개요

이 전략은 들리어 출구 (Chandelier Exit), 제로 지연 이동 평균 (ZLSMA) 및 상대 거래량 (RVOL) 펄스 검출을 결합하여 하나의 완전한 거래 시스템을 형성한다. 들리어 출구 (Chandelier Exit), 제로 지연 이동 평균 (ZLSMA) 및 상대 거래량 (RVOL) 펄스 검출은 전략이 낮은 변동률의 시장에서 피하는 데 도움을 주고 거래 품질을 향상시킵니다.

전략 원칙

- ATR을 계산하고 ATR과 최고 가격/최저 가격에 따라 다중 헤드 및 빈 헤드 중지 위치를 계산한다.

- ZLSMA를 계산하여 트렌드 방향을 판단합니다.

- RVOL를 계산하여 RVOL와 설정한 임계값을 비교하여 트래픽이 펄스가 발생하는지 판단한다.

- 다단 입시: 현재 종결 가격에 ZLSMA를 착용하고, RVOL이 절감값보다 크며, 과다 입장을 열어, 스톱 로드 위치가 근래의 최저점이다.

- 공허 입시: 현재 종결 가격 아래 ZLSMA를 뚫고, RVOL이 시한부보다 크며, 공허권을 열고, 스톱 로드는 근래의 최고점이다.

- 다수 출전: ZLSMA를 현재 종결 가격 아래로 착용하고, 평대 다수 .

- 빈 머리 출장: 현재 폐장 가격에 ZLSMA를 입고, 빈 티켓.

전략적 이점

- 램프 출전 법칙은 고정된 손실의 위험을 줄여서 손해의 위치를 동적으로 조정할 수 있다.

- ZLSMA는 가격 변화에 신속하게 반응하여 거래에 대한 신뢰할 수있는 추세 판단을 제공합니다.

- RVOL 펄스 검사는 전략이 낮은 변동률의 정립 시장을 피하고 거래 품질을 향상시키는 데 도움이 됩니다.

- 전략의 논리는 명확하고, 이해하기 쉽고, 실행하기 쉽다.

전략적 위험

- 트렌드가 보이지 않거나 자주 변동하는 시장에서 이 전략은 더 많은 거래 수를 나타낼 수 있으며, 이로 인해 수수료 비용이 증가한다.

- 전략의 파라미터 설정 (ATR 주기, ZLSMA 주기, RVOL 값 등) 은 전략의 성능에 큰 영향을 미치며, 부적절한 파라미터는 전략의 성능이 떨어질 수 있다.

- 이 전략은 포지션 관리 및 위험 통제를 고려하지 않고 실제 적용에서는 자금 관리 원칙을 결합해야합니다.

전략 최적화 방향

- 추세 판단의 정확성을 더욱 높이기 위해 평균선 시스템이나 동력 지표와 같은 추세 확인 지표를 도입하십시오.

- RVOL 펄스 검출의 논리를 최적화하여, 예를 들어, 연속적으로 발생하는 여러 RVOL 펄스를 고려하여 거래를 하기 전에, 신호 품질을 더욱 향상시키기 위해.

- 출전 조건에 수익정지 논리를 추가하여, 특정 수익 목표가 달성되면 매매를 청산하여 이미 얻은 수익을 잠금합니다.

- 시장 특성과 거래 유형에 따라 전략 파라미터를 최적화하여 최적의 파라미터 조합을 찾습니다.

- 포지션 관리 및 위험 제어 원칙과 결합하여 전략의 완성도를 높이고 전략의 안정성과 신뢰성을 향상시킵니다.

요약하다

ZLSMA-강화형 램프 출구 전략과 거래량 펄스 검출은 트렌드 추적형 전략으로, 동적 스톱로스, 트렌드 판단 및 거래량 펄스 검출을 통해 트렌드 기회를 잡는 동시에 거래 위험을 제어한다. 전략 논리는 명확하고 이해하기 쉽고 구현되지만 실제 응용에서는 특정 시장 특성과 거래 품종과 결합하여 여전히 최적화 및 개선이 필요합니다. 더 많은 신호 확인 지표를 도입하고 출구 조건을 최적화하고 매개 변수를 합리화하고 엄격한 포지션 관리 및 위험 관리를 통해 전략은 안정적이고 효율적인 거래 도구가 될 전망이다.

전략 소스 코드

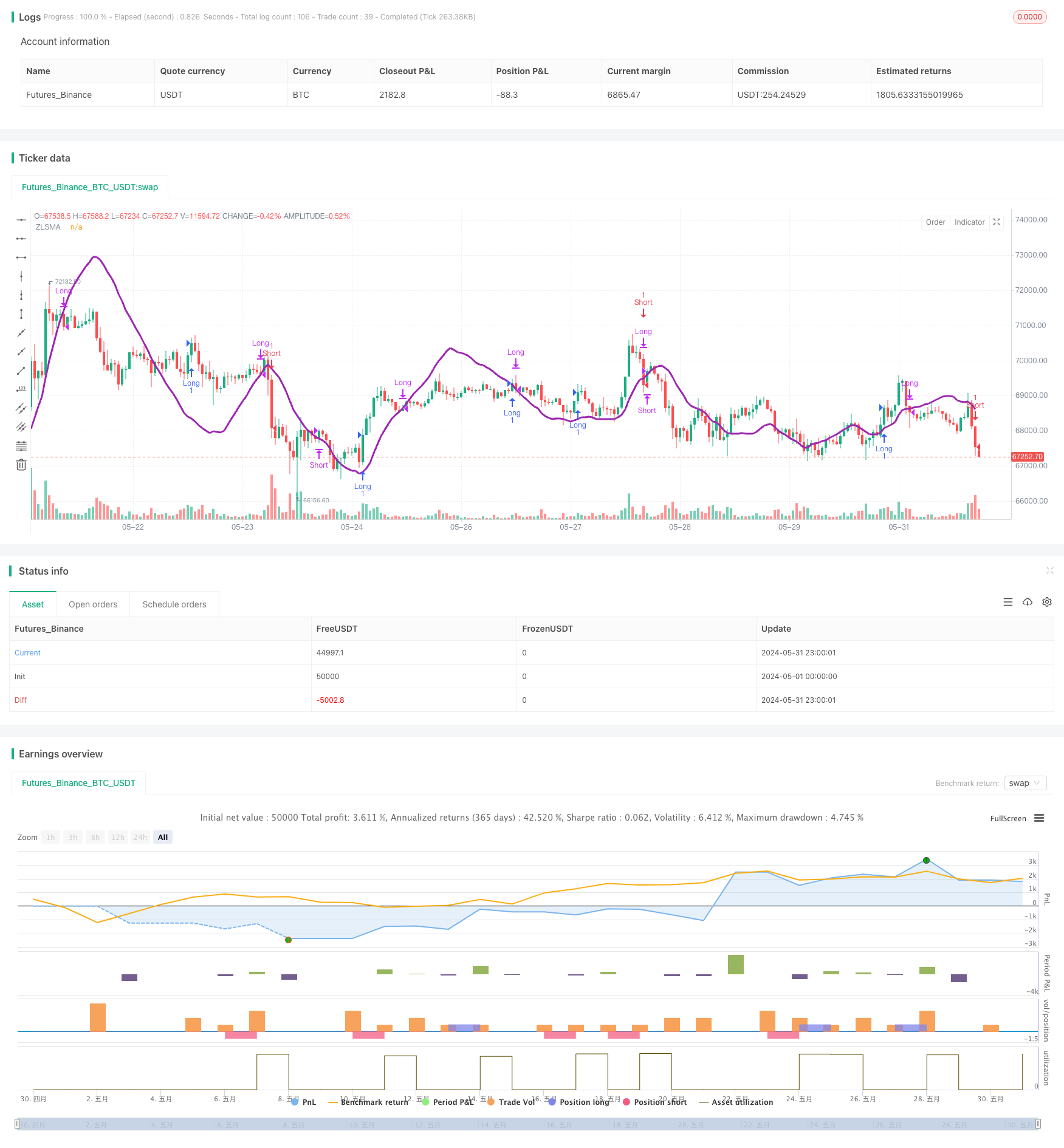

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Chandelier Exit Strategy with ZLSMA and Volume Spike Detection", shorttitle="CES with ZLSMA and Volume", overlay=true, process_orders_on_close=true, calc_on_every_tick=false)

// Chandelier Exit Inputs

lengthAtr = input.int(title='ATR Period', defval=1)

mult = input.float(title='ATR Multiplier', step=0.1, defval=2.0)

useClose = input.bool(title='Use Close Price for Extremums', defval=true)

// Calculate ATR

atr = mult * ta.atr(lengthAtr)

// Calculate Long and Short Stops

longStop = (useClose ? ta.highest(close, lengthAtr) : ta.highest(high, lengthAtr)) - atr

shortStop = (useClose ? ta.lowest(close, lengthAtr) : ta.lowest(low, lengthAtr)) + atr

// Update stops based on previous values

longStop := na(longStop[1]) ? longStop : close[1] > longStop[1] ? math.max(longStop, longStop[1]) : longStop

shortStop := na(shortStop[1]) ? shortStop : close[1] < shortStop[1] ? math.min(shortStop, shortStop[1]) : shortStop

// Determine Direction

var int dir = na

dir := na(dir[1]) ? (close > shortStop ? 1 : close < longStop ? -1 : na) : close > shortStop[1] ? 1 : close < longStop[1] ? -1 : dir[1]

// ZLSMA Inputs

lengthZLSMA = input.int(title="ZLSMA Length", defval=50)

offsetZLSMA = input.int(title="ZLSMA Offset", defval=0)

srcZLSMA = input.source(close, title="ZLSMA Source")

// ZLSMA Calculation

lsma = ta.linreg(srcZLSMA, lengthZLSMA, offsetZLSMA)

lsma2 = ta.linreg(lsma, lengthZLSMA, offsetZLSMA)

eq = lsma - lsma2

zlsma = lsma + eq

// Plot ZLSMA

plot(zlsma, title="ZLSMA", color=color.purple, linewidth=3)

// Swing High/Low Calculation

swingHigh = ta.highest(high, 5)

swingLow = ta.lowest(low, 5)

// Relative Volume (RVOL) Calculation

rvolLength = input.int(20, title="RVOL Length")

rvolThreshold = input.float(1.5, title="RVOL Threshold")

avgVolume = ta.sma(volume, rvolLength)

rvol = volume / avgVolume

// Define buy and sell signals based on ZLSMA and Volume Spike

buySignal = (dir == 1 and dir[1] == -1 and close > zlsma and rvol > rvolThreshold)

sellSignal = (dir == -1 and dir[1] == 1 and close < zlsma and rvol > rvolThreshold)

// Define exit conditions based on ZLSMA

exitLongSignal = (close < zlsma)

exitShortSignal = (close > zlsma)

// Strategy Entries and Exits

if (buySignal)

strategy.entry("Long", strategy.long, stop=swingLow)

if (sellSignal)

strategy.entry("Short", strategy.short, stop=swingHigh)

if (exitLongSignal)

strategy.close("Long")

if (exitShortSignal)

strategy.close("Short")

// Alerts

alertcondition(buySignal, title='Alert: CE Buy', message='Chandelier Exit Buy!')

alertcondition(sellSignal, title='Alert: CE Sell', message='Chandelier Exit Sell!')