개요

이 전략은 SSL 통로 지표를 사용하여 시장 추세를 판단하고, 평균선을 기준으로 추세를 따르는 전략이다. 그것은 중장선의 4 시간선과 일선에 적용된다.

전략 원칙

SSL 채널은 켈트 평균선과 실제 진동량으로 구성된다. 그것은 시장의 경향 방향을 판단할 수 있다. 가격이 상승 궤도를 돌파할 때 호불호 신호이며, 하락 궤도를 돌파할 때 하락 신호이다.

전략은 EMA와 같은 평균선 지표를 사용하여 기준 평균선을 계산한다. 이 평균선은 일부 가짜 돌파구를 필터링 할 수 있다.

전략은 가격이 SSL 상궤도를 돌파할 때 더 많이 하고, 가격이 SSL 하궤도를 돌파할 때 공백을 한다. 상승 추세에서 하락 추세를 따라잡고, 하락 추세에서 사본을 knife。

스톱 로드 방식은 백분율 스톱, ATR 스톱 및 최저 가격/최고 가격 스톱 로드를 회상한다. 스톱 로드는 스톱 로드의 N배이다. 구체적인 매개 변수는 사용자에 의해 결정된다.

우위 분석

SSL 통로는 트렌드 방향을 정확하게 판단하고, 가짜 신호를 줄인다. 동선결합과 협력하여 상장 근거를 마련하고, 뒤따르는 것을 피한다.

다양한 종류의 평균선을 유연하게 선택할 수 있으며, 보다 광범위한 시장 상황에 적응할 수 있다.

스톱 손실 방식은 유연하고, 위험을 조절할 수 있다. 스톱 스톱 배수는 다양한 선호도를 충족시키기 위해 유연하게 설정할 수 있다.

이 시장의 양방향 기회를 최대한 활용할 수 있습니다.

위험 분석

평균선 지표는 모두 지연되어 손실이 누적될 수 있다.

이 사건은 지진이 발생했을 때 경로를 돌파한 후 반전되는 현상이며, 쉽게 잡히는 현상이다.

ATR 및 회귀 중지 손실은 비정상적 인 돌파구에서 너무 느려져 손실이 확대 될 수 있습니다.

위험 대응:

- 적절하게 평균선 변수를 조정하거나 다른 유형의 평균선을 선택하십시오.

- “지난 몇 년 동안, 우리는 많은 사람들을 위해 노력했습니다.

- ATR에 배수 인자를 추가하거나 회귀 주기를 조정한다.

최적화 방향

- 더 많은 종류의 평균선 지표를 테스트하여 최적의 변수를 찾아보세요.

- 손실을 막는 ATR 주기 변수를 최적화한다.

- 다른 스톱 로즈 배수 변수를 테스트한다.

- 다른 항우울증 위험요소를 시험해 보세요.

요약하다

이 전략은 SSL를 사용하여 트렌드를 판단하고, 평행 지표를 확인하여 효과적으로 트렌드를 추적할 수 있습니다. 이것은 위험을 통제하면서 더 높은 수익을 얻기 위해 유연한 중지 및 중지 방법을 제공합니다. 매개 변수를 계속 테스트하고 최적화함으로써 더 나은 거래 성과를 얻을 수 있습니다.

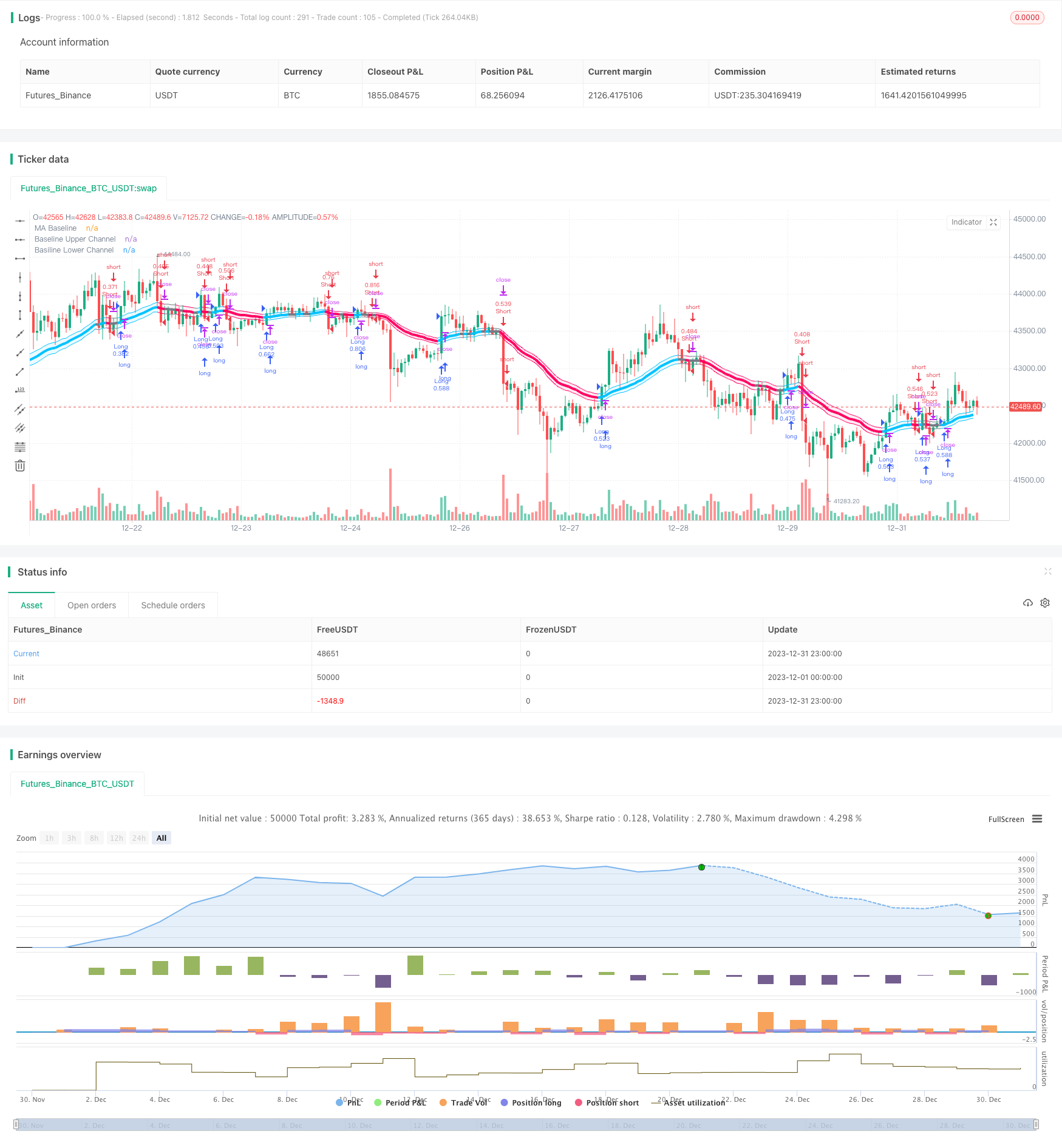

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Thanks to @kevinmck100 for opensource strategy template and @Mihkel00 for SSL Hybrid

// @fpemehd

// @version=5

strategy(title = '[fpemehd] SSL Baseline Strategy',

shorttitle = '[f] SSL',

overlay = true)

// # ========================================================================= #

// # Inputs

// # ========================================================================= #

// 1. Time

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

inDateRange = true

// 2. Inputs for direction: Long? Short? Both?

// i_longEnabled = input.bool(defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "1", group = "Long / Short" )

// i_shortEnabled = input.bool(defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "1", group = "Long / Short" )

// 3. Shared inputs for Long and Short

//// 3-1. Inputs for Stop Loss Type: ATR or Percent?

i_slType = input.string (defval = "ATR", title = "SL Type ", group = "Strategy: Stop Loss Conditions", options = ["Percent", "ATR", "Previous LL / HH"], tooltip = "Stop Loss based on %? ATR?", inline = "1")

i_slPercent = input.float (defval = 3, title = "SL % ", group = "Strategy: Stop Loss Conditions", inline = "2")

i_slAtrLength = input.int (14, "SL ATR Length ", group = "Strategy: Stop Loss Conditions", inline = "3", minval = 0, maxval = 10000)

i_slAtrMultiplier = input.float (4, "SL ATR Multiplier", group = "Strategy: Stop Loss Conditions", inline = "3", minval = 0, step = 0.1, tooltip = "Length of ATR used to calculate Stop Loss. \nSize of StopLoss is determined by multiplication of ATR value. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

i_slLookBack = input.int(30, "Lowest Price Before Entry", group = "Strategy: Stop Loss Conditions", inline = "4", minval = 30, step = 1, tooltip = "Lookback to find the Lowest Price. \nStopLoss is determined by the Lowest price of the look back period. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

//// 3-2. Inputs for Quantity & Risk Manangement: Take Profit

i_riskReward = input.float(2, "Risk : Reward Ratio ", group = "Strategy: Risk Management", inline = "1", minval = 0, step = 0.1, tooltip = "Previous high or low (long/short dependant) is used to determine TP level. 'Risk : Reward' ratio is then used to calculate SL based of previous high/low level.\n\nIn short, the higher the R:R ratio, the smaller the SL since TP target is fixed by previous high/low price data.")

i_accountRiskPercent = input.float(1, "Portfolio Risk %", group = "Strategy: Risk Management", inline = "1", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

// 4. Inputs for Drawings

i_showTpSlBoxes = input.bool(false, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

i_showLabels = input.bool(false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "1", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

i_showDashboard = input.bool(false, "Show Dashboard", group = "Strategy: Drawings", inline = "1", tooltip = "Show Backtest Results")

i_show_color_bar = input.bool(false , "Color Bars", group = "Strategy: Drawings", inline = "1")

// 5. Inputs for Indicators

//// 5-1. Inputs for Indicator - 1: SSL Hybrid

i_useTrueRange = input.bool(defval = true , title = "use true range for Keltner Channel?", tooltip = "", inline = " ", group = "1: SSL Hybrid")

i_maType = input.string(defval='EMA', title='Baseline Type', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'],group = "1: SSL Hybrid")

i_len = input.int(defval=30,title='Baseline Length', group = "1: SSL Hybrid")

i_multy = input.float(0.2, step=0.05, title='Base Channel Multiplier', group = "1: SSL Hybrid")

// Input for Baseline

i_kidiv = input.int(defval=1, maxval=4, minval=0, title='Kijun MOD Divider',inline="Kijun v2", group="1: SSL Hybrid")

i_jurik_phase = input.int(defval=3, title='Baseline Type = JMA -> Jurik Phase', inline='JMA',group="1: SSL Hybrid")

i_jurik_power = input.int(defval=1, title='Baseline Type = JMA -> Jurik Power', inline='JMA',group="1: SSL Hybrid")

i_volatility_lookback = input.int(defval=10, title='Baseline Type = VAMA -> Volatility lookback length', inline='VAMA',group="1: SSL Hybrid")

// MF

i_beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Baseline Type = MF (Modular Filter, General Filter) ->Beta', inline='MF',group="1: SSL Hybrid")

i_feedback = input.bool(defval=false, title='Baseline Type = MF (Modular Filter) -> Use Feedback?', inline='MF',group="1: SSL Hybrid")

i_z = input.float(0.5, title='Baseline Type = MF (Modular Filter) -> Feedback Weighting', step=0.1, minval=0, maxval=1, inline='MF',group="1: SSL Hybrid")

// EDSMA

i_ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20, inline='EDSMA',group="1: SSL Hybrid")

i_ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3], inline='EDSMA',group="1: SSL Hybrid")

// # ========================================================================= #

// # Functions for Stop Loss & Take Profit & Plots

// # ========================================================================= #

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if i_showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if i_showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if i_showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##") + "\nExit Price: " + str.tostring(close,"#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + " " + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// # ========================================================================= #

// # Entry, Close Logic

// # ========================================================================= #

// 1. Calculate Indicators

//// 1-1. Calculate Indicators for SSL Hybrid Baseline

////// TEMA

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

////// EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = i_feedback ? i_z * src + (1 - i_z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = i_beta * b + (1 - i_beta) * c

lower = i_beta * c + (1 - i_beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, i_volatility_lookback)

vol_down = ta.lowest(dev, i_volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = i_jurik_phase < -100 ? 0.5 : i_jurik_phase > 100 ? 2.5 : i_jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, i_jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / i_kidiv), ta.highest(len / i_kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = i_ssfPoles == 2 ? get2PoleSSF(avgZeros, i_ssfLength) : get3PoleSSF(avgZeros, i_ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

////// Keltner Baseline Channel (Baseline)

BBMC = ma(i_maType, close, i_len)

Keltma = ma(i_maType, close, i_len)

range_1 = i_useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, i_len)

upperk = Keltma + rangema * i_multy

lowerk = Keltma - rangema * i_multy

// 2. Entry Condition for Long and Short

// Condition 1

bullSSL = close > upperk

bearSSL = close < lowerk

// Enter Position based on Condition 1

goLong = inDateRange and bullSSL

goShort = inDateRange and bearSSL

// # ========================================================================= #

// # Position Control Logic (Entry & Exit)

// # ========================================================================= #

// 1. Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

// 2. Entry decisions

openLong = (goLong and not inLong) // Long entry condition & not in long position

openShort = (goShort and not inShort) // Short entry condition & not in short position

flippingSides = (goLong and inShort) or (goShort and inLong) // (Long entry condition & in short position) and the opposite

enteringTrade = openLong or openShort // Entering Long or Short Condition

inTrade = inLong or inShort

// 3. Stop Loss & Take Profit Percent

lowestLow = ta.lowest(source = low, length = i_slLookBack)

highestHigh = ta.highest(source = high, length = i_slLookBack)

llhhSLPercent = openLong ? math.abs((close - lowestLow) / close) * 100 : openShort ? math.abs((highestHigh - close) / close) * 100 : na

atr = ta.atr(i_slAtrLength)

slAmount = atr * i_slAtrMultiplier

slPercent = i_slType == 'ATR' ? math.abs((1 - (close - slAmount) / close) * 100) : i_slType == 'Percent' ? i_slPercent : llhhSLPercent

tpPercent = slPercent * i_riskReward

// 4. Risk calculations & Quantity Management

riskAmt = strategy.equity * i_accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

// 5. Open Position

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

// Can add more take profit Actions

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// # ========================================================================= #

// # Plots (Bar Color, Plot, Label, Boxes)

// # ========================================================================= #

// 1. SSL Hybrid Baseline

longColor = #00c3ff

shortColor = #ff0062

color_bar = close > upperk ? longColor : close < lowerk ? shortColor : color.gray

p1 = plot(BBMC, color=color.new(color=color_bar, transp=0), linewidth=4, title='MA Baseline')

// 2. Bar color Based On SSL Hybrid Baseline

barcolor(i_show_color_bar ? color_bar : na)

up_channel = plot(upperk, color=color_bar, title='Baseline Upper Channel')

low_channel = plot(lowerk, color=color_bar, title='Basiline Lower Channel')

fill(up_channel, low_channel, color.new(color=color_bar, transp=90))

// 3. Stoploss Boxes

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

entryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

if (inTrade and exitTriggered)

inShort := false

inLong := false

printTpSlHitBox(tradeEntryBar + 1, bar_index, slHit, tpHit, entryPrice, slPrice, tpPrice)

printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, entryPrice, pnl)

if barstate.islastconfirmedhistory and strategy.position_size != 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// 4. Data Windows

plotchar(slPrice, "Stop Loss Price", "")

plotchar(tpPrice, "Take Profit Price", "")

// 5. Showing Labels

plotDebugLabels = false

if plotDebugLabels

if bar_index == tradeEntryBar

printLabel(bar_index, "Position size: " + str.tostring(entryQty * close, "#.##"))

// 6. Showing Dashboard

if i_showDashboard

var bgcolor = color.new(color.black,0)

// Keep track of Wins/Losses streaks

newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

varip int winRow = 0

varip int lossRow = 0

varip int maxWinRow = 0

varip int maxLossRow = 0

if newWin

lossRow := 0

winRow := winRow + 1

if winRow > maxWinRow

maxWinRow := winRow

if newLoss

winRow := 0

lossRow := lossRow + 1

if lossRow > maxLossRow

maxLossRow := lossRow

// Prepare stats table

var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

if barstate.islastconfirmedhistory

// Update table

dollarReturn = strategy.netprofit

f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

_profit = (strategy.netprofit / strategy.initial_capital) * 100

f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

_numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

_winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)