이중 반전 CMO 양자 전략

저자:차오장, 날짜: 2024-01-04 14:35:23태그:

전반적인 설명

이 전략은 이중 반전 전략으로 123 반전 지표와 CMOWMA 양자 지표를 결합하여 빨간색과 녹색 K-라인 시각 효과로 가격 반전 신호의 이중 확인을 달성합니다.

전략 원칙

이 전략은 두 부분으로 구성됩니다.

-

123 반전 지표

- 가격 상승 또는 하락을 결정하기 위해 종료 가격과 이전 종료 가격을 사용

- 역전 신호를 확인하기 위해 스토카스틱 지표의 빠른 라인과 느린 라인 크로스오버를 사용하십시오.

- 조건이 충족되면 긴 신호 또는 짧은 신호를 생성

-

CMOWMA 양자 지표

- 가격 동력을 측정하기 위해 CMO 지표를 사용

- WMA 가중된 이동 평균을 CMO 지표에 적용합니다.

- CMO가 WMA보다 높을 때 길게 (단기)

두 부분 모두 같은 방향으로 신호를 내릴 때 위치를 입력합니다.

전략 의 장점

- 이중 확인 메커니즘은 잘못된 브레이크를 필터하고 불필요한 위치를 줄일 수 있습니다.

- 빨간색과 녹색의 K-라인 컬러링은 시장 조건을 쉽게 판단하기 위해 시각 효과를 생성합니다.

- 역전 및 추진력 지표의 조합은 전반적인 안정성을 제공합니다.

- 간단한 매개 변수 설정은 다양한 제품에 적합하고 구현하기 쉽습니다

전략 의 위험

- 처음 반전된 후에도 가격이 다시 뒤집어질 수 있으며, 위프사 (Whipsaws) 의 위험이 있습니다.

- 빈번한 위치 전환은 과도한 거래 수수료를 발생

- 부적절한 매개 변수 설정은 신호가 너무 많거나 너무 적을 수 있습니다.

- CMO 매개 변수는 제품 특성에 따라 조정해야 합니다.

리스크는 반전 조건의 완화, 보유 기간의 연장, 매개 변수 조합의 최적화 등으로 줄일 수 있습니다.

최적화 방향

- 다른 스토카스틱 매개 변수의 테스트 영향

- MACD, KDJ 등과 같은 다른 지표로 확인을 대체/충분합니다.

- 다른 CMO 및 WMA 길이의 테스트 최적화

- 특정 수준에서 스톱 로스/프로프트 테킹을 추가해보세요

- 새로운 위치의 주파수를 제어하는 필터를 설정

요약

이 전략은 간단한 매개 변수와 구현하기 쉬운 전반적으로 견고하며, 잘못된 신호를 제거하기 위해 효과적인 이중 신호 필터링 메커니즘을 형성하기 위해 가격 반전 및 추진력 지표를 결합합니다. K-라인 컬러링은 직관적인 시각을 제공합니다. 매개 변수 최적화 및 위험 통제에서 추가 성능 향상이 발생할 수 있습니다.

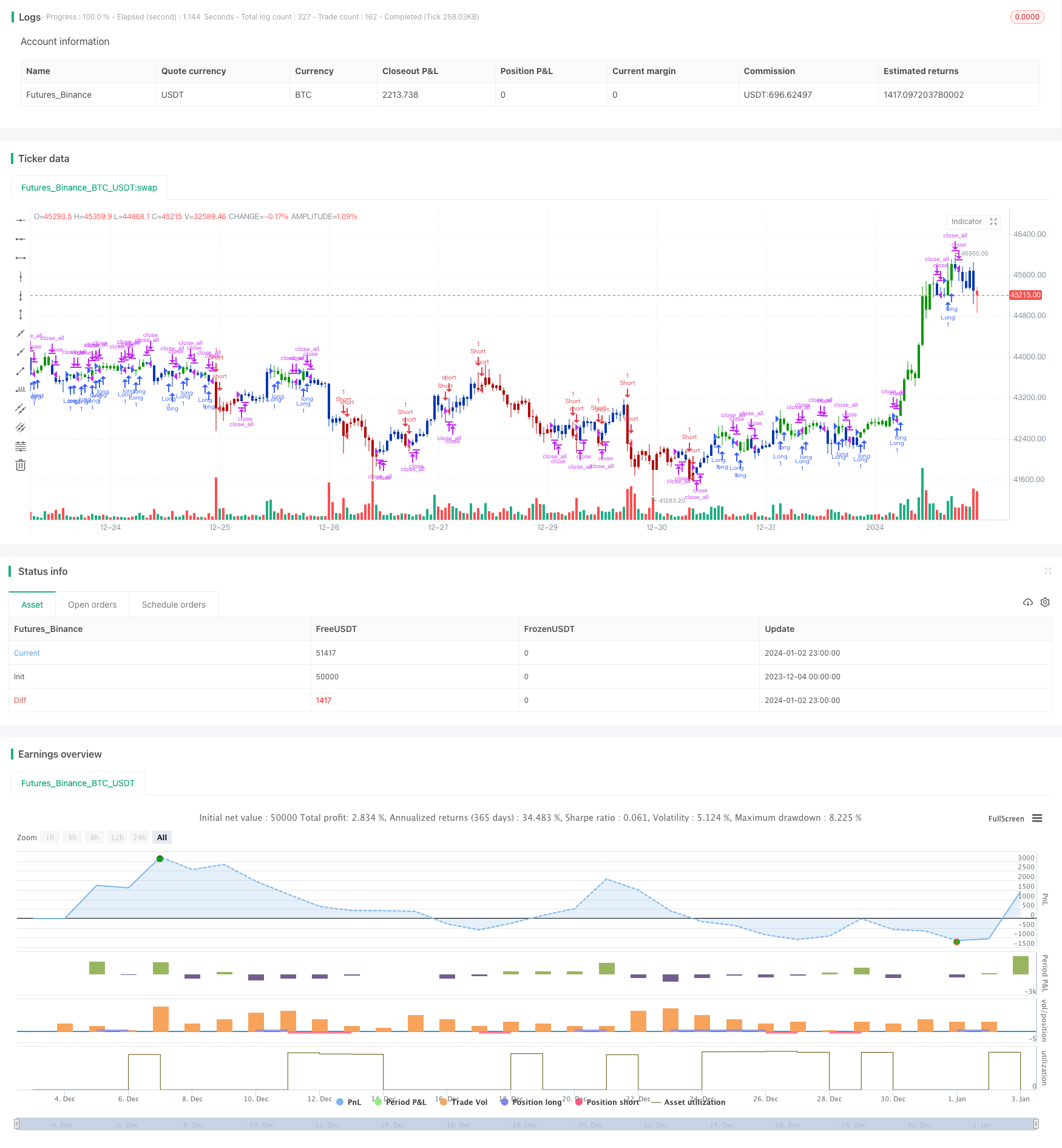

/*backtest

start: 2023-12-04 00:00:00

end: 2024-01-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 19/08/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This indicator plots Chandre Momentum Oscillator and its WMA on the

// same chart. This indicator plots the absolute value of CMO.

// The CMO is closely related to, yet unique from, other momentum oriented

// indicators such as Relative Strength Index, Stochastic, Rate-of-Change,

// etc. It is most closely related to Welles Wilder?s RSI, yet it differs

// in several ways:

// - It uses data for both up days and down days in the numerator, thereby

// directly measuring momentum;

// - The calculations are applied on unsmoothed data. Therefore, short-term

// extreme movements in price are not hidden. Once calculated, smoothing

// can be applied to the CMO, if desired;

// - The scale is bounded between +100 and -100, thereby allowing you to clearly

// see changes in net momentum using the 0 level. The bounded scale also allows

// you to conveniently compare values across different securities.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

CMOWMA(Length, LengthWMA) =>

pos = 0

xMom = abs(close - close[1])

xSMA_mom = sma(xMom, Length)

xMomLength = close - close[Length]

nRes = 100 * (xMomLength / (xSMA_mom * Length))

xWMACMO = wma(nRes, LengthWMA)

pos := iff(nRes > xWMACMO, 1,

iff(nRes <= xWMACMO, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & CMO & WMA", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthCMO = input(14, minval=1)

LengthWMA = input(13, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posCMOWMA = CMOWMA(LengthCMO, LengthWMA)

pos = iff(posReversal123 == 1 and posCMOWMA == 1 , 1,

iff(posReversal123 == -1 and posCMOWMA == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

더 많은

- 이중 이동 평균 크로스오버 역동 트렌드 추적 전략

- 양자 빛 이동 평균 트렌드 추적 최적화 전략

- 부피 에너지 기반 전략

- HMA 추진력 돌파구 전략

- ATR 및 변동 지수 기반 트렌드 추적 전략

- 동력 트렌드 추적 전략

- 양자 추세 전략

- 선체 필터 이동 평균 전략

- 곰 힘 전략

- 이중 이동 평균 크로스오버 전략

- RSI와 SMA 크로스오버 전략

- 볼링거 밴드 브레이크업 전략

- 가격 동력 추적 전략

- 이동평균 시스템에 기반한 그리드 거래 전략

- 추진력 역전 전략

- 크로싱 이동 평균 트렌드 추적 전략

- 피보나치 황금 비율 및 상대적 강도 RSI 전략

- 복합 전략에 기반한 인버스 및 중력 중심 통합 거래 전략

- 이중 및 삼중 기하급수적 이동 평균 교차 전략

- 볼링거 밴드 브레이크업 스윙 거래 전략