD 지표가 추세를 결정하고, PSR 지표가 지원 저항을 식별하여 조합 거래를 한다. 배경 색상 설정은 시장 정서를 표시하고, 추세 방향을 결정하는 데 도움을 준다.

전략적 강점 분석:

- 평균선 지표는 명확하고 직관적이어서 트렌드 방향을 쉽게 판단할 수 있다.

- RSI는 과매매 현상을 효과적으로 식별하고, MACD는 장단한 추세를 판단하고, PSR는 핵심 가격대를 찾고, 지표 조합은 상호 보완한다.

- 다양한 출전 규칙과 변수 설정의 유연성이 높습니다.

- 최적화 가능한 지표와 매개 변수 조합이 많습니다. 시장에 따라 지속적으로 조정 및 최적화 할 수 있습니다.

위험 분석:

- 짧은 주기의 작업은 큰 추세를 파악하기 어렵고, 반전을 놓칠 위험이 있습니다.

- 파라미터를 잘못 설정하면 너무 많은 가짜 신호가 발생하거나 신호가 누락될 수 있다.

- 순수 기술적인 지표는 경매 기관에 의해 손해가 발생하기 쉽다.

- 큰 지진이 발생했을 때 손상을 입을 수 있습니다.

어떻게 대처해야 할까요?

- 적당한 장선 트렌드를 파악하고 역동적인 단선 조작을 방지한다.

- 최적화 변수 모음, 정지 손실, 위험 관리

- 높은 지점에서의 회전과 낮은 지점에서의 반발의 가능성에 주의하십시오.

최적화 방향:

- 평균선 변수를 조정하고, 최적의 조합을 테스트한다.

- 다른 보조 지표 필터링 신호를 추가하십시오.

- 기계 학습 지표 판단 확률을 높여주세요.

- 거래량 변화와 함께 신호의 정확도를 높여줍니다.

- 손실을 막기 위한 전략이 추가되었습니다.

요약: 이 전략은 여러 보조 지표 신호를 통합하여 평균 지표의 장점을 활용하여 단선 저가 고가 판매의 기회를 활용합니다. 매개 변수 최적화 및 지표 조합을 통해 전략 효과를 지속적으로 향상시킬 수 있지만, 작업 빈도와 위험을 적절히 제어하여 한 번의 손실이 전체 수익에 큰 영향을 미치지 않도록해야합니다.

||

Overview: This strategy is a typical technical analysis strategy that utilizes several common moving average indicators like EMA and auxiliary indicators like RSI, MACD, PSR to form entry and stop loss rules for finding low buy high sell opportunities.

Principle: The core of this strategy is the 5, 9, 21 day moving averages. When the short period MA crosses over the long period one, it signals an uptrend; when the short period MA crosses below the long period one, it signals a downtrend. In addition, RSI is used to determine overbought and oversold levels, MACD to judge the trend, PSR to identify support and resistance for combo trading. The background color shows market sentiment to assist trend judgment. The parameters are customizable for configuring entry rules.

Advantages:

- MA indicators give clear trend direction.

- RSI effectively spots overbought/oversold levels, MACD judges short-long trend, PSR finds key price levels. The indicators are complementary.

- Flexible entry rules and parameter settings.

- Many optimizable indicators and parameter combinations adaptable to varying market conditions.

Risks:

- Short-term operations may fail to capture major trend and miss reversals.

- Improper parameter configuration can lead to too many false signals or missing good signals.

- Pure technical indicators are susceptible to manipulation by arbitrageurs causing losses.

- Prone to being stopped out in high volatile markets.

Solutions:

- Capture mid-long term trend appropriately to avoid trading against major trend.

- Optimize parameters, use stop loss to control risks.

- Watch out the possibilities of pullback from highs and bounce from lows.

Optimization:

- Fine tune MA parameters for best combo.

- Add more indicators to filter signals.

- Increase machine learning metrics for probability estimate.

- Combine volume changes to enhance signal accuracy.

- Add stop loss to restrict loss expansion.

Summary: This strategy integrates multiple auxiliary signals, leverages the strength of MA indicators to identify short-term low buy high sell chances. Parameters and indicators combinations may be optimized continuously to improve strategy efficacy, but operation frequency and risks should be moderated to prevent oversized single trade loss from eroding overall profitability.

[/trans]

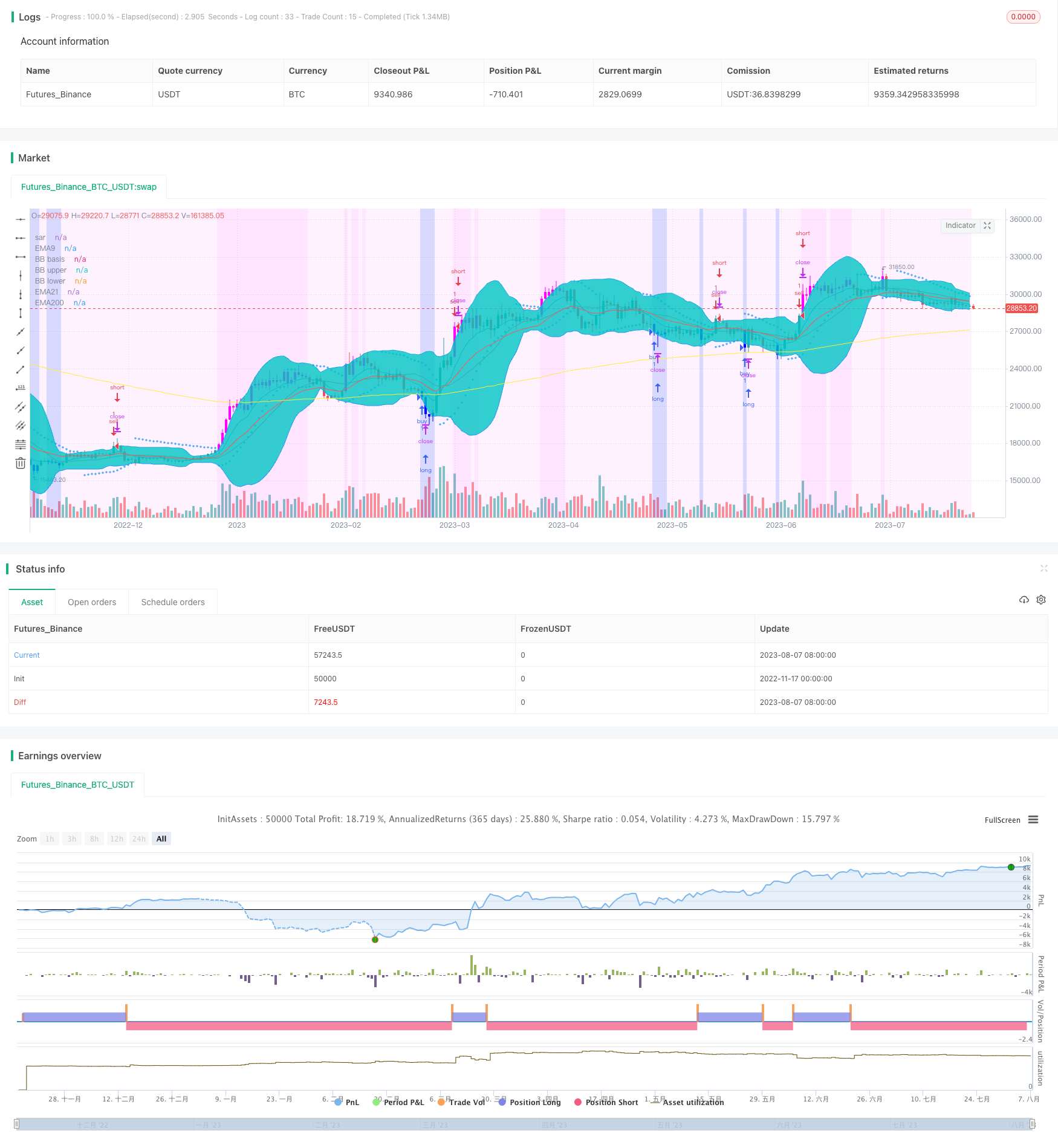

/*backtest

start: 2022-11-17 00:00:00

end: 2023-08-08 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("f.society v7", title="f.society v7", overlay=true)

//@Author: rick#1414

// -----------------------------------------------------

// f.society : Pone 3EMA: 5, 9, 21, 50, 100, 200, SAR,

// velas azules en sobreventa y velas moradas sobre compra

// SAR 0.02, 0.02, 0.2 , Bandas de Bollinger

// estrategia de compra y venta con rsi, macd o psr

// color de fondo: ema, rsi (color azul sobreventa 35, 25 (mas intenso))

// -----------------------------------------------------

// Como agregar a Trading view:

// 1 Cerrar todos los otros indicadores antes de añadirlo

// 2. Ir a la página de inicio TradingView.com

// 3. En la parte inferior, haga clic en Editor Pine // ver imagen: // https://cdn.discordapp.com/attachments/407267549047422976/407393815112974336/unknown.png

// 4. borrar todo el texo y reemplazar con todo el contenido de este archivo

// 5. Pulse el botón "Añadir a trazar" (Add to graph)

// -----------------------------------------------------

// revisar opciones de on y off segun indicadores deseados

// https://cdn.discordapp.com/attachments/405885820114042883/412115277883506700/unknown.png

// se puede cambiar la estrategia desde este menu desplegable para señales buy/sell

// Options

estrategia = input(defval="rsi", title = "Strategy", options=["ema","rsi","macd","psr","off","BB","ema5"])

in_bkcolor = input(defval="rsi", title = "background color", options=["ema","rsi","macd","psr","off","exchange","BB","ema5"])

e5 = input(title="Show ema5?", type=bool, defval=false)

e9 = input(title="Show ema9?", type=bool, defval=true)

e21 = input(title="Show ema21?", type=bool, defval=true)

e50 = input(title="Show ema50?", type=bool, defval=false)

e100 = input(title="Show ema100?", type=bool, defval=false)

e200 = input(title="Show ema200", type=bool, defval=true)

in_rsi = input(title="Color oversold and overbought bars?", type=bool, defval=true)

in_sar = input(title="Show Parabolic Sar", type=bool, defval=true)

in_bb = input(title="Show Bollinger Bands?", type=bool, defval=true)

sd = input(false, title="Show Daily Pivots?")

linew = input(1, title="linewidth", minval=0)

sarw = input(1, title="sar points width", minval=0)

ovs = input(40, title="oversold rsi", minval=0)

ovb = input(65, title="overbought rsi", minval=0)

//pf = input(false,title="Show Filtered Pivots")

pf=false

// 3 ema

src = close // input(close, title="Source")

//len9 = input(9, minval=1, title="ema9 Length")

//len21 = input(21, minval=1, title="ema21 Length")

//len200 = input(200, minval=1, title="ema200 Length")

len5=5

len9=9

len21=21

len50=50

len100=100

len200=200

ema5 = ema(src, len5)

ema9 = ema(src, len9)

ema21 = ema(src, len21)

ema50= ema(src, len50)

ema100 = ema(src, len100)

ema200 = ema(src, len200)

plot(e5? ema5 : na, title="EMA5", linewidth=linew, color=purple)

plot(e9? ema9 : na, title="EMA9", linewidth=linew, color=blue)

plot(e21? ema21 : na, title="EMA21", linewidth=linew, color=red)

plot(e50? ema50 : na, title="EMA50", linewidth=linew, color=green)

plot(e100? ema100 : na, title="EMA100", linewidth=linew, color=lime)

plot(e200? ema200 : na, title="EMA200", linewidth=linew, color=yellow)

// RSI Color

//lenR = input(14, minval=1, title="RSI Length")

lenR=14

//up = rma(max(change(src), 0), lenR)

//down = rma(-min(change(src), 0), lenR)

//vrsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

vrsi=rsi(close,lenR)

//plot(vrsi,title="vrsi")

oversold = vrsi < ovs

overbought = vrsi > ovb

barcolor(in_rsi? oversold? #0000FF : overbought? #ff00ff:na : na)

// SAR

plot(in_sar? sar(0.02, 0.02, 0.2): na, style=cross, linewidth=sarw, color=blue, title="sar")

// BB

//length = input(20, title="Bollinger length", minval=1)

length=20

//mult = input(2.0, title="Bollinger stdDev", minval=0.001, maxval=50)

mult=2.0

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

plot(in_bb? basis :na, color=red, linewidth=linew, title="BB basis")

p1 = plot(in_bb? upper :na, color=blue, linewidth=linew, title="BB upper")

p2 = plot(in_bb? lower :na, color=blue, linewidth=linew, title="BB lower")

fill(p1, p2)

//background

bgcolor(in_bkcolor=="exchange"? #0000FF40 : in_bkcolor=="rsi"? vrsi < (ovs-15) ? #0000FF50 : vrsi < ovs ? #0000FF30 :( vrsi < ovb ? #ff00ff10 : #ff00ff20): in_bkcolor=="ema"?(ema9>ema21?#ff00ff10 : #0000FF20):in_bkcolor=="BB"?(lower>close?#ff00ff10 : close>upper?#0000FF20:#ff00ff10): in_bkcolor=="ema5"?(ema5>ema21?#ff00ff10 : #0000FF20):na)

// Strategy

if estrategia == "ema"

strategy.entry("buy", true, 1, when= crossover(ema9,ema21) ),

strategy.entry("sell", false, 1, when = crossover(ema21,ema9))

else

if estrategia =="rsi"

strategy.entry("buy", true, 1, when= vrsi <ovs),

strategy.entry("sell", false, 1, when = vrsi > ovb or crossover(close,upper))

else

if estrategia =="macd"

[macdLine, signalLine, histLine] = macd(close, 12, 26, 9),

//bgcolor(macdLine > signalLine ? #98c8ff : #ff8b94),

strategy.entry("buy", true, 1, when= macdLine>=signalLine ),

strategy.entry("sell", false, 1, when = macdLine<signalLine)

else

if estrategia=="psr"

leftBars = 4 //input(4)

rightBars = 2 //input(2)

swh = pivothigh(leftBars, rightBars)

swl = pivotlow(leftBars, rightBars)

swh_cond = not na(swh)

hprice = 0.0

hprice := swh_cond ? swh : hprice[1]

le = false

le := swh_cond ? true : (le[1] and high > hprice ? false : le[1])

if (le)

strategy.entry("buy", strategy.long, comment="buy", stop=hprice + syminfo.mintick)

swl_cond = not na(swl)

lprice = 0.0

lprice := swl_cond ? swl : lprice[1]

se = false

se := swl_cond ? true : (se[1] and low < lprice ? false : se[1])

if (se)

strategy.entry("sell", strategy.short, comment="sell", stop=lprice - syminfo.mintick)

else

if estrategia=="BB"

strategy.entry("buy", true, 1, when= crossover(lower,close) ),

strategy.entry("sell", false, 1, when = crossover(close,upper))

else

if estrategia=="ema5"

strategy.entry("buy", true, 1, when= crossover(ema5,ema21) ),

strategy.entry("sell", false, 1, when = crossover(ema21,ema5))

// pivots

// Classic Pivot

pivot = (high + low + close ) / 3.0

// Filter Cr

bull= pivot > (pivot + pivot[1]) / 2 + .0025

bear= pivot < (pivot + pivot[1]) / 2 - .0025

// Classic Pivots

r1 = pf and bear ? pivot + (pivot - low) : pf and bull ? pivot + (high - low) : pivot + (pivot - low)

s1 = pf and bull ? pivot - (high - pivot) : pf and bear ? pivot - (high - low) : pivot - (high - pivot)

r2 = pf ? na : pivot + (high - low)

s2 = pf ? na : pivot - (high - low)

//Pivot Average Calculation

smaP = sma(pivot, 3)

//Daily Pivots

dtime_pivot = request.security(syminfo.tickerid, 'D', pivot[1])

dtime_pivotAvg = request.security(syminfo.tickerid, 'D', smaP[1])

dtime_r1 = request.security(syminfo.tickerid, 'D', r1[1])

dtime_s1 = request.security(syminfo.tickerid, 'D', s1[1])

dtime_r2 = request.security(syminfo.tickerid, 'D', r2[1])

dtime_s2 = request.security(syminfo.tickerid, 'D', s2[1])

offs_daily = 0

plot(sd and dtime_pivot ? dtime_pivot : na, title="Daily Pivot",style=line, color=fuchsia,linewidth=linew)

plot(sd and dtime_r1 ? dtime_r1 : na, title="Daily R1",style=line, color=#DC143C,linewidth=linew)

plot(sd and dtime_s1 ? dtime_s1 : na, title="Daily S1",style=line, color=lime,linewidth=linew)

plot(sd and dtime_r2 ? dtime_r2 : na, title="Daily R2",style=line, color=maroon,linewidth=linew)

plot(sd and dtime_s2 ? dtime_s2 : na, title="Daily S2",style=line, color=#228B22,linewidth=linew)

// References:

// get number of bars since last green bar

//plot(barssince(close >= open), linewidth=3, color=blue)

//bgcolor(close < open ? #ff8b94 : #98c8ff , transp=10)

//http://www.color-hex.com/

// #98c8ff light blue

// #ff8b94 red #b21c0e

// #7d1d90 purple

// #0029ff blue

// #fffa86 yellow