Perlindungan Delta Dinamik Pilihan Deribit

Penulis:Ninabadass, Dicipta: 2022-04-24 11:32:48, Dikemas kini: 2022-04-24 15:50:56Perlindungan Delta Dinamik Pilihan Deribit

Kali ini, strategi yang dibawa oleh FMZ Quant adalahPerlindungan Delta Dinamik Pilihan Deribit, disingkat sebagai DDH.

Untuk kajian perdagangan opsyen, kita biasanya perlu menguasai konsep dalam beberapa aspek:

-

Model harga opsyen; model B-S; harga opsyen ditentukan berdasarkan

harga asas , harga mogok , hari-hari sehingga tamat tempoh , (tersirat) turun naik dan kadar faedah bukan risiko . -

Eksposur risiko opsyen:

- Risiko arah pilihan Delta

Jika nilai delta adalah +0.5, prestasi keuntungan dan kerugian pilihan apabila harga asas naik dan turun boleh dianggap sebagai 0.50 tempat. - Gamma

kelajuan yang dipercepatkan risiko arah. Sebagai contoh, pilihan panggilan. Oleh kerana Gamma, dari mana harga asas adalah pada harga mogok, Delta akan mendekati +1.00 dari +0.50, dalam proses peningkatan harga. - Apabila anda membeli opsyen, jika harga asas kekal malar, dengan setiap hari yang berlalu, anda akan membayar caj yang dipaparkan oleh nilai Theta (Deribit berharga dalam USD). Apabila anda menjual opsyen, dan harga asas kekal tetap, dengan setiap hari yang berlalu, anda akan menerima bayaran yang dipaparkan oleh nilai Theta.

- Vega

pendedahan kepada turun naik. Apabila anda membeli opsyen, Vega dinyatakan sebagai nilai positif, iaitu turun naik tersirat panjang. Apabila turun naik tersirat meningkat, anda boleh membuat keuntungan dengan terdedah kepada Vega. Situasi sebaliknya juga seperti itu. Apabila anda menjual opsyen, turun naik tersirat berkurangan, dan anda akan mendapat keuntungan.

- Risiko arah pilihan Delta

Penjelasan Strategi DDH:

-

Penjelasan Prinsip DDH Dengan menyeimbangkan delta opsyen dan niaga hadapan, netraliti risiko arah perdagangan dicapai. Selepas memegang kedudukan kontrak opsyen dan menggunakan niaga hadapan untuk lindung nilai dan menyeimbangkan Delta, apabila perubahan harga asas, keseluruhan Delta akan muncul tidak seimbang lagi.

Contohnya: Apabila kita membeli pilihan panggilan, kita mempunyai kedudukan bullish. pada masa ini, adalah perlu untuk masa hadapan pendek untuk lindung nilai pilihan Delta untuk mencapai netraliti keseluruhan Delta (0 atau dekat dengan 0). Mari kita abaikan faktor-faktor, seperti hari-hari sehingga tamat tempoh dan turun naik tersirat kontrak opsyen. Skenario 1: Apabila harga asas meningkat, pilihan Delta meningkat, dan keseluruhan Delta bergerak ke nombor positif. Masa hadapan diperlukan untuk lindung nilai lagi, dan beberapa kedudukan pendek dibuka untuk meneruskan masa hadapan pendek, sehingga keseluruhan Delta seimbang lagi. (Sebelum menyeimbangkan semula, delta opsyen adalah besar, delta niaga hadapan agak kecil, keuntungan marginal opsyen beli melebihi kerugian marginal kontrak pendek, dan keseluruhan portfolio akan menghasilkan keuntungan.) Skenario 2: Apabila harga asas jatuh, delta opsyen menurun, dan keseluruhan delta bergerak ke nombor negatif, dan beberapa kedudukan niaga hadapan pendek ditutup untuk membuat baki delta keseluruhan lagi. (Sebelum menyeimbangkan semula, delta opsyen adalah kecil, delta niaga hadapan agak besar, kerugian marginal opsyen panggilan adalah kurang daripada keuntungan marginal kontrak pendek, dan keseluruhan portfolio masih akan mempunyai keuntungan.)

Oleh itu, secara ideal, kenaikan dan kejatuhan asas kedua-duanya membawa keuntungan, selagi pasaran turun naik.

Walau bagaimanapun, terdapat faktor lain yang perlu dipertimbangkan: nilai masa, kos perdagangan dan lain-lain.

Jadi, saya memetik penjelasan seorang guru dari Zhihu:

Fokus Gamma Scalping bukan delta, lindung nilai delta dinamik hanyalah cara untuk mengelakkan risiko harga yang mendasari dalam proses. Gamma Scalping memberi tumpuan kepada Alpha. Alpha bukan Alpha pemilihan saham. Di sini, Alpha = Gamma / Theta, iaitu berapa banyak Gamma ditukar dengan kemerosotan masa unit Theta. Itulah intinya. Adalah mungkin untuk membina gabungan kenaikan dan kejatuhan dengan keuntungan terapung, pasti disertai dengan kemerosotan masa, dan masalahnya adalah nisbah prestasi kos. Penulis: Xu Zhe; pautan artikel asal:https://www.zhihu.com/question/51630805/answer/128096385

Reka Bentuk Strategi DDH

- pengekap antara muka pasaran agregat, reka bentuk struktur;

- reka bentuk UI strategi;

- Reka bentuk strategi interaksi;

- Reka bentuk fungsi lindung nilai automatik.

Kod sumber:

// constructor

function createManager(e, subscribeList, msg) {

var self = {}

self.supportList = ["Futures_Binance", "Huobi", "Futures_Deribit"] // from the supported platforms

// object attributes

self.e = e

self.msg = msg

self.name = e.GetName()

self.type = self.name.includes("Futures_") ? "Futures" : "Spot"

self.label = e.GetLabel()

self.quoteCurrency = ""

self.subscribeList = subscribeList // subscribeList : [strSymbol1, strSymbol2, ...]

self.tickers = [] // all market data obtained by the interface; define the data format as: {bid1: 123, ask1: 123, symbol: "xxx"}}

self.subscribeTickers = [] // the market data in need; define the data format as: {bid1: 123, ask1: 123, symbol: "xxx"}}

self.accData = null

self.pos = null

// initialization function

self.init = function() {

// judge whether the platform is supported

if (!_.contains(self.supportList, self.name)) {

throw "not support"

}

}

self.setBase = function(base) {

// switch base address, used to switch to the simulated bot

self.e.SetBase(base)

Log(self.name, self.label, "switch to simulated bot:", base)

}

// judge the data precision

self.judgePrecision = function (p) {

var arr = p.toString().split(".")

if (arr.length != 2) {

if (arr.length == 1) {

return 0

}

throw "judgePrecision error, p:" + String(p)

}

return arr[1].length

}

// update assets

self.updateAcc = function(callBackFuncGetAcc) {

var ret = callBackFuncGetAcc(self)

if (!ret) {

return false

}

self.accData = ret

return true

}

// update positions

self.updatePos = function(httpMethod, url, params) {

var pos = self.e.IO("api", httpMethod, url, params)

var ret = []

if (!pos) {

return false

} else {

// arrange data

// {"jsonrpc":"2.0","result":[],"usIn":1616484238870404,"usOut":1616484238870970,"usDiff":566,"testnet":true}

try {

_.each(pos.result, function(ele) {

ret.push(ele)

})

} catch(err) {

Log("error:", err)

return false

}

self.pos = ret

}

return true

}

// update the market data

self.updateTicker = function(url, callBackFuncGetArr, callBackFuncGetTicker) {

var tickers = []

var subscribeTickers = []

var ret = self.httpQuery(url)

if (!ret) {

return false

}

// Log("test", ret)// test

try {

_.each(callBackFuncGetArr(ret), function(ele) {

var ticker = callBackFuncGetTicker(ele)

tickers.push(ticker)

if (self.subscribeList.length == 0) {

subscribeTickers.push(ticker)

} else {

for (var i = 0 ; i < self.subscribeList.length ; i++) {

if (self.subscribeList[i] == ticker.symbol) {

subscribeTickers.push(ticker)

}

}

}

})

} catch(err) {

Log("error:", err)

return false

}

self.tickers = tickers

self.subscribeTickers = subscribeTickers

return true

}

self.getTicker = function(symbol) {

var ret = null

_.each(self.subscribeTickers, function(ticker) {

if (ticker.symbol == symbol) {

ret = ticker

}

})

return ret

}

self.httpQuery = function(url) {

var ret = null

try {

var retHttpQuery = HttpQuery(url)

ret = JSON.parse(retHttpQuery)

} catch (err) {

// Log("error:", err)

ret = null

}

return ret

}

self.returnTickersTbl = function() {

var tickersTbl = {

type : "table",

title : "tickers",

cols : ["symbol", "ask1", "bid1"],

rows : []

}

_.each(self.subscribeTickers, function(ticker) {

tickersTbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1])

})

return tickersTbl

}

// return the positon table

self.returnPosTbl = function() {

var posTbl = {

type : "table",

title : "pos|" + self.msg,

cols : ["instrument_name", "mark_price", "direction", "size", "delta", "index_price", "average_price", "settlement_price", "average_price_usd", "total_profit_loss"],

rows : []

}

/* the position data format returned by the interface

{

"mark_price":0.1401105,"maintenance_margin":0,"instrument_name":"BTC-25JUN21-28000-P","direction":"buy",

"vega":5.66031,"total_profit_loss":0.01226105,"size":0.1,"realized_profit_loss":0,"delta":-0.01166,"kind":"option",

"initial_margin":0,"index_price":54151.77,"floating_profit_loss_usd":664,"floating_profit_loss":0.000035976,

"average_price_usd":947.22,"average_price":0.0175,"theta":-7.39514,"settlement_price":0.13975074,"open_orders_margin":0,"gamma":0

}

*/

_.each(self.pos, function(ele) {

if(ele.direction != "zero") {

posTbl.rows.push([ele.instrument_name, ele.mark_price, ele.direction, ele.size, ele.delta, ele.index_price, ele.average_price, ele.settlement_price, ele.average_price_usd, ele.total_profit_loss])

}

})

return posTbl

}

self.returnOptionTickersTbls = function() {

var arr = []

var arrDeliveryDate = []

_.each(self.subscribeTickers, function(ticker) {

if (self.name == "Futures_Deribit") {

var arrInstrument_name = ticker.symbol.split("-")

var currency = arrInstrument_name[0]

var deliveryDate = arrInstrument_name[1]

var deliveryPrice = arrInstrument_name[2]

var optionType = arrInstrument_name[3]

if (!_.contains(arrDeliveryDate, deliveryDate)) {

arr.push({

type : "table",

title : arrInstrument_name[1],

cols : ["PUT symbol", "ask1", "bid1", "mark_price", "underlying_price", "CALL symbol", "ask1", "bid1", "mark_price", "underlying_price"],

rows : []

})

arrDeliveryDate.push(arrInstrument_name[1])

}

// traverse arr

_.each(arr, function(tbl) {

if (tbl.title == deliveryDate) {

if (tbl.rows.length == 0 && optionType == "P") {

tbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price, "", "", "", "", ""])

return

} else if (tbl.rows.length == 0 && optionType == "C") {

tbl.rows.push(["", "", "", "", "", ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price])

return

}

for (var i = 0 ; i < tbl.rows.length ; i++) {

if (tbl.rows[i][0] == "" && optionType == "P") {

tbl.rows[i][0] = ticker.symbol

tbl.rows[i][1] = ticker.ask1

tbl.rows[i][2] = ticker.bid1

tbl.rows[i][3] = ticker.mark_price

tbl.rows[i][4] = ticker.underlying_price

return

} else if(tbl.rows[i][5] == "" && optionType == "C") {

tbl.rows[i][5] = ticker.symbol

tbl.rows[i][6] = ticker.ask1

tbl.rows[i][7] = ticker.bid1

tbl.rows[i][8] = ticker.mark_price

tbl.rows[i][9] = ticker.underlying_price

return

}

}

if (optionType == "P") {

tbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price, "", "", "", "", ""])

} else if(optionType == "C") {

tbl.rows.push(["", "", "", "", "", ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price])

}

}

})

}

})

return arr

}

// initialize

self.init()

return self

}

function main() {

// initialize, and vacuum logs

if(isResetLog) {

LogReset(1)

}

var m1 = createManager(exchanges[0], [], "option")

var m2 = createManager(exchanges[1], ["BTC-PERPETUAL"], "future")

// switch to the simulated bot

var base = "https://www.deribit.com"

if (isTestNet) {

m1.setBase(testNetBase)

m2.setBase(testNetBase)

base = testNetBase

}

while(true) {

// options

var ticker1GetSucc = m1.updateTicker(base + "/api/v2/public/get_book_summary_by_currency?currency=BTC&kind=option",

function(data) {return data.result},

function(ele) {return {bid1: ele.bid_price, ask1: ele.ask_price, symbol: ele.instrument_name, underlying_price: ele.underlying_price, mark_price: ele.mark_price}})

// perpetual futures

var ticker2GetSucc = m2.updateTicker(base + "/api/v2/public/get_book_summary_by_currency?currency=BTC&kind=future",

function(data) {return data.result},

function(ele) {return {bid1: ele.bid_price, ask1: ele.ask_price, symbol: ele.instrument_name}})

if (!ticker1GetSucc || !ticker2GetSucc) {

Sleep(5000)

continue

}

// update positions

var pos1GetSucc = m1.updatePos("GET", "/api/v2/private/get_positions", "currency=BTC&kind=option")

var pos2GetSucc = m2.updatePos("GET", "/api/v2/private/get_positions", "currency=BTC&kind=future")

if (!pos1GetSucc || !pos2GetSucc) {

Sleep(5000)

continue

}

// interaction

var cmd = GetCommand()

if(cmd) {

// process interaction

Log("interactive command:", cmd)

var arr = cmd.split(":")

// cmdClearLog

if(arr[0] == "setContractType") {

// parseFloat(arr[1])

m1.e.SetContractType(arr[1])

Log("exchanges[0] sets contract:", arr[1])

} else if (arr[0] == "buyOption") {

var actionData = arr[1].split(",")

var price = parseFloat(actionData[0])

var amount = parseFloat(actionData[1])

m1.e.SetDirection("buy")

m1.e.Buy(price, amount)

Log("executed price:", price, "executed amount:", amount, "executed direction:", arr[0])

} else if (arr[0] == "sellOption") {

var actionData = arr[1].split(",")

var price = parseFloat(actionData[0])

var amount = parseFloat(actionData[1])

m1.e.SetDirection("sell")

m1.e.Sell(price, amount)

Log("executed price:", price, "executed amount:", amount, "executed direction:", arr[0])

} else if (arr[0] == "setHedgeDeltaStep") {

hedgeDeltaStep = parseFloat(arr[1])

Log("set hedgeDeltaStep:", hedgeDeltaStep)

}

}

// obtain futures contract price

var perpetualTicker = m2.getTicker("BTC-PERPETUAL")

var hedgeMsg = " PERPETUAL:" + JSON.stringify(perpetualTicker)

// obtain the total delta value from the account data

var acc1GetSucc = m1.updateAcc(function(self) {

self.e.SetCurrency("BTC_USD")

return self.e.GetAccount()

})

if (!acc1GetSucc) {

Sleep(5000)

continue

}

var sumDelta = m1.accData.Info.result.delta_total

if (Math.abs(sumDelta) > hedgeDeltaStep && perpetualTicker) {

if (sumDelta < 0) {

// delta value is more than 0, hedge futures and make short

var amount = _N(Math.abs(sumDelta) * perpetualTicker.ask1, -1)

if (amount > 10) {

Log("exceeding the hedging threshold value, the current total delta:", sumDelta, "call futures")

m2.e.SetContractType("BTC-PERPETUAL")

m2.e.SetDirection("buy")

m2.e.Buy(-1, amount)

} else {

hedgeMsg += ", hedging order amount is less than 10"

}

} else {

// delta value is less than 0, hedge futures and make long

var amount = _N(Math.abs(sumDelta) * perpetualTicker.bid1, -1)

if (amount > 10) {

Log("exceeding the hedging threshold value, the current total delta:", sumDelta, "put futures")

m2.e.SetContractType("BTC-PERPETUAL")

m2.e.SetDirection("sell")

m2.e.Sell(-1, amount)

} else {

hedgeMsg += ", hedging order amount is less than 0"

}

}

}

LogStatus(_D(), "sumDelta:", sumDelta, hedgeMsg,

"\n`" + JSON.stringify([m1.returnPosTbl(), m2.returnPosTbl()]) + "`", "\n`" + JSON.stringify(m2.returnTickersTbl()) + "`", "\n`" + JSON.stringify(m1.returnOptionTickersTbls()) + "`")

Sleep(10000)

}

}

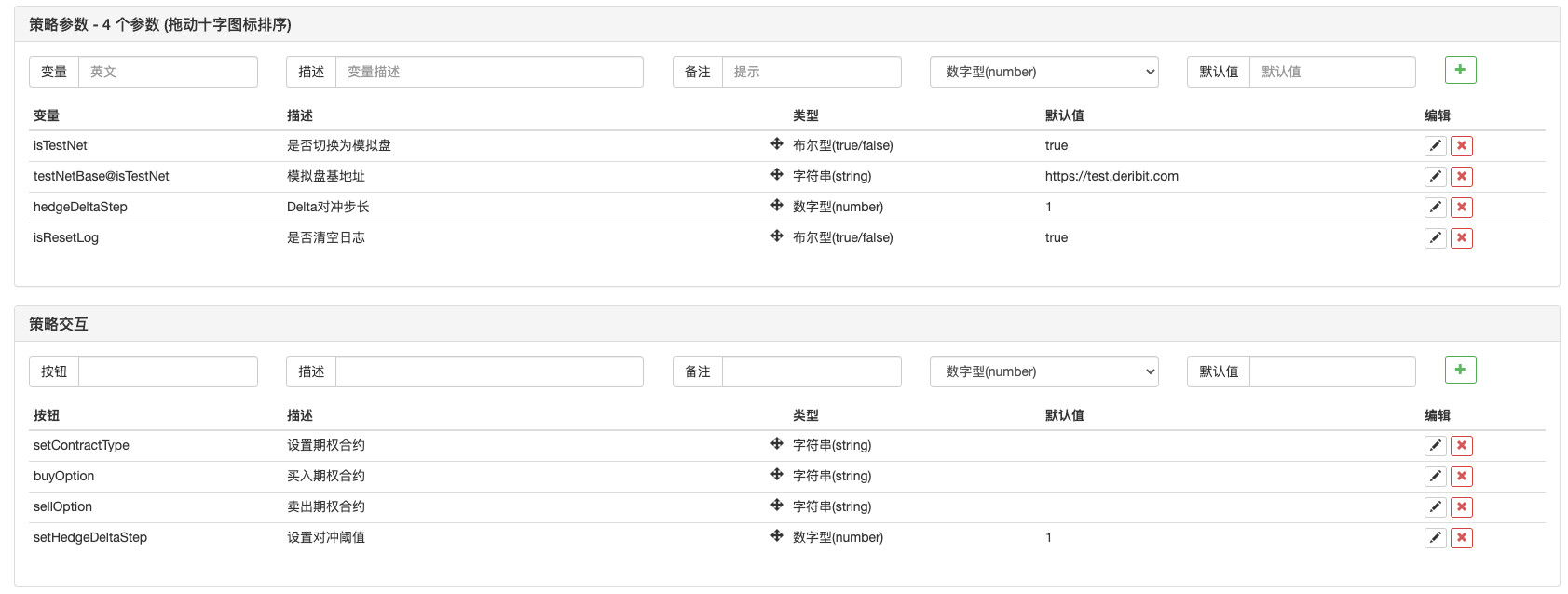

Parameter strategi:

Alamat strategi:https://www.fmz.com/strategy/265090

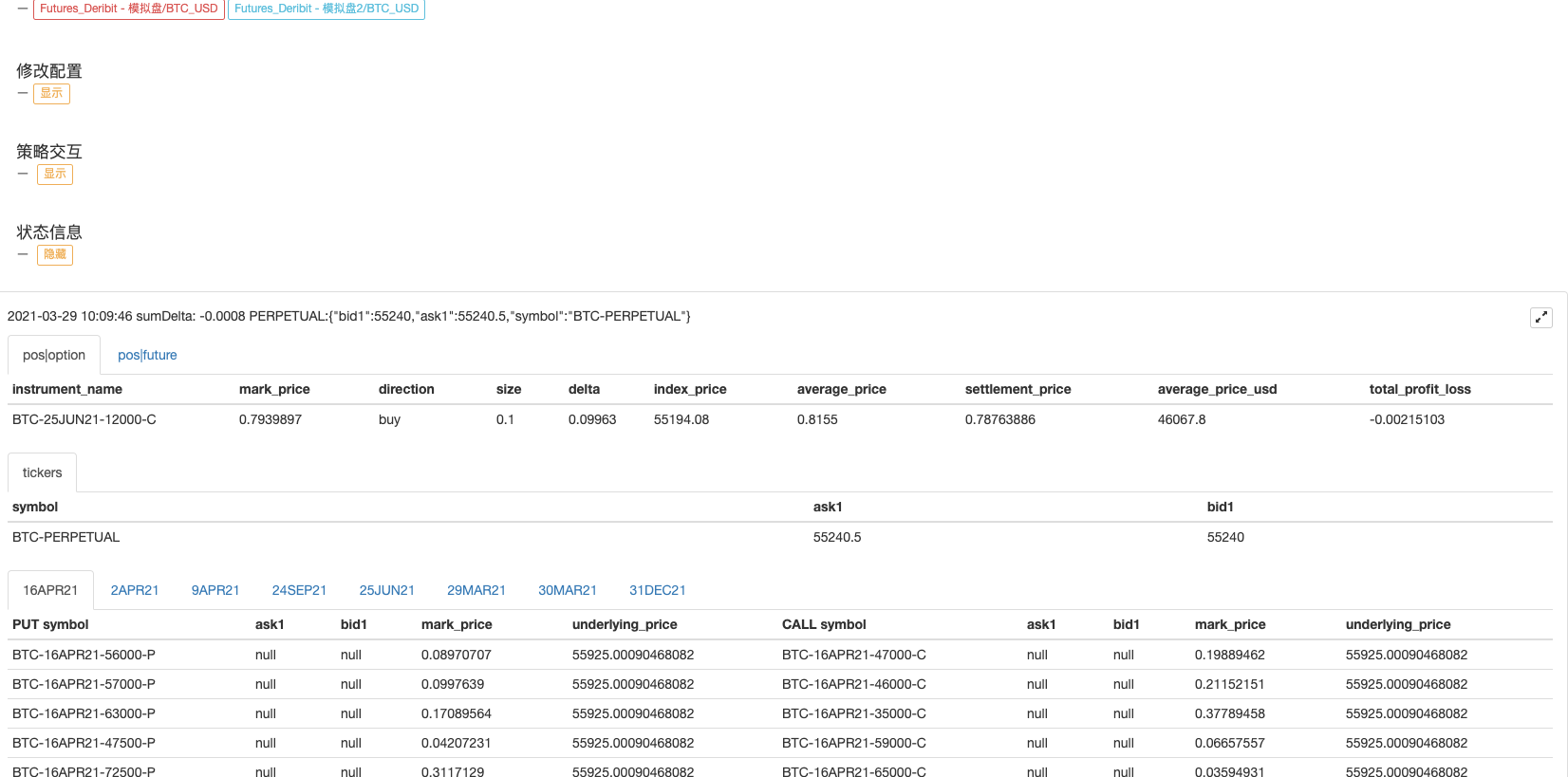

Operasi Strategi:

Strategi ini adalah tutorial, terutamanya digunakan untuk kajian, jadi sila berhati-hati menggunakan dalam bot.

- Penyelesaian untuk Mendapatkan Docker Http Permintaan Mesej

- Memperluaskan Templat Sesuai dengan Visual (Blockly) Strategy Editing

- Analisis Strategi Pengumpul Keuntungan (2)

- Analisis Strategi Pengumpul Keuntungan (1)

- USdt dalam Python untuk menukar urus niaga yang kekal kepada busd yang kekal untuk menukar fungsi mana yang akan mempengaruhi ini.

- Tambah Stoploss untuk mengawal risiko

Apakah Harga - Perbincangan mengenai Reka Bentuk Strategi Frekuensi Tinggi

Pengumpul Keuntungan yang Dimodifikasi Ajaib - Binance Perpetual Funding Rate Arbitrage (100% daripada Kadar Tahunan di Pasar Bull)

- Menggunakan Antara muka Pasaran Pengumpulan Platform Cryptocurrency untuk Membina Strategi Multi-Simbol

- Bahasa my menulis di sini untuk mendapatkan isyarat hanya untuk mencetak dan mengeluarkan sekali.

- Gunakan SQLite untuk membina pangkalan data kuant FMZ

- Pemula, periksa

Membawa anda ke Perdagangan Kuantitatif Cryptocurrency (8) - Pemula, periksa

Membawa anda ke Perdagangan Kuantitatif Cryptocurrency (7) - Pemula, periksa

Membawa anda ke Perdagangan Kuantitatif Cryptocurrency (6) - Pemula, periksa

Membawa anda ke Perdagangan Kuantitatif Cryptocurrency (3) - Pemula, periksa

Membawa anda ke Perdagangan Kuantitatif Cryptocurrency (2) - Masa pencipta saya tidak tepat.

- Berikan idea untuk strategi penulisan yang hebat!

- Pemula, periksa

Membawa anda ke Perdagangan Kuantitatif Cryptocurrency (5) - Pemula, periksa

Membawa anda ke Perdagangan Kuantitatif Cryptocurrency (4)